Oranges have seen unprecedented success with strong consumer demand at retail during the pandemic.

Below are some charts and data points that tell the amazing story the citrus item has had this year.

Leadership in Orange production in the U.S. remains in California through the third quarter of 2020.

We approach the last quarter of 2020 with increasing volumes and pricing for oranges, following disruptions to the food supply chain arising from the Covid-19 pandemic.

Oranges was one of the products that saw a spike during the beginning of the shelter in place orders in March of this year.

Blue Book has teamed with Agtools Inc., BB #:355102 the data analytic service for the produce industry, to look how a fruit or vegetable fared in 2020 and what it should expect next year.

Producing Regions

California is consistently the highest producer of fresh oranges consumed in the United States, accounting for 90+ percent of the market.

This consistency is also evident when we move down the list to other regions, which year after year rank among the top suppliers of oranges. We are referring to Florida, Mexico, and Texas.

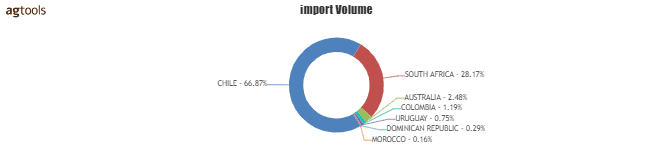

From outside of North America, Chile is the most important supplier of oranges to the U.S. market, accounting for two-thirds of all orange imports so far this year.

We continue to see presence of more countries in the domestic supply of oranges, such as South Africa and Australia, which among other, are vying for a piece of the action of the almost 5 Billion pound market that is the U.S. Orange opportunity.

Valencia prices have trended upwards since the beginning of July

2020 Pricing

The supply side is benefiting from a strong season, both in demand as well as pricing.

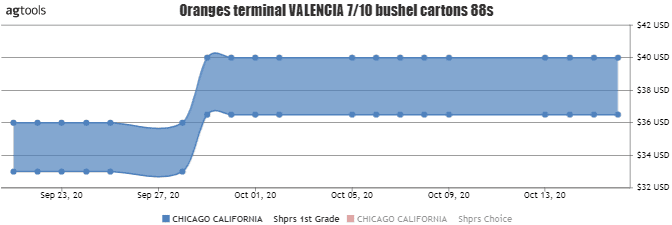

Since July, Valencia oranges in 7/10 bushels of 88s and 138s have commanded the highest prices and surpassed those for the comparable 2019 period.

This year’s pricing for the analyzed period is 60 percent higher for the 138s and 77 percent higher for 88s, while demand and supply have remained strong.

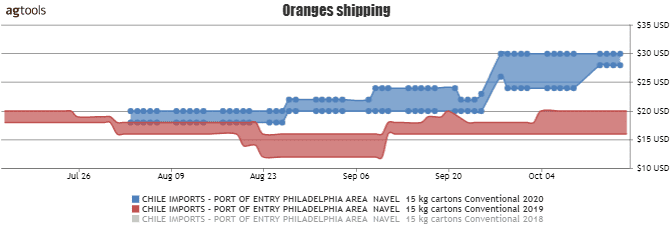

Higher prices are also the story when looking at imports from Chile of the Navel variety. The price for Navel oranges in 2020 for 88’s coming from Chile have peaked at $30, which is an increase of 50 percent over 2019 prices.

The strong demand for oranges is expected to continue for the remainder of the year and close monitoring will allow us to confirm if the pattern holds for the rest of 2020.

Terminal Pricing

Since the beginning of October, the Valencia variety out of California has been selling between $36.50 and $40, indicating a potential gross margin for the terminal market around 22.5 percent.

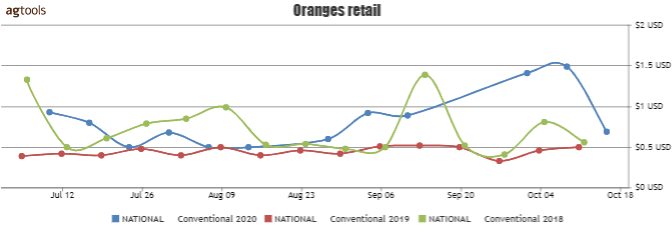

Retail Pricing

Apart from the most recent reports, national prices per pound for the Valencia variety have been steadily increasing since August. This is a rather unexpected combination of trends, given volume and supply are on the rise, so are FOB prices and national retail prices.

When we last visited this product, we found that retail pricing had not been increasing in a pace mirroring that of F.O.B. No longer the case through the middle of October, we will closely monitor the next pricing reports to confirm whether the upward national retail price for the Valencia variety holds.

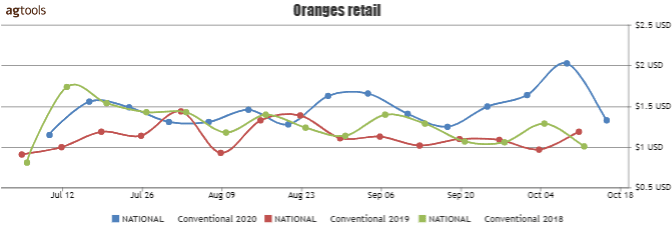

National pricing for Navel oranges has increased during the last four weeks, falling only during the most recent report.

Different to the Valencia variety, the price for Navel oranges has experienced changing prices since July. An upward trend was not evident until the beginning of the most current increase, which started approximately one month ago.

Just like with the Valencia variety, we will monitor future pricing reports to confirm whether the increase, which accompanies increasing volumes and F.O.B. pricing, holds through the rest of 2020.

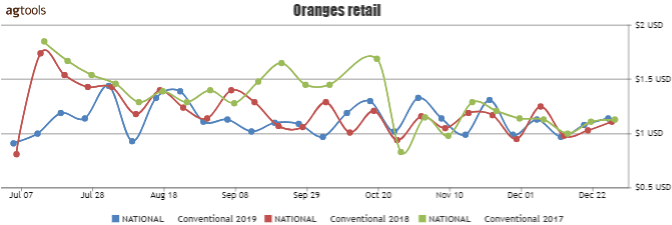

It is worth noting that this season is showing the highest prices of both varieties for the third quarter when compared to the last four years (2017 through 2020).

The highest retail national price for Valencia oranges did not hit $2.00 ($1.99 to be exact) until week 49, which happened during 2018 (see graph above). This year’s pricing is proving to be the highest of the last four years through October, with 2.5 months to go in 2020.

The highest retail national price for Navel oranges peaked at $1.65 during week 38 in 2017 (see graph above). In 2020, price for Navel oranges already reached $2 in week 41, with eleven weeks to go in the year.