This year, the World Economic Forum borrowed the produce industry’s slogan, “cooperation in a fragmented world,” as their theme for the buzzworthy conference.

Unlike fresh produce news, Davos is an experience practically irrelevant to the everyday person but still of great interest to the general public.

The World Economic Forum’s annual meeting was initially intended to foster a spirit of stakeholder capitalism in its attendees. But today, it’s generally remembered for its private jets, exclusive parties, and world-class skiing.

Perhaps fresh produce news should take notes and infuse more extravagance into the coverage of its events in 2023.

Barring major freeze events, overall produce markets will fall from now through early March as Mexican production reaches maximum throughput.

ProduceIQ Index: $1.13/pound, down -1.7 percent over prior week

Week #2, ending January 13th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

In weather news, the atmospheric fire hose pointed at California is almost out of water (metaphorically speaking). More rain is expected early this week, but fortunately for soggy California residents, things should dry out considerably by Friday. Our prayers are with the farmers that experienced devastating floods that wrecked low-lying fields.

In the East, Florida growers received another “icy” blast this weekend, with temperatures in Central Florida reaching into the upper thirties. Slower growth of commodities such as bell peppers, tomatoes, and strawberries should be expected. Cold-sensitive cucurbits, cucumbers, and squash have begun the import season.

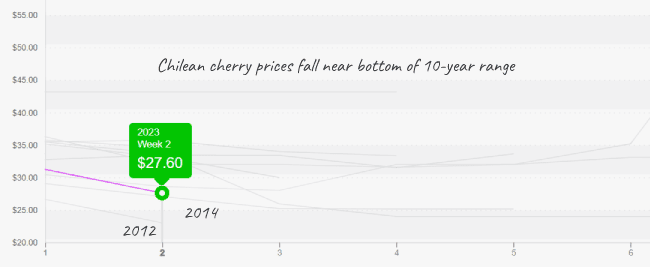

Early projections of an abundant 2023 Chilean cherry crop were accurate. Thanks to an impressive supply, cherry prices are at a ten-year low.

Estimated production volume is up +19 percent over the previous year due to favorable climatic conditions and increased acreage. If Chilean growers keep up this ambitious growth, we may live to see the notoriously inaccessible stone fruit go mainstream.

Imported cherry prices continued to fall as the season matures.

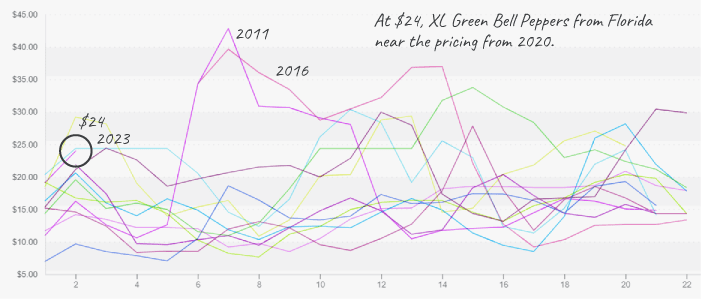

Bell-pepper supply is not quite recovered. In the East, green bell supply is rising but is still behind expected week #2 projections. In the West, green bell supply is adequate, but yellow and red supply is lagging. As Florida and Mexico ramp up production, markets are expected to recover in the next two weeks.

Florida Green Bell Pepper prices near historical highs yet expected to fall through February.

Strawberry demand exceeds supply. This time of year, Florida produce stands are usually flush with ripe strawberries. Unfortunately for berry-hungry consumers, cooler than usual weather across all growing regions and rain in Oxnard, CA, are delaying the start of the local season.

Prices are only up +4 percent over the previous week but will most likely increase in the build-up to Valentine’s Day.

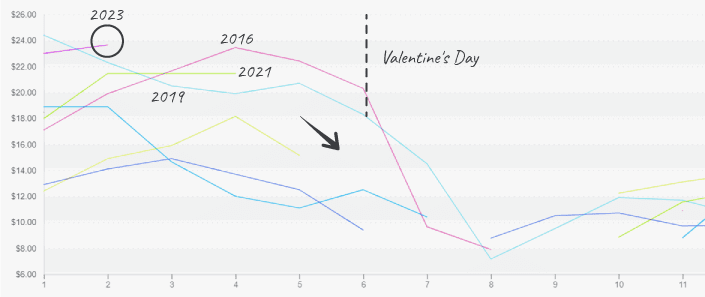

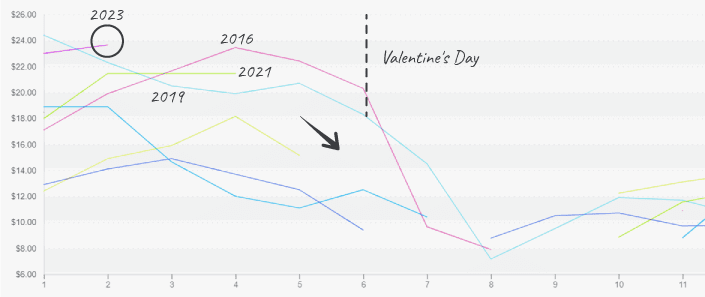

Florida Strawberry prices (8 1lb clamshells, medium) reach historical highs near $24 before Valentine’s Day pull.

Rain in California is posing an immense challenge to orange growers. Supply is reportedly extremely tight and will likely stay until growers get a substantial break from the rain. At $21, navel oranges are at a ten-year high, exceeding the previous record set in 2022.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.