I can’t believe it’s that time of year again. No, I’m not referring to pumpkin or turkey time. Its transition time in the Salinas Valley and produce markets are beginning to reflect the festive spirit.

Buckle up and prepare to see significant fluctuations in the supply and prices of products grown in the Salinas/Watsonville areas.

Just across the border, warm ocean temperatures fuel an active hurricane season in the Northeastern Pacific. Last week, Hurricane Otis, a devastating Category 5 storm, ravaged the Western Mexican vacation city of Acapulco.

Fortunately, for water-logged Mexican growers, the affected area is south of the current major growing regions. And hurricane season isn’t over yet. Another tropical disturbance in the Eastern North Pacific has a 90 percent chance of developing in the next seven days.

On the other side of the world, the escalating Israel-Hamas conflict is spiking fertilizer stock prices. Countries in the Middle East and North Africa are responsible for approximately 30 percent of nitrogen-based fertilizers globally. However, an extreme shortage situation, like what we saw when Russia initially invaded Ukraine, is improbable as long as the conflict remains localized and does not spread to the surrounding Arab nations.

ProduceIQ Index: $1.06/pound, up +7.6 percent over prior week

Week #43, ending October 27th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

The index price is up +7 percent over the previous week, primarily driven by increases in berries, tomatoes, corn, and mangos. Despite last week’s heavy rain in Mexico, the supply of commodities such as cucumbers, limes, and beans has improved.

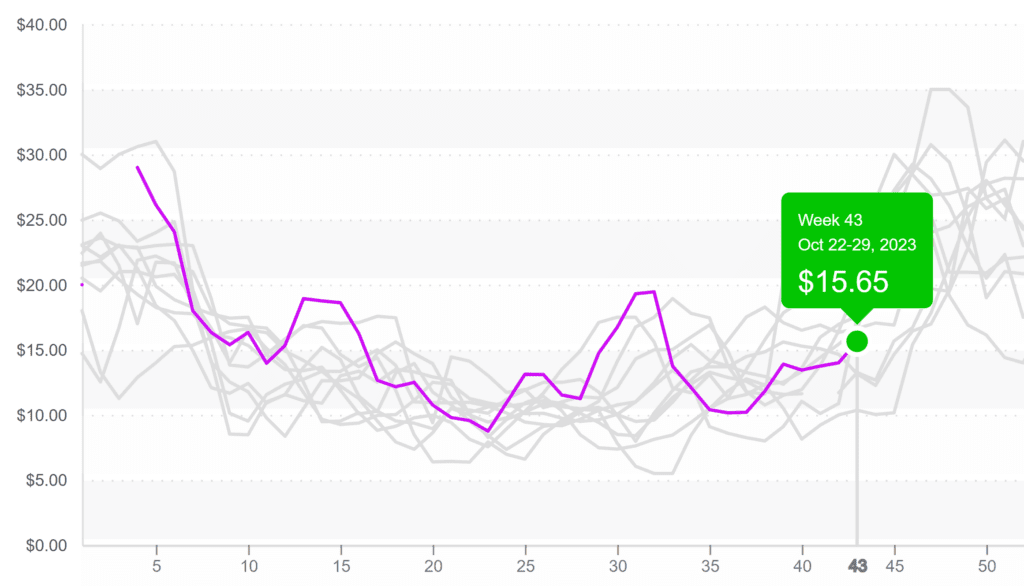

On the other hand, strawberry prices are not fairing as well. Prices are up +26 percent over the previous week and are expected to climb more. Growers in the Salinas/Watsonville area are winding down production, and Mexican suppliers have yet to start exporting in a meaningful way.

Strawberry prices are still well below average for week #43. However, this will likely change over the next few weeks in response to supply volatility.

Strawberry prices begin their typical upward trend, moderate for this time of year.

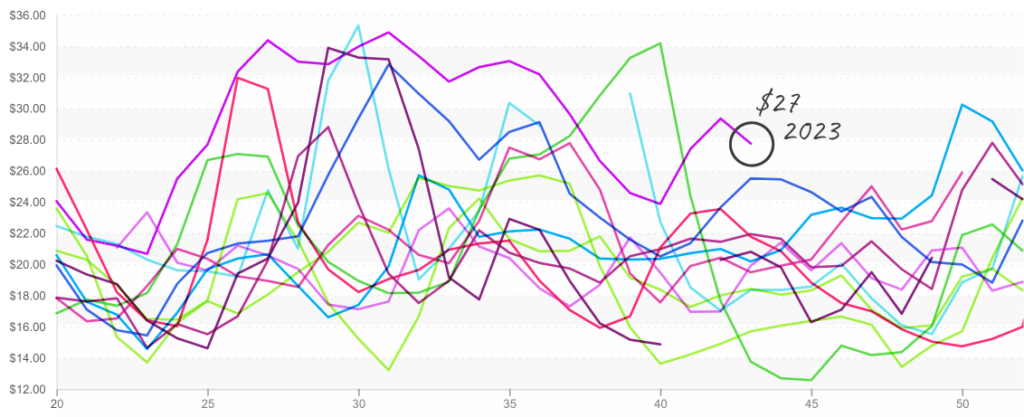

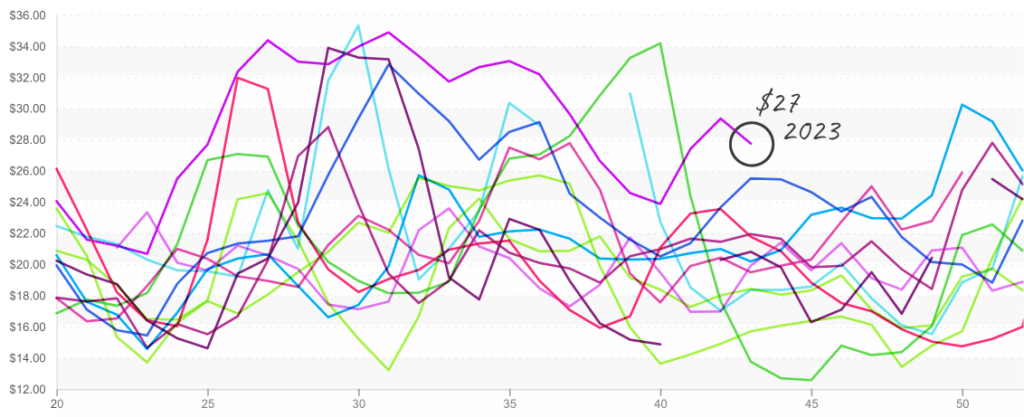

Unlike many other in-season commodities from Mexican growers, asparagus markets aren’t faring well. Even though prices are down -6 percent over the previous week, markets are still at a 10-year high. Supply from Mexico and Peru is anemic due to poor growing conditions. Expect the market to remain tight through Thanksgiving.

Asparagus prices begin descent to $27, still a record high

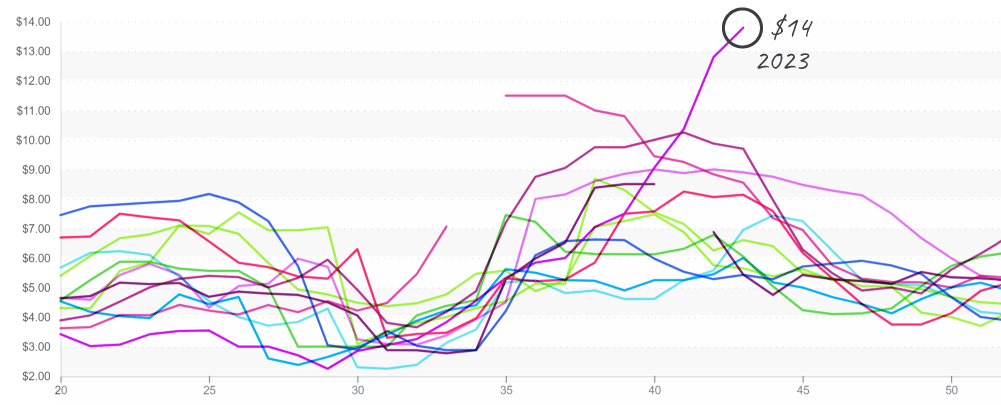

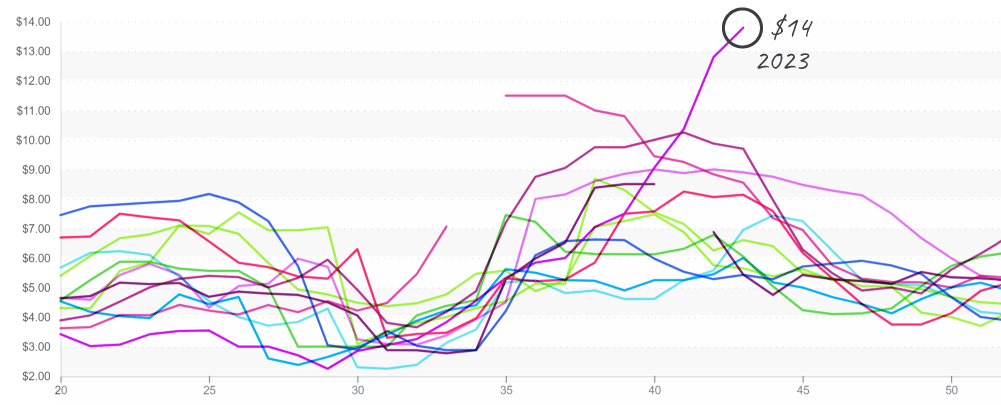

Mango markets continue to soar. At an average price of $14, mango prices are in unprecedented territory. El Niño weather patterns in South America contribute to low yields for Brazilian and Ecuadorian growers. In Ecuador, growers are forecasting 60 percent lower yields this season. Prices should stay elevated through December.

At $14 for 10-count in the East, Mango prices are a record outlier.

Blueberry prices continue to outpace the average after a couple of weeks of price volatility. We are nearing ten weeks of blueberry prices being at a ten-year high. But good news for price-weary buyers: November’s outlook for blueberry supply is more favorable.

Please visit our website to discover how our online tools can save you time and expand your business relationships, here https://www.produceiq.com.

ProduceIQ is a digital toolset designed to improve the produce trading process for buyers and suppliers. We save you time, increase your profits, expand your network, and provide valuable information.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.