Overall produce prices are accelerating as holiday demand swells and Eastern supply paddles through swampy, fall weather.

If you, like the hordes of new transplants, were lured to Florida with promises of sunshine and temperate winters, please don’t sue for false advertising. Over the weekend, 35-40 mph wind gusts lashed Florida growers as a low-pressure system moved up the East Coast, bringing 2-6 in. of rain. This storm followed what was already an unusually wet fall for the state.

ProduceIQ Index: $1.21/pound, up +4.3 percent over prior week

Week #50, ending December 15th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Unfortunately for produce markets, this extremely wet weather isn’t a one-off. Heavy rain and cooler weather have plagued growers across the Southeastern US and Mexico for weeks.

In addition, 2023’s hurricane season is still having widespread effects. Although major growing regions avoided the calamity of a direct impact, heavy rains from tropical systems damaged and delayed early plantings, stunting the supply of many produce commodities harvested in late fall/early winter. And the recent weather hasn’t aided grower’s recovery.

In Florida, supplies of bell peppers, yellow squash, zucchini, cucumbers, strawberries, sweet corn, and tomatoes struggle to gain traction.

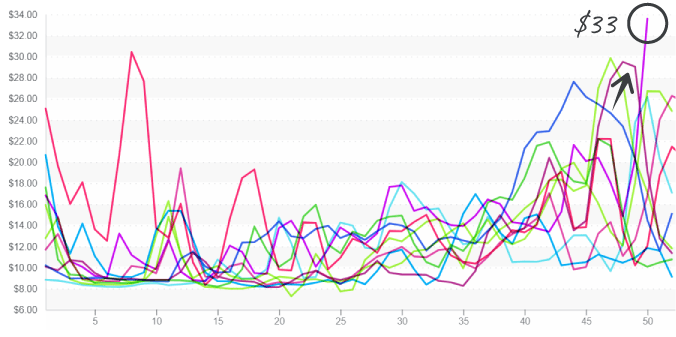

Tomato markets are arguably in the direst of circumstances. Demand exceeds supply for plum-type and grapes due to cool and wet growing conditions. The prices are unprecedented at $50 for grape-type and $34 for plum (Roma)-type tomatoes. Supply will likely remain lean until Mexico picks up production around week #3.

Plum/Roma tomatoes jump past $33, reaching record-high levels.

Mexico’s asparagus, blackberry, and bean supply are low due to heavy rain and/or cool weather.

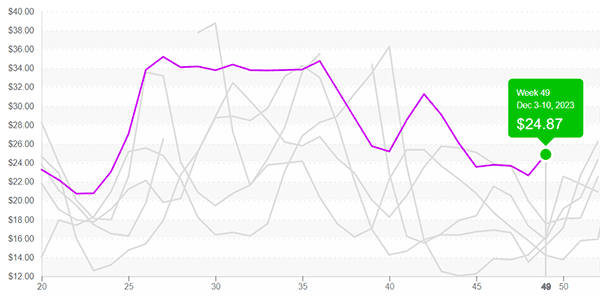

Nothing says happy holidays like overcooked, very expensive asparagus. And at prices above $25, asparagus prices certainly do their part to satisfy tradition. Supply from Mexico is meager due to a series of cold fronts in Baja California. And Peruvian supply is just as severe due to unfavorable growing conditions. Markets are forecasted to remain elevated through the New Year.

Asparagus prices reach $25 (11lb. large in Eastern US) before the typical holiday spike.

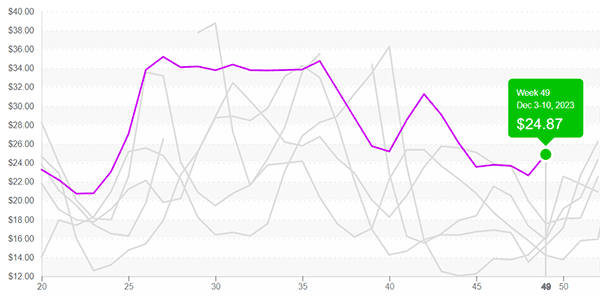

Mango markets are at war. In a period usually defined by declining prices, markets are up +11 percent over the previous week to a ten-year high. Mango producers across South America report severe shortages due to unfavorable growing conditions exacerbated by El Niño weather patterns.

Buyers in North America compete with buyers in Europe and Asia for the little supply trickling out of South America. Mexican exports should pick up again in late January. Until then, expect this war to wage on.

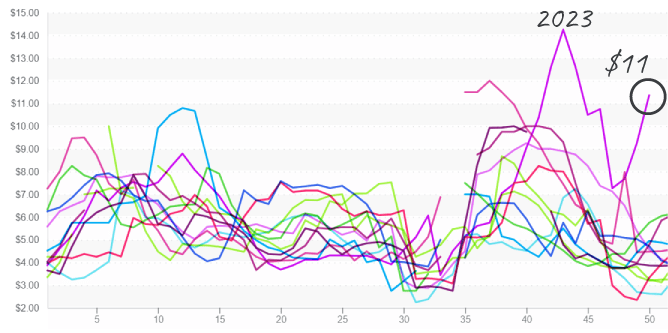

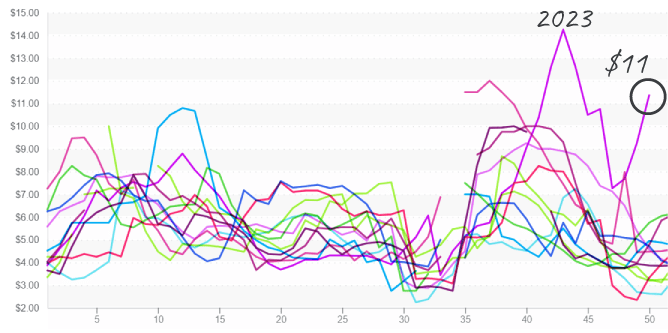

Mango prices rebound to $11 (12ct in East), surpassing prior years.

Import grape volume has swelled steadily over the past few weeks. Although prices are still far above the historical average for week #50, supply appears to be making a turn for the better—welcome news for weary buyers after five months of record prices.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.