In time for Father’s Day lunch, seasonal items are filling up the produce section of your favorite retailer. Flavorful cherries, stone fruit, and melons are nearing their peak.

But unfortunately, produce demand is soft, and the early summer weather is already sweltering.

Production regions, from California to Georgia, are practically feverish. A high of 111 degrees is forecasted to scorch Coachella, CA, this Friday, and Adel, GA, may reach 103 degrees by Wednesday.

In light of the U.S. Bureau of Labor Statistics’ disheartening inflation news, it is relieving for buyers to see FOB prices soften. But no matter how tasty those California cherries look, dropping $100 to fill the gas tank makes consumers less likely to splurge in the produce section.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Week 24’s roundup isn’t without its sore thumbs. Last weekend’s heat wave damaged a few commodities grown in California, and disobliging weather in Mexico and Peru negatively impacted yields. Georgia is in full swing but may end earlier than usual due to the heat. Local growers up the coast should begin harvesting earlier than normal, balancing supply.

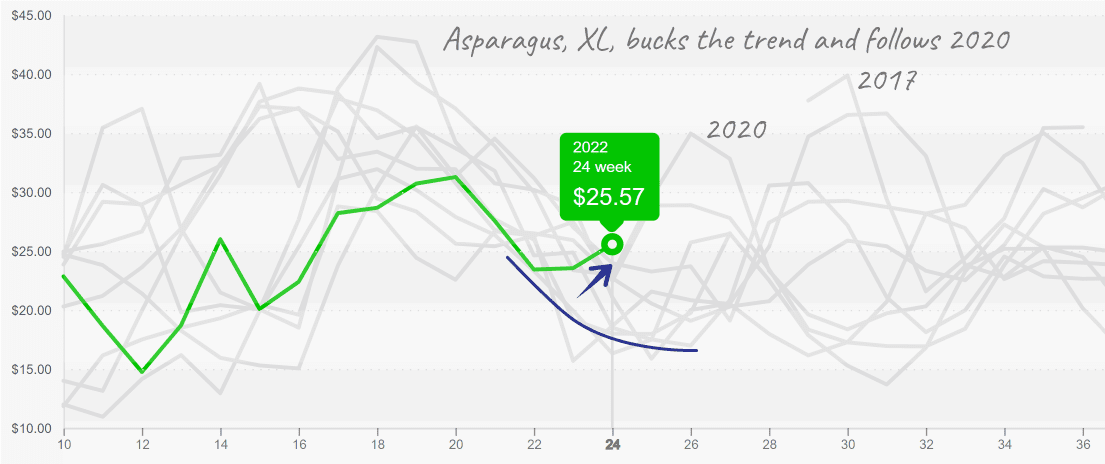

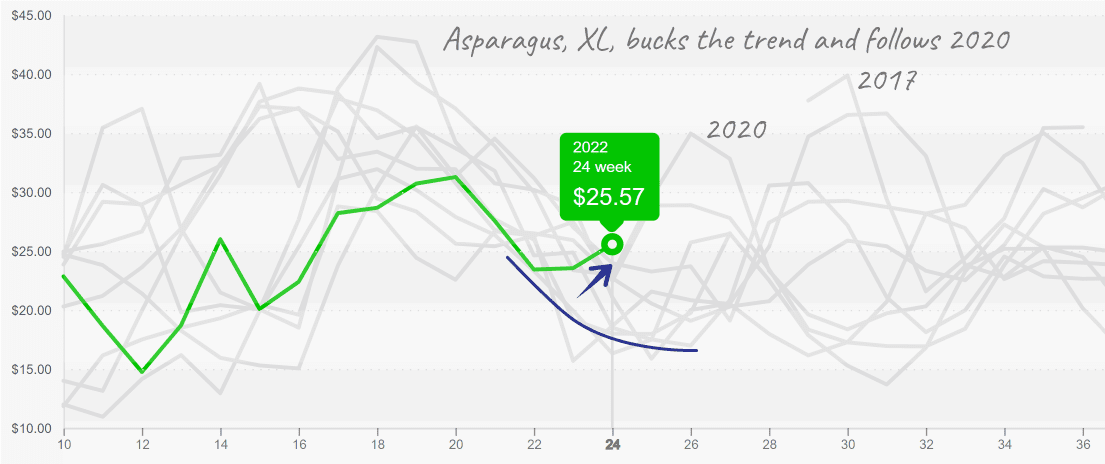

Asparagus prices are up +19 percent over the previous week. Mexican growing regions for asparagus are in transition. Baja California, Mexico, is winding down, and Central Mexico has yet to pick up production. There is some light supply coming from Peru; however, cooler weather is lessening yields. Therefore, supplies should remain somewhat limited for the next two weeks.

Asparagus LG/XL rises past $25 and is poised to climb higher

After two weeks of what seemed like the beginning of the end to sky-high avocado prices, Mexican and Californian avocados are back up to $80 (48 count). Mexico’s production of the Negra crop is waning, and the Loca crop has yet to mature enough to meet harvest standards. As a result, supply is again incredibly short and will probably remain so until Mexican growers begin their summer harvest in early July.

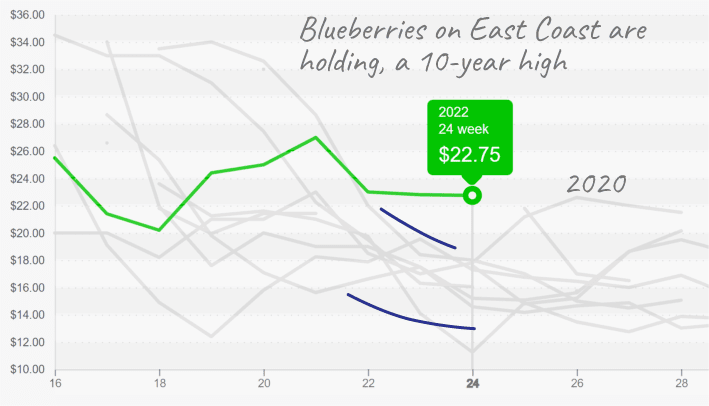

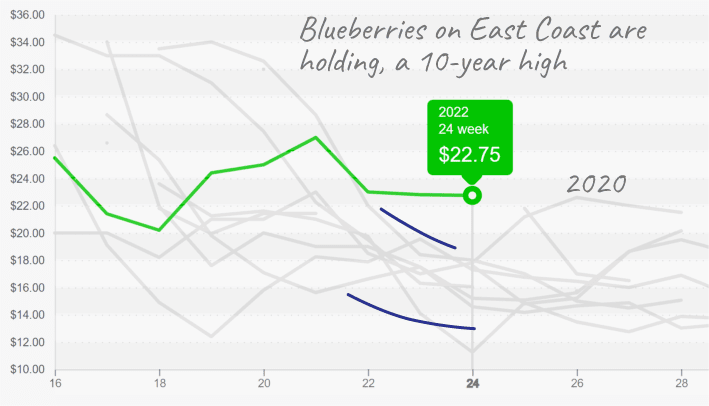

Last weekend’s heat on the West Coast damaged Californian blackberries and blueberries.

Before last week’s heatwave, blueberry supply was already thin. Despite the continued shortages and damage to crops in the Central Valley, prices seem to be steadying at their, albeit high levels. The Pacific Northwest is still a couple of weeks out; however, other domestic growers on the East Coast (Georgia, North Carolina, and New Jersey) have quality product.

Like blueberries, blackberries on the West Coast also suffered damage from the heat though prices have yet to show any severe reaction. In the meantime, Georgia growers are shipping product West to cover shortages.

East-coast Blueberries are outpacing prior years, including 2020

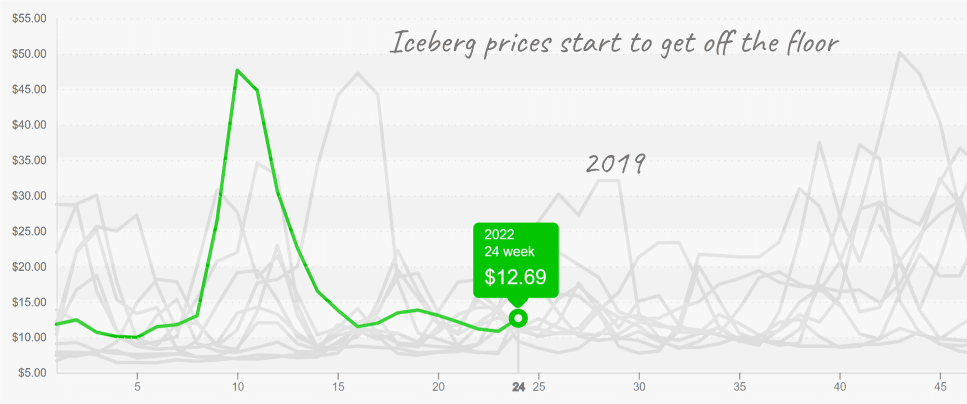

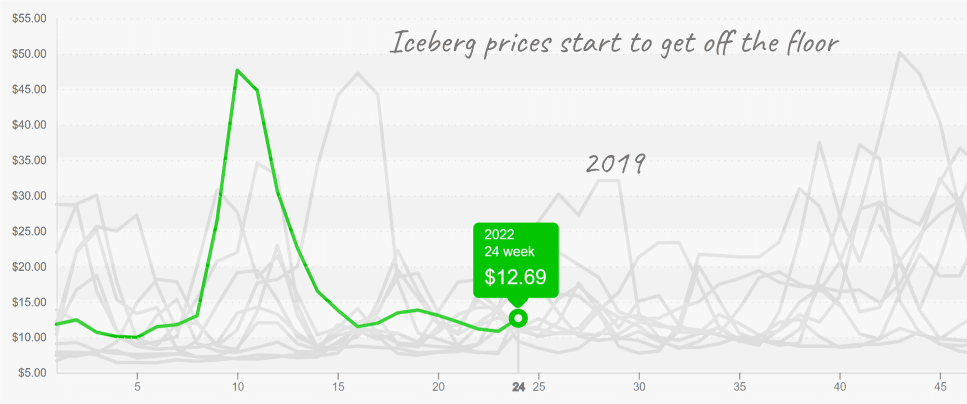

The heat wave didn’t just affect berry yields. Iceberg and romaine fields suffered damage. However, unlike berry markets, prices are responding to the reduced supply. Prices for romaine are up +4 percent, and iceberg prices are up +14 percent. Lower demand caused by the closing of schools for summer is softening the market and steadying prices.

Iceberg lettuce trying to move higher

Some vegetables just don’t enjoy summer that much. Broccoli markets are tightening up in response to short supply. Prices are only up +4 percent but may climb further in response to warm/wet weather in Mexico and subsequent pest problems. Fortunately, California has plenty of good supply and can pick up any remaining slack.

Please visit Stores to learn more about our qualified group of suppliers, or our online marketplace, here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.