This year’s SEPC will be a hard tradeshow to top. With a strong turnout from suppliers clamoring for a coveted booth spot, there was no shortage of entertaining and informative conversation with buyers.

The show’s theme, unseen heroes, felt particularly relevant given the recent spotlight on farmer and farmworker’s rights in and outside the U.S. From Palm Beach, FL, to France, typically inconspicuous farm owners and workers are grabbing headlines as they protest for change in government and business practices.

ProduceIQ Index: $1.08/pound, down -8.5 percent over prior week

Week #10, ending March 9th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

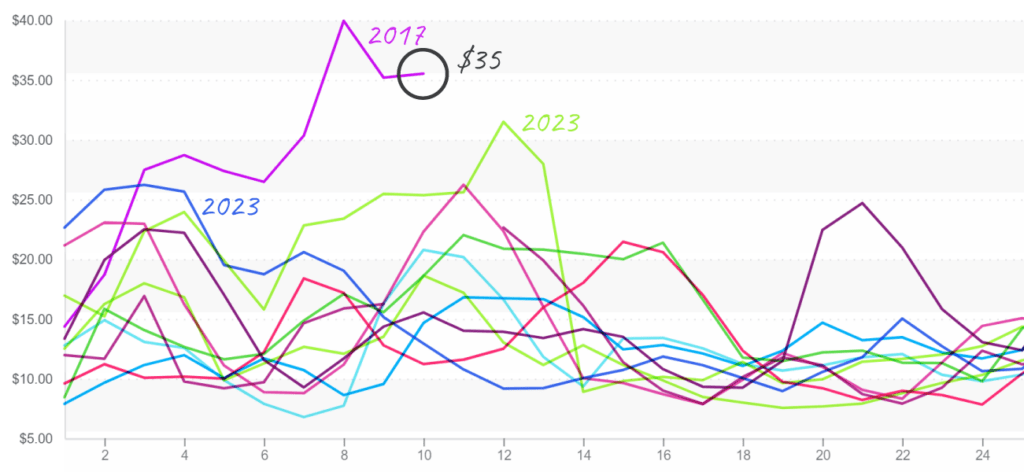

On a more entertaining note. Cucumber markets are putting on an Oscar-worthy performance. While the academy may not be in the habit of nominating produce commodities, we think cucumbers should be the exception. Short supply on both coasts has solidified cucumber prices at a ten-year high for the seventh consecutive week.

Unfortunately, this year’s offshore season has been particularly brutal. Cucumber growers in Mexico are battling pervasive drought and endured damaging rainstorms early in the plant’s growth cycle.

While on the East Coast, volume from Honduras is significantly below the norm. With Florida’s Spring season still a few weeks out, expect cucumber markets to give a performance worthy of at least a few buyer’s tears.

Cucumber prices (medium in the East) level off at $35, $10 higher than any prior year.

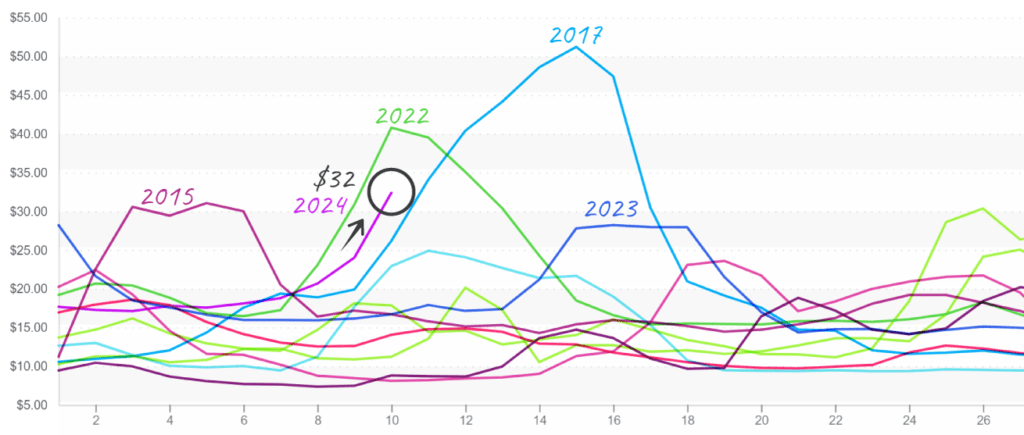

Like SEPC so aptly put this year, the produce industry is full of overlooked heroes. But we’d like to nominate lettuce growers and packers for some much-needed recognition. After a series of heavy rainstorms, embattled lettuce supply has finally given way to high prices. Growers and packers are working tirelessly to fight mildew pressure, ensure quality, and increase yields in water-logged fields.

Romaine is up +41 percent, and Iceberg is up +11 percent over the previous week. Quality issues such as blister, peel, and lightweight should be expected.

Romaine prices in the West are $32 and rising; Spring 2017 prices topped out at $50.

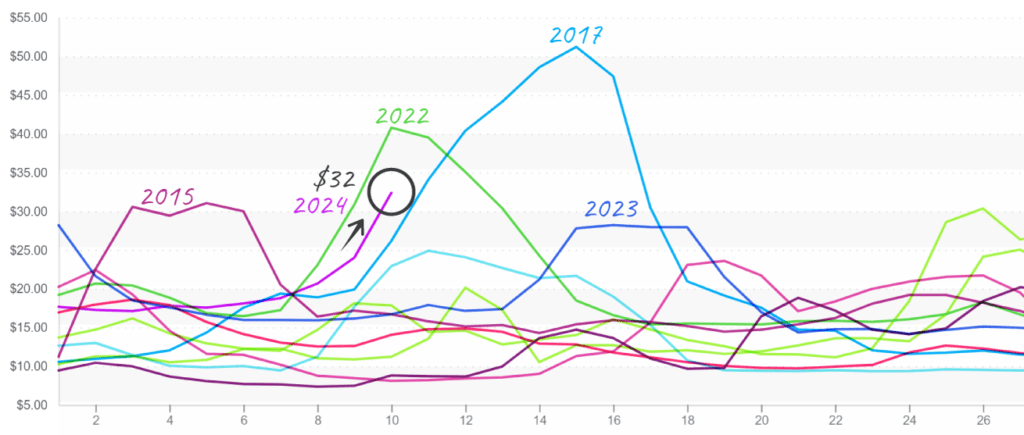

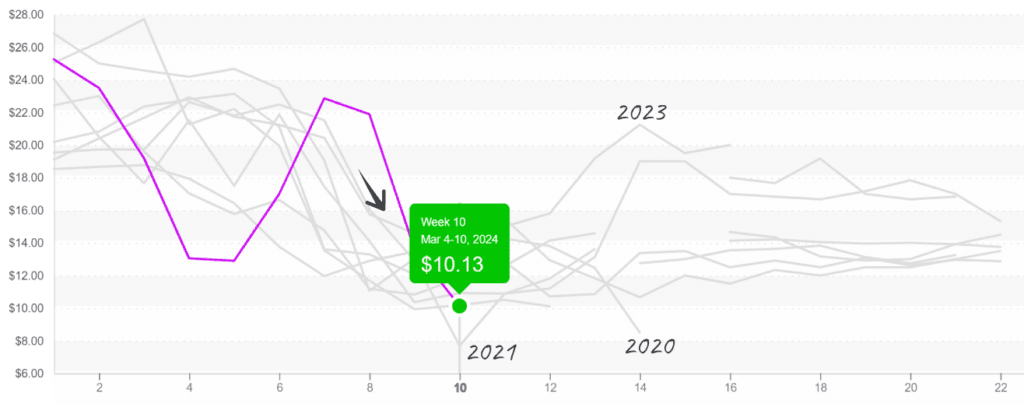

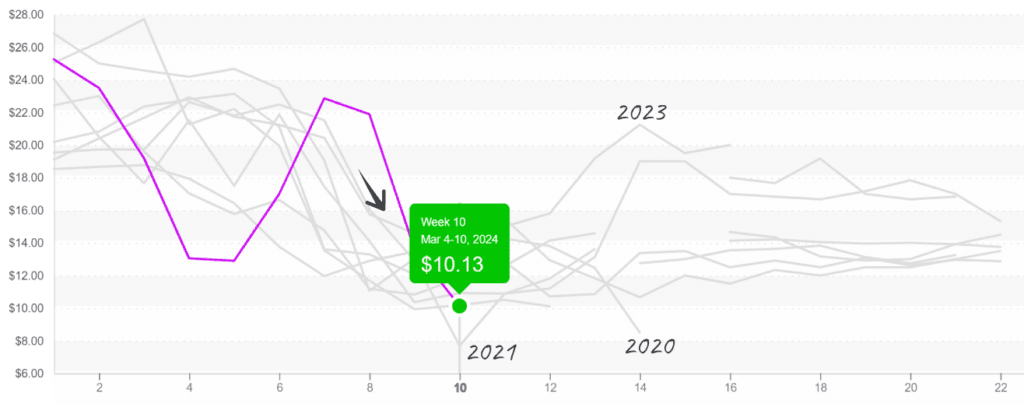

Strawberry markets couldn’t defy gravity forever. Prices moved from a ten-year high to well below average in one week. Florida growers pushed out some solid numbers in week #9, which helped alleviate stress on the supply side. However, due to heat, growers will likely finish earlier than expected in the Sunshine State, and quality issues and shorter shelf life should be anticipated.

In the West, growers in Mexico and California are ramping up production. Barring an AOG, prices should trend lower through Easter.

Strawberry prices in the East crash to $10, though typically flatten out (to a slight rise) for the remainder of the Florida season.

Please visit our website to discover how our online tools can save time and expand your reach. [hyperlink:

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.