Overall produce prices stick to the status quo. Prices are down -2 percent over the previous week, which aligns with previous trends for week #16.

The beginning of blueberry season for Georgia growers and an upturn in volume from growers in Mexico and Florida helped ease index prices.

Stay tuned for more insights into produce market trends as warm weather increases domestic supply and decreases prices.

ProduceIQ Index: $1.28/pound, down -2.3 percent over prior week

Week #16, ending April 19th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

It’s that time of year again when every know-it-all needs to remind us that Cinco de Mayo isn’t Mexican Independence Day and is only greatly celebrated in the U.S.

And if you need a response, you can kindly remind them that good-humored acculturation in the name of tacos, guacamole, and tequila is a long-standing American tradition that won’t disappear anytime soon.

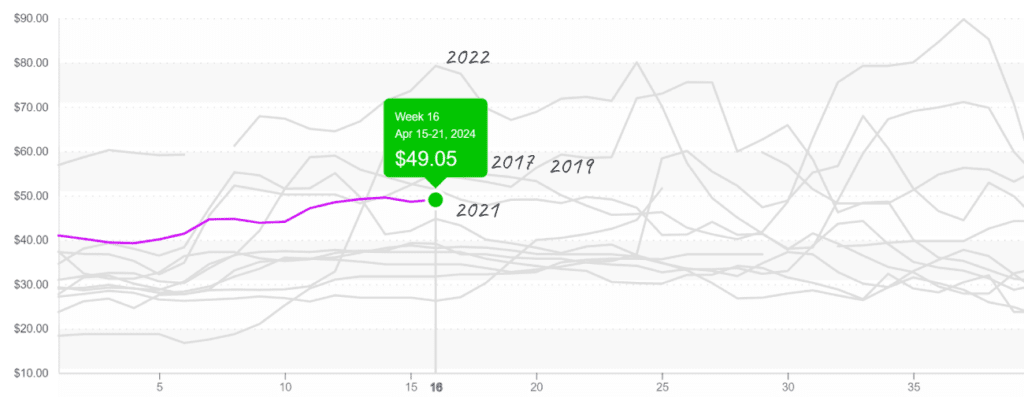

Hass yields in Mexico are declining, and larger fruits are becoming scarce as demand increases in anticipation of the holiday. Prices are only up slightly, +1 percent over the previous week, though they will likely grow more as demand swells.

Smaller fruits are more plentiful, keeping markets stable. However, the quality is only moderate due to the impact of extended heat in Mexico, resulting in fruit with high dry matter.

Hass Avocado (48ct) through Texas reach $49/case, which is above average, though nothing near the $80 price reached in 2022.

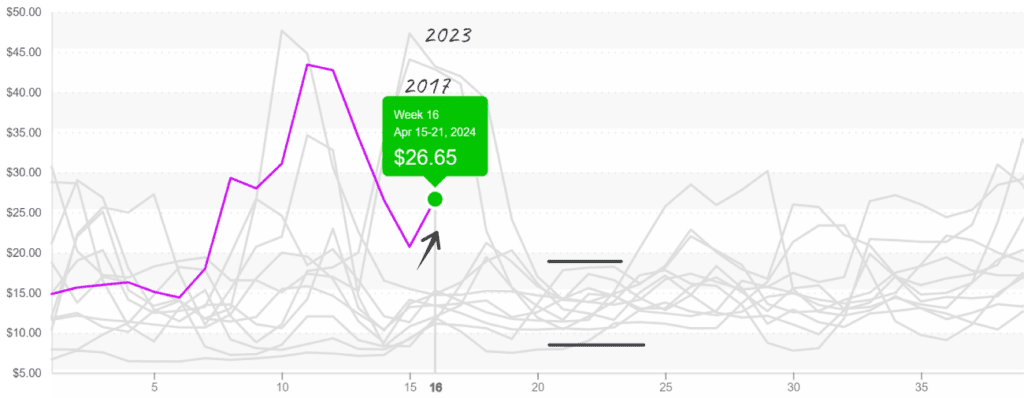

Iceberg and romaine prices spike after weeks of heavy rains catch up to California growers through mildew and disease pressure.

Iceberg prices are up +29 percent over the previous week and are well above average compared to the last ten years of week #16 USDA data. The iceberg lettuce market has tightened rapidly due to lower yields.

Romaine lettuce is also facing similar challenges. Although prices are only up +8 percent over the previous week, quality concerns will likely drive market prices higher. Anticipate limited supplies through the end of the month.

Iceberg prices (24ct film wrapped) increase to $27; historically, prices decline from here until week 20, but this year may be unpredictable.

Pear prices are slowly trotting back towards Earth after weeks of historic highs. Small pears are especially short, leading to the initial rise in market prices. However, low storage supply and the end of bosc season will likely keep prices well above average until the beginning of California’s bartlett season in July.

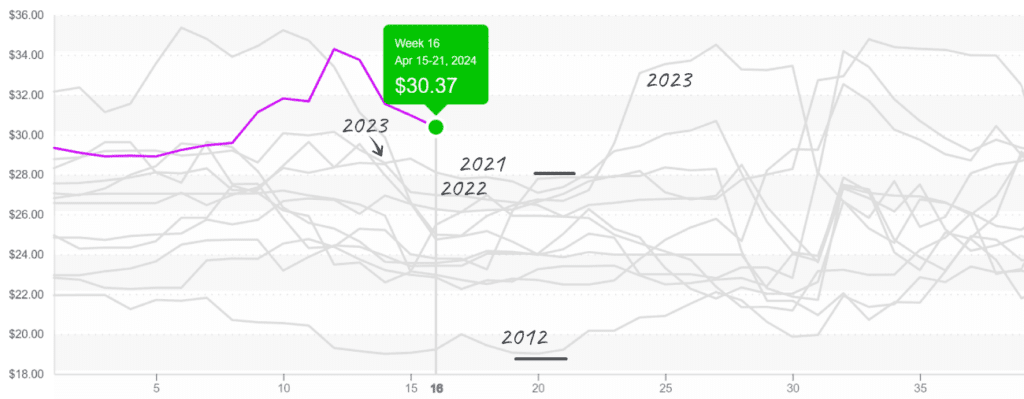

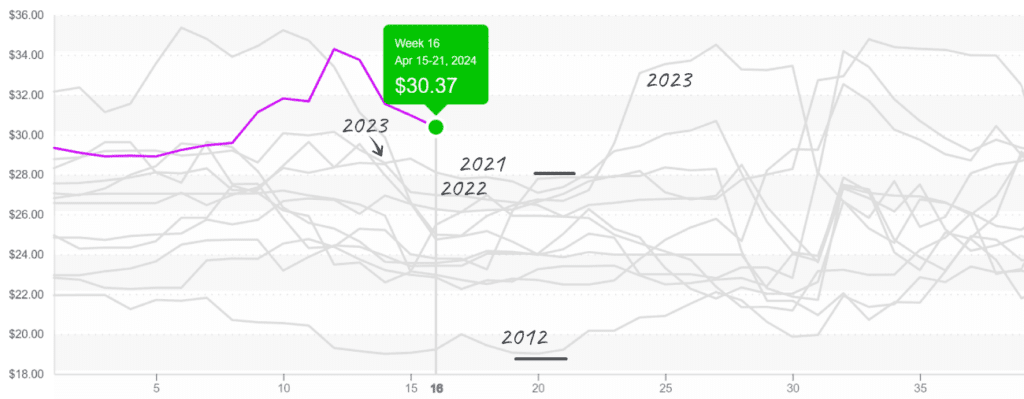

A blended Pear price is $30/case. Prices are falling but are still at a record high for week #16.

Yellow squash is exceptionally tight. At $16, average market prices reflect the dire state of supply. Production in Mexico is declining, and growers in Florida are working hard to fill the gap until Georgia begins in a couple of weeks.

Please visit our website to discover how our online tools can save time and expand your reach. [hyperlink:

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.