Week #20 coverage is brought to you by scorching heat, a freak snowstorm, and a megadrought.

This past weekend, the East Coast trudged through record May temperatures in the mid-90s, the Western U.S. had a very late spring snowstorm with up to 20 inches in parts of Colorado, and the Southwest’s drought powered the Hermit’s Peak and Calf Canyon Fire, the largest in New Mexico’s state history.

With summer weather arriving early and the Memorial Day pull, produce demand is generally stronger than sources of supply. Harvest transitions are underway, yet not fully complete, and quality supply may require your truck to pickup in more than one region.

Fortunately for those living on the East Coast, late weekend thunderstorms will bring much-needed relief in the form of a cold front. But, of course, rain is not as welcomed by mature produce plants, particularly after fruit set.

ProduceIQ Index: $1.49 /pound, +4.2 percent over prior week

Week #20, ending May 20th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

With New Mexico’s dry onion season just around the corner, circumstances feel like mother nature is playing Whac-A-Mole with our late spring/early summer growing regions. And she is getting uncomfortably close to taking something out.

Industry produce prices are at record levels, reflecting the supply challenges and steady demand.

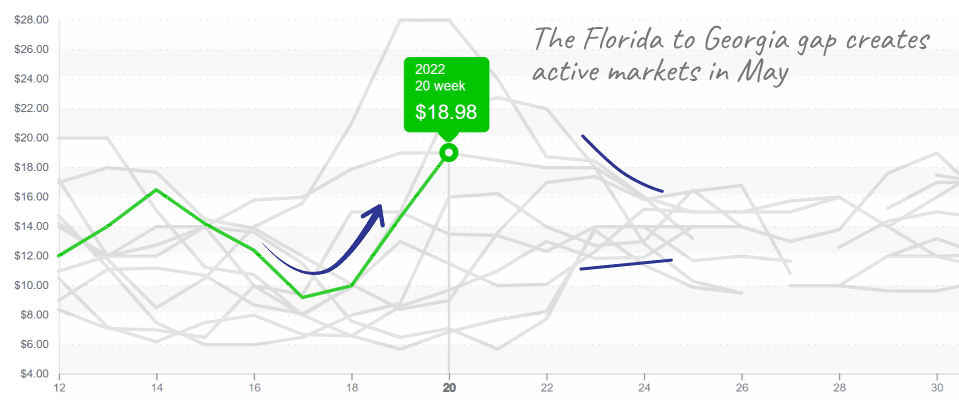

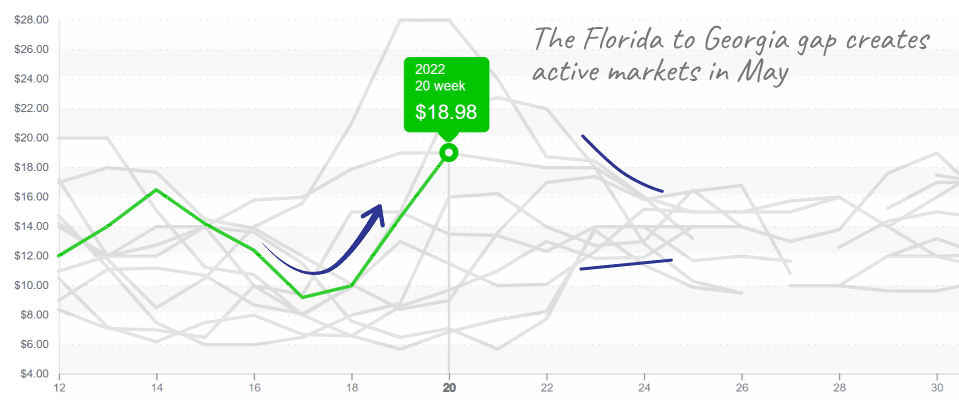

Speaking of heat, at $19, tomato markets in Florida are lit. Warm weather and rain are forcing Central FL to wrap up its tomato season a week early, adding pressure to a reduced Mexican supply. Within the next two weeks, Quincy, FL, and South Georgia should pick up production and provide relief to the vine ripe and the mature green round markets.

Plum and grape-type markets are also priced higher due to short supply. Plum-type tomatoes are just barely short of a ten-year high, and Grape-type prices are at a nine-year high. Baja California, Mexico, should pick up production over the next couple of weeks and ease overextended roma and grape-tomato supply.

Additionally, June usually marks the increased availability of locally grown tomatoes as more domestic regions come online for the summer.

Hothouses in Grainger County, TN, will be showing off their local, vine-ripe flavors soon. Highs of 89 degrees in Rutledge, TN, should accelerate production.

Tomatoes, 5×6 mature green from Florida, are at $19 and have the potential to increase further during the gap to Georgia volume.

Same story different commodity. Brussels sprout prices are up for the seventh week due to low supply. Extreme heat in Mexico is causing plants to bolt and reducing overall yields. Supply is expected to stay lean for another two weeks until domestic production picks up.

Celery prices are down slightly; however, supply is still on the leaner side this week. Although warm weather is causing plants to seed and decreasing yields, the smaller-sized market is fairing slightly better. Salinas should begin within the next three to four weeks. In the meantime, Santa Maria and Oxnard are the main suppliers.

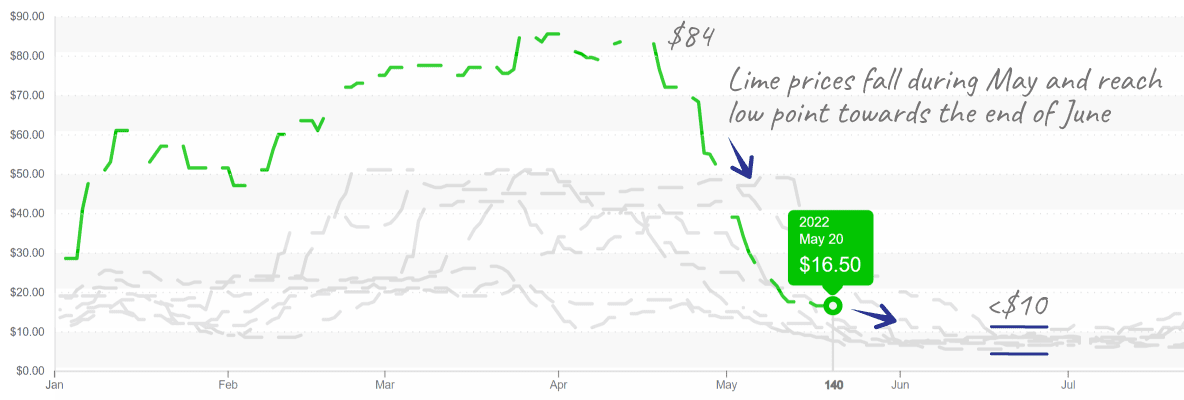

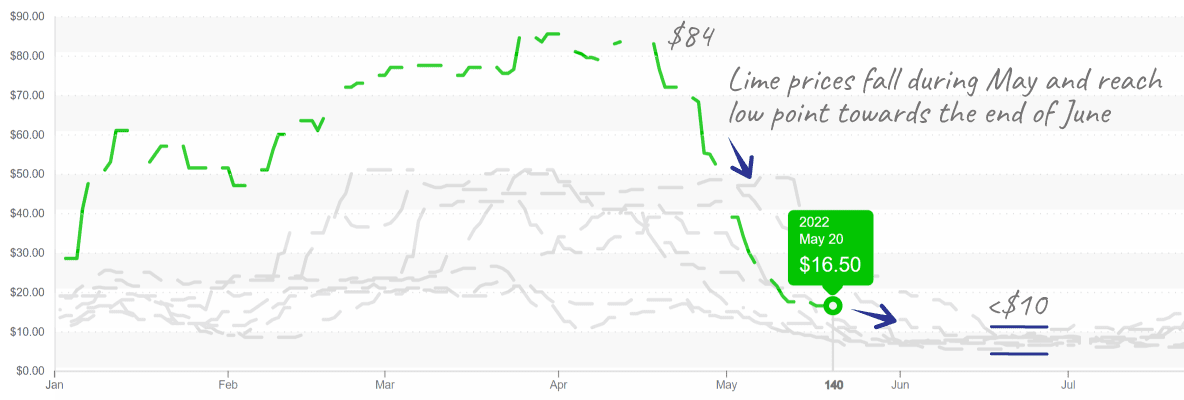

Remember when Miami Beach bar owners shed a tear every time a sunbaked spring-breaker ordered a Mojito? Lime prices fell again for the fifth straight week. Prices are now a very reasonable $16 and may even drop further.

Lime prices, 200ct, have fallen from meteoric highs, reaching $16.

Parsley prices are still at a ten-year high. Recent heat in CA triggered seeders and continues to cause shortages across the industry. As a result, expect prices to stay elevated for the immediate future.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of US entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.