Pineapple Express takes aim at the West Coast. Among the widespread targets are oranges, green onions, lettuce, leafy greens, and strawberries.

In case you’re out of the loop on trendy weather slang, the term “Pineapple Express” refers to a recurring atmospheric river that draws moisture from the tropical Pacific near Hawaii.

It’s a two-edged sword of atmospheric rivers in the West. All that rain and snow brings life to depleted reservoirs, but too much water so close together can cause catastrophic flooding and crop damage. As the worst storms continue to roll across the West this afternoon, it will be a few days before we know the extent of damage to in-season commodities.

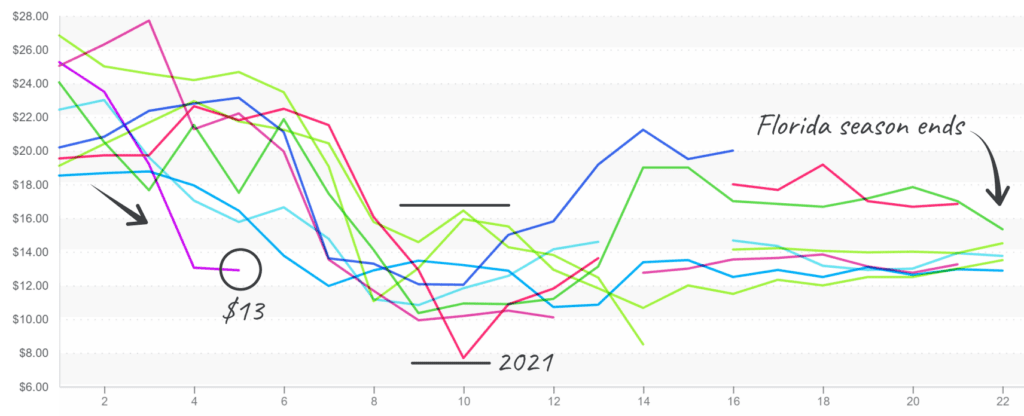

Inclement weather in California and strong Valentine’s Day demand are pushing strawberry prices in the West slightly up by +15 percent over the previous week. Strawberry prices typically decline sharply through May with a few moments of increased demand, such as these few weeks leading to Valentine’s.

Despite these significant increases, strawberry markets are still at a ten-year low for week #5 and are ripe for promotion. More rain is in the forecast for growers in California and Florida this week, which, at best, will cause delays in harvesting and, at worst, cause damage to unharvested fruit.

ProduceIQ Index: $1.30/pound, down 0.8 percent over prior week

Week #5, ending February 2nd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Florida’s strawberry prices fell faster than expected, reaching an 8-year low at $13.

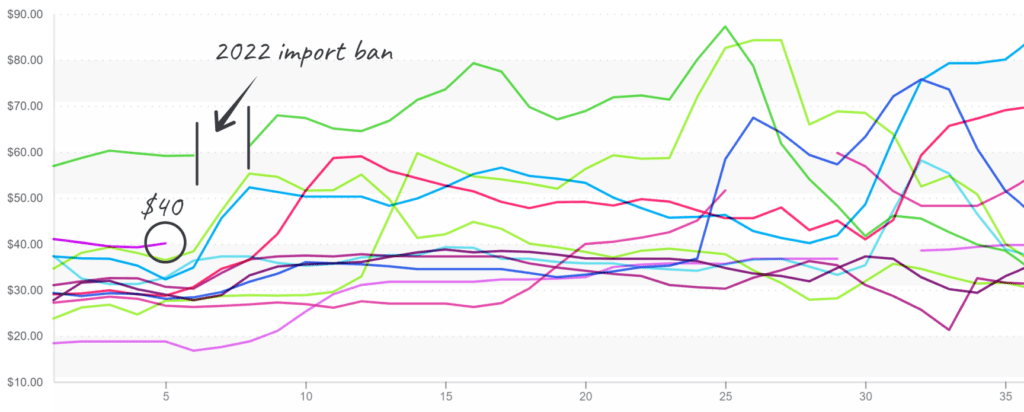

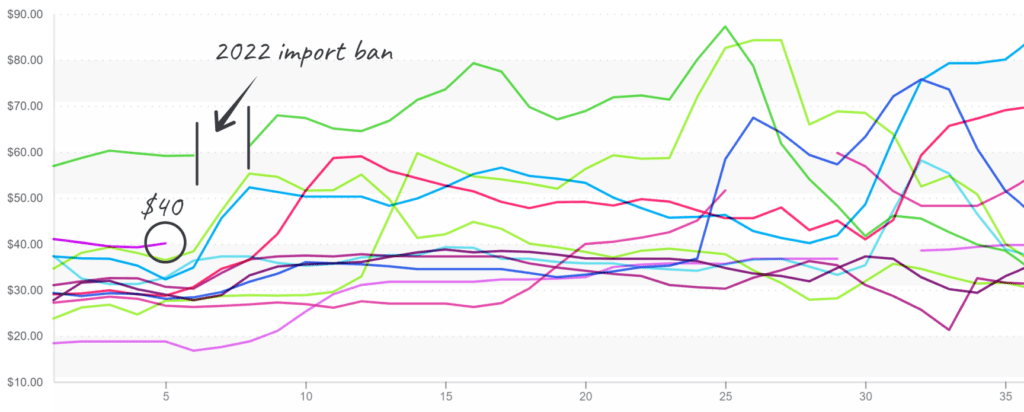

After almost a decade of game-defining advertisements, Avocados from Mexico are skipping this year’s Super Bowl. Although their witty ad presence will be sorely missed, avocados won’t be absent from the millions of smorgasbords feeding ravenous football and Taylor Swift fans.

Strong pre-game demand is raising Hass avocado prices slightly, up marginally over the previous week. This year’s week #5 prices are nothing compared to 2022’s astronomical pre-game highs but are still consistently above average.

What can compare to when the U.S. banned imports of Mexican Avocados just before the big game, thrusting prices to unparalleled heights? Going forward, prices will likely decline slightly before regaining momentum as Mexican production wanes over the next few weeks.

Avocado prices, $40 FOB Texas (48ct), are already high and are about to enter a seasonal period of high drama.

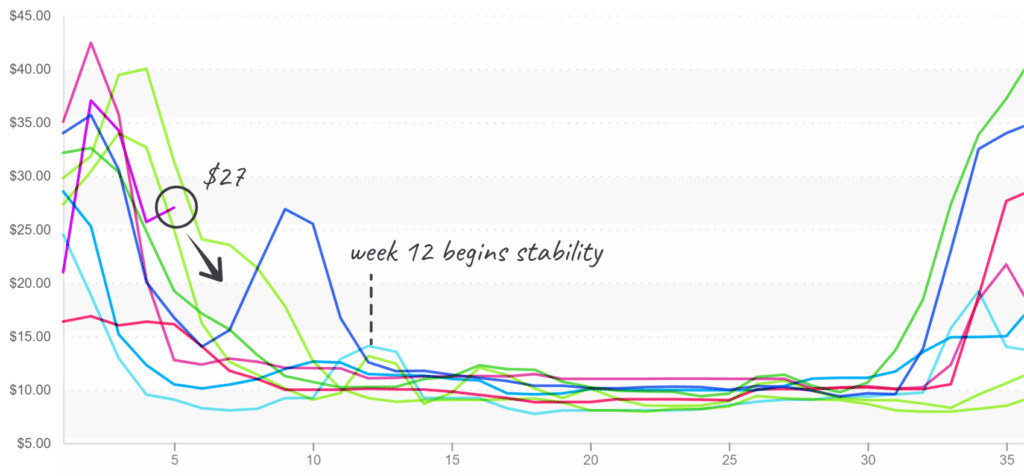

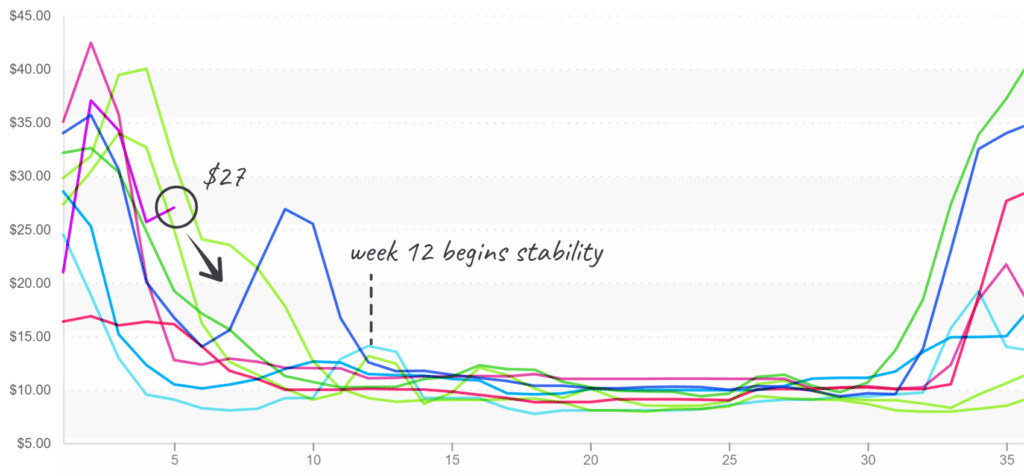

Rain in Mexico dampens green onion volume and, at $27, clinches a ten-year high for week #5. Green onion prices typically experience a dramatic decline this time of year as growers in Mexico and Southern California ramp up production. Weather forecasts are still very wet for growers this week, so expect at least 7-10 days before volume can fully recover.

Prices stall at $27 before continuing the downward trend towards stability in April.

Bell Pepper markets are in a demand-exceeds-supply situation on both coasts. At $19, average prices are at a ten-year high due to poor (cold and wet) growing conditions in Florida and Mexico. Anticipate at least two more weeks of high prices.

Please visit our website to discover how our online tools can save time and expand your reach. [hyperlink:

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.