Cool weather tightens domestic supply and ups overall produce prices.

For the second week in a row, a winter storm is bringing much-needed hydration to parched California, albeit while causing some temporary havoc for growers and shippers across Central and North America.

Winter storm Hudson, an atmospheric river, brought heavy rain and snowfall to much of California on Saturday. The storm will continue East this week, bringing more wintery weather to North America.

ProduceIQ Index: $1.13/pound, up +2.7 percent over prior week

Week #52, ending December 30th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Asparagus prices are up +20 percent over the previous week. Crop transition, cooler weather in Mexico, and civil unrest in Peru are tightening available supply and forcing the East to cover Western demand. As a result, prices will likely remain elevated through the first few weeks of the year as Mexico works to ramp up production.

Asparagus prices typically rise towards the year-end and quickly descend into February.

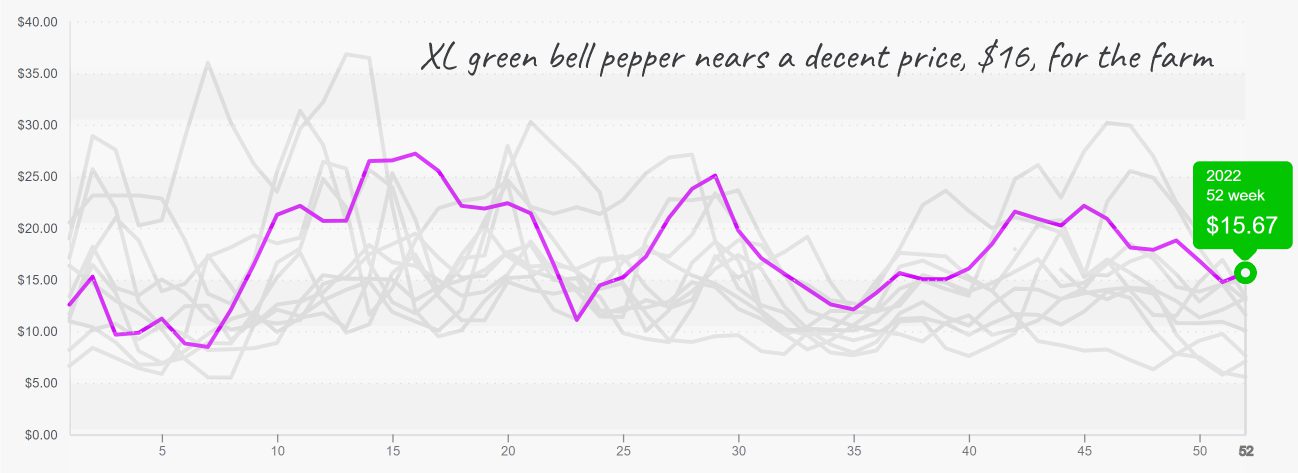

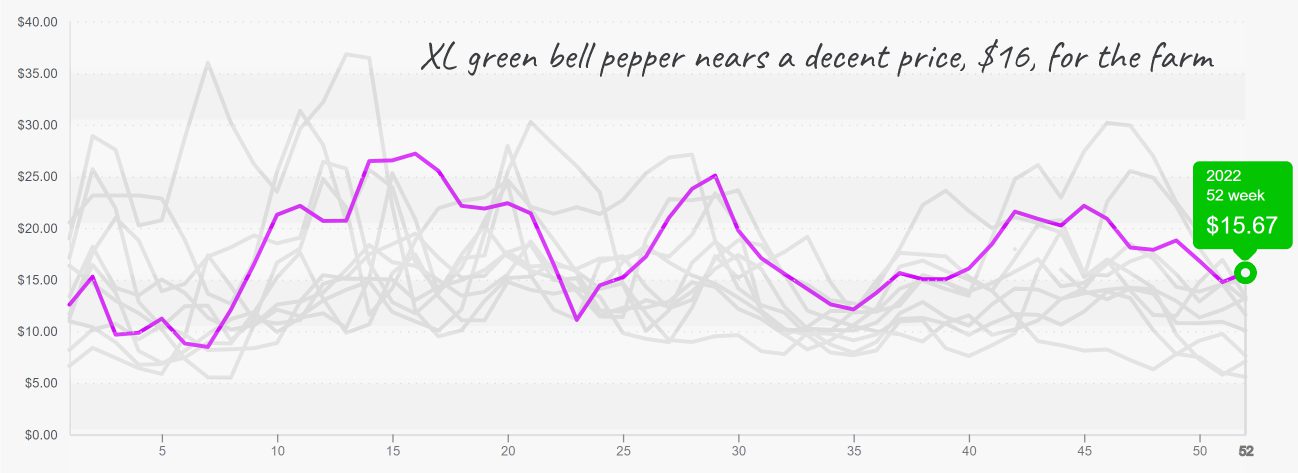

Colder than usual weather is tightening pepper supply. Florida green supply suffered minimal damage from the cold snap; however, chilly weather in Mexico is slowing pepper growth, delaying the availability of red fruit.

Green supply should recover as soon as next week, but the red supply may be pushed until mid-January.

Green pepper nears a respectable $16 as this winter holiday creates challenges.

Lime prices continue to skyrocket in response to low supply and strong demand. Prices are at $36, a ten-year high for week #52. 175/200cts are the tightest.

In Mexico, the last bit of the old crop is working its way through the supply chain, and the new crop has just begun. Consequently, lime markets will remain active through mid to late January.

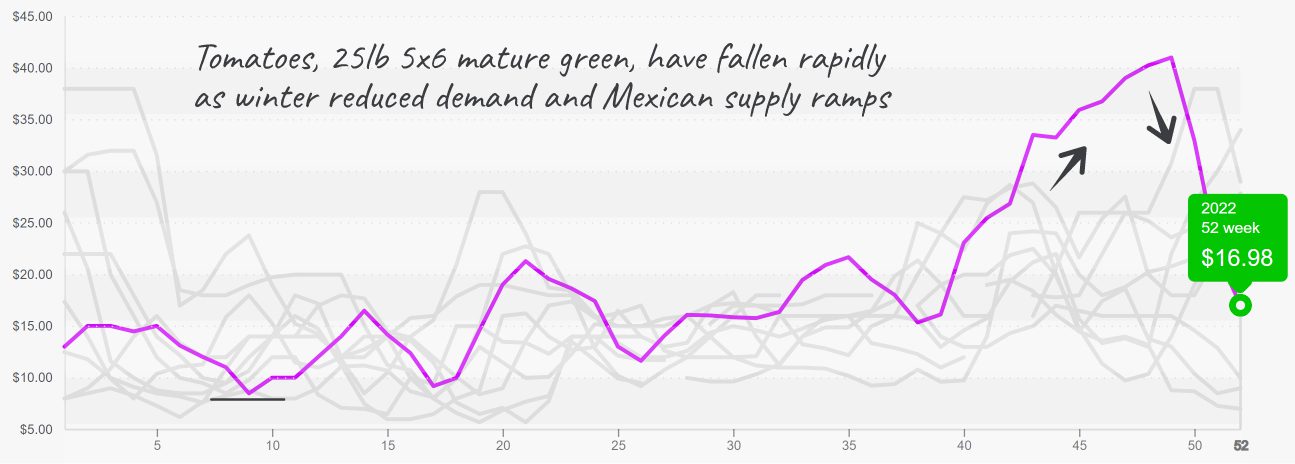

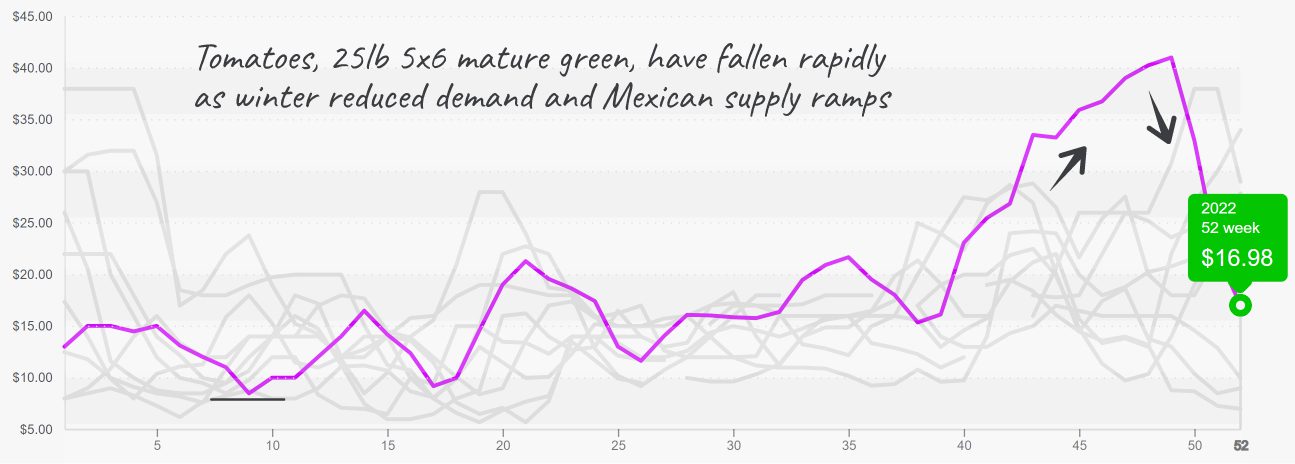

Although Florida barely avoided a White Christmas this year, Florida tomatoes certainly endured a cold one. In response to freezing temperatures felt as far South as Central FL, tomato prices are temporarily halting their steep descent.

As South Florida picks up production over the next two weeks and the West transitions to Sinaloa, Mexico, prices across all varieties should soften. We’ll soon enter the season when the Mexican and U.S. trade agreements influence tomato market prices.

Tomatoes remain in a volatile period after falling from an extreme high.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.