Undeterred by inflation, robust 4th of July demand and supply issues thrust average produce prices up +9 percent over the previous week. Heavily weighted commodities such as avocados and mixed berries are making this week’s prices some of the highest on record.

ProduceIQ Index: $1.22/pound, up +8.9 percent over prior week

Week #25, ending June 23rd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

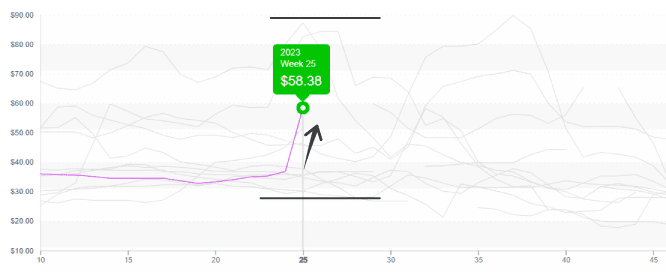

Sorry, Pamela, we may have jinxed avocados. After remaining significantly below average since December 2022, Hass avocado prices are now miraculously at their third highest price for week #25 in the last ten years.

We can’t take on all the responsibility for the market’s radical reaction. Strong demand for the 4th of July celebrations and the delayed start of Mexico’s Loca crop are leaving markets in an apparent demand exceeds supply situation.

Mexican imports fell by half, week over week, and are expected to decrease more as we near July. California, Florida, and Peruvian growers will not have enough supply to cover the gap. Expect more volatility until the new crop kicks in two weeks.

Hass Avocados (48ct) through Texas jump $22 in one week to reach $58

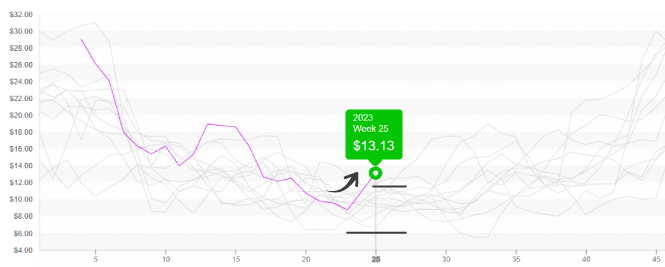

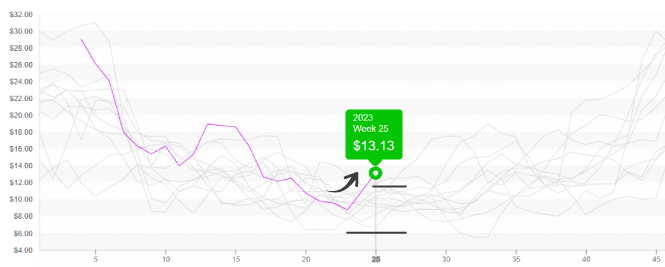

Strawberry prices inch quietly to a ten-year high. As production in Santa Maria fades out and growers in the Salinas/Watsonville area struggle to shake off the cold, strawberry prices rise with very little fanfare. This is a strange occurrence for week #25, as markets are usually flooded with product from California.

Different from the extreme shortages seen during much of the Spring, an OK supply is available, just significantly below average for this time of year. Prices will likely stabilize next week as the Independence Day holiday demand cools and growers in California ramp up production.

Strawberries rise off their seasonal lows to $13 for an 8/1 lb. flat.

Wet and windy weather in Georgia is worsening a bleak sweet corn supply situation. Severe thunderstorms ransacked sweet corn fields last week, a sad ending to what has already been a challenging season for Georgia corn growers.

In the West, supply of sweet corn from Central California is also below average for week #25. Markets on both coasts will only be able to keep up the supply once more local options come online throughout the Midwest and Northeast in a couple of weeks.

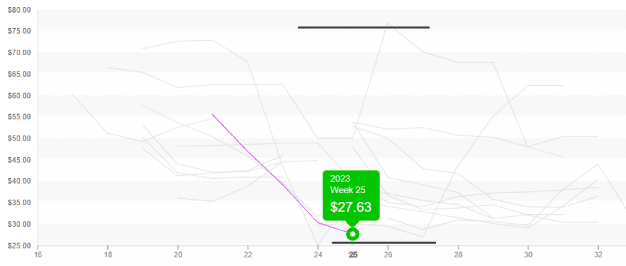

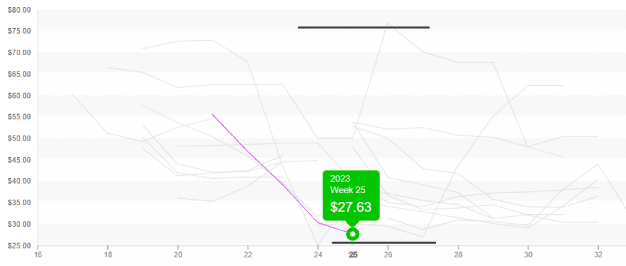

Compared to the historical average, a lot of produce may not be very cheap during 2023’s Independence Day celebrations. However, one surprising, high value item is determined to be the exception. Cherries are at the lowest week #25 price in the last ten years.

Although cherries are not an obvious choice to substitute redacted sweet corn promotion spots in the produce section, at $27, they aren’t that much more expensive.

Cherry prices are at bargain levels for this time of year.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.