El Niño turned the chillers on. Now, growers across North America are scrambling to salvage the last bit of their fall season as production shifts to warmer climates.

Produce commodities aren’t alone in their pilgrimage South. Even Amazon founder Jeff Bezos decided it was time to migrate somewhere warmer. Although, we doubt he’ll be growing much produce on his recently purchased $147 million Miami estate.

ProduceIQ Index: $1.15/pound, up +0.9 percent over prior week

Week #44, ending November 3rd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

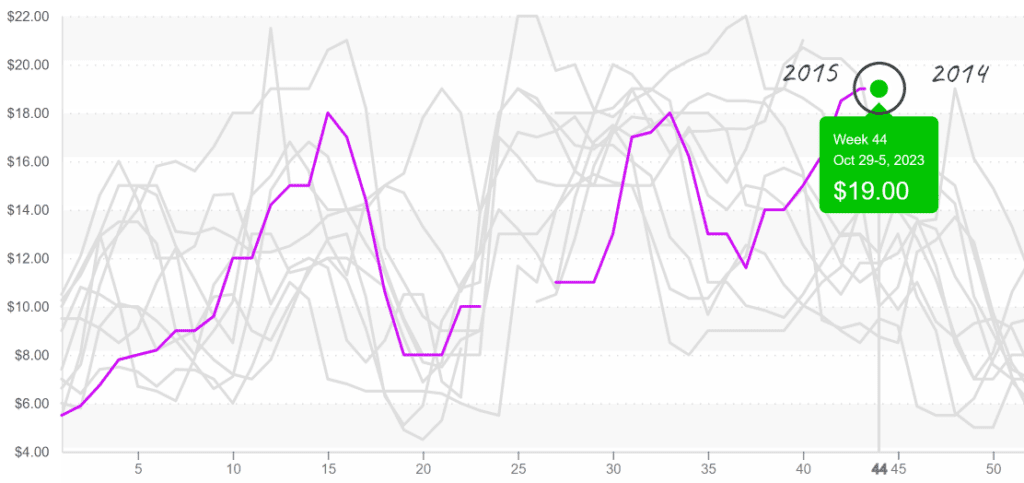

At $19 in the West, blackberry prices are holding tight to a ten-year high. Consecutive hurricanes that passed through Central Mexico over the past few weeks have decimated blackberry supply. Import volume from Mexican growers, usually the primary suppliers of blackberries this time of year, is dangerously low.

In a typical year, increasing Mexican supply causes blackberry prices to trend lower through week #52. However, due to heavy crop losses and lagging Mexican production, prices will likely remain on the higher end of the historical spectrum for the remainder of 2023.

Blackberry prices reach a record high for week #44.

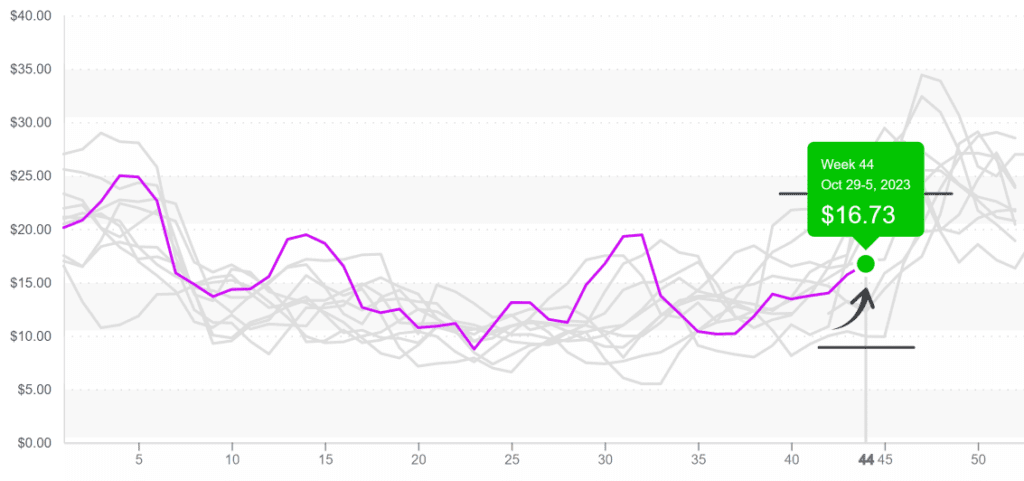

Strawberry markets continue to soar. Prices are up +55 percent over the previous week to $17 in response to mounting pressure for So-Cal growers to fill the gap in supply left by the end of the Salinas/Watsonville season.

Despite significant increases, prices are still below average for week #43. However, with Mexico still weeks away, prices have lots of upside potential in November.

Strawberry prices remain at the mid-point of a predictable range that swings upward now.

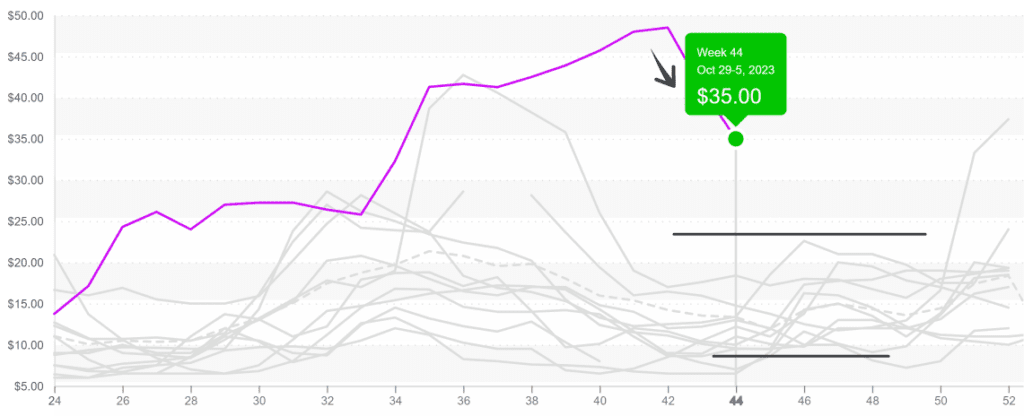

Lime prices are declining, and it’s not because supply has miraculously improved. Impishly sluggish demand is softening lime markets. Like avocados, wavering Mexican supply is forcing markets to diversify. Although Mexican lime growers are nowhere near being dethroned, buyers are beginning to look to suppliers in Colombia to create more price stability in the notoriously volatile market.

At $35 for 175ct, Lime prices remain soaring above historical norms for this season.

After weeks of tight markets, honeydew and cantaloupe supply is improving. In response, prices fell by over -20 percent over the previous week for both commodities. Arizona desert melon supply should continue to swell over the next few weeks before coming to an abrupt decline at the end of the short growing season.

In line with historical trends for week #44, tomato markets are experiencing rising volatility. Growers in California are winding down, Mexican supply is a little tighter than usual for week #44, and growing regions in the East are transitioning South to escape the colder weather.

Tomato markets across varieties will continue to experience instability until Florida growers ramp up production toward the end of December.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is a digital toolset designed to improve the produce trading process for buyers and suppliers. We save you time, increase your profits, expand your network, and provide valuable information.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.