Spring is not all vibrant blooms and backyard grilling. The arrival of warmer weather brings a capriciousness to forecasts that impacts everything from crop yields to quality and availability. Snow, a tornado, or even the rare tropical storm could be in the forecast for April.

Speaking of tropical activity, ocean temperatures in the Atlantic are already warm enough for a hurricane, remarkably eight weeks before the season’s official start. With the switch to La Niña, which will likely be in summer 2024, all legs of the produce supply chain need to take proactive measures to brace for a potentially hectic storm season in the Southeast.

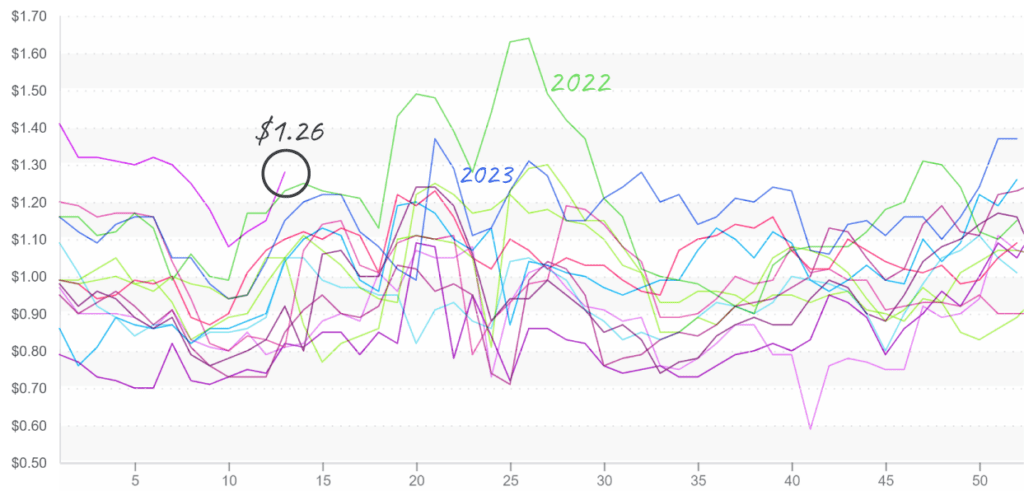

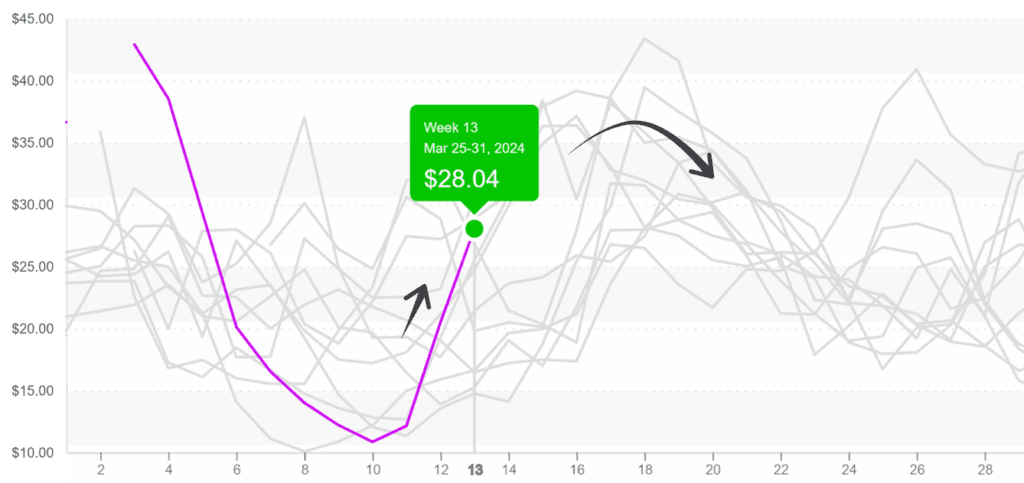

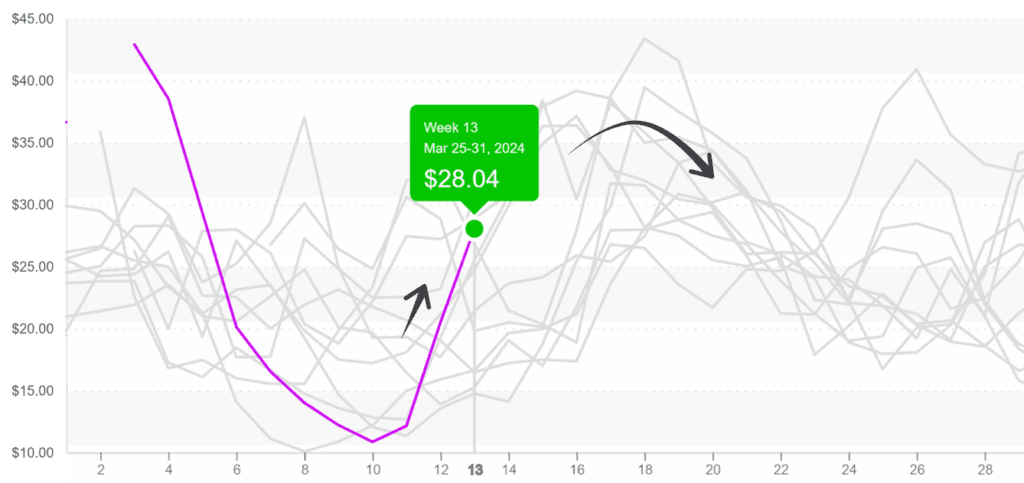

ProduceIQ Index: $1.28/pound, up +11.3 percent over prior week

Week #13, ending March 29th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Overall produce prices are a mirror image of the infamous volatility Spring transition is known for. Markets are up +11 percent over the previous week due to widespread increases in the price of commodities such as grapes, berries, broccoli, celery, asparagus, and melons.

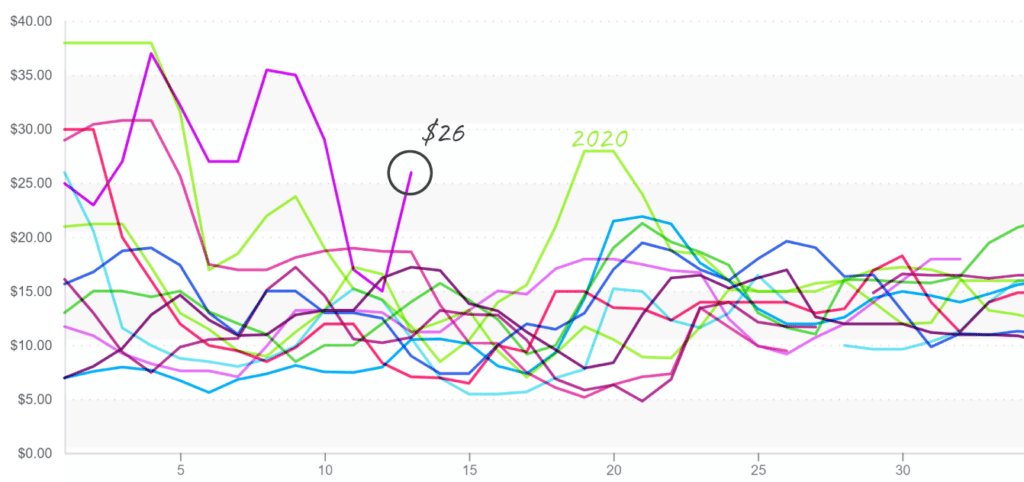

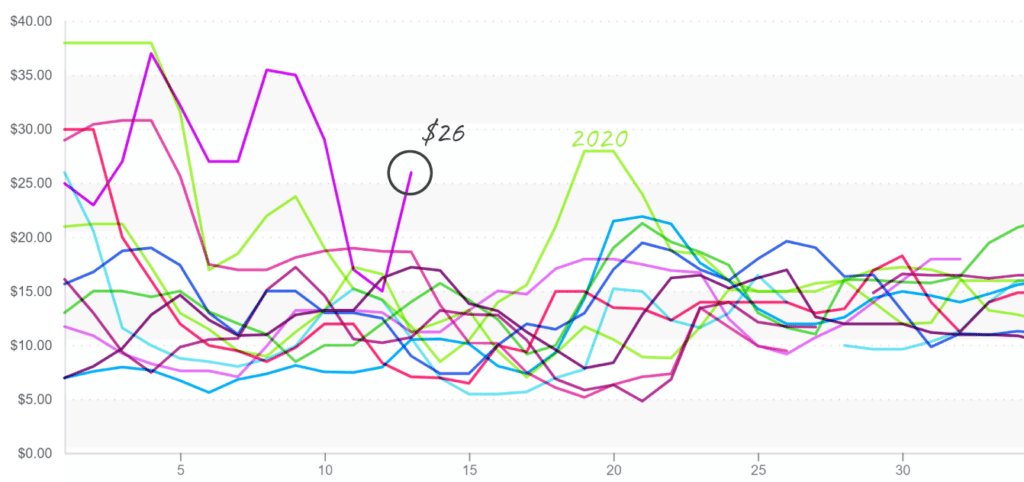

A significant jump in the ProduceIQ index isn’t uncommon between weeks ten and fifteen. However, shortages and weather challenges pushed average prices to a ten-year high this week.

ProduceIQ index returns to record highs for week #13.

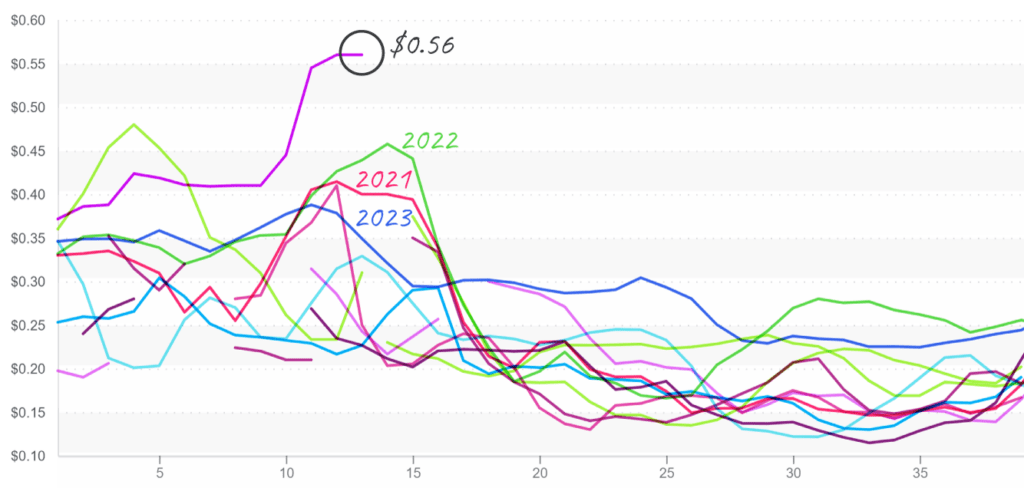

This week’s headline is obviously a poorly executed April Fool’s joke: But watermelon, cantaloupes, and honeydew are experiencing severe shortages due to vessel delays, strong Easter demand, and poor yields from growers in Central America. Prices for all three commodities are running well above average for week #13, and watermelon prices are at a record-breaking ten-year high.

Going forward, watermelon supply is forecasted to improve slightly sometime in the next two weeks. The supply of cantaloupe and honeydew should be better but still tight until domestic growers pick up production in May.

Watermelon prices, $0.56/ lb, seedless in the East, far surpass prior years for this transition time.

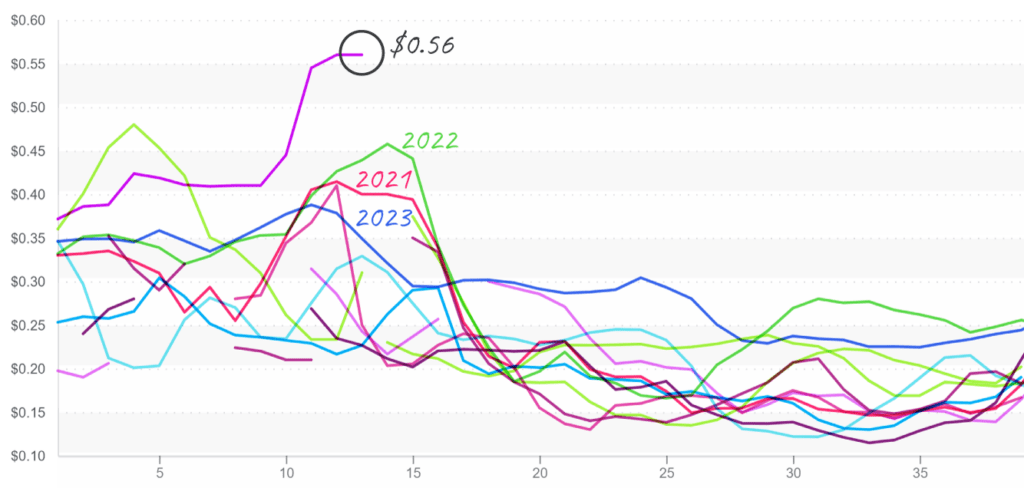

Tomatoes can’t catch a break. As a category, average prices are up +23 percent over the previous week. Mexico finished early, and rain in Florida is putting supply in a dangerously short position.

Field-grown varieties such as plum and round are in the worst shape. According to USDA data, plum and round markets average $20. Grape-type supply is doing okay and may serve as a flavorful substitution for foodservice buyers.

Round tomatoes (25 lb, 5×6) in the East reached a new level, $26.

Up +34 percent over the previous week, asparagus seems to have made it on most Easter menus this year. Prices are well above average but aren’t setting any records. In line with seasonal trends, prices will rise over the next few weeks as Mexican supply fades through April.

Asparagus prices are on their seasonal rise until around week #18.

Please visit our website to discover how our online tools can save time and expand your reach. [hyperlink:

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.