Over the last seven days, 6-20 inches of rain fell in Houston, TX, and surrounding areas. Most places experienced the bulk of that rainfall within a 24-hours, and water levels are higher in some towns than during the devastating floods from Hurricane Harvey in 2017.

Hundreds have been rescued from homes and roads, and even more have been evacuated from at-risk areas. One four-year-old boy died Sunday morning after being swept away in flood waters in North Texas.

Houston is now more prepared for major flood events than it was for Hurricane Harvey’s effects. However, logistics will still be delayed in the area for a few days as roadways dry out.

ProduceIQ Index: $1.17/pound, down -3.3 percent over prior week

Week #18, ending May 3th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Watermelon growers in East Texas are certainly having a wet start to their growing season, but significant losses have yet to be reported.

Dramatic temperature contrasts are in store for this week. Winter will lay one last claim to the West while Spring takes a firm grasp of the East. This “battle of the seasons” brings more risk for severe weather and tornado activity to the storm-weary mid-west and East.

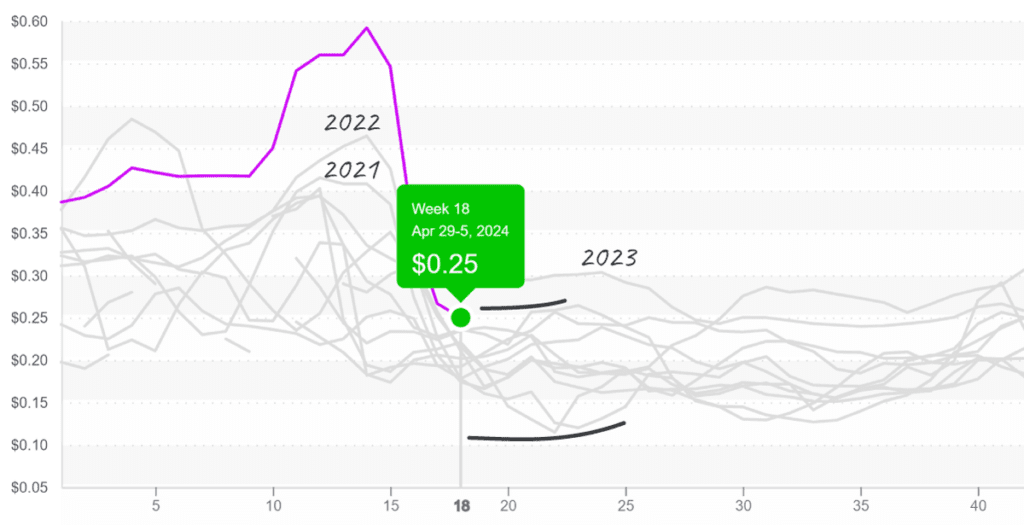

Watermelon prices are down another -20 percent over the previous week. Markets are finally “normal,” still trending slightly above average for week #18, but are nowhere near the record-breaking prices we saw a month ago.

Watermelon supply is forecasted to improve as supply out of Arizona and Florida ramps up.

Watermelon prices reach $0.25/lb (45ct seedless) and tend to fall further until the July 4th pull.

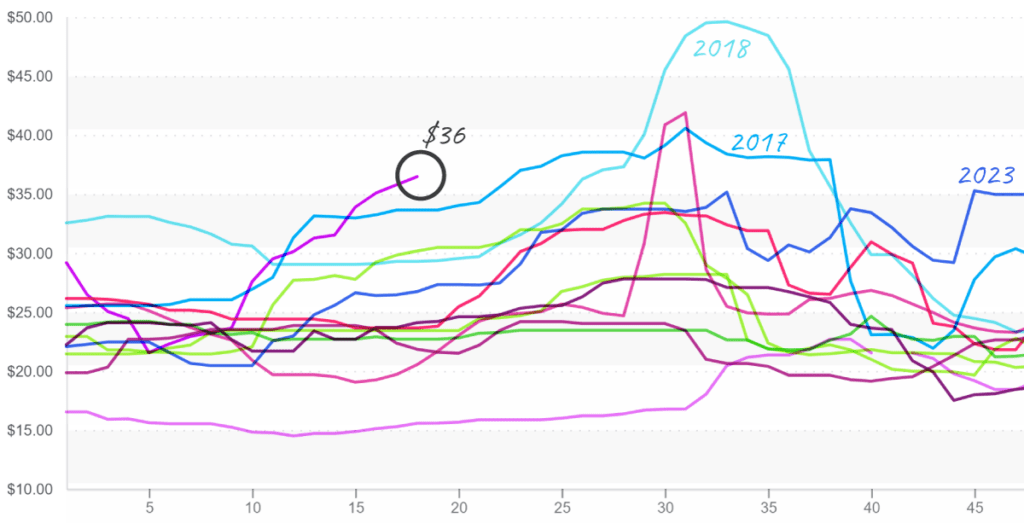

With the average price of lemons around $31 for a 7/10 bushel carton, your neighborhood burgeoning entrepreneur may be forced to raise the prices or switch beverages at their roadside refreshment stand to stay in the black. Smaller-sized fruit is exceptionally tight, but larger sizes are more readily available. Expect prices to remain elevated through July.

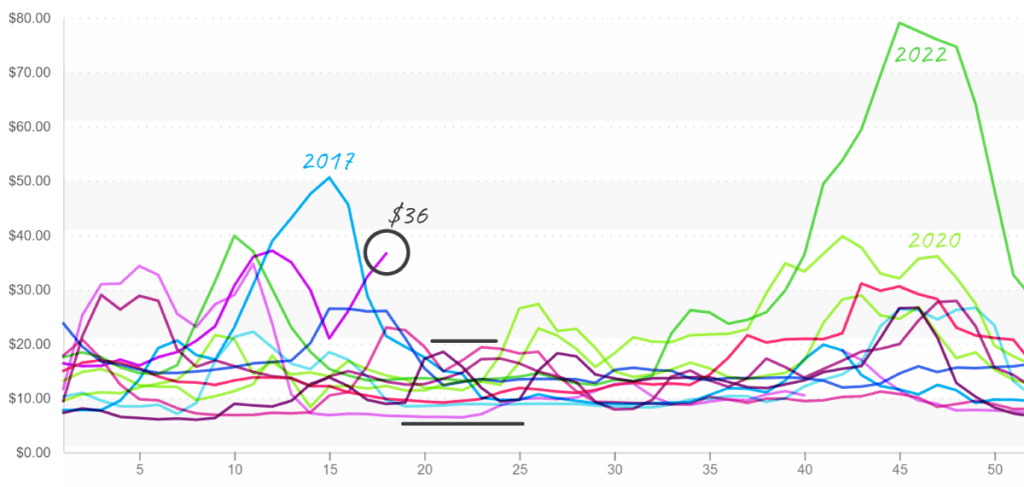

Lemon prices, $36 (200ct), are rising quicker than all prior years; prices typically rise further until week 33.

In the West, another bout of cold weather is sore news for lettuce and leaf growers in the Salinas Valley and Santa Maria, CA, struggling to ramp up their supply. Cool, wet weather is slowing growth and creating quality issues, especially for romaine growers.

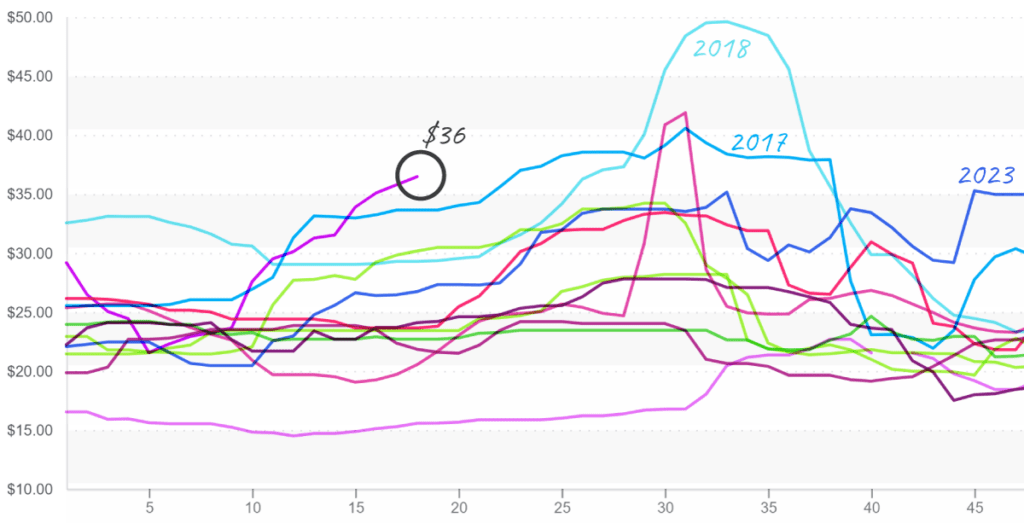

Romaine prices are up another +20 percent over the previous week to a ten-year high. Supply is forecasted to improve, and pricing decrease after Mother’s Day as new fields come online.

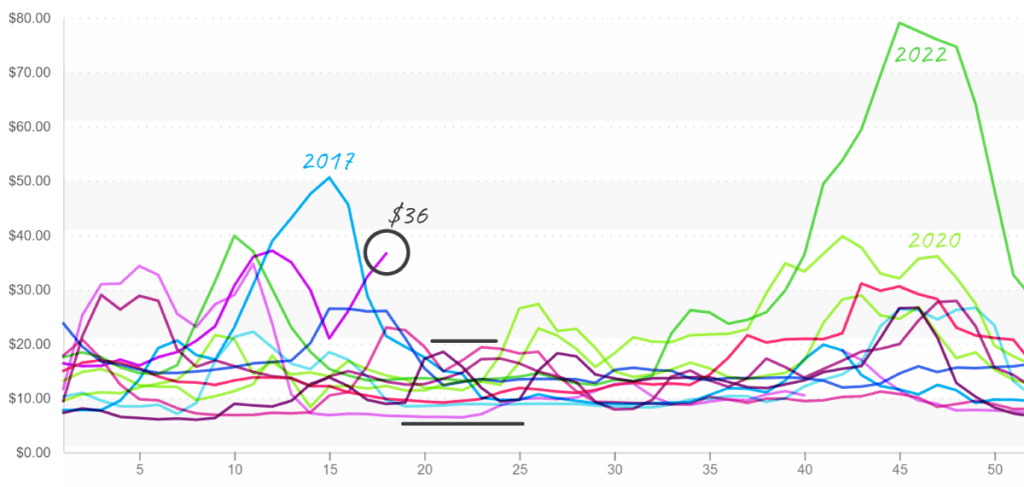

Romaine prices, $36 24ct, look poised for new records; prices typically remain stable (low) until August.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.