We can’t guarantee 2023 will end on a high note, but we can predict it will be an expensive finale for produce buyers. The ProduceIQ index is up a whopping +14 percent over the previous week, reaching a record high, driven by notable increases in commodities across categories and growing regions.

El Niño and its subsequent extreme weather continue to be a driving architect in produce markets. Cold and rain in Mexico and the Southern U.S. is a theme we predict will drive produce prices and ideas for our weekly images through the first month(s) of the new year.

ProduceIQ Index: $1.38/pound, up +14.1 percent over prior week

Week #51, ending December 22nd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

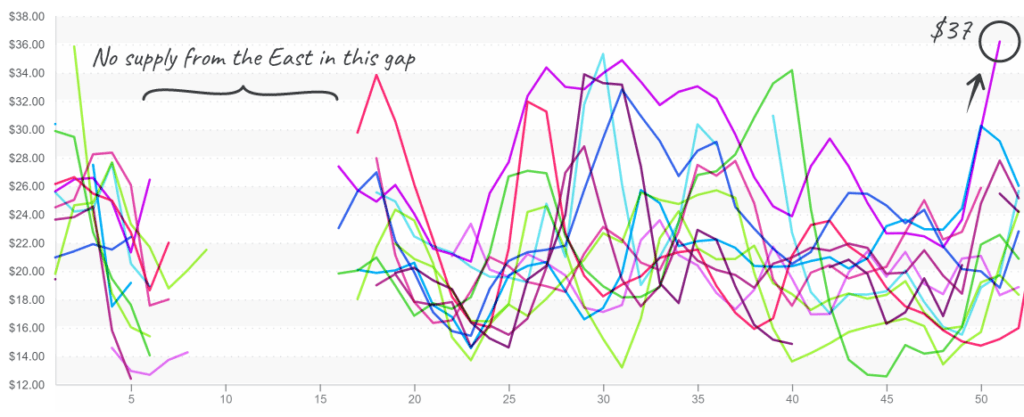

Up +76 percent over the previous week to a ten-year high, asparagus markets are in a demand-exceeds-supply situation. Cooler than usual weather in Mexican growing regions and similarly abysmal yields from Peruvian producers are putting asparagus markets in record-breaking territory for the fifth time this year. Supply is forecasted to improve in the third week of January when Cabacora, Mexico, begins production.

Asparagus prices in the East exceed $37, and product is still hard to find

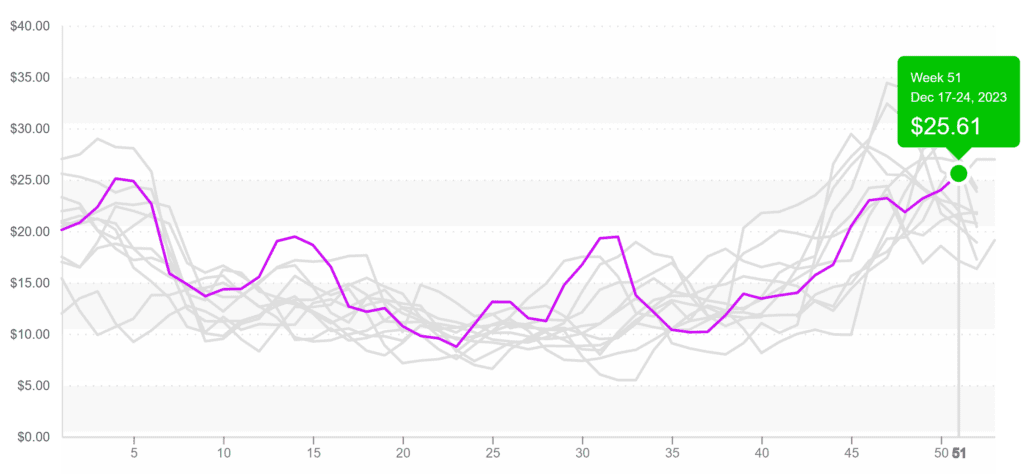

Strawberry markets are up +12 percent over the previous week in response to low supply in most major growing regions. Cool and rainy weather in Mexico, Florida, and California is hurting yields. In addition, the Christmas holiday is causing labor shortages, particularly in Mexico. Dry weather is in the forecast for Central Mexico and Florida growers this upcoming week and should relieve overextended supply.

Strawberry prices pass $25, typical for this challenging time of year.

Cauliflower prices may be up +36 percent over the previous week, but prices are still well below average for week #51. A series of cold fronts in Yuma, AZ, have dampened yields. However, supply is enough to meet demand. Promote this commodity while you can, and watch out for real-time weather alerts on the ProduceIQ platform.

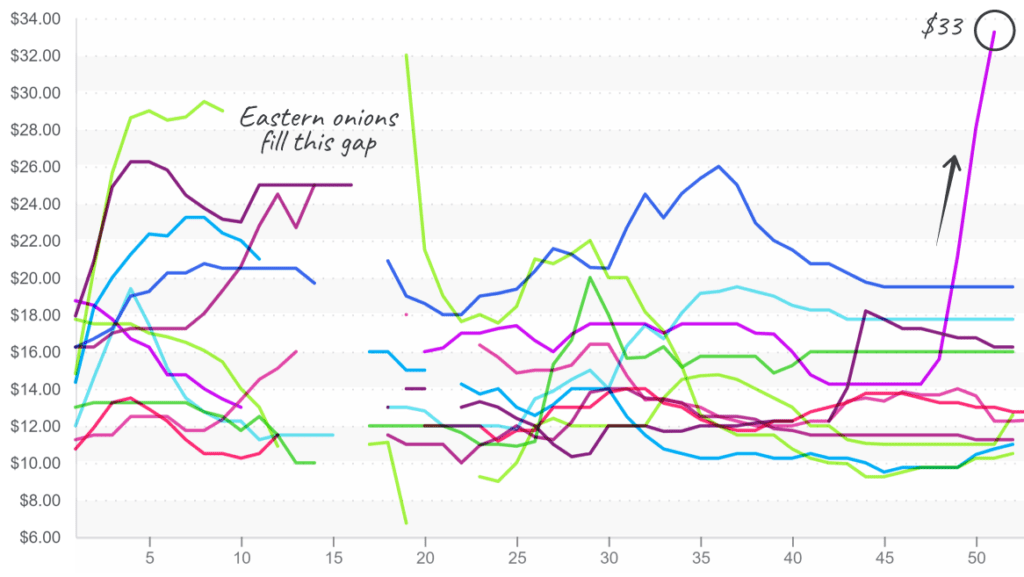

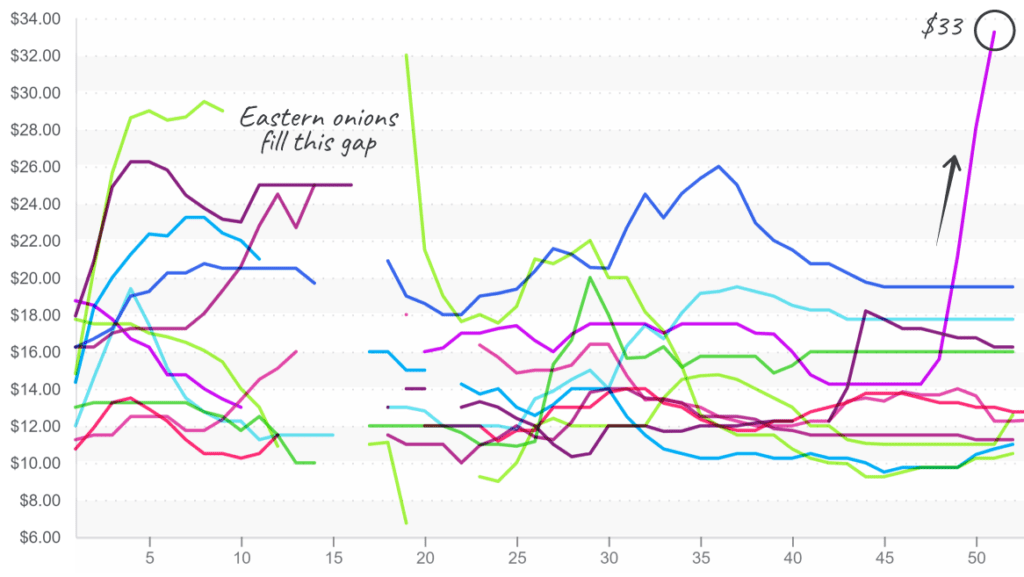

Strong export demand for onions continues to drive prices up and shows no signs of crying uncle. And, with Yellow above $15 and White shooting past $33, dry onion prices are determined to defy historical precedent for week #51. Onion prices typically enjoy a period of relative price stability during the winter months thanks to ample supply from the storage crop.

White onions, 50# from the West, shoot up past $33

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, increase your profits, expand your network, and provide valuable information.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.