SEPC’s Southern Exposure boomed once again. The days of COVID shutdown are seemingly a distant memory as several thousand movers and shakers in the industry embarked on Orlando for a few action-packed days. Hundreds of those with the highly sought red (retail) or blue (food service) name tags mingled on Saturday afternoon’s expo floor.

Western iceberg and romaine markets suffer from the cold, but lettuce prices remain unaffected. However, growers are reporting cold-related injuries such as blisters, peeling, and pink ribbing.

The current lettuce supply is sufficient to meet demand; however, as the production in the Arizona desert wanes, prices will likely spike sometime in the next few weeks before settling again.

ProduceIQ Index: $0.98/pound, down -6.7 percent over prior week

Week #9, ending March 3rd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

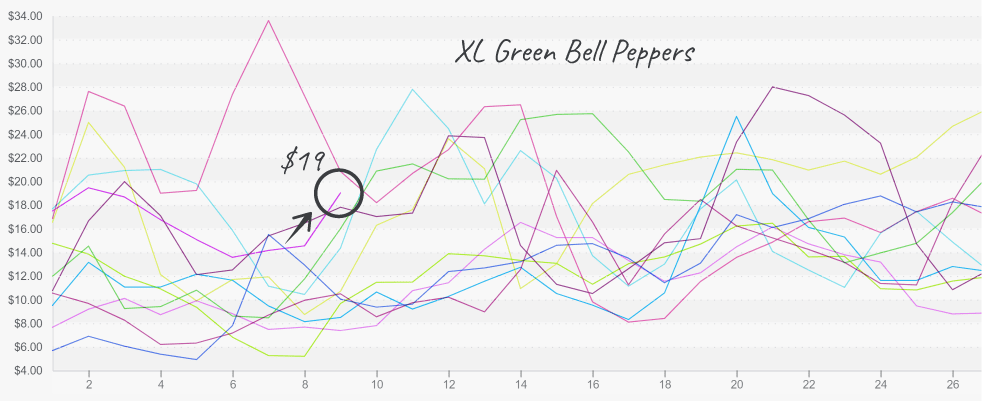

Average pepper prices are up +27 percent over the previous week, largely due to a low supply of yellow and red peppers. The recent cold weather is lowering yields. Green supply is barely sufficient but is enough to meet demand. Relief can be expected sometime in late March/early April as the Spring crop picks up production.

Green pepper

Cold in the West, a recurring theme for this week, is limiting yellow squash supply. Prices are up significantly over the previous week, nearing a ten-year high. But it should improve with the warmer weather forecasted for Mexico in March.

Surprise…surprise…wintery weather is warming up wet veg prices. Due to low supply, the prices of celery, cauliflower, and broccoli are all up considerably over the previous week.

At $24, celery prices are the second highest recorded USDA prices in the last ten years. Oxnard and Santa Maria production should pick up throughout March and relieve a struggling supply.

Haggard cauliflower markets are at a ten-year high, and broccoli markets are following dutifully behind.

Fortunately for broccoli and cauliflower markets, better weather is on the horizon. As a result, supplies will remain tight through the end of Yuma’s season but then improves steadily as Mexican and Californian growers reach their peak.

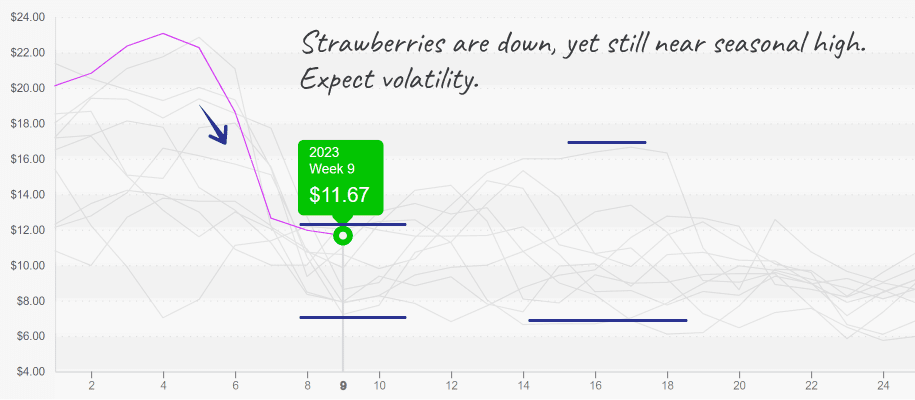

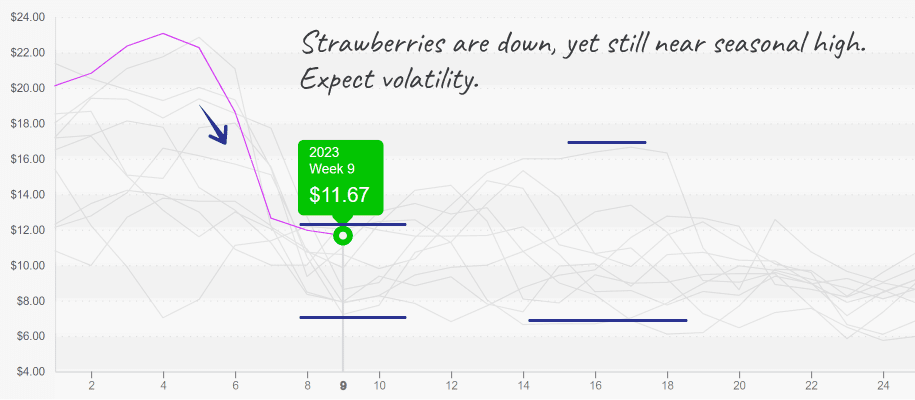

Rain in California is disrupting the start of the domestic Western strawberry season. Prices are only up +6 percent over the previous week due to strong supply out of Florida. Unluckily for CA growers, more rain is forecasted for the next two weeks and will probably tighten supply further.

Strawberry markets may become active as the rain impacts unfold.

Mexican asparagus growers are charging full steam ahead, and prices are responding. After weeks of record-high prices, asparagus markets are down -32 percent over the previous week. It seems Western growers were able to avoid the worst of the cold-related damage.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.