While decreases across categories dragged the overall index slightly down, anxiety over Western heat and forecasted precipitation is causing prices for lettuce and certain dry vegetables to jump off the floor.

Growing regions on the West Coast of the United States are under an “active heat advisory.” In anticipation of reduced yields and heat-related damage, iceberg and romaine lettuce experienced much needed price increases.

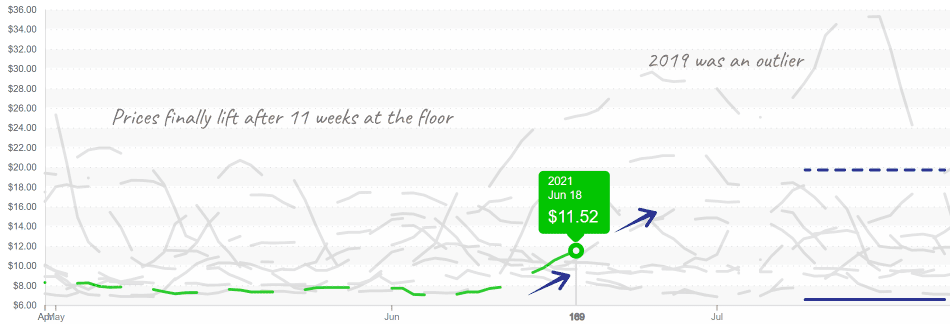

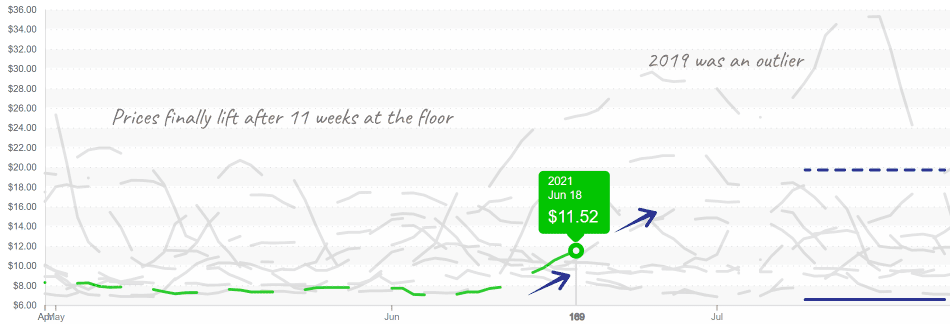

In what has been a flat year for iceberg, a jump is a welcome change for growers weary of rock bottom prices. Although Iceberg is up +40 percent over the previous week to $11.50 per case, the rise is caused by reduced yields.

Warranting further price increases, abnormal temperatures in the Central Valley will negatively impact yields and quality of the heat-sensitive crop over the next couple of weeks.

Iceberg needs continued price increases to make up for losses and reduced yield.

Similarly, Romaine has enjoyed a relatively even-keeled year. Though prices have managed to stay slightly closer to historical norms than iceberg lettuce, a slight increase, +33 percent, may invigorate drowsy markets. Expect availability to be tight and quality to vary greatly due to heat related damage.

ProduceIQ Index: $1.01/pound, -2.9 percent over prior week

Week #24 ending June 18th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

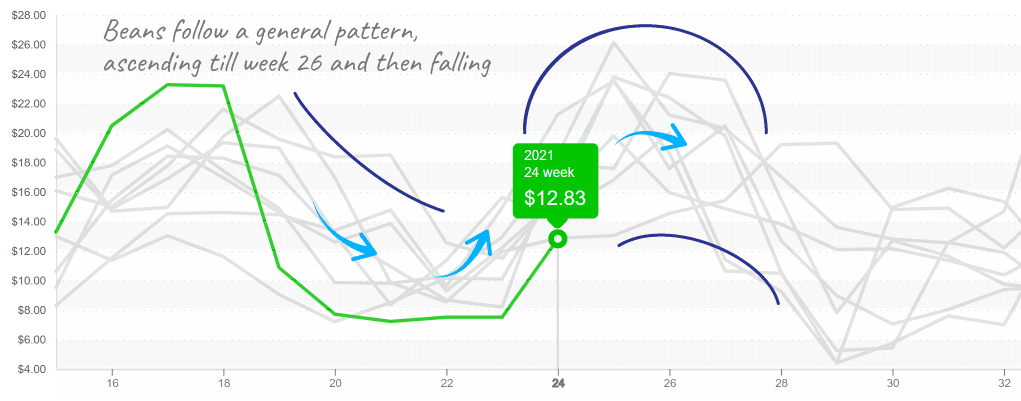

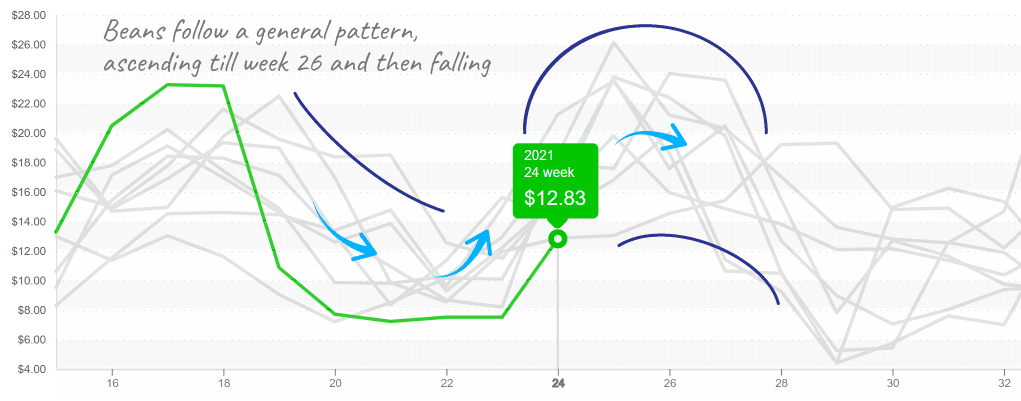

Beans are week #24’s real standout. After four weeks at record-breaking low prices, beans bounced an astounding +90 percent in one week. Nevertheless, prices remain less than fully loaded production costs. Prices should continue to rise as extreme heat affects production in the West, and East Coast volumes lag behind demand.

Beans have remained at the low-end of their trading range since week #19.

Strong, quality supply of cherries, nectarines, peaches and plums is keeping stone fruit lovers and consumers very happy this season. It’s only the beginning of peak cherry season and prices are already low, falling another -32 percent over the previous week.

Nectarines, peaches and plums are enjoying a similarly fruitful season. As long as harvests remain unaffected by the heat wave, prices are expected to remain sweet and low. The stone fruit category is highly promotable item for the next 6 to 8 weeks.

Cherry prices began high, above $55 per case, and are now close to $30.

Bell Peppers are fighting to stay above $10 per case during a fast and furious Georgia Spring. Most certainly a buy, prices are at a 10-year low and good supply is available on both green and colored bell peppers. Quality and availability are forecasted to stay remain stable for the next several weeks.

Roma tomatoes are down -24 percent over the previous week. If able to substitute, Roma tomatoes offer a bit of hope for buyers looking to avoid tight tomato markets. Romas are increasingly grown in Mexico under protected agriculture. Overall tomato markets are expected to stabilize as domestic volume increases.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.