Apparently, in response to last month’s audacity to be, on average, one of the coolest Junes in the last few years, July weather is determined to set the whole North American continent ablaze.

Canadian wildfires are officially in the worst season on record, and smoke from the blazes refuses to adhere to border laws. Arid and hot weather in Canada is making for ideal fire conditions. This is only the beginning of Canada’s fire season, so forecasters aren’t optimistic that conditions will improve soon.

Abnormal heat isn’t just limited to Canada. A heat dome, a relatively rare weather anomaly, is barbecuing parts of the Southern U.S. in triple-digit heat. Southern Georgia is in the low to mid-90s this week. With more advisories than we could reasonably fit in this introduction, we recommend giving our new weather tool a free trial; check and receive updates on the cities that matter most to you.

ProduceIQ Index: $1.31/pound, up +7.4 percent over prior week

Week #26, ending June 30th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

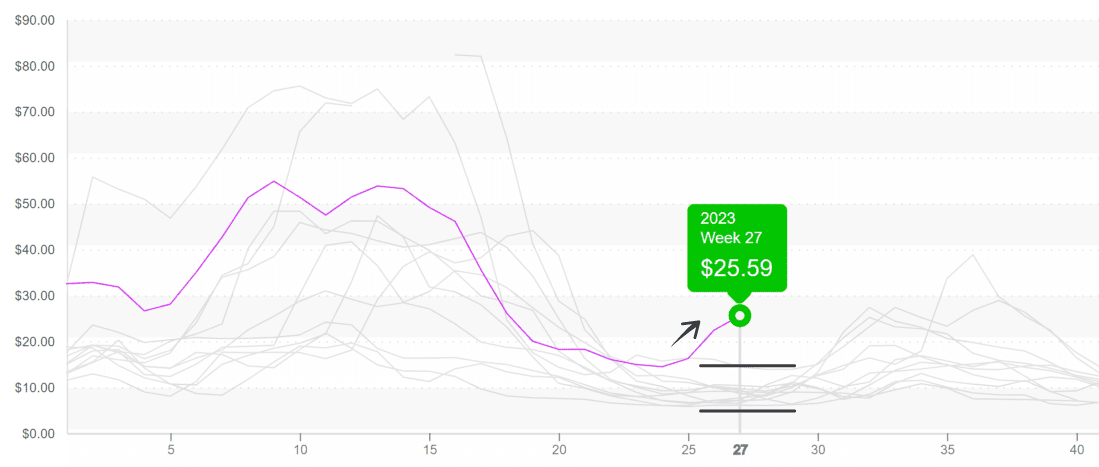

Up +48 percent over the previous week, lime prices are at a ten-year high by a significant margin. Growing conditions in Veracruz, Mexico, are improving; however, persistent drought in the region has weakened yields.

At a time of year when lime markets are usually flush with supply, it is odd to see such dramatic price increases. Reported USDA lime volume is below average for what is expected of week #26. Prices will stay elevated until supply improves.

Lime prices spike past $25 during a seasonal time that should have low prices.

Surprisingly, heat isn’t a problem for every commodity…yet. Iceberg lettuce is at its third-highest price in the last ten years. Quality issues such as Scerlotinia, tip burn, and cooler-than-average weather are decreasing yields and forcing prices upwards. Temps are forecasted to be near a high of 70 and a low of 55; at least, it sounds gorgeous for humans. Supply from Salinas is substantially below the average for week #26.

The volume will hopefully increase as the weather in the Salinas/Watsonville areas heats up.

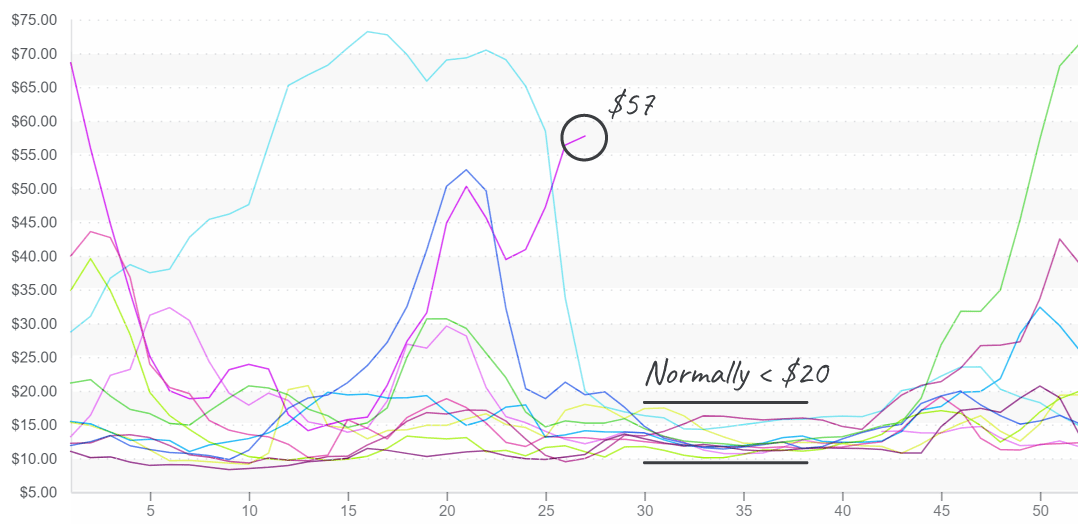

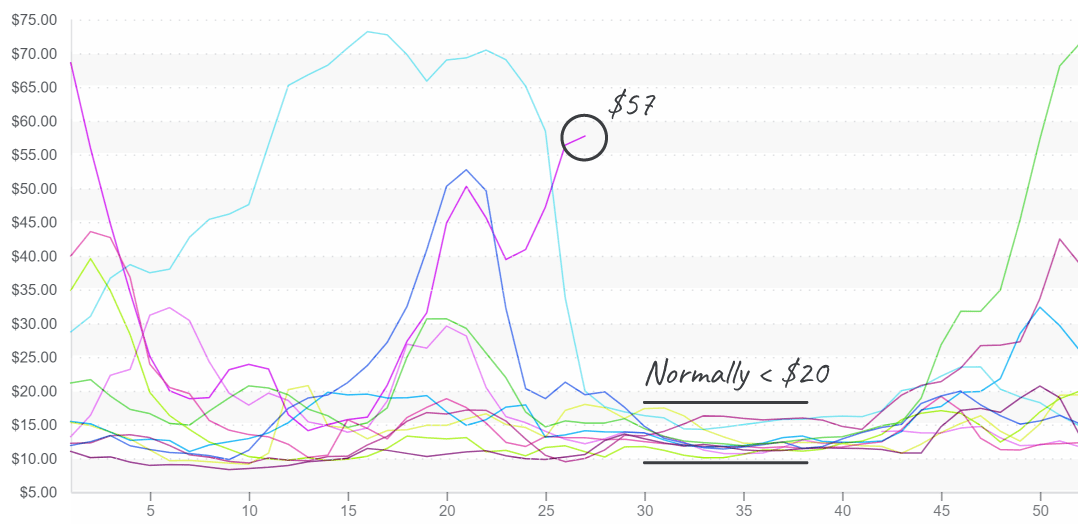

Even though celery prices have been in the stratospheric territory for some time, at $56, they have only now surpassed 2019’s ten-year record.

Celery markets have been active for a while due to meager supplies coming out of California. Production in Oxnard, CA, is finished, and Salinas is struggling to grow supply due to the same cool weather afflicting lettuce markets. Celery prices are forecasted to remain elevated through July.

Celery prices are entering unchartered territory and, historically, would have crashed by now.

If you haven’t been following, table grape prices have returned to normal, $18-20. As is typical with prices in fresh produce, the price descent went a bit quicker than the climb.

Up +6 percent over the previous week, round-type tomatoes barely edge out a ten-year high. Florida’s and Georgia’s volume numbers are fading fast in the East. In the West, growers in Central California aren’t even close to their usual volume for week #26.

Supplies on both coasts should roar to life over the next few weeks as more summer growers come online.

Even as Mexico growers commence the Loca crop, Hass Avocado prices shoot up another +14 percent over the previous week. The old crop is nearly finished, and it will take a couple more weeks until the Loca crop has enough volume to satiate the American appetite for the savory fruit.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.