Overall market prices fell faster than your bank balance after buying a last-minute Mother’s Day Hallmark card.

Nothing can ever repay our mothers for giving us life, raising us, and most importantly, teaching us to love our fruits and veggies. But reasonably priced spring produce is a good start.

ProduceIQ Index: $1.12 /pound, -7.4 percent over prior week

Week #18, ending May 6th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Spring’s warmth is bringing crops to a full harvest quickly. Declining prices are led by limes, most melons, broccoli, peppers, and cucumbers. Even avocados are enjoying a brief break from ever-climbing prices, though complete respite is expected to hold out until June.

On the other hand, cherries from California are beginning their season swinging at $70 per 16-pound case for 11-row size. The larger cherries, 10-row, are trading for around $78, and the smaller size, 12-row, can be had for $32.

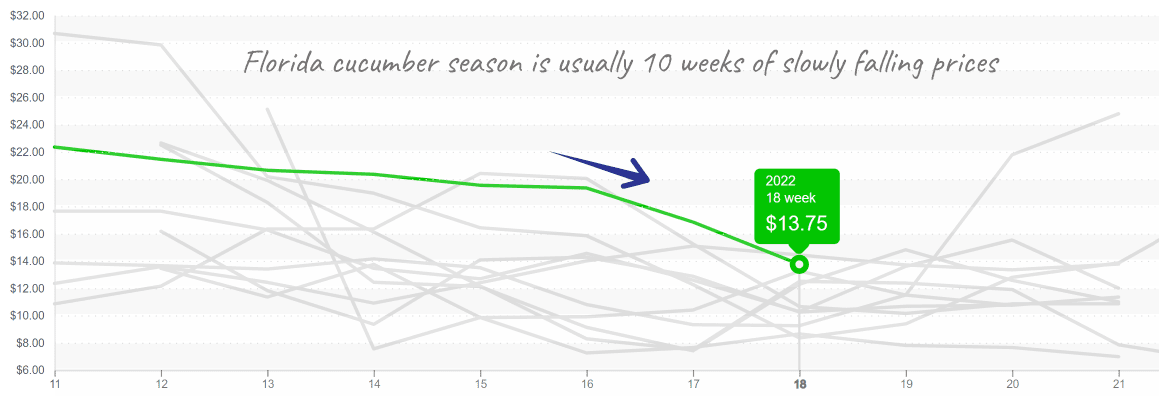

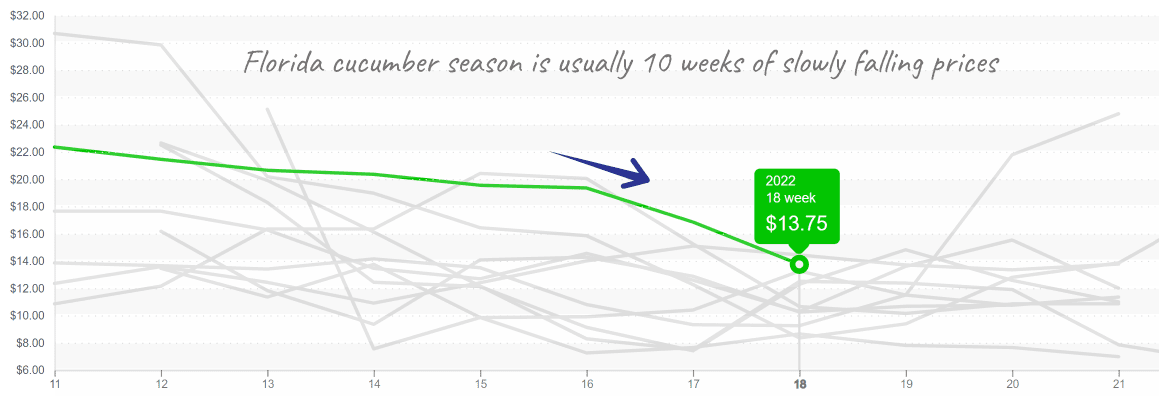

Overall, supply is expected to decrease from last year’s bumper crop due to a late freeze impacting the more Northern growing regions. Prices typically fall from the start of the season until the end as the early-mover advantage wears off and the volume accelerates.

As in the fable of Icarus, limes flew high and crashed fast. It hasn’t been abnormal for limes to reach $40/case before falling to $10 by early June. However, this winter season has been elevated to extreme altitude, over $60/case, due to the shortage of larger fruit. After an extended battering since January, exhausted buyers are eager for a return to normalcy. Recent rains are helping fruit size, and prices are dropping faster than usual.

Lime markets need careful attention as quality varies and falling prices haven’t found a floor.

Good supplies of seedless watermelon in South Florida are sinking prices, currently $0.22 to $0.23/pound. Domestic watermelon prices, and quality, have a wider range as growers are fragmented. Unlike other commodities, such as corn, watermelon growers are less consolidated and can be less disciplined regarding price.

Logistics become more critical as freight can cost more than the fruit itself. Watermelon is a great item to promote as summer approaches.

Spring prices for seedless watermelons in the East vary widely as growers become geographically scattered.

Florida is beginning to feel like summer as temps reach 90 degrees. South Georgia remains in spring mode with temps in the low 80s. The dry vegetable category transitions to Georgia during May with shorter-grow day crops becoming ready earlier: squash is first, then cucumbers, then pepper.

USDA doesn’t use industry-recognized sizes for American slicing cucumbers, such as super select and selects. Their data is represented in small and medium sizes. USDA mediums are $13, whereas super selects are trading around $16. Prices typically descend into the Georgia season unless a gap occurs.

Cucumbers, medium size, continue to fall from the late winter crop. Florida will be transitioning to Georgia later this month.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.