Maybe we should have read the terms and conditions before signing up for 2023?

Heavy rain, drug cartel violence in Sinaloa, Mexico, and civil unrest in Peru are just a few of the factors causing shortages and elevating week #1 prices.

Yet another atmospheric river will soak California this week from Los Angeles to San Francisco Bay. With 3-6 inches of rain and several feet of snow expected in the mountains this week, road closures caused by powerful flooding, rockslides, mudslides, and avalanches will intensify.

Not only will logistics experience complications resulting from the fifth Western weather phenomenon since Christmas, but growers, specifically strawberry, citrus, celery, and tender green growers, are all facing some degree of challenges due to the inclement weather.

In Mexico, authorities captured Sinaloa Cartel leader Ovidio Guzman, a younger of the sons of the former boss, El Chapo (Joaquin Guzman). The arrest is sparking a wave of violence centralized in the city of Culiacan as members of the Sinaloa cartel fought authorities in retaliation for the arrest. Culiacan produces much of the fentanyl smuggled into the U.S. According to Mexican authorities, at least 250 vehicles have been set on fire and used as roadblocks.

Unfortunately for fresh produce, the roadblocks and temporary business closures thwarted the efforts of strawberry and bell pepper growers trying to ship product into the U.S. Import volumes for both commodities are about half of what they usually are for week #1.

After a two-week hiatus, violent protests against President Dina Boluarte have resumed in Peru. As a result, asparagus, grapes, and berries are all vulnerable to the logistic delays that will likely resume if the protests continue.

ProduceIQ Index: $1.15/pound, up +1.77 percent over prior week

Week #1, ending January 6th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

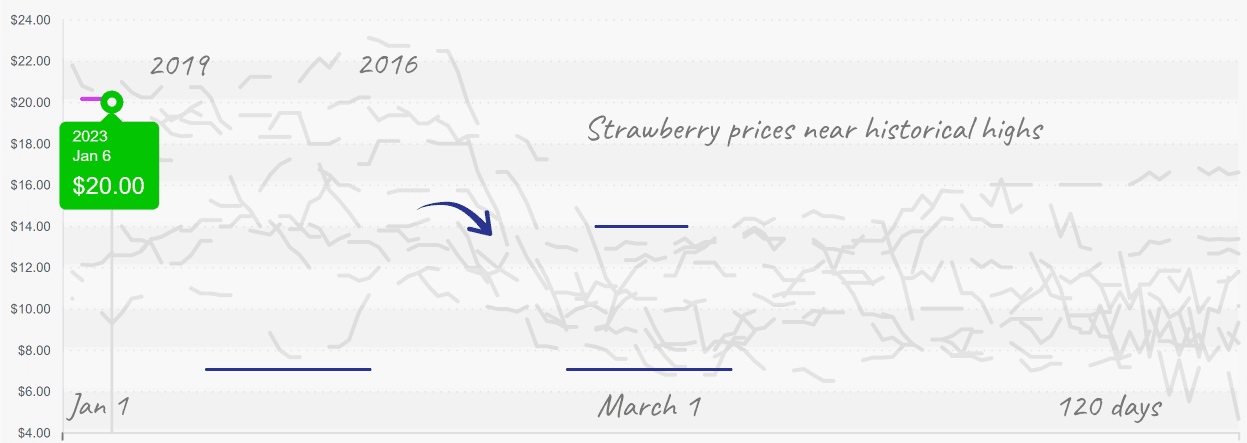

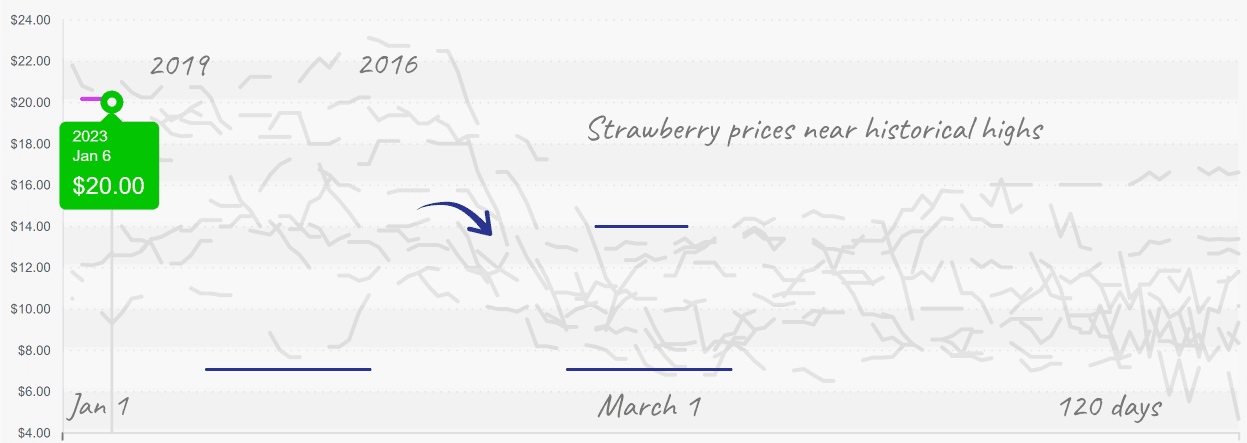

Strawberry prices are not being obedient to our December projections. Despite a solid start for Florida’s strawberry season, volume out of Mexico and California is historically low. Average prices are up +9 percent over the previous week and will likely climb higher until weather and Cartel related shipment delays ease.

Strawberry prices, $20, near record highs as Florida season is underway.

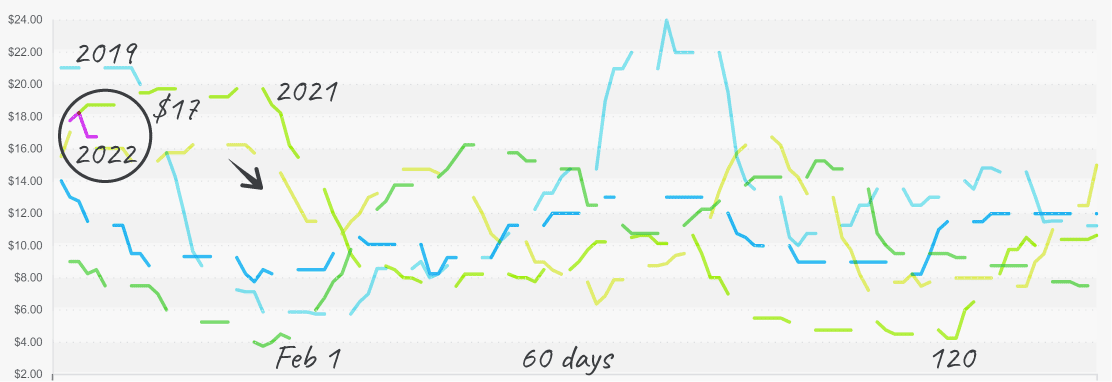

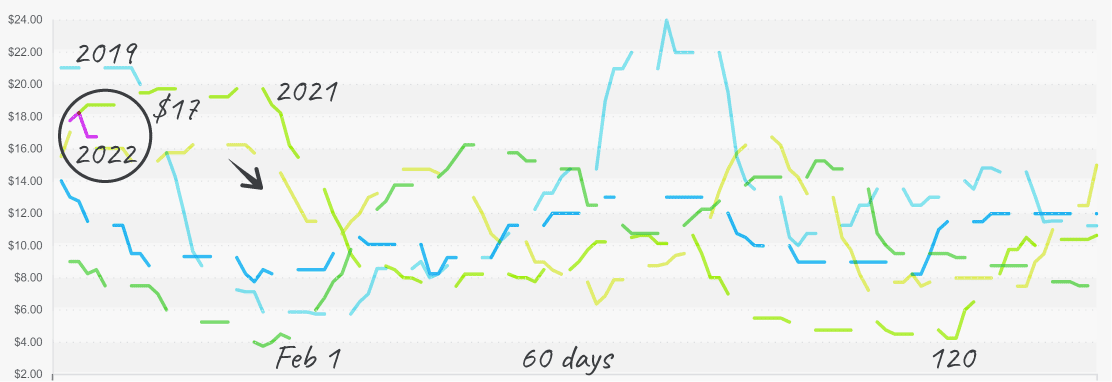

Bell pepper prices are up another +8 percent over the previous week. Delays in crossings from Mexico and chilly weather are tightening supply. However, volume is expected to improve over the next few weeks as Florida and Mexico ramp up production.

Red Pepper, 11lb XL, prices near $16 and typically falls into February.

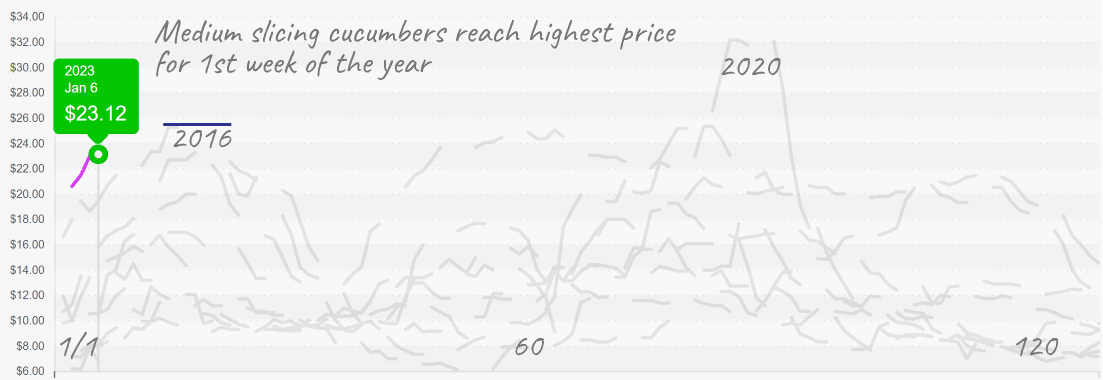

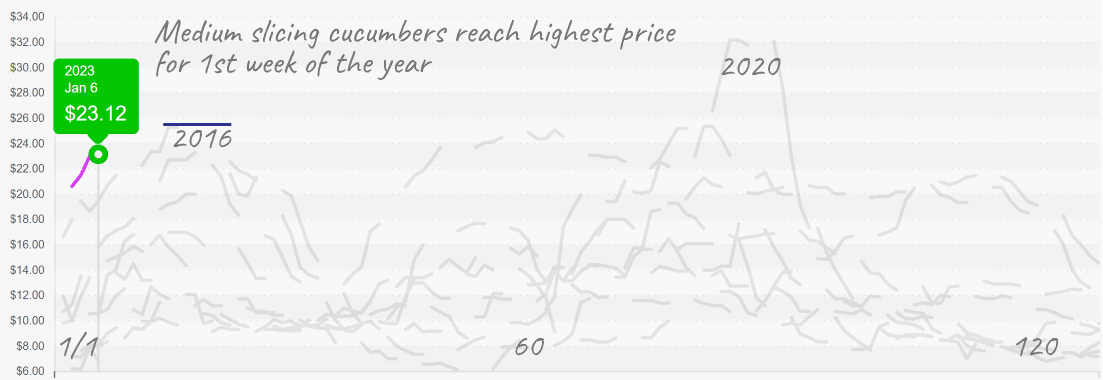

Cucumbers are experiencing an inconvenient supply gap. Prices are up +47 percent over the previous week. Florida growers are winding down, and Honduras and Mexico have yet to pick up production. Prices will likely settle, then continue to climb as the U.S. enters the mid-winter import season.

Slicing Cucumber prices are at seasonal highs as imports are slow to ramp up.

Squash supply remains slow after successive weeks of cooler weather in Eastern and Western growing regions. The average price is up +30 percent over the previous week. Central American production should pick up in the next few weeks and relieve elevated prices.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.