Winter Storm Elliott transformed into a bomb cyclone over Christmas weekend. The storm plunged nearly all of North America into below-freezing temperatures, causing more than 50 deaths.

Winter storms like Elliott reduce both demand and supply. Blizzards, ice storms, and snow cause consumers to stay home. Since the consumer is more likely to eat soup than a salad, demand for lettuce and other fair-weather produce must play catch up.

ProduceIQ Index: $1.10/pound, down -0.9 percent over prior week

(Week #51, ending December 23rd)

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

On the supply side, severe winter weather complicates transportation, slows growth, and sometimes causes freeze and cold wind damage. Supply challenges should be expected for the next week as ice and snow-filled roads are cleared and a warm front sweeps in from the West.

Florida strawberry growers worked through the holiday weekend to save their valuable fruitfrom Winter Storm Elliot. By dousing the fruit and delicate blossoms in water before the freeze, the growers can create an igloo-like effect, preserving the strawberries inside the ice.

Thanks to the diligent work of strawberry farmers in Florida, the sweetness of the fruit might even benefit from the cooler-than-average temperatures.

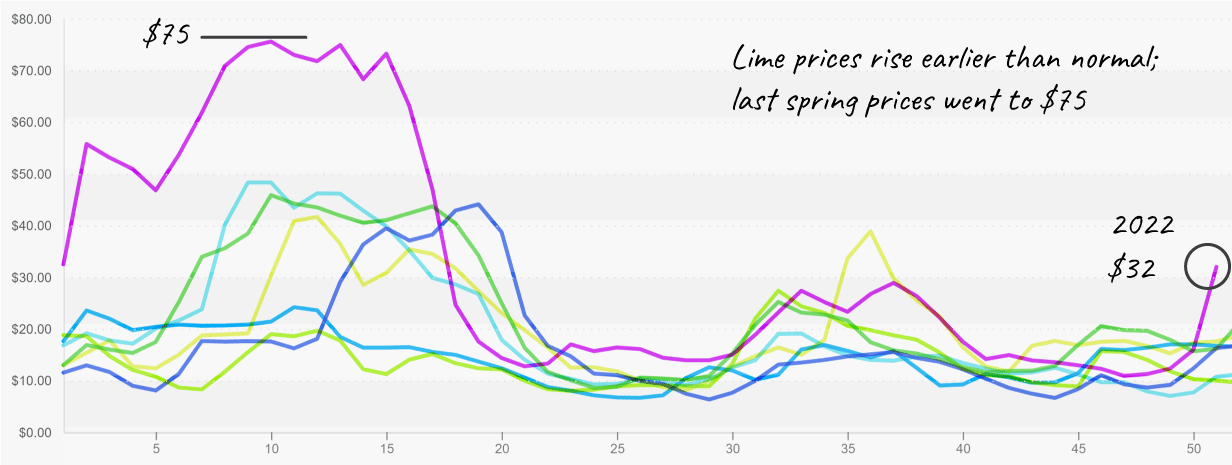

We assume key-lime pie was popular on Christmas menus this year. Prices exploded, up +95 percent over the previous week on strong demand and a transitioning supply.

Lime prices typically increase between week #50 and week #15 as Mexico enters its lowest production season.

Lime prices double and are poised to follow last year’s extreme highs.

Green and red grape production is on the decline. California is nearly finished, and Peruvian exports are being bottlenecked due to civil unrest. What product is making it out of Peru is very good. However, red and green grapes will increase in price over the next three weeks unless the unlikely happens and protesters and the government reach an understanding.

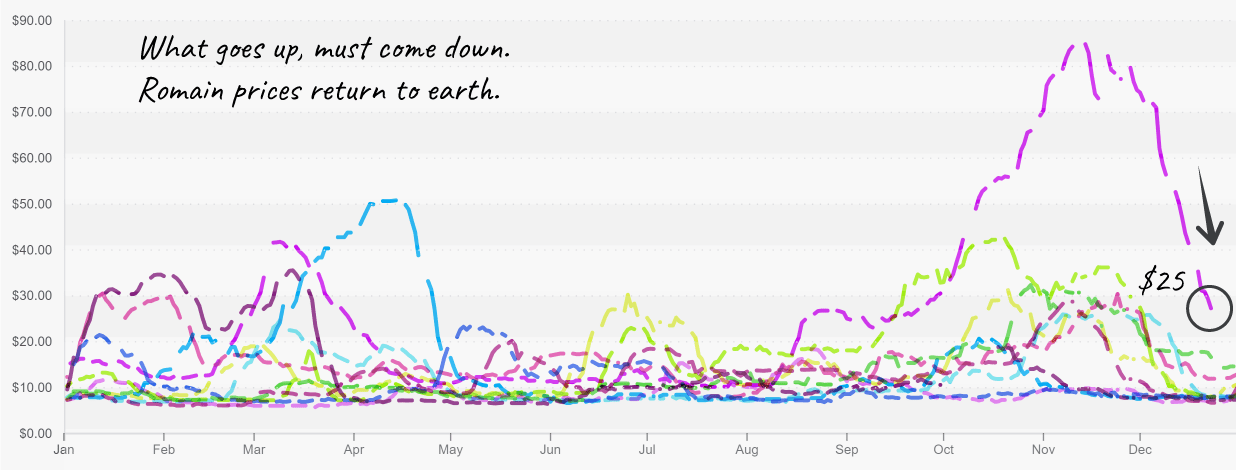

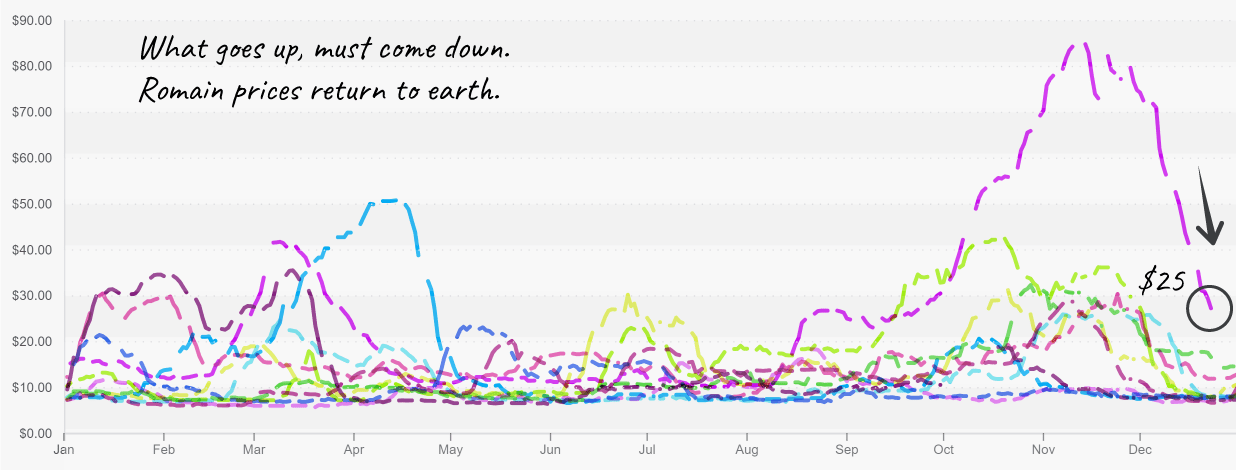

Lettuce prices are down significantly over the previous week. Iceberg plummeted -30 percent and romaine -34 percent week over week.

Some lettuce growers in the desert are reporting quality issues like skin blister and peel; however, it depends on the variety, and not enough damage has been reported to really impact prices. Anecdotally, demand for lettuce is lower during extreme winter storms.

Romaine, 24 count, crashes and is expected to fall further.

The wet veg market (celery, broccoli, and cauliflower) is tightening significantly due to low supply. Cooler weather is delaying product growth out of the desert and forcing prices up.

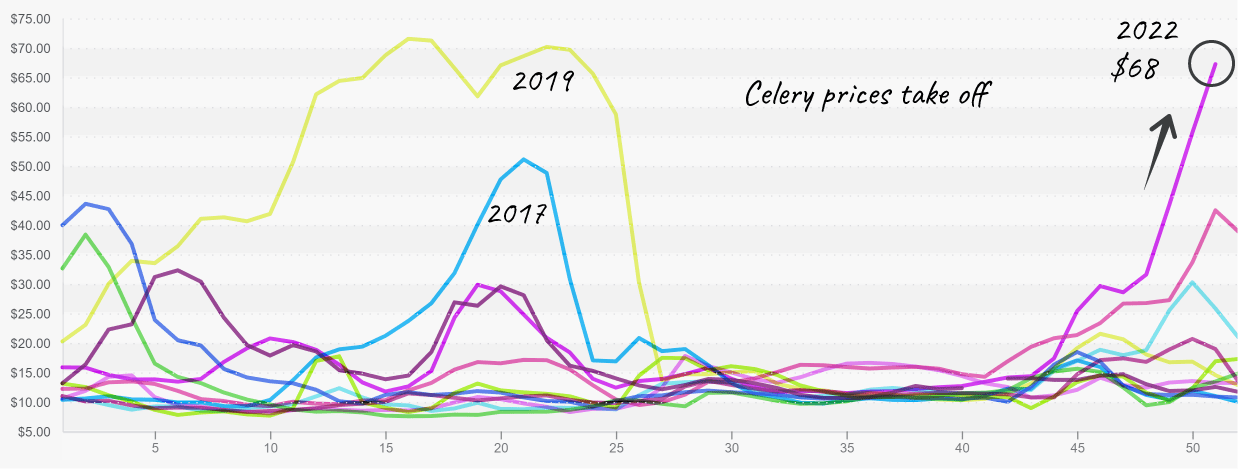

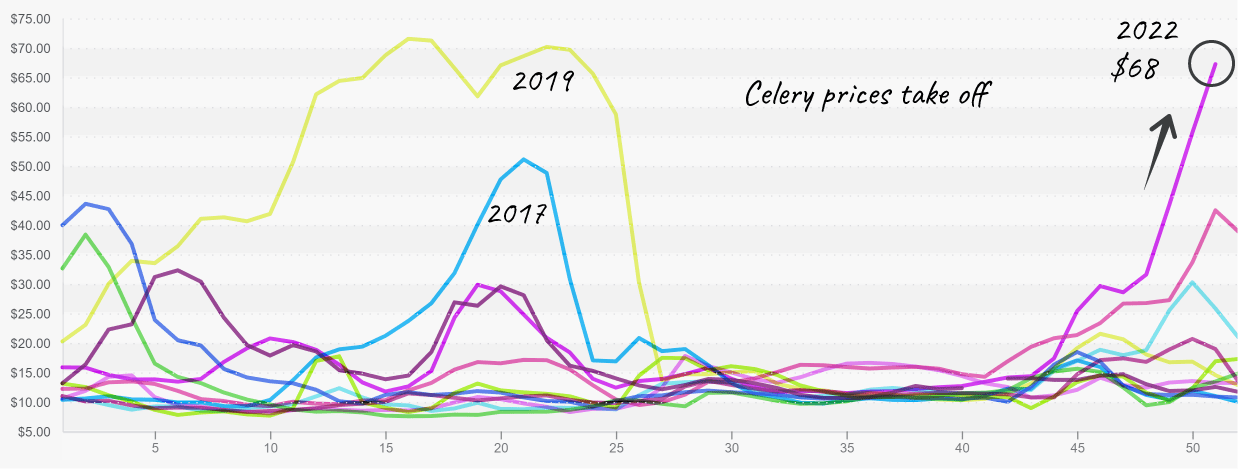

Celery prices are at a ten-year high by an astounding margin. At $68 fob, a celery juice cleanse will be off the menu of budget-conscious consumers setting ambitious health goals for the new year.

Celery prices accelerate to new highs.

Broccoli and Cauliflower markets are back on our radar. Prices are up significantly week over week in response to the frigid temperatures of Winter Storm Elliot.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.