September’s inflation report is out, and it isn’t exactly soothing. Grocery prices remain a whopping 13 percent over the previous year, down slightly from 13.5 percent from August’s report. Economists are concerned that price increases show little to no signs of slowing down.

However, the Fed’s sharp increase in interest rates is putting a damper on the housing market; mortgage rates have increased from 2.75 to 7 percent in the past year. Unfortunately, a recession may be necessary to get inflation under control.

An unseasonable cold front this week could bring record-low temperatures to the Midwest and Eastern regions of the U.S. The front started in the upper Midwest on Sunday and will continue to bleed East and Southeast throughout the week. A freeze warning is in effect as far South as Atlanta.

ProduceIQ Index: $1.08 /pound, Flat over prior week

Week #41, ending October 14th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

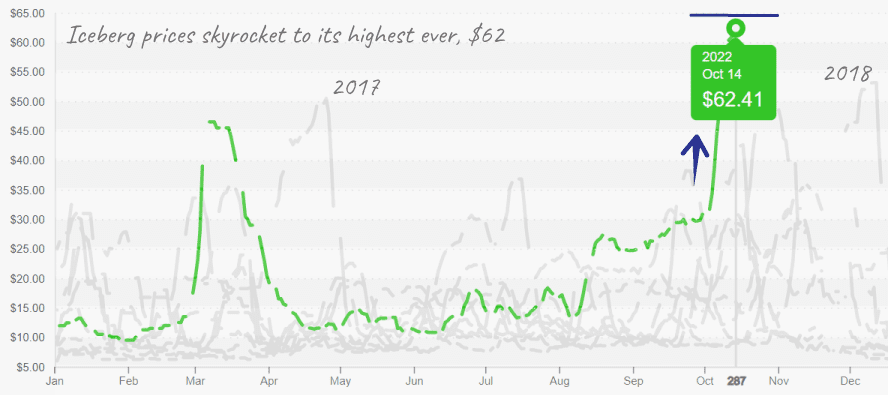

The lettuce situation is getting pretty dire. California supplies are incredibly tight, and quality is low. Most fields in Salinas Valley are harvesting 30 percent less than their usual volume due to the INSV outbreak. Iceberg prices are up +56 percent, and Romaine +39 percent over the previous week. Both commodities are at a ten-year high by a staggering margin.

Yuma and the desert regions will start lettuce production, in a light way, in about four weeks. Unfortunately, recent rains are not helping supply. Until then, we are expecting more extremely tight supplies and historic prices.

Iceberg lettuce prices reach new highs, surpassing 2017 and 2018

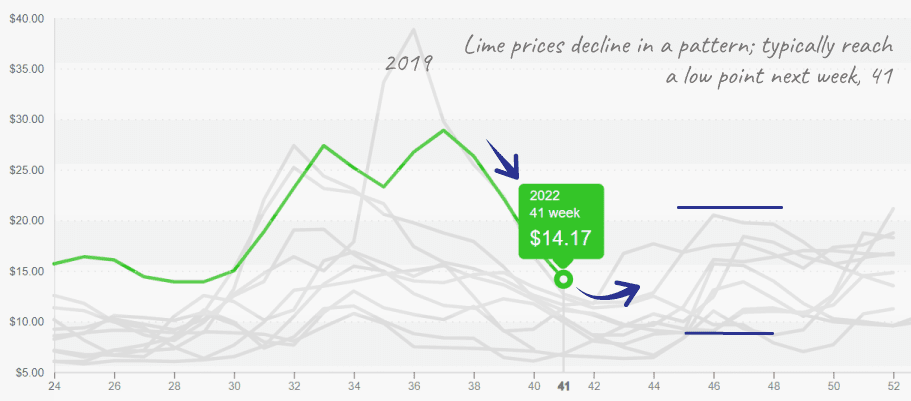

Lime prices are down -18 percent this week on low demand and decent supply. Although, rain from Tropical Storm Karl in Southern Mexico could tighten supplies and cause prices to jump next week.

Lime prices fall but are anticipated to firm up soon

Many commodities have already transitioned South, but a few are still vulnerable to this week’s preview of wintery weather.

Tomatoes join the growing list of fresh produce commodities looking towards the new year for supply relief. Rounds are up +19 percent, grape-type up +33 percent, and plum-type up +8 percent over the previous week, a ten-year high.

Lots of wind and rain from Hurricanes and Tropical Storms have wreaked havoc on tomato fields in all active regions over the past few weeks. Now this week, an early cold front is expected to send freezing temperatures to much of the Midwest and East, including Tennessee.

South Georgia is anticipated to be as low as 37 degrees mid-week. Due to the meager supply, tomato market prices are forecasted to remain high throughout the holiday season.

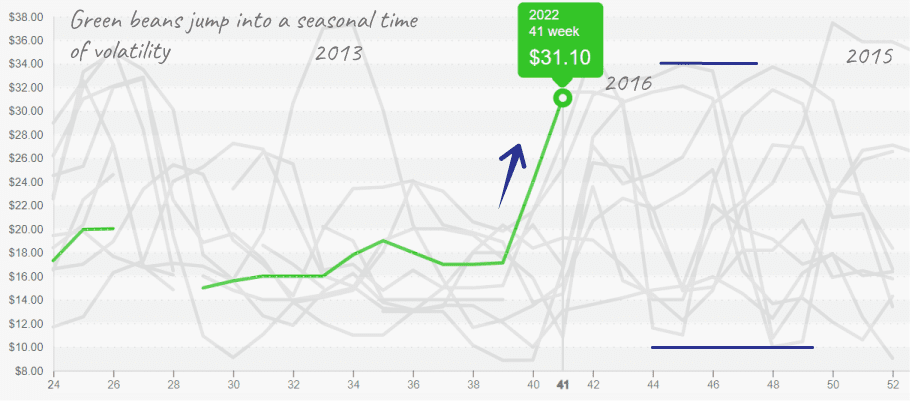

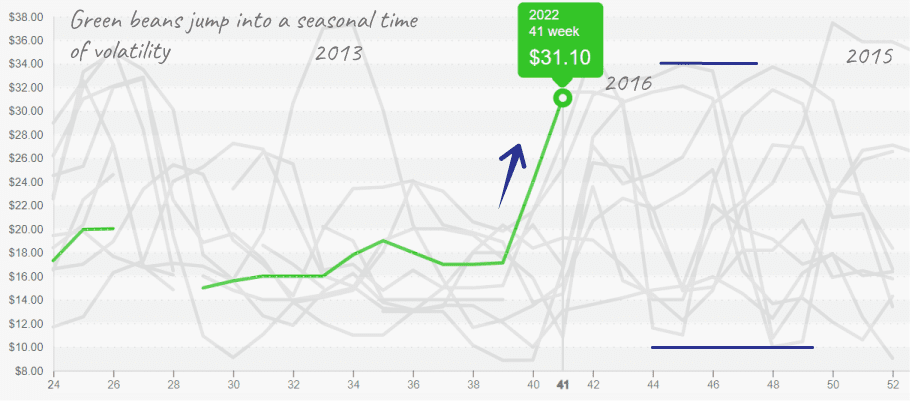

A gap in East and West Coast production is spiking bean prices to a ten-year high. In the East, Georgia finished up early, and Florida has only just begun. In the West, the gap is caused by heat in California and a delayed start to Mexican bean production. As a result, supply will likely remain tight for a couple of weeks, that is depending if this week’s Eastern cold snap affects production.

Green bean prices increase past $30, which nears the record highs for this time of year

This week’s early winter chill will close the window of opportunity on the more Northern bell pepper growers, tightening an already thin pepper supply. Western pepper markets are vulnerable due to short red and green volumes. Prices are up +16 percent over the previous week, a ten-year high for the fifth straight week.

In the East, production in the Northern growing regions is wrapping up and moving to South Georgia and North Florida. In the West, Oxnard is finished, and Coachella is expected to ramp up production any day. Expect prices to fluctuate as markets transition and supply finds more sure footing at warmer latitudes.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.