For the first time in 84 years, a tropical storm has hit Southern California. Hurricane Hilary struck the coast of Mexico and then Southern California as a tropical storm yesterday.

Although severe tropical weather is not uncommon in Mexico’s Baja California, storms usually lose steam before reaching Southern California due to cooler ocean currents. However, abnormally warm ocean surface temperatures and high-pressure ridge makes for once-in-a-century conditions for the Southwestern portion of the US.

The storm brought heavy rain and strong wind to drought-stricken regions in the Southwest. The storm has affected growing areas, including Bakersfield, Coachella, and even Yuma. In 24 hours, Las Vegas received 2 inches of rain, around half of the desert city’s annual rain total. Fortunately, the storm is moving eastward and is avoiding Salinas.

We won’t know the extent of physical damage to in-season crops until growers have more time to assess. However, reports of flooding and wind damage are common throughout impacted produce-growing areas, including table grapes, citrus, and avocados.

This unusual headline highlights the hazard of increasing ocean temperatures. Just last week, a buoy in the gulf off the coast of Florida set a new record for sea surface temperature at a sweat-inducing 101.1 degrees Fahrenheit.

As we near the peak of Atlantic hurricane season, it is important to remember that warmer oceans are gasoline for tropical activity and pose a real threat to the produce supply chain.

ProduceIQ Index: $1.20/pound, down -7.0 percent over prior week

Week #33, ending August 18th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Blackberry prices are up +4 percent over the previous week. Supply is generally improving; however, impacts from Hurricane Hilary may negatively affect supply in the short term. Prices are nearing a ten-year high. Blackberry growers in Oxnard, CA, and Ensenada, Mexico, are still tallying losses from the storm.

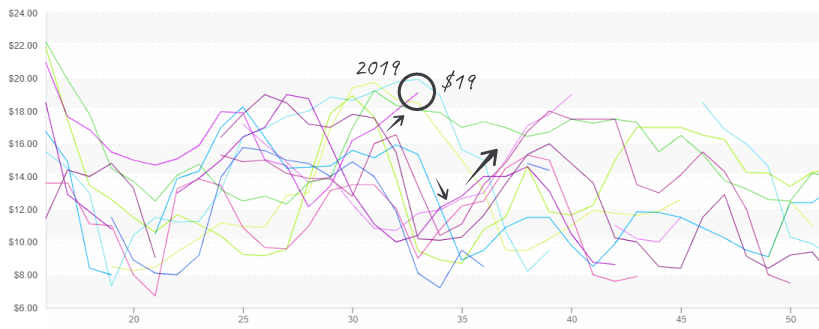

Blackberry prices are still rising, $19 in the East, almost surpassing the record year of 2019

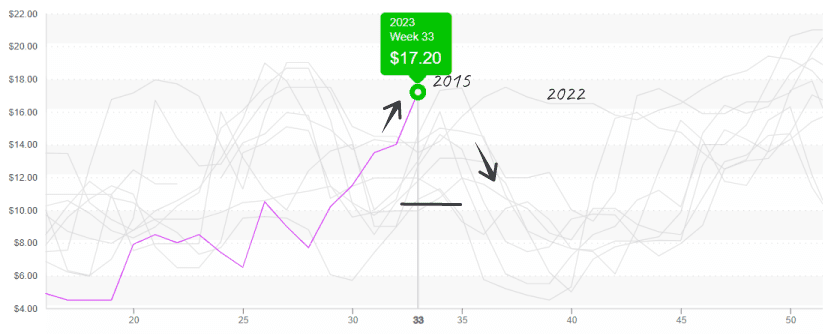

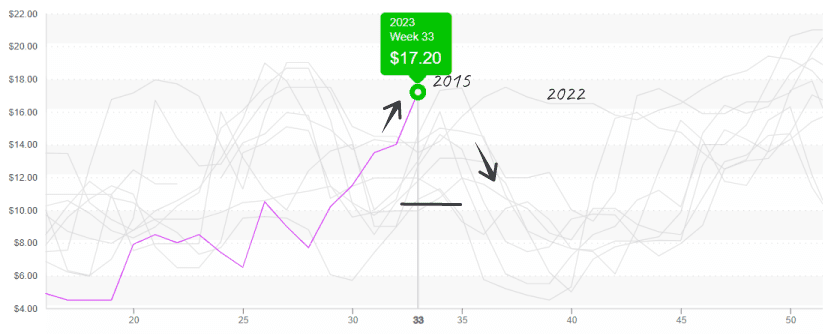

Red and yellow bell pepper supply is painfully short, especially in the East. Average prices moved up two dollars over last week. Heavy rain in California, high heat in Mexico, and seasonal transition compound a precarious supply situation for colored bells. Supply will remain short for at least two more weeks as growers attempt to transition on the West Coast.

Red Pepper, 11 lb XL, East Coast prices climb past $17 to a new high.

Areas of Southern California responsible for producing over 60 percent of California avocados experienced 2-3 inches of rain over the weekend due to Tropical Storm Hilary. This is worrisome because Mexican growers are in transition. Prices are only up +3 percent over the previous week but may surge higher as growers assess the damage to the in-season crop.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.