Things are heating up; unfortunately, we aren’t referring to the demand for fresh produce. From Dallas, TX, to Coachella, CA, temperatures reached record highs over the weekend.

As a result, much of the Southwest and Southern portions of the U.S. are under excessive heat warnings and advisories. And now, temperatures across the U.S. are forecasted to reach record highs over this week.

That heatwave is expected to spread East over the next few days, making much of the East Coast feel as if summer wasn’t still nearly two weeks away.

ProduceIQ Index: $1.28/pound, -7.9 percent over prior week

Week #23, ending June 10th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

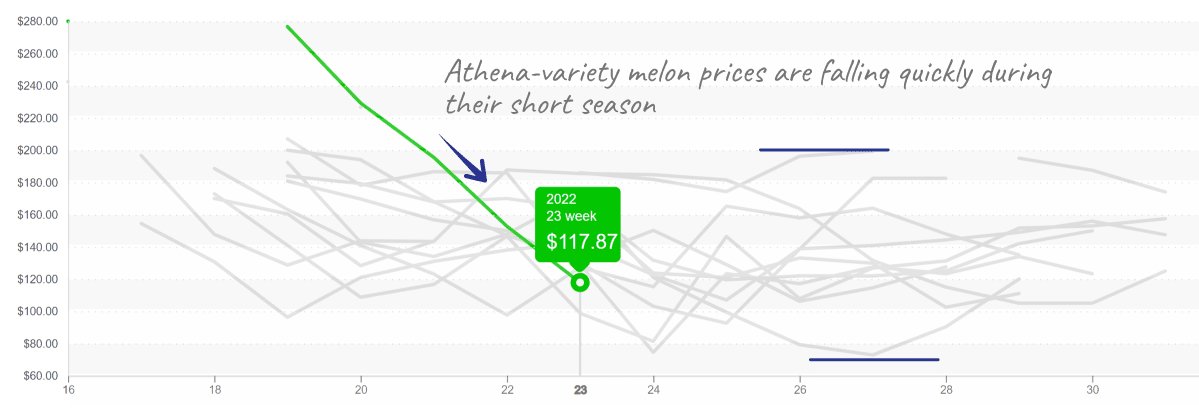

Although the weather may have some adverse effects, the extra heat units will accelerate the harvest of cantaloupes and other Georgia spring items over the next couple of weeks. Adel, GA is slated to have a high of 99 degrees on Wednesday, making the already-short Georgia season even more fleeting.

Cantaloupes are ready to soak up the heat. As Mexico finished up production, cantaloupe prices rose considerably. Now, markets are ripe for an influx of supply. Increased production out of Yuma, AZ, and Imperial Valley, CA has started to move prices towards the ledge, and this heatwave may very well push them over.

Athenas from Georgia are in full swing and are ripe for promotion. As it goes in fresh produce, prices tend to be low when quality is the best. This year is a beauty contest and a great opportunity to promote!

Athena-variety cantaloupes are quality and harvesting with strong supply in Georgia.

Mexican and Californian avocado volumes are on the decline. Mexican export volume fell -25 percent over the previous week. Despite decreasing supply, overall market prices are staying relatively flat. Peruvian exports are increasing but aren’t quite in full swing.

There is no shortage of opinions regarding the quality of Peruvian versus Mexican product. Many buyers are skeptical of the Peruvian fruit and stay loyal to California or Mexican fruit despite the significant price premium. Expect markets to fluctuate over the next couple of weeks as elevations in Michoacan, Mexico, transition to the Loca crop.

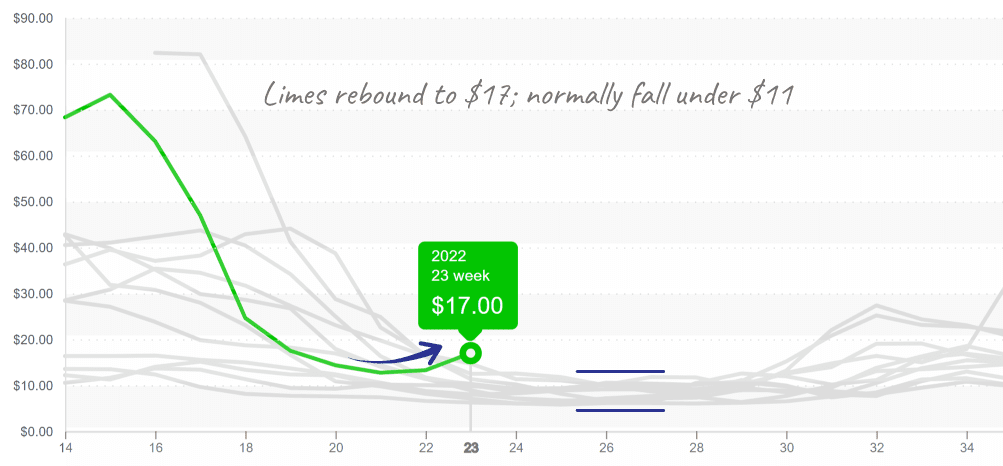

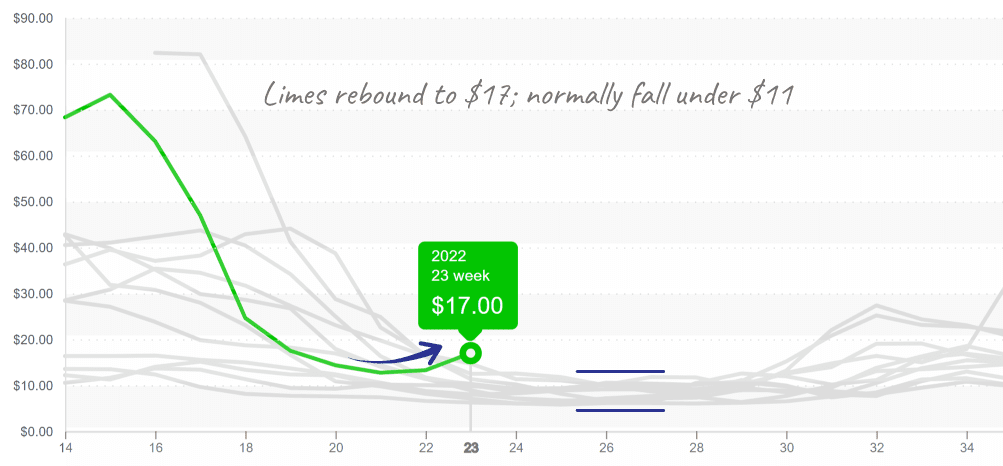

Lime prices are on the rise. Rainy weather is limiting Mexican supply. Due to the potential tropical development off the coast, more heavy rain is forecast for this week near Tabasco and across southern Mexico.

This time of year, lime markets are flooded with plentiful supply and follow a predictable pattern. However, this week, lime prices are making an unprecedented jump to $17. Still, compared to April’s $73, $17 seems like a deal.

Lime prices bounce with the rain, avoiding the typical floor pricing this time of year.

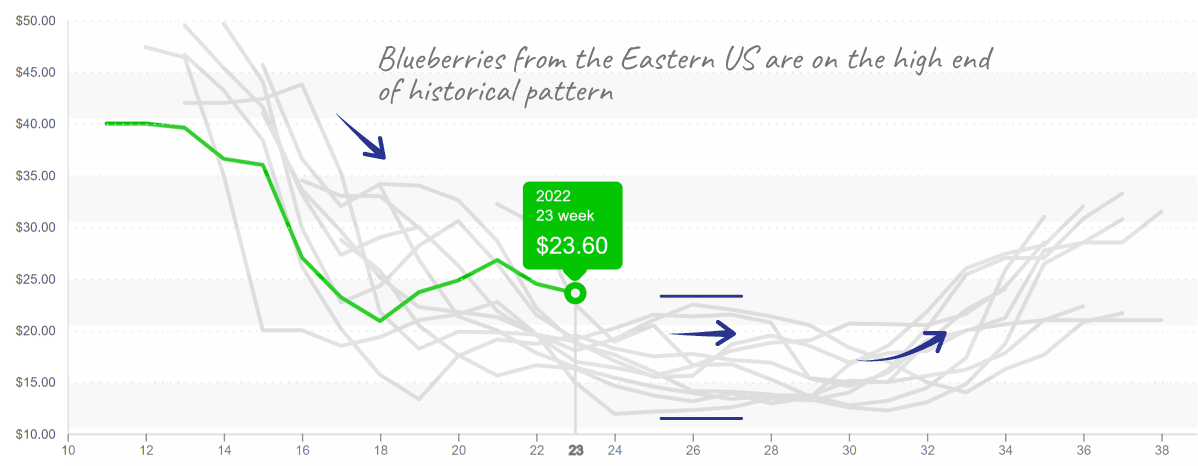

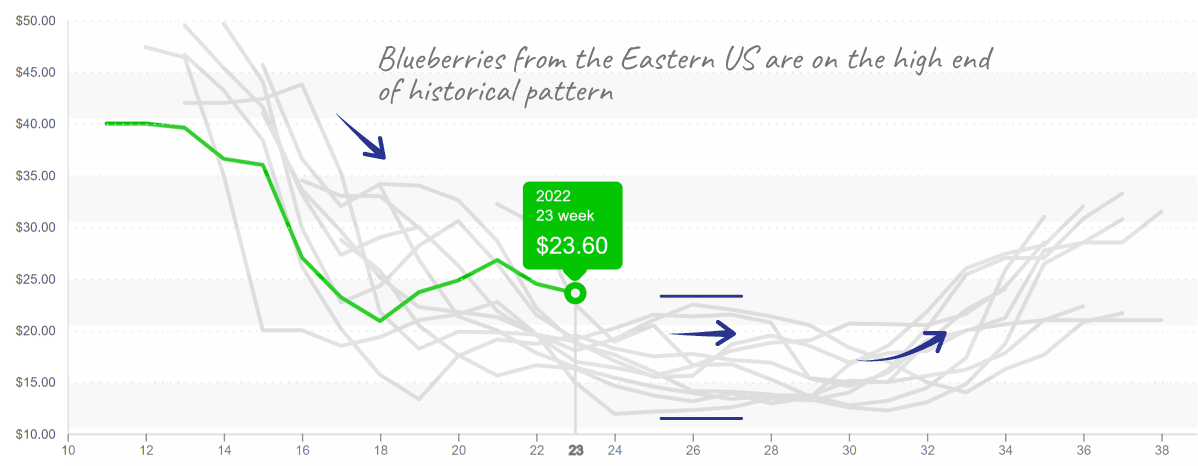

Blueberry prices are just barely scraping out a ten-year high. Mexican production is declining, and the Pacific Northwest is still a couple of weeks out. In the meantime, growers in North Carolina, Georgia, and California are working to fill the gap.

Georgia’s blueberries, twelve 1-pint containers, are fighting the trend for lower prices leading to summer.

Now is the time to promote red grapes. Grape prices are nearing a ten-year low due to a massive oversupply of red grapes. On the other hand, green markets are relatively tight. A weak supply out of Coachella, CA, and Mexico, is swelling prices and keeping grape markets afloat.

The heat wave that burned through the West this weekend may negatively affect grape yields in California. The temperature in Coachella Valley is forecasted to stay in the triple digits over the next week. The weather over 100 degrees can cause berry growth to stop, discoloration in the fruit, and delayed sugar accumulation.

Please visit our new grower stores, or our online marketplace, here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.