Congratulations to Greg Johnson and the Kansas City Chiefs for another historic win. We know you couldn’t have done it without Taylor Swift.

It was a wet week out West, with parts of active growing regions in Southern California and Arizona receiving ½-1 inch of rain over just a few days. Despite soggy conditions, lettuce and leaf markets are relatively stable. We can’t say the same for strawberries, however.

Driven by strong Superbowl and Valentine’s Day demand, overall produce industry prices remain 14 percent higher than in any prior year.

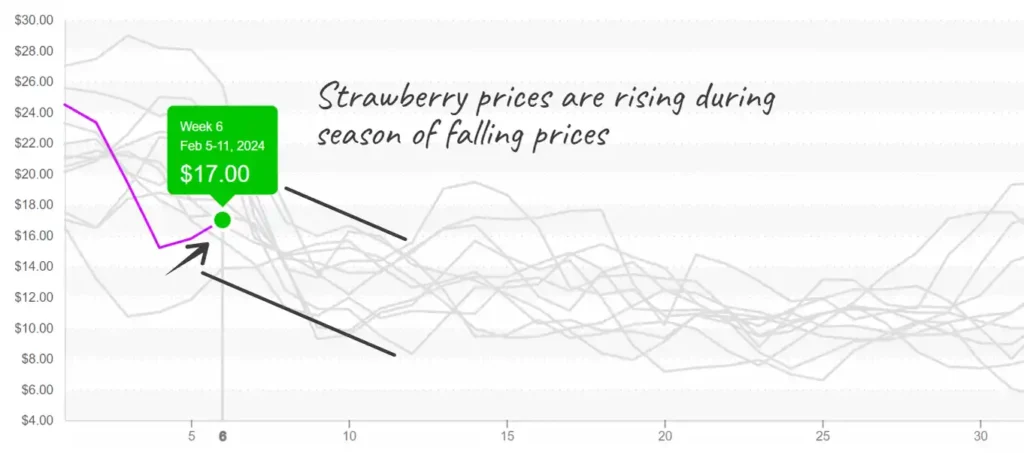

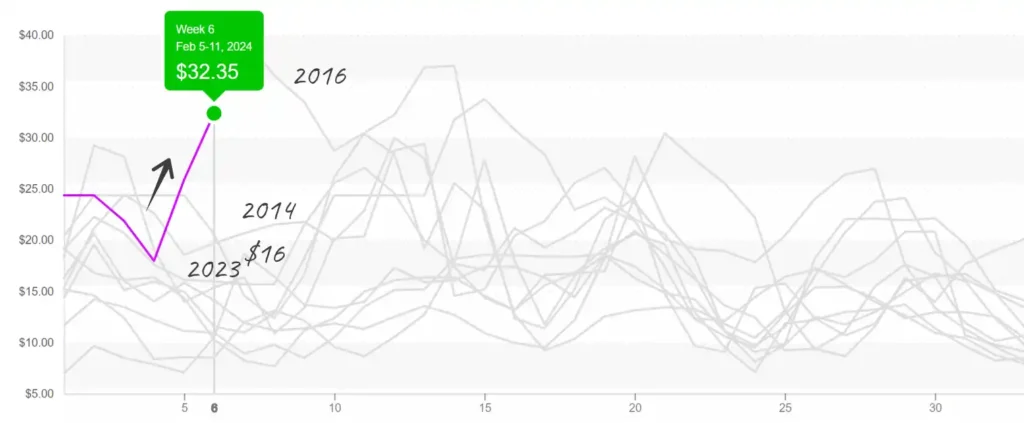

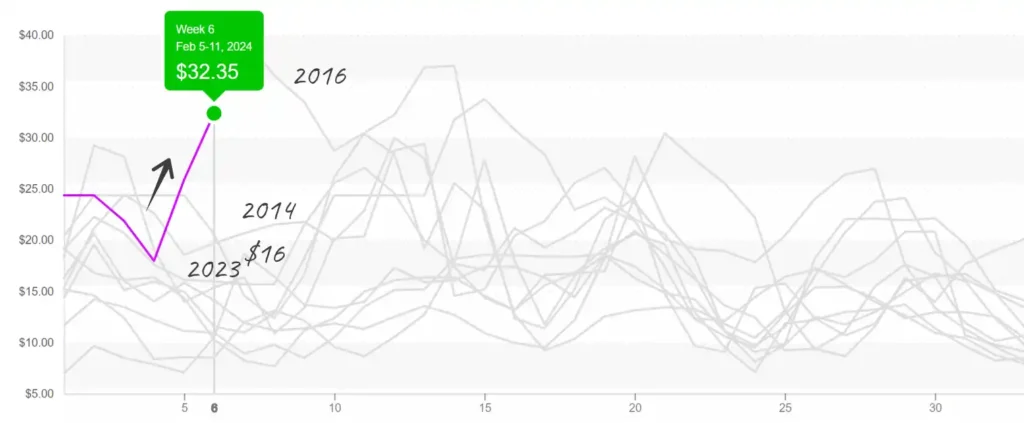

We hope you weren’t ‘in love’ with your Valentine’s Day promotional plans for strawberries. After heavy rains inundated strawberry growers in California last week and relief from Mexico stalled at the border, prices defied historical convention and increased in week #6.

California’s production is significantly below the norm. However, the supply situation should turn around quickly as holiday demand wanes and strawberry fields in California dry out. And despite this very wet start, the overall supply forecast for 2024’s Southern California winter strawberry season is optimistic. Buyers should look to suppliers in Florida and Texas to cover shorts in the interim.

ProduceIQ Index: $1.32/pound, up 1.5 percent over prior week

Week #6, ending February 9th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Strawberry prices are high, at $17, but may soon decline.

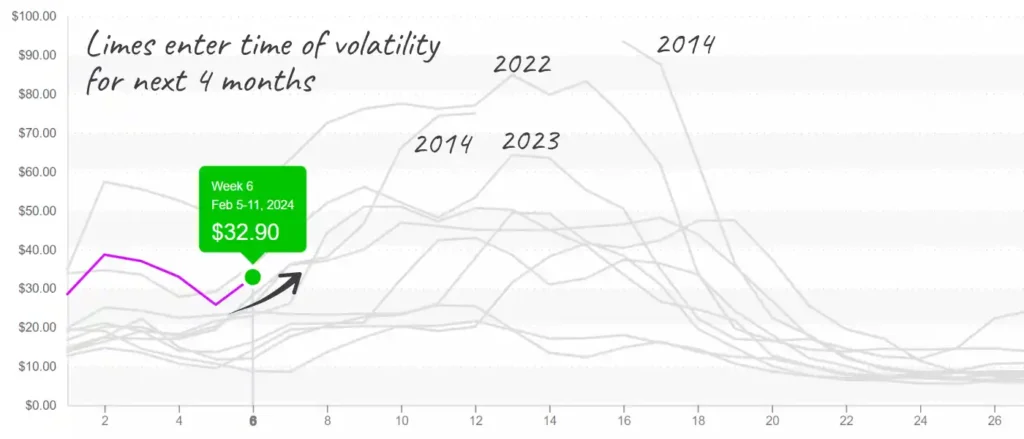

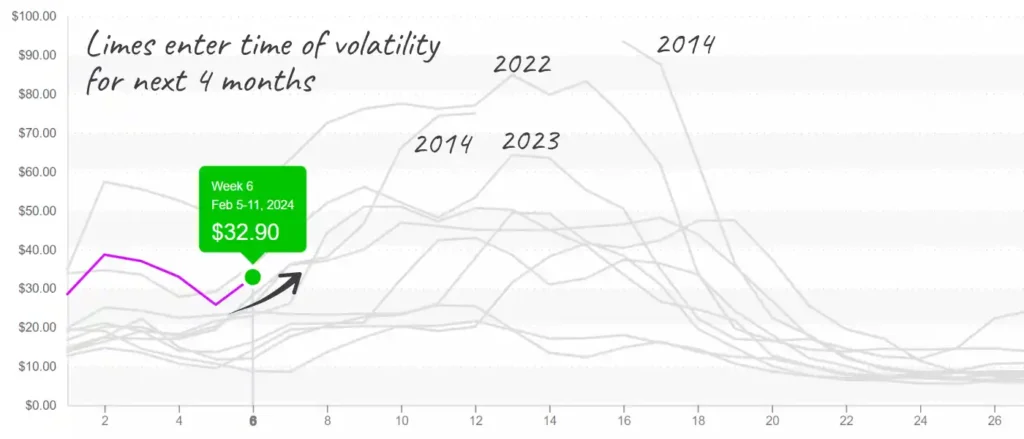

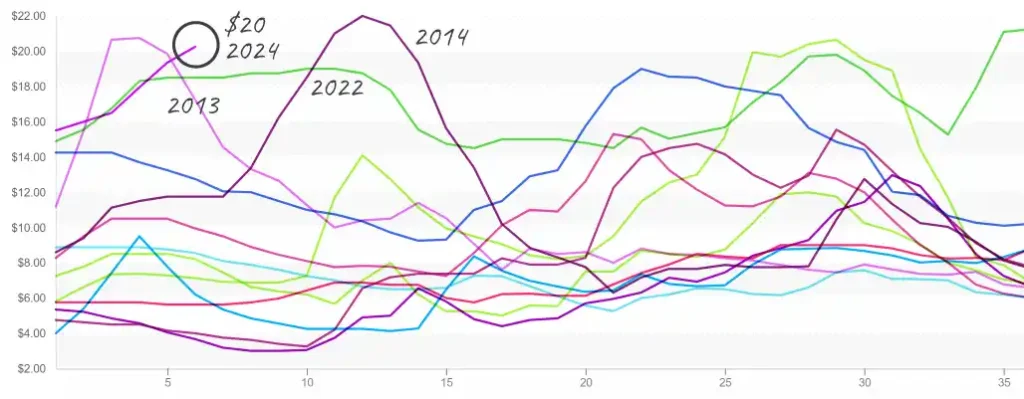

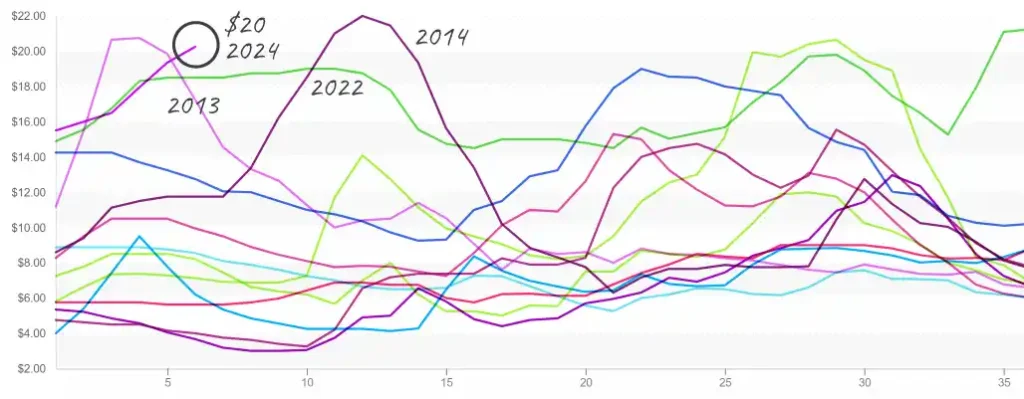

The Mexican lime crop is aging, and unfortunately, even a trip to the best-budget plastic surgeon in Mexico City won’t save the supply from rapidly deteriorating over the next couple of weeks. At $29, prices are still fairly reasonable for week #6, even if a bit above average. Expect prices to climb steadily through February and decline rapidly when the new crop begins in March.

Lime prices, 200ct, are at $33 and headed into a period of historic volatility.

Average bell pepper prices are up a scandalous +40 percent over the previous week. Demand is strong on both coasts. In the West, green bell peppers are very tight due to a gap in production. In the East, red and yellow are very short due to cooler-than-average temperatures in Florida preventing coloring. Supplies should increase, and prices should ease as supplies out of Nogales increase.

Onion markets are on fire. White, yellow, and red varieties are all short to some degree, but white supply is the most frail. According to USDA data, white onion prices are averaging $25, and high prices for the kitchen staple aren’t limited to the Americas. Across the globe, onion prices are soaring primarily due to weather-related yield issues and trade disruptions caused by violence in the Red Sea.

Long-term forecasts show white onion prices remaining elevated for North American markets through the summer. Yellow and red varietals may sometimes become necessary alternatives to accommodate unprecedented prices.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.