During the last week of May, restaurants in many states had started to reopen dine-in facilities with social distancing measures in place, with subsequent improvements in reservation and transaction metrics and continued elevated engagement with takeout.

This increase in produce demand from the foodservice side of the business came on top of continued elevated levels of at-home meal occasions. This results in an ever-changing demand landscape for grocery retailing as a whole, and produce along with it. 210 Analytics, IRI and PMA partnered to understand how retail sales for produce are developing throughout the pandemic and as restaurants around the country are starting to re-open their doors.

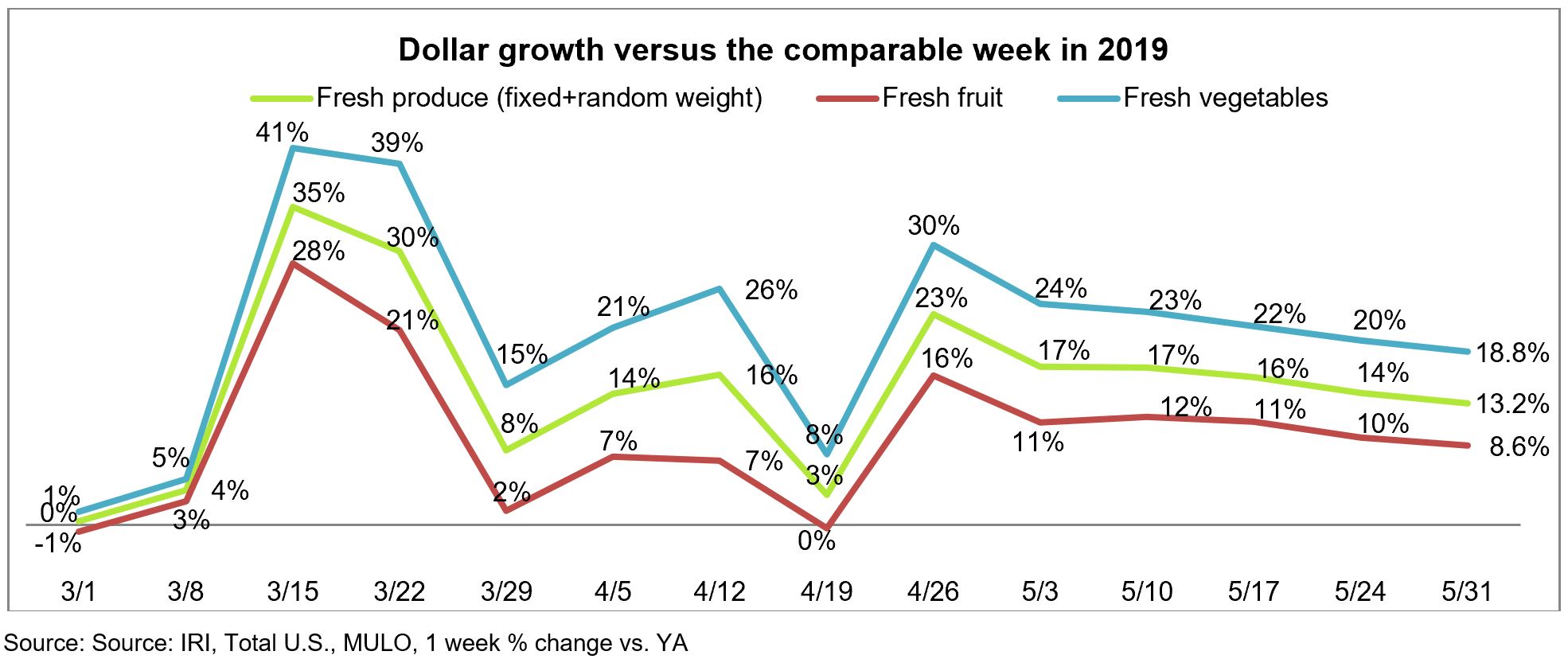

During the last week of May, elevated everyday demand drove double-digit produce gains for fresh, frozen and shelf-stable fruits and vegetables. Fresh produce year-over-year growth for the week of May 31 versus the comparable week in 2019 increased 13.2%.

Year-to-date, fresh produce sales are up 10.4% over the same time period in 2019. Frozen fruit and vegetables increased the most, up 28.8%, despite continued high out-of-stocks and severely limited assortment availability for both frozen vegetables and fruit. Year-to-date growth for frozen was also +28.8% versus last year.

“Fresh produce has grown in double-digits for 11 out of the last 12 weeks,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA). “While gains eroded by about a point this week once more, demand is still well above 2019 levels. As an industry, we sold an additional $2.7 billion in fresh produce since the beginning of the year at retail, or 944 million pounds. At the same time, restaurant demand is strengthening across the country with trucks full of fresh produce hitting the road once more.”

Fresh Produce

With an additional $166 million in fresh produce sales or 87 million pounds, growth for the week ending May 31 came in at +13.2%.

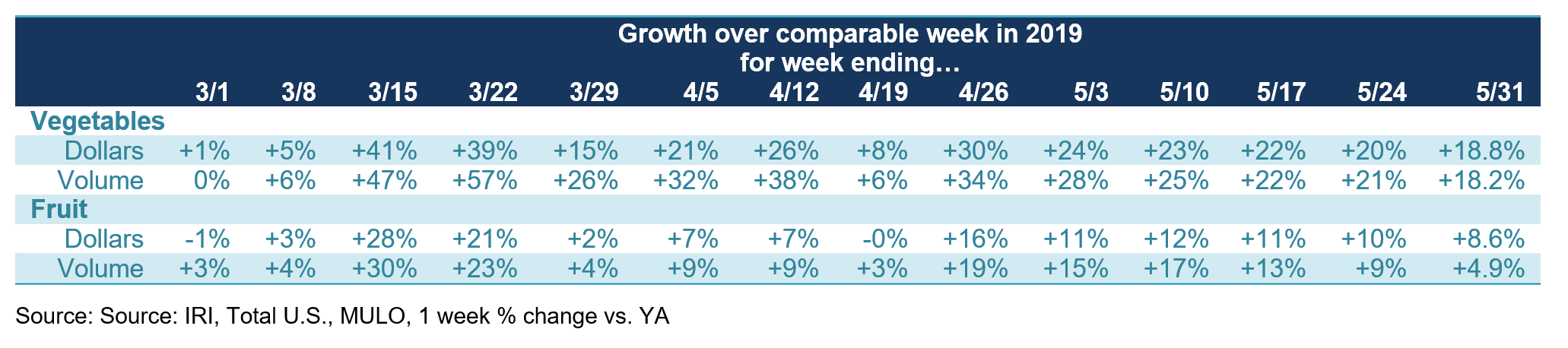

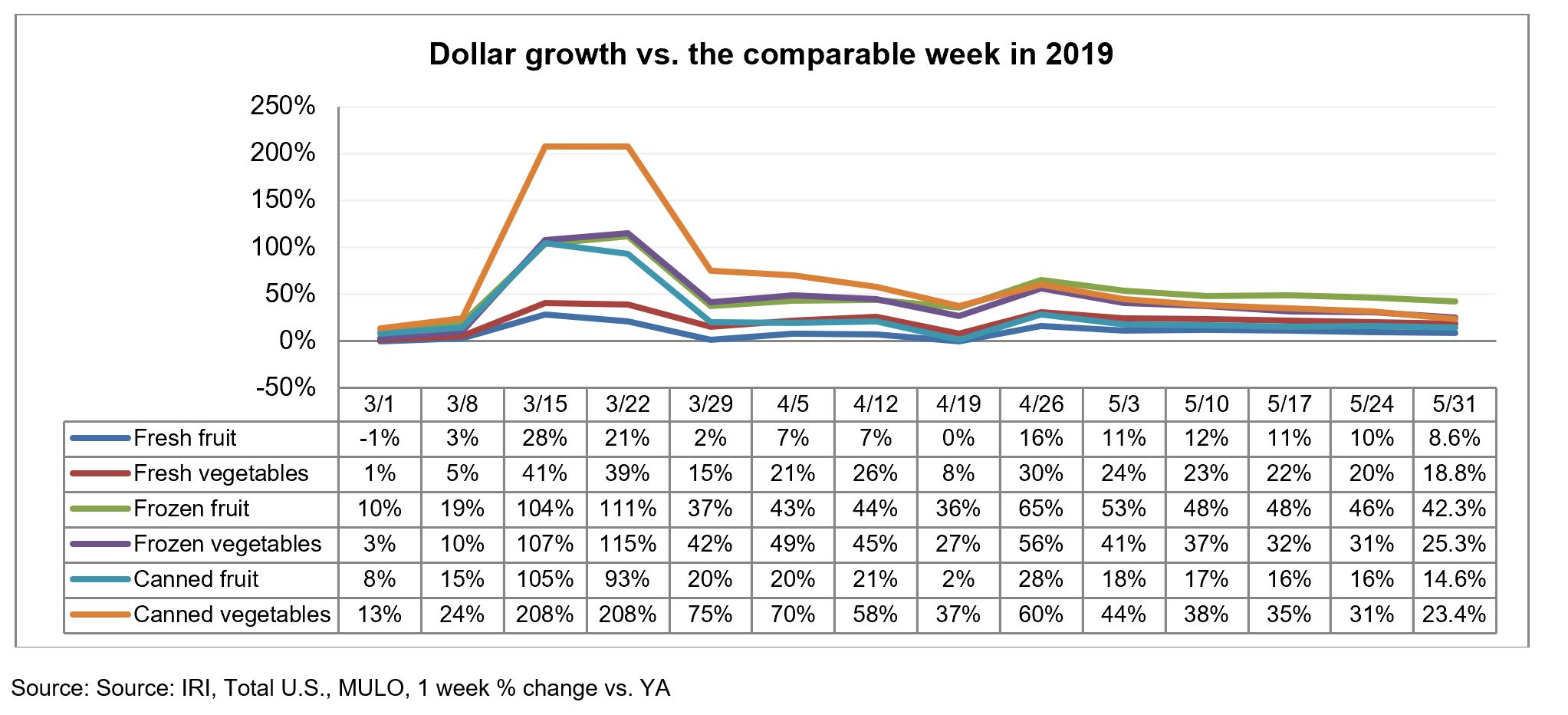

Vegetables, up 18.8%, easily outperformed fruit, which has fallen back into single-digit gains. While strong, growth rates have dropped by one to two percentage points each week since the last week of April. Fresh vegetables have seen the stronger performance throughout with double-digit gains for all but one week since mid March.

“Fruit sales are typically highly reliant on impulse purchases,” said Jonna Parker, Team Lead, Fresh for IRI. “Importantly, in our latest wave of consumer surveys, 42% of consumers said they are spending less time in the store when shopping for groceries than pre-pandemic. That means four in 10 consumers tend to hurry through the aisles which undermines impulse tendencies. Making sure consumers are aware of a great new batch of cherries or watermelons before they even enter the store has become all the more important.”

Fresh versus frozen and shelf-stable

Percentage-wise, gains in fresh produce are bound to be lower than frozen and shelf-stable due to its share of total store fruits and vegetables.

“Every week, fresh produce claims back another point of the share it lost during the major panic buying weeks when shoppers were looking for stock-up items,” said Watson. “At the end of May, shelf-stable was actually below normal levels, down from its highest share of 19% mid March, but the share for frozen fruits and vegetables remained elevated.”

Shoppers commented on the Retail Feedback Group’s Constant Customer Feedback (CCF) program this week on the improved availability, quality and freshness in the produce department. One shopper wrote, “Seems that lately the produce freshness has actually improved since the COVID-19 crisis started.”

But others wrote about lacking organic items, a recurring theme among shopper comments since early March. “Organic produce in general (berries, root vegetables, peaches, plums, etc.) were out of stock.”

Other consumers commented on practical issues amid the new shopping reality, which underscore that all store-level decisions, whether SKU rationalization, mask policies, packaged versus bulk, etc. have shopping implications that are liked by some and disliked by others. “I bought eight corn cobs this week because they were on sales but the trashcan to shuck them in the store was not there. Is that some kind of pandemic measure? If so, what is the reasoning behind that?” Another shopper commented on produce bag issues, “I cannot open the bags to put produce in now that masks are required.”

Fresh Produce Dollars versus Volume

Memorial week was the first time that dollar gains tracked slightly ahead of pound gains since the onset of the pandemic. During the final week of May, this trend accelerated, with dollars increasing 13.2%, while pounds grew 10.1%.

Both fruit and vegetables saw volume growth tracking ahead of dollars the week of May 31 versus the comparable week in 2019. However, the volume/dollar gap for fresh vegetables was just 0.6 percentage points. In fruit, dollar gains are tracking 3.7 points ahead of volume, signaling price increases.

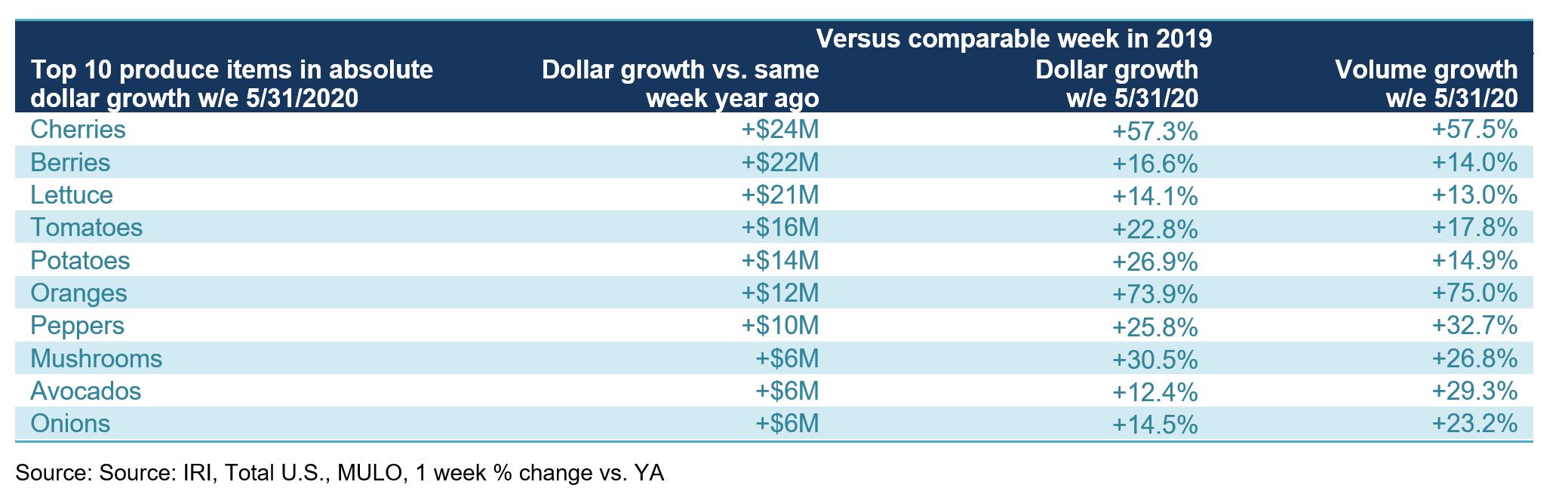

The top three growth items in terms of absolute dollar gains for the week of May 31 versus year ago were cherries, berries and lettuce. “It is great to see that despite all that is different in our lives amid the pandemic, summer fruit sales traditions are holding strong,” said Watson.

“Week after week it had been lettuce and potatoes that led absolute dollar growth, but, this week, both cherries and berries jumped over the top of lettuce with a combined $46 million in additional dollars versus year ago. That gives us some good indication that other summer vegetable and fruit trends are likely to hold up as well.”

Strong demand is driving volume along with dollar gains across the board. However, in some areas, ample supply is still suppressing prices which means there are continued significant volume/dollar gaps for items such as avocados (17 point gap) and onions (nine points).

In other areas, dollar gains are starting to take a bigger lead over volume, such as tomatoes, where dollars paced five points ahead of volume. “The strengthening demand coming out of foodservice combined with the continued elevated demand seen in retail will continue to balance out supply and demand in the coming weeks,” said Watson.

Fresh Fruit

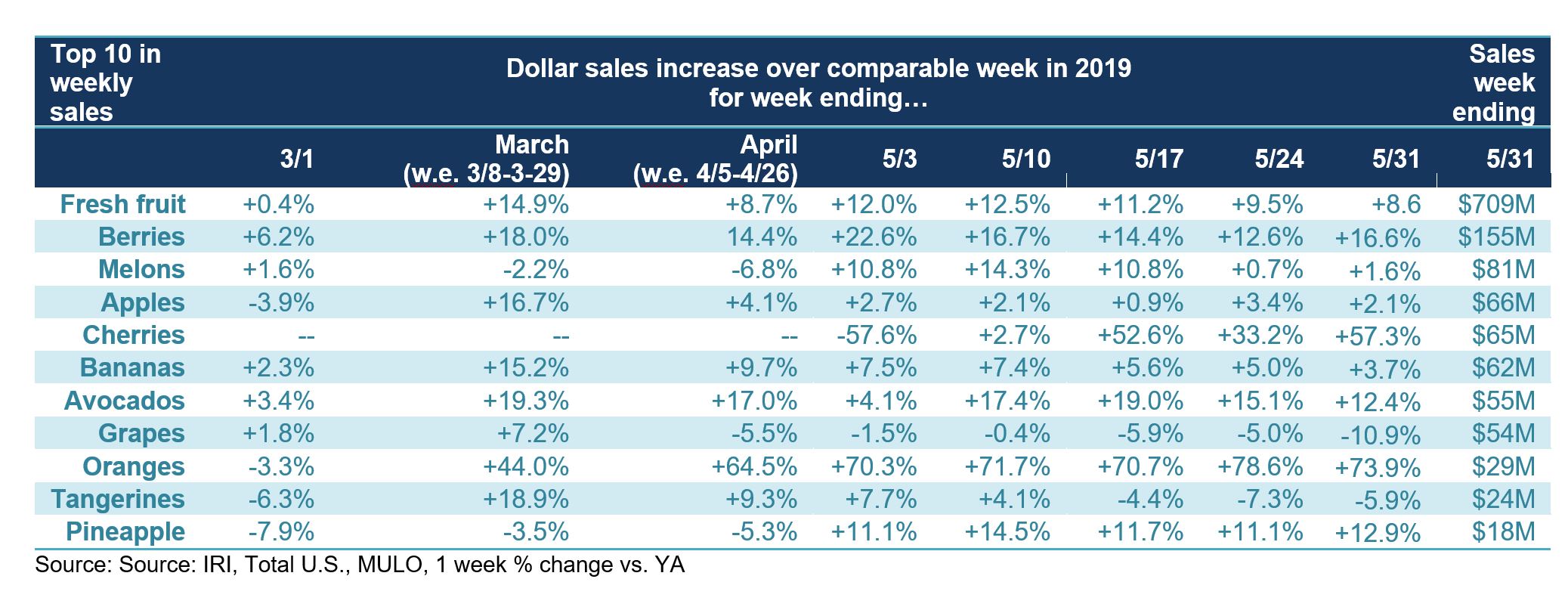

“Like we have seen for the last four weeks, fruit gains lost about one point and dropped just below +9% the week of May 31 versus the same week year ago,” said Parker.

“Oranges continued to amaze with gains upward of 70% throughout the entire month of May. Citrus is a logical choice for consumers looking to boost immune systems and solid supply is meeting this elevated demand. Cherries were the biggest grower of all fruits and vegetables this week and were the number four in terms of sales, generating $65 million for the week. The strong volume is allowing retailers to utilize cherries in ad and front of store to herald the arrival of summer, even in these unprecedented times.”

Five out of the top 10 items in terms of dollar sales saw double-digit increases during the week of May 30 versus the comparable week in 2019, whereas grape and tangerine sales continued to see dollar sales pressure.

Fresh vegetables

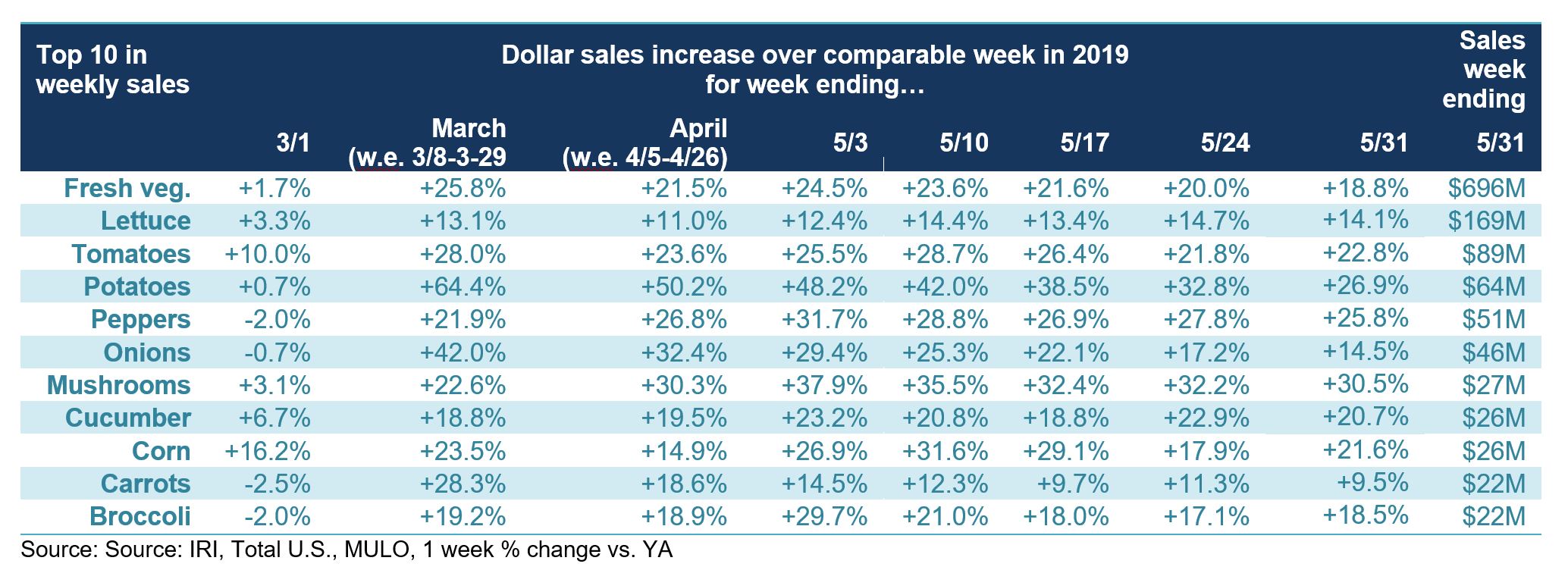

All top 10 vegetable items in terms of dollar sales gained double-digits the week ending May 31, with the exception of carrots that fell just below +10%.

“Vegetables had been outgrowing fruit for a few years,” said Parker. “But that disparity got amplified amid the pandemic. Fresh vegetables are still pacing nearly 20% above last year’s levels nearly three months into the pandemic. Many more consumers are cooking and 23% plan to cook from scratch more often going forward. Manufacturers and retailers have an opportunity to innovate around solutions to the top cooking challenges consumers say they are facing, including coming up with new meal ideas, finding inspiration to cook, having the right ingredients on-hand, and accessing more quick and healthy meal creation options.”

Lettuce was the top sales category followed by tomatoes and potatoes.

Sales gains for fresh cut salad (included in Lettuce above) continued to be a strong performer over the week ending May 31, with dollar sales 13% above year ago levels — maintaining the record gain measured in the prior week.

Fresh Versus Frozen and Shelf-Stable Fruits and Vegetables

While gains in frozen continued to outpace those in fresh and canned, frozen is also the smallest of the three areas and the difference has grown significantly smaller since the two panic buying weeks. Both frozen and canned fruit and vegetables had double-digit growth once more, with frozen fruit reporting the highest gains, at +42.3%.

Perimeter Performance

Gains for center-store edibles (+17.5%) outpaced those in fresh (+11.2%) during the week of May 31. Whereas the meat department had been outpacing produce by a large margin, the gap in growth numbers has narrowed significantly as meat sales were hampered by tight supply.

The fresh perimeter performance continued to be pulled down by deli prepared and the in-store (fresh) bakery that have struggled since the end of March as quarantines ramped up.

What’s Next?

The next sales report will cover the first week of June, when many schools officially stared summer vacation. In normal years, summer vacation affects consumption patterns and subsequent demand for several produce categories as meal occasions switch from foodservice to at-home. Additionally, early June retail sales may have been affected by shortened store hours due to local and state-wide curfews.

Meanwhile, the relaxation of the stay-at-home executive orders looks different from state to state. In most states, consumers are able to resume shopping, dining and working out of home. The speed of economic recovery along with any levels of latent social anxiety will drive the demand for meat coming from foodservice for the foreseeable future. Given the limited seating for in restaurant dining and significant levels of economic pressure, it is likely that demand for produce in retail will continue to track well above 2019 levels for the foreseeable future.

Please recognize the continued dedication of the entire grocery and produce supply chains, from farm to retailer, on keeping the produce supply flowing during these unprecedented times. #produce #joyoffresh #SupermarketSuperHeroes. 210 Analytics and IRI will continue to provide weekly updates as sales trends develop, made possible by PMA. We encourage you to contact Joe Watson, PMA’s Vice President of Membership and Engagement, at jwatson@pma.com with any questions or concerns.