It was a blustery weekend for the players at The Masters in Augusta, GA, and fresh produce growers across the U.S.

Blistering winds whipped through growing regions on the West Coast and Southeast as separate fronts brought rain and cooler weather to California, Arizona, and parts of the Southeast.

We wish we could say the supply of Valencia and Navel oranges is handling Mother Nature’s whims as well as 2024 Master’s champion, Scottie Scheffler. But sadly, repeated rain and wind events have caused low fruit set for both varieties. Prices may ease for the next two weeks but will likely hold onto record-breaking territory for a while longer as supply and sizing continue to challenge buyers.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.31/pound, flat over prior week

Week #15, ending April 12th

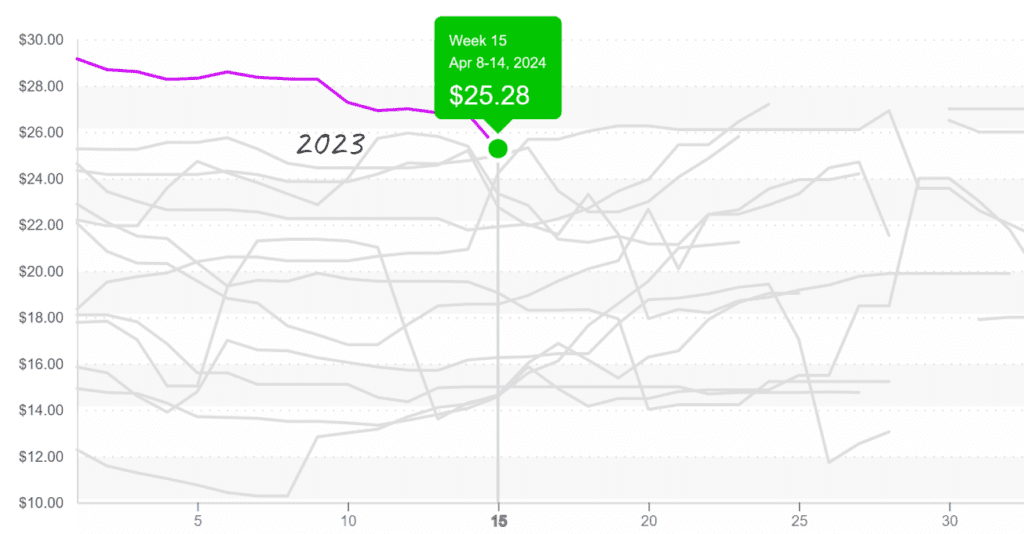

Navel oranges from the West (72ct) dip to $25 yet remain higher priced than any other year.

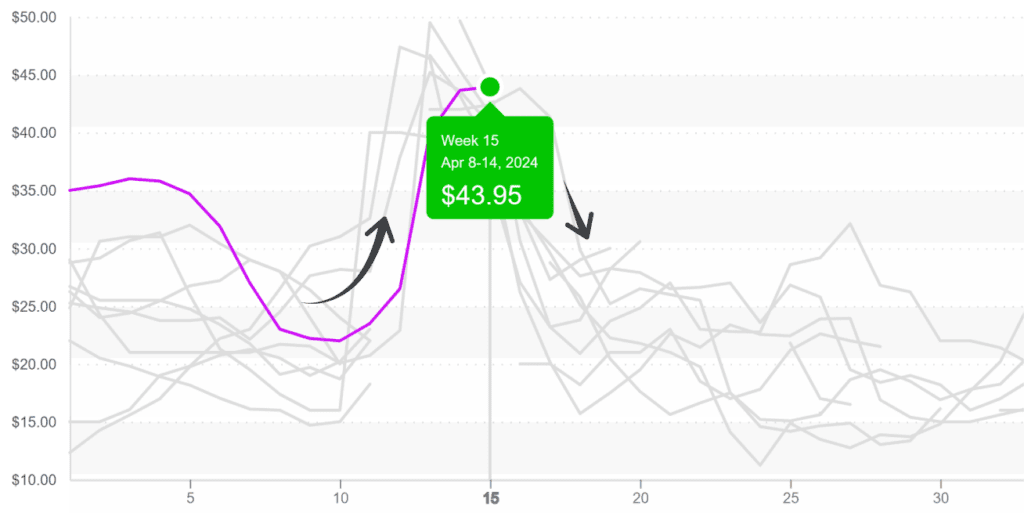

Up +17 percent over the previous week, blueberry prices are rising at a time typically defined by declining prices. Week #15 volume from domestic and foreign growers is paltry compared to the last ten years of USDA data.

After South America’s unfortunate blueberry export season, US markets are hungry for product. Florida growers are starting to come online and are optimistic about 2024’s prospects. Unlike last year, growers in the state have predominantly recovered from the aftermath of Hurricane Ian.

In addition, more chill hours during Florida’s winter season compared to 2023 have deciduous crop growers hopeful that a larger harvest will be possible this year.

Blueberries in East (12 1pt clamshells; large size) reach peak seasonal pricing, $44.

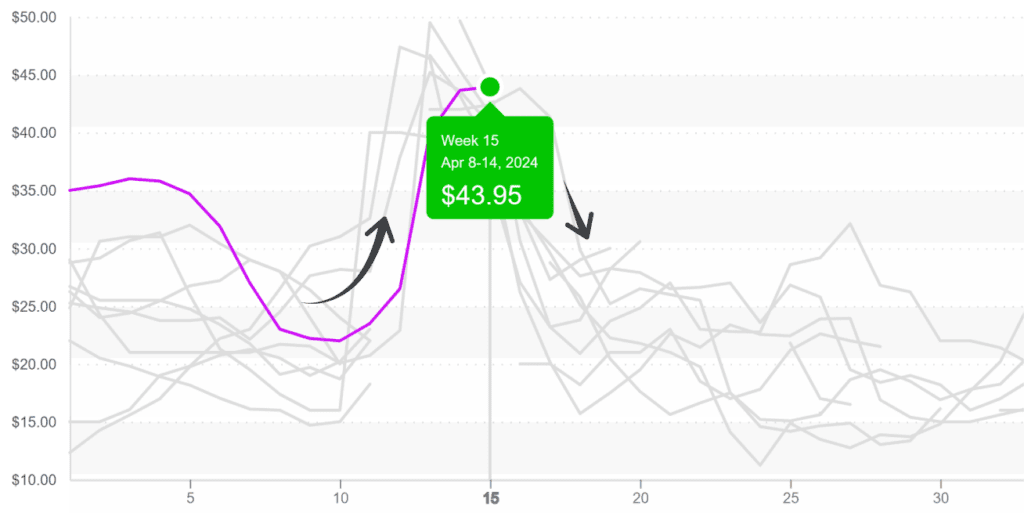

Strawberry markets are on a roller coaster that won’t stop. Repeated rain events in California are slowing the transition to the Salinas/Watsonville areas and are sending strawberry prices back into record-breaking territory.

Suppliers expect conditions to soon swing in the opposite direction. Weather forecasts for this week predict that growing areas in Northern California will be quickly brought online, flooding the market with much-needed product.

Watermelon prices are down for the third consecutive week. The import season is coming to a close, and the domestic season is just beginning. Supply is still tight but will steadily improve as warmer weather brings growers on both coasts online. However, that same heat fueling plant growth is also thawing out demand for ‘the Spring picnic’s favorite fruit.

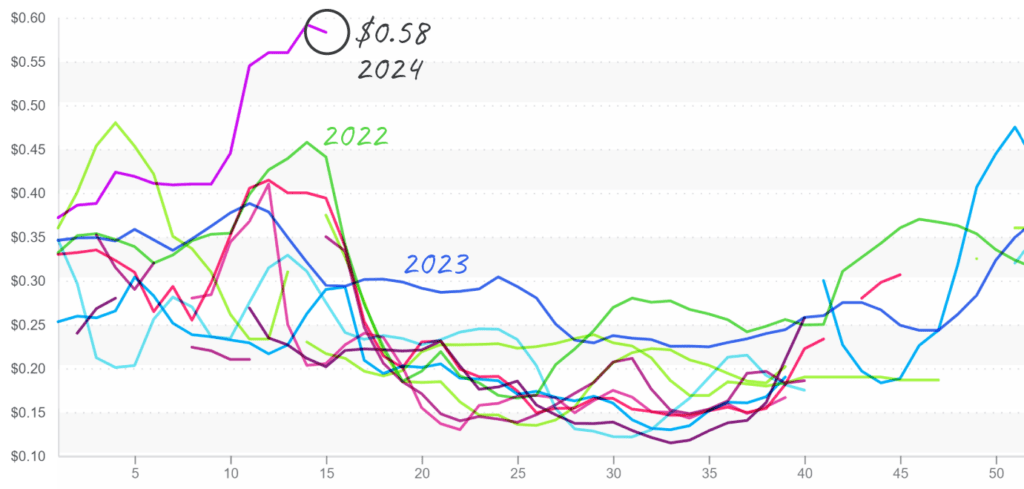

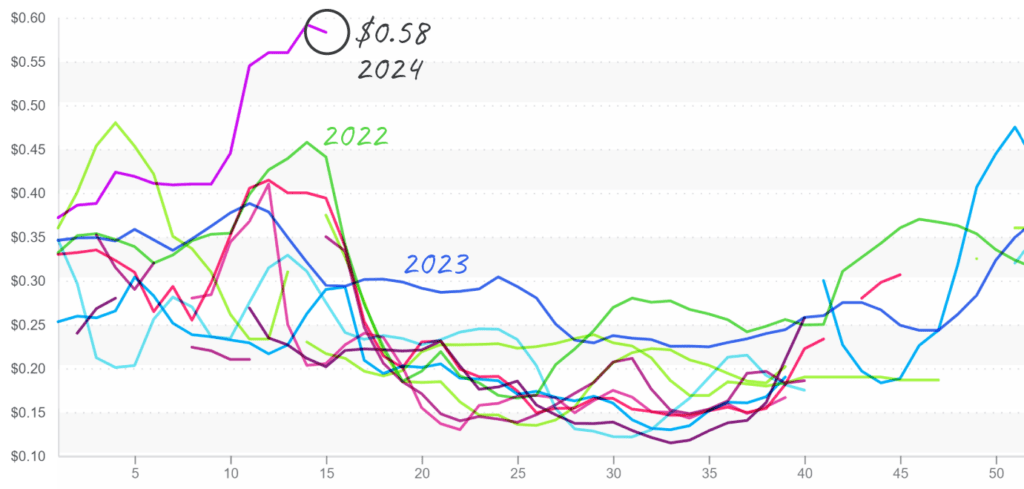

Eastern Seedless Watermelon (24″ bins) remain at record prices, $0.58. Available product is still hard to find.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.