Demand is outpacing supply in California, and it has nothing to do with any produce commodity the state is known for. Water is in a demand-exceeds-supply situation.

Tuesday, August 3rd, regulators voted unanimously to ban the diversion of water from the Sacramento-San Joaquin Delta, one of the state’s largest watersheds, for agricultural uses.

Though the Delta isn’t a major growing area for fresh produce, it is a sign that the state government may be required to preserve water supply for the driest parts of the year in other regions as well.

The U.S. Drought Monitor uses a five-category system to rate the severity of a drought. 46 percent of California is in the most severe category, D4 – Exceptional Drought, impacting major growing regions. 95 percent of California has at least a D2 – Severe Drought classification.

Many in the produce industry are left wondering how the drought will affect not only this season’s prices but also the number of acres planted and harvested in future seasons.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $0.99 /pound, -3.9 percent over prior week

Week #31, ending August 6th

Strawberries, one of the commodities most heavily affected by California’s historically dry summer, are up +20 percent over the previous week.

Though volume harvested has been similar to 2019 levels, strawberries are rising past $13 per case of 8 one-pound clamshells. A combination of labor shortages and declining yields in the Salinas/Watsonville growing regions is elevating strawberry prices.

This week’s prices have only been surpassed once in the last ten years; 2020 was an outlier due to abnormally high retail demand.

Strawberry prices typically increase this time of year due to the decrease in output from Salinas/Watsonville growers towards the end of summer. But hot and dry weather is driving up prices even further.

Reduced supply may cause strawberries to test new price highs for this time of year.

Up 40 percent over the previous week, lime markets continue to soar on short supply. Lower yields brought on by rain are reducing crossings from Mexico. Markets tighten but fall just short of a ten-year record.

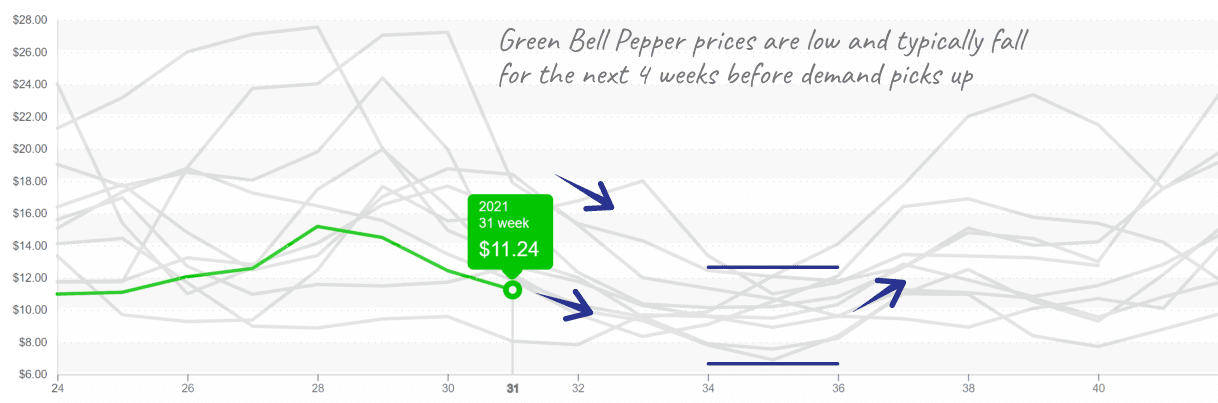

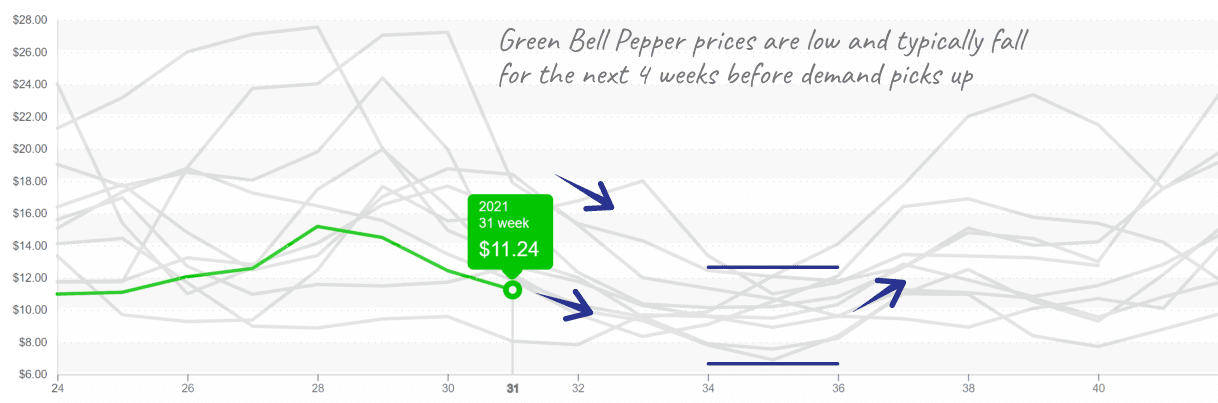

Bell pepper prices are at an eight-year low. Availability from multiple growing regions continues to soften markets. Bell peppers are available from a large number of U.S. states and also quality fruit from Canada.

In the East, green and red bells are promotable. Quality across East and Western markets is good. We are anticipating prices to be low for the next four weeks.

Peppers are in full harvest from multiple growing regions with only moderate demand, causing low prices to persist.

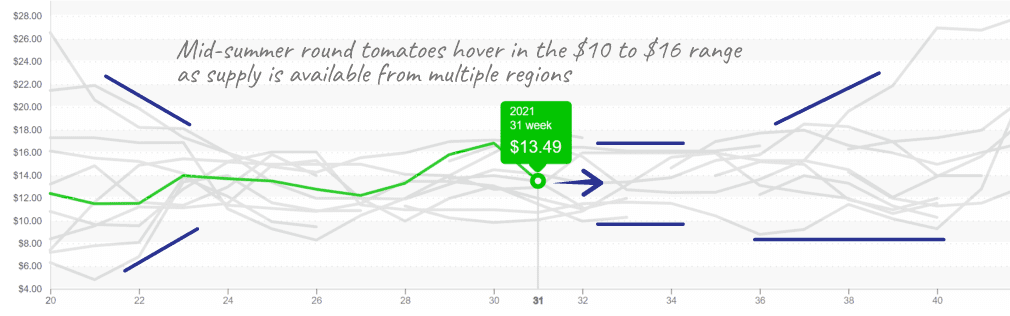

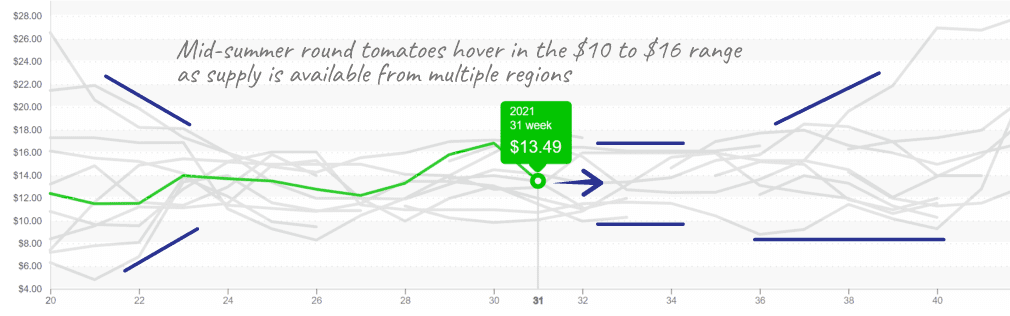

For the first time in what feels like all summer, tomato markets across all varieties are granting buyers some relief. The ProduceIQ tomato category fell -15 percent over the previous week thanks to more growing regions coming online in the East. Western FOB produce prices are at a disadvantage due to high freight rates.

Tomatoes enter production in many northern states, allowing local-grown to be promoted.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.