Overall produce prices continue to fall as late summer demand struggles to gain momentum. Last week’s Western heat wave damaged a few commodities, but the supply drop was insufficient to counter the general economic malaise.

A week ago, Southern California reported extreme temperatures of 114 degrees, and some areas continue to have hot forecasts; Coachella may hit 100 degrees again later this week. Dry heat or not, the warm weather remains abnormal for mid-September.

A “cold” front is being discussed for the country’s lower half, which is more likely to bring dry air than anything you’d describe as cold.

ProduceIQ Index: $0.96 /pound, -3.0 percent over prior week

Week #36, ending September 9th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

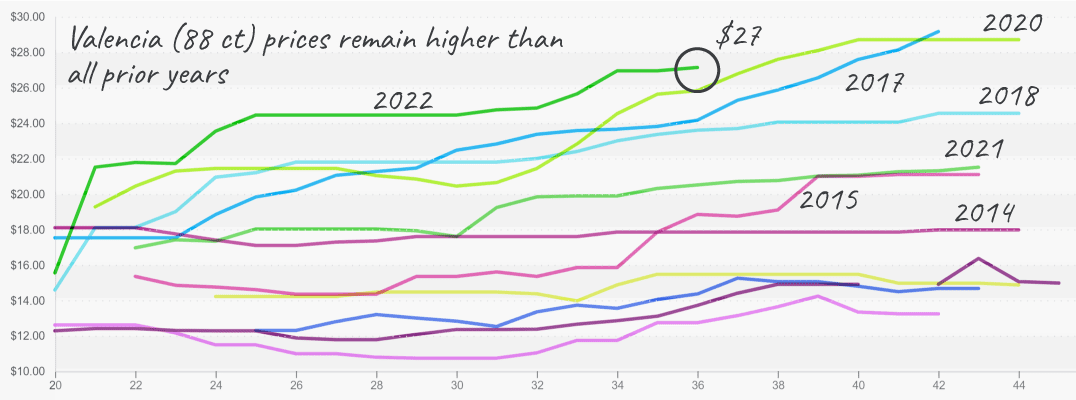

Orange prices rise slightly and maintain a fierce grip on a ten-year high. It’s been widely reported that this year’s domestic citrus production has been borderline catastrophic. To put this in perspective, reported volumes out of California have been only half of what they usually are due to drought and disease.

Now that peak domestic season is waning and import season is ramping up, there is a small hope that increased volume from foreign growers may relieve elevated orange prices.

Valencia prices remain at historic highs and are poised to increase further

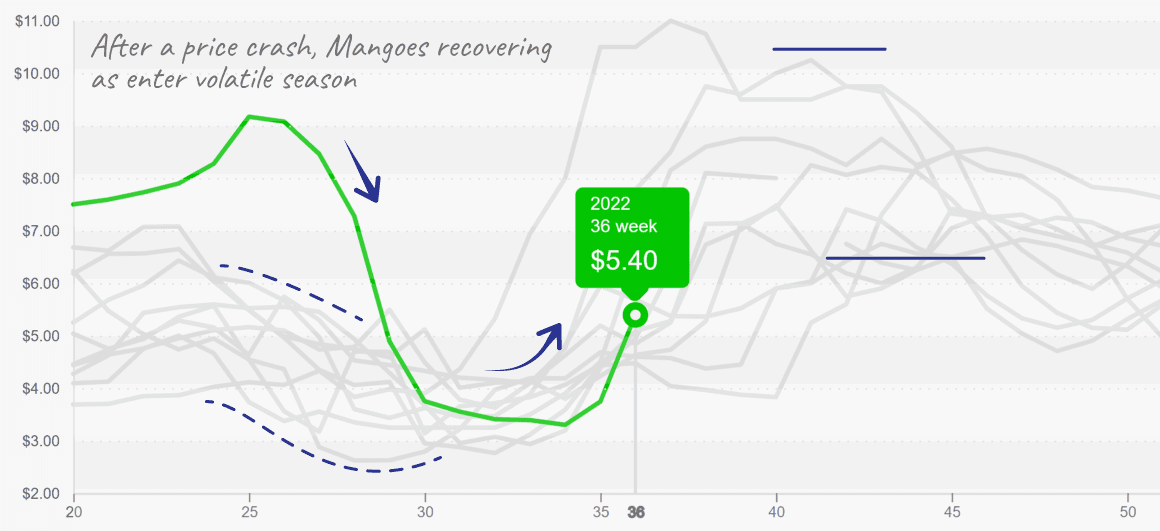

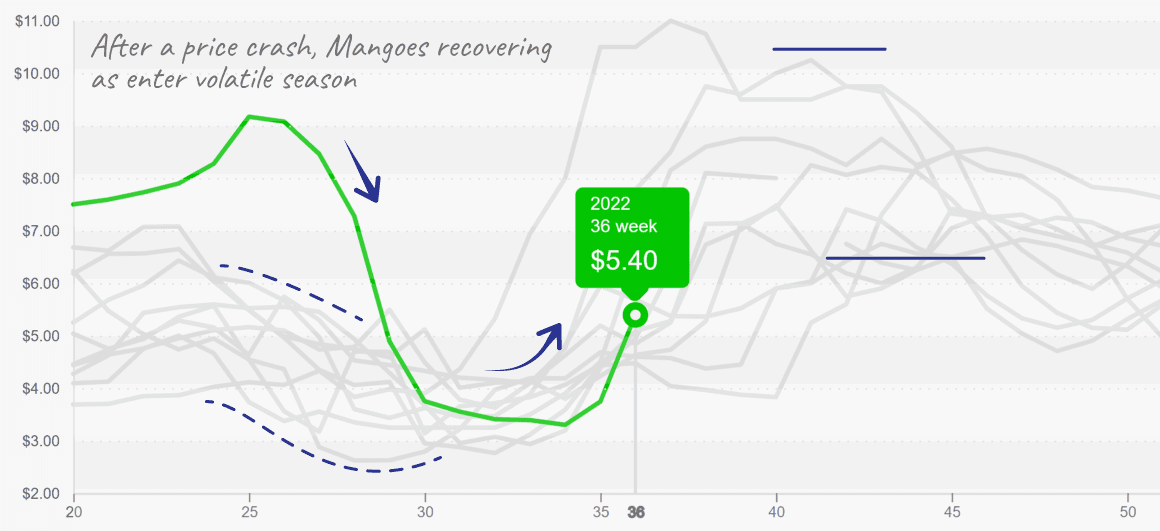

A sharp drop in the export volume of Mexican mangoes is spiking mango prices, +51 percent. Mango prices typically increase this time of year as production in Mexico wanes and shifts towards less prolific exporters such as Brazil, Ecuador and Peru. As a result, expect prices to rise throughout the fall.

Mango prices increase as we enter the season of market volatility

Blueberry production in the Pacific Northwest is waning, and foreign growers are beginning to rule the markets. Prices typically increase throughout late August and September as growing regions transition and supply becomes unstable. Prices are up +13 percent over the previous week. However, at $21, markets are still on the lower end of a fairly consistent historical price range.

Rain in Mexico is causing lime markets to counter general price trends for the week. Lime prices are up +20 percent; if the rain continues, markets may see further increases in the coming weeks.

Last week’s heat wave damaged California iceberg lettuce, and growing regions saw temperatures in the triple digits. In response, iceberg prices increased by an apathetic +4 percent over the previous week due to heat-related quality and labor shortages.

The heat wave is finally over, but Tropical Storm Kay is bringing rain to parts of California. Cooler weather should bring respite to high prices and set iceberg markets back on a downward trajectory.

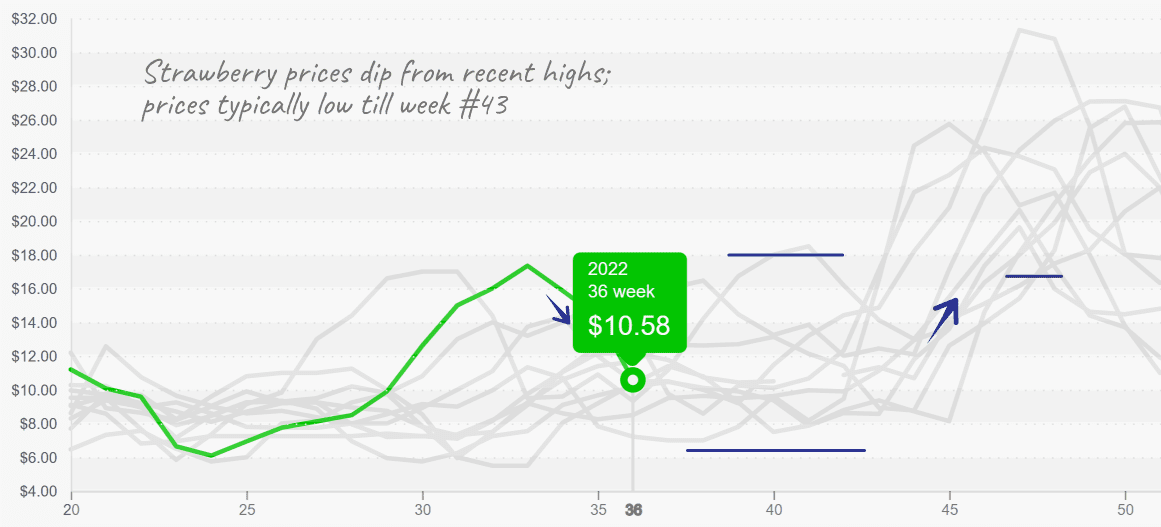

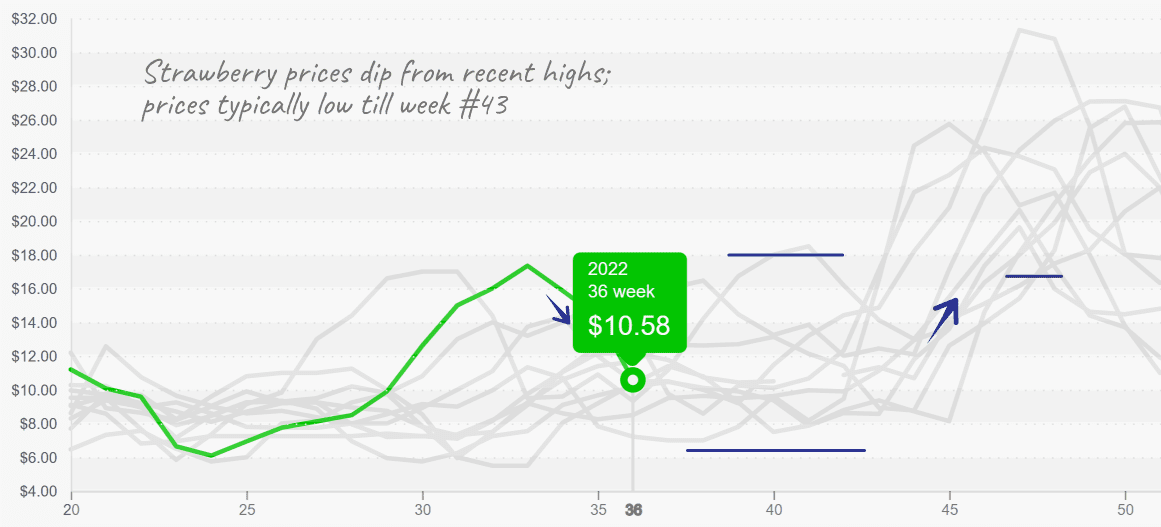

Coincidentally one of Queen Elizabeth’s favorite fruits, domestic strawberries are seeing increased yields and decreased quality due to last week’s heat wave. Despite the news of heat compromised quality, prices are lower, -22 percent over the previous week. It seems even strawberry prices are feeling down about the queen’s death.

Strawberry (8 1 lb clamshells) prices fall from $18 to $10 in 2 weeks

Heat has at least two commodities moving. Broccoli prices are up +31 percent and cauliflower +19 percent over the previous week, pushing broccoli prices to a ten-year high. Expect heat-related quality issues as growers battle unseasonably warm weather.

Squash prices are down for the second week even as volume from Mexico stutters. After weeks of lean squash supply and high prices, this news should be a great relief for squash buyers. Prices should continue to decrease steadily as production in Georgia and Northern Mexico picks up over the next few weeks.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.