While we were washing away our last few memories of COVID restrictions at IFPA, Hurricane Norma made landfall on the Southern tip of Baja California, Mexico, as a Category 1 storm and then again in Sinaloa as a tropical storm. Rain from the tropical system will impact growers in North and Central Mexico.

Depending on how the rugged Northwestern terrain in Mexico breaks up the storm, the remaining moisture could affect the Southwestern U.S. and the Southeast later this week. Some commodities that might see a dip in volume due to the storm are beans, mangos, and peppers.

A bit further south, protests in Guatemala surrounding an attempt to overturn the recent presidential election are threatening honeydew, cantaloupe, bean, and blackberry markets. Protestors are blockading major roadways, limiting the flow of goods in the country.

ProduceIQ Index: $1.06/pound, down -0.9 percent over prior week

Week #42, ending October 22nd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

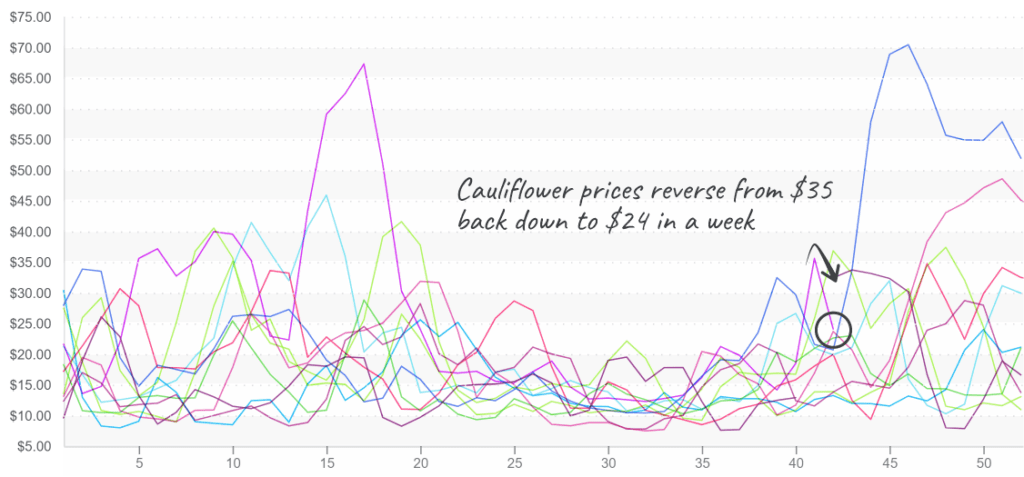

Broccoli and cauliflower markets are losing steam. Broccoli fell -21 percent and cauliflower -37 percent over the previous week. Broccoli’s dramatic price decrease can be credited to a sudden increase in volume from Mexican growers. Reported USDA volume nearly doubled week over week. If growers can sustain this output, prices will overcome the seasonal trend to increase in price through the holiday season.

Though domestic cauliflower supply is as bleak as its greener cousin, import supply improved pointedly this week. Increased volume from Canada helped to lower prices, and the quality outlook is generally optimistic across product origins.

Cauliflower prices have a sharp reversal of direction as new growing regions end the gap.

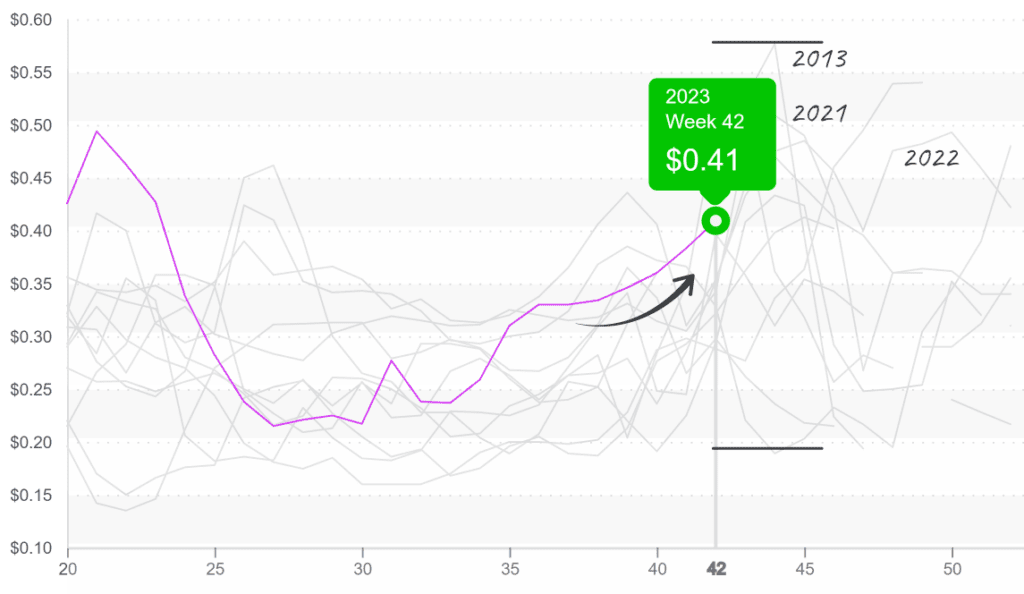

Honeydew and cantaloupe prices are teetering on the edge of a cliff, and our crystal ball is foggy as to their fate. Arizona growers are ramping up production, but supply disruptions in Guatemala and Mexico have the potential to dampen the flow of product from foreign growers.

Cantaloupes prices, $0.41/lb., continue their steady incline, leading into a volatile time of year.

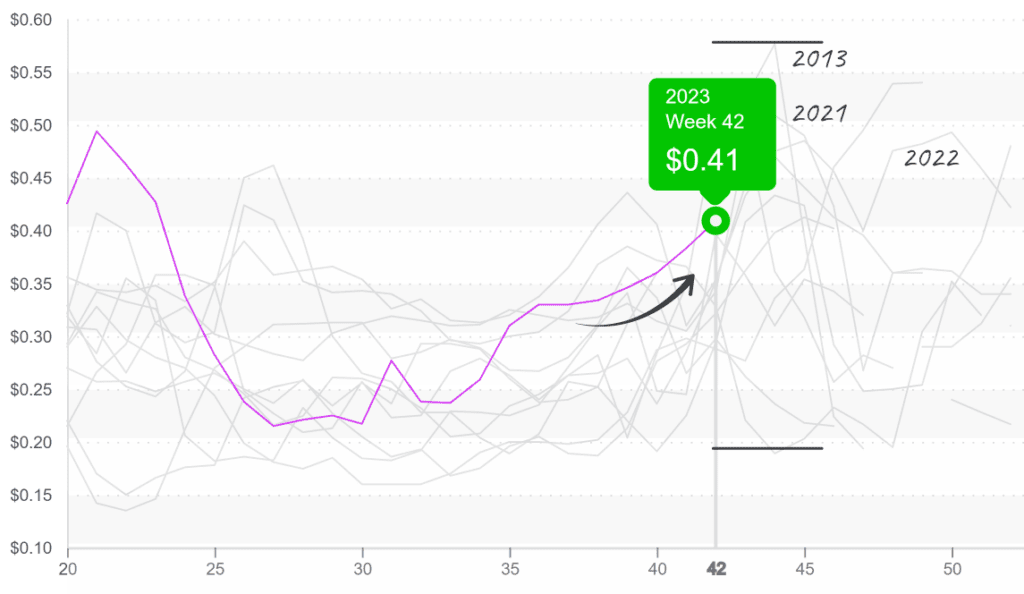

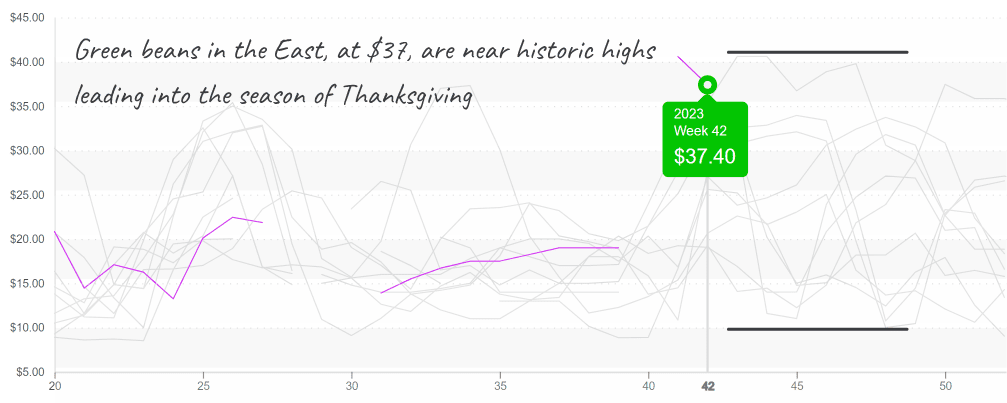

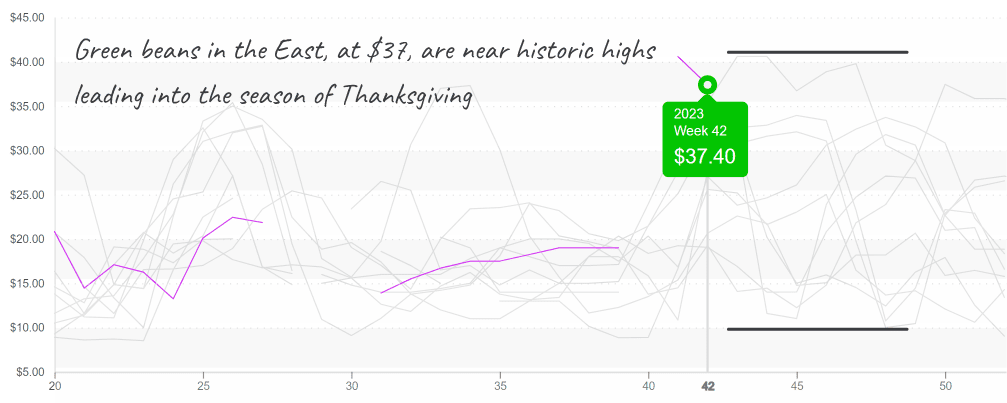

Despite challenges for domestic and foreign growers, green bean prices are down -7 percent over the previous week. East Coast growers’ supplies are understandably anemic; however, importers are working hard to fill the gap. Prices are above average but still within the range of historical precedent.

Like honeydews and cantaloupe,a lot depends on how supply from importers fluctuates this week as growers navigate inclement weather and civil unrest.

Green Bean prices begin a volatile period in record highs yet may be helped soon from late plantings.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.