Breaking news: For the first time in what feels like years, California has a critical shortage of umbrellas.

As if mother nature was tempted to show how fickle she is, California has had one of the wettest winters on record. Last week was the 10th atmospheric river to hit the West Coast this winter season, and more are coming.

The storms are doing more than refilling severely depleted reservoirs. In residential and rural areas alike, intense flooding, rockslides, and heavy snow are negatively impacting supply chains.

As if signaled by the historic precipitation on the West Coast this week, the La Nina weather trend is finally gone. So what does this mean for fresh produce? Generally, and shift toward El Nino means a potentially less intense Atlantic Hurricane season and Western drought season.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $0.94/pound, down -4.1 percent over prior week

Week #10, ending March 9th

Celery prices clamp an iron fist on record-breaking territory, and inclement weather in Western growing regions hamper embattled growers’ production. At $25, this week’s celery prices are surpassed only by 2019’s outstanding prices. Expect strong markets to continue for the next two weeks.

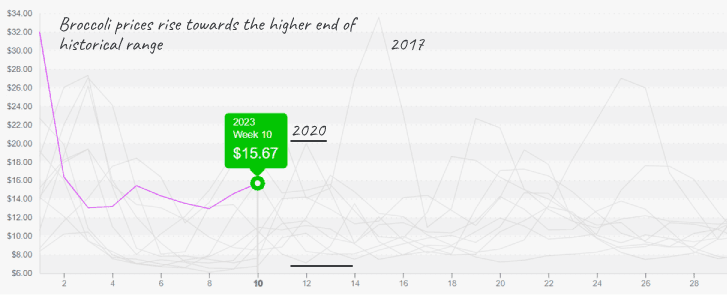

Rain is throwing a wet towel on California’s broccoli and cauliflower production. Prices are trending upwards. Fortunately, the supply gods are somewhat appeased by the steady late season volume from the Arizona desert. Still, relief for these commodities is a few weeks out, and prices have more than enough incentive to escalate.

Broccoli prices are near the high end of their range and are poised to go higher.

Strawberry prices diverge from historical week #10 trends and increase for the second week. West Coast growers are struggling to gain momentum due to a series of extreme rain events. Growers in Florida are working to extend their season into March, or if the weather allows. Unfortunately, the severe weather’s effects on strawberry markets will likely linger for a couple more weeks before easing up.

Though we don’t typically include baby potatoes because they are not a part of the ProduceIQ index, California rains have reportedly reduced the supply of this niche item.

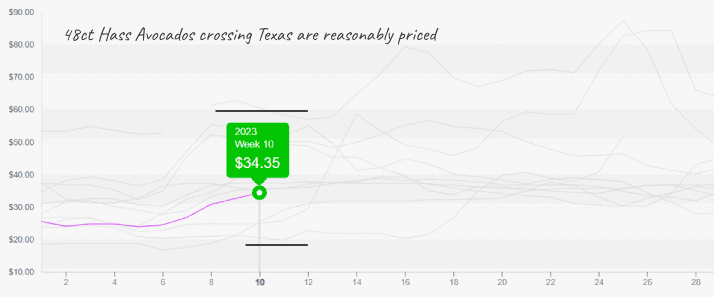

Week #10 avocado supply wanes, demand strengthens, and prices increase. Prices are up +6 percent over the previous week and can rise further. The Mexican public holidays, Benito Juarez Day, and Easter will also contribute to lower supply as we move into early Spring. As a result, avocado prices are forecasted to increase steadily over the next few weeks.

Fortunately for buyers, despite fading supply, avocado supply is still on the lower end of the historical spectrum.

Avocado prices are affordable and worth promoting.

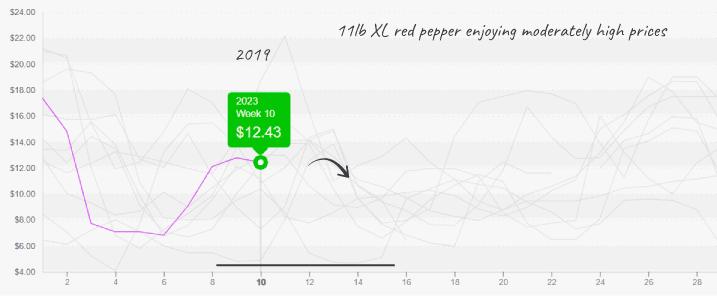

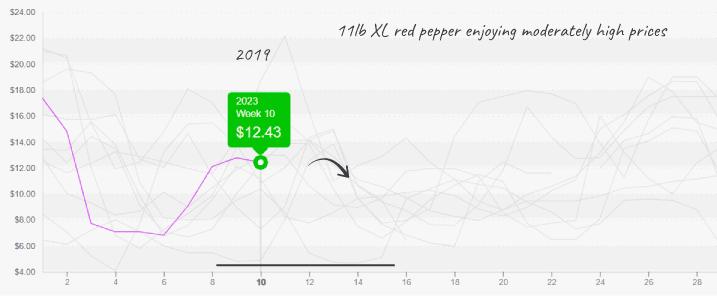

Previously stalled green bell pepper plantings in Florida are finally catching up to markets. In Mexico, red and yellow supply is also meager. Average prices are nearing historic highs. Expect prices to remain elevated through April.

Red pepper prices are full and expected to stay high for at least several weeks.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.