A new analysis reveals important shifts in the eGrocery customer mix at key formats: Supermarkets, Walmart, Target, and Hard Discounters.

Barrington, Ill. – May 2, 2023 – A new report examining where and how shoppers choose to buy groceries online found that while the overall base of average monthly users in the U.S. has increased by nearly 3 percentage points, the online penetration of Supermarkets declined by 2 points in 2022 compared to 2021 levels.

The report, Profiling the Online Shopper: eGrocery Purchase Patterns in the U.S., dives deep into the four major grocery retail formats – Supermarkets, Walmart, Target, and Hard Discount – to analyze how household penetration, spending, and order frequency for eGrocery orders have shifted between 2021 and 2022 by income and age groups.

Conducted by Brick Meets Click and sponsored by Mercatus, the report analyzed more than 42 thousand responses to the monthly Brick Meets Click/Mercatus Grocery Shopping Survey for 2021 and 2022 and found that on average during 2022, more than half of all U.S. households ordered groceries online each month, but only one-third of those active eGrocery shoppers purchased from Supermarkets online.

“This analysis highlights the benefit to Supermarkets of better understanding who their core online customer segments are, and the value that different shopper segments represent to them,” said David Bishop, Partner at Brick Meets Click. “These findings provide evidence that can support recommending refinements to how Supermarkets compete online – especially against the lower-priced leaders in the market.”

Persistent high inflation is contributing to changes in eGrocery shopper behavior at both ends of the income spectrum. The analysis found that households earning under $50K per year (over one-third of all U.S. households in 2022) were 25% more likely to shop online with Walmart compared to Supermarkets. And, between 2021 and 2022 Supermarkets’ reach into this income group contracted by 150 basis points (bps) while it expanded for Walmart by 210 bps.

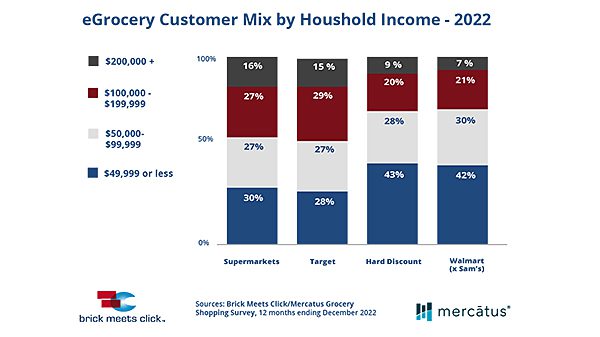

This shift can be characterized as a “flight to value” as the most cost-conscious customers are attracted to the Every Day Low Price (EDLP) strategy that’s generally employed by Walmart and Hard Discounters like Aldi. During 2022, households earning under $50K per year accounted for only 30% of the online customer mix for Supermarkets, and slightly less for Target, while they accounted for over 40% of the customer mix at Walmart and Hard Discounters.

Households earning over $200K per year also made changes to find greater value. This group (slightly more than 10% of all U.S. households) was almost 3 times more likely to shop online with Supermarkets compared to Walmart in 2022; however, Walmart gained ground with these shoppers, expanding its penetration by 210 bps while Supermarkets lost 120 bps in 2022 versus 2021.

Understanding the shift among households earning over $200k per year is vital for Supermarkets because they are such valuable customers. On a monthly basis, households in this group spent 80% more online with Supermarkets than those earning under $50K. In aggregate, these upper income shoppers generated over one-fifth of Supermarkets’ online sales, which is comparable to the share generated by the lowest income group even though the upper income group makes up a considerably smaller portion of the Supermarket online customer mix.

“Customers who shop with Supermarkets tend to do so because of the quality of products they can receive, rather than paying the lowest price,” said Sylvain Perrier, president and CEO, Mercatus. “So, identifying and improving aspects of the online shopping experience that matter more to the quality-conscious customer can help increase competitiveness in ways that are not focused solely on price.”

The analysis also highlights the need for Supermarket operators to look at Walmart and Target separately when evaluating their Mass rivals. Target and Supermarkets have very similar customer mixes from an income perspective, but they differ significantly based on the age of the primary shopper, with Target attracting younger households. The youngest households (18-29 years old) are 36% more likely to shop online at Target compared to Supermarkets, and the early-family formation households (30-44) are nearly 30% more likely to do so.

While lower prices may be driving some of Supermarkets’ online customers to shift a portion of their eGrocery orders to lower-priced formats, a better shopping experience at Target is likely causing changes in purchase patterns for others. The analysis found that Target also expanded its penetration with the highest-income households in 2022 versus the prior year. In addition, the report documented that the rate of cross-shopping with both Walmart and Target increased year-over-year among Supermarkets’ online customer base.

About this report and analysis

Profiling the Online Shopper: eGrocery Purchase Patterns in the U.S. is a report created by Brick Meets Click and sponsored by Mercatus. The conventional grocer is the main audience for this report, so it highlights the Supermarket format and its primary competitors: Hard Discount formats and Walmart and Target banners. Most metrics exclude the Ship-to-Home segment since most conventional grocers don’t offer this type of service.

The monthly Brick Meets Click/Mercatus Grocery Shopping Survey is an independent research initiative created and conducted by Brick Meets Click since March 2020 and sponsored by Mercatus. This analysis is based on 21,799 responses compiled over the 12 months of 2021 and 20,948 responses compiled over the 12 months of 2022 from adults 18 years and older who participated in the household’s grocery shopping.

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in consumer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s, Kowalski’s Markets, Buehler’s Fresh Foods, WinCo Foods, Smart & Final, Stater Bros. Markets, Southeastern Grocers’ Fresco y Más, Harveys Supermarket and Winn-Dixie grocery stores among others.

Media Inquiries

David Bishop, Partner, Brick Meets Click

847-722-2732, david.bishop@brickmeetsclick.com

www.brickmeetsclick.com