Finally, the December holiday pull is towing fresh produce prices out of the Thanksgiving rut.

High-end produce categories including grapes, berries, avocados, melons, and asparagus are undergoing additional increases. These items have lower supply due to challenged holiday labor availability.

Although there are notable price surges across many high-end items, not all commodities are benefiting from the uptick in demand. High-dollar items that are rising further include grapes, berries, avocados, melons and asparagus.

Green bell prices fell again, inching even closer to a ten-year low. Current prices are reported at $5.59. Reported Mexican import volume of green bells is slightly less than last week, but not enough to reverse the current floor pricing.

Our two cents, don’t let green bells become the Grinch that stole Christmas, promote!

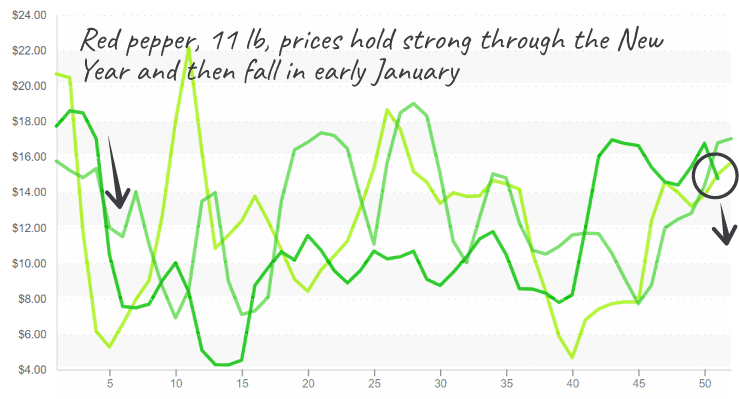

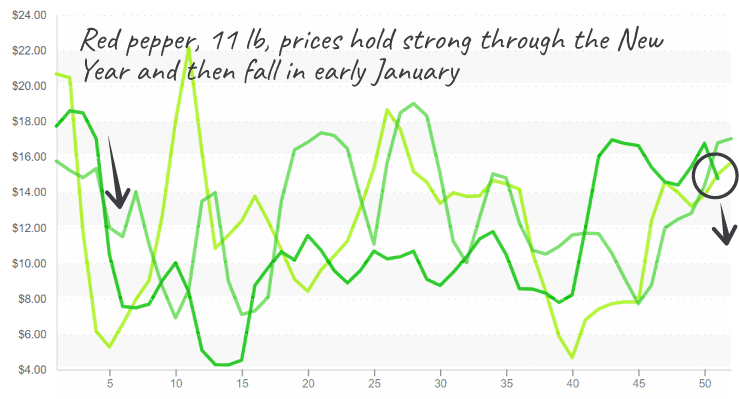

Red and yellow pepper supply is increasing, easing market tension and consumer prices. Red pepper prices fell $1 over the previous week, and yellow nearly $3. Red and yellow pepper volume out of Mexico should continue to increase over the next few weeks.

With green pepper prices at the floor, many green peppers will stay on the vine to turn red.

Red pepper falls slightly into holidays. As Mexican green bells mature, red bells will increase in supply.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.05/pound, +6.1 percent over prior week

Week #51, ending December 24th

Where did the bell pepper go to have a few drinks? [Read to the end for the answer]

Another fresh produce commodity not seeing price increases, cucumbers. For 1 1/9 cartons, cumbers are at a ten-year low, below $6. Similar to bell peppers, cucumber markets are flooded with product. With harvesting out of Mexico, Florida, and Honduras, markets are expected to stay low for at least a couple more weeks.

On the opposite end of the price spectrum, overextended Hass Avocado markets received a dismal forecast for the next two weeks, and prices reacted dramatically. For the sixth week in a row, Hass Avocado prices are at a ten-year high.

It’s the holidays, and even harvest crews deserve a break. Unfortunately, Mexican growers will battle labor shortages the next two weeks while harvest crews get some well-earned R&R. As a result, high-value commodities hard-pressed for supply, such as Hass Avocados, will see even more extreme prices.

Avocados end the year at record highs, bucking historical trends.

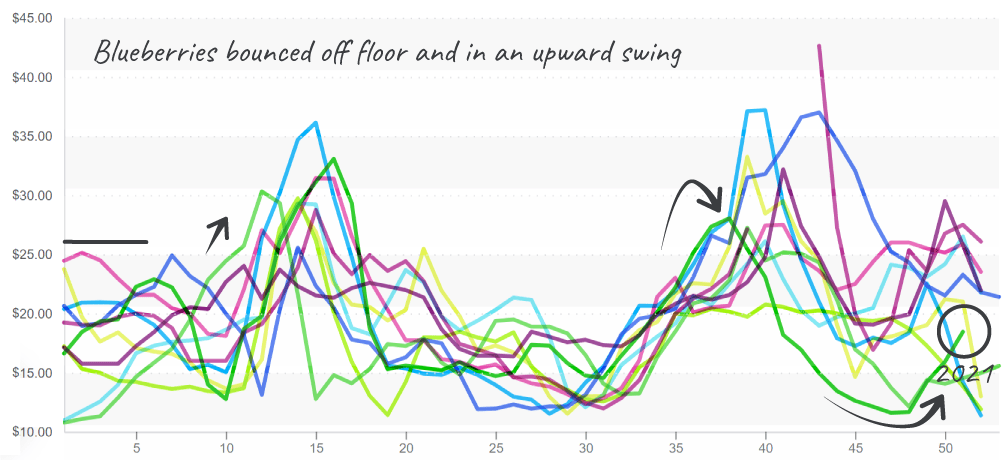

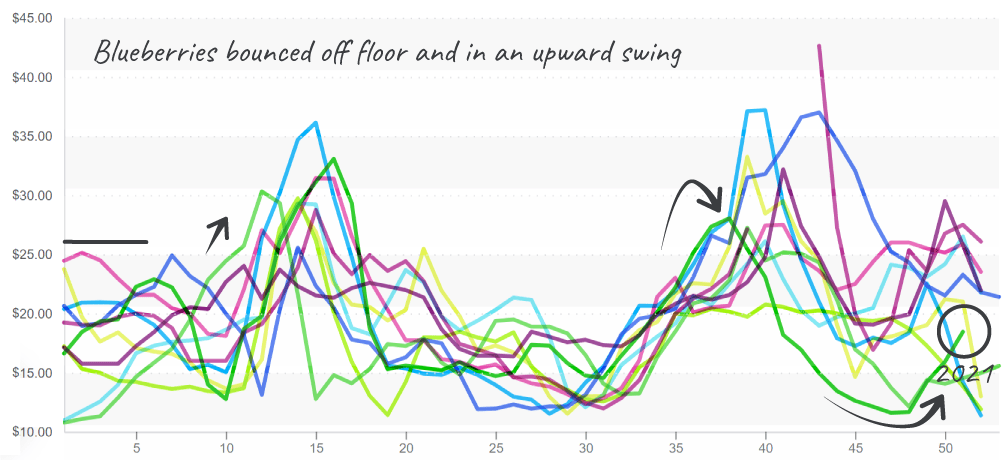

Mexican labor shortages are throwing a wrench in the prices of more than one commodity this week. Blueberry prices are up an impressive +22 percent. Blueberry prices have moved from a ten-year low to $21 for 12-1 pint within three weeks. Blueberry supply is weak due to a perfect storm of problems.

Offshore shipping delays and the typical Mexican holiday labor shortages add pressure to strengthening markets. At the same time, blueberry growing regions are in transition. Peruvian growers are winding down while Chilean and Mexican growers are picking up production. Prices should settle in a couple of weeks when supply stabilizes again.

Blueberry prices have room to increase through the new year.

Answer: The salad bar

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.