Like the once-popular high-school jock, El Niño has passed its peak and will most likely fade as we move into an ENSO-neutral Spring.

Most forecasts predict La Niña will reappear sometime between summer and early fall. The re-emergence of La Niña plays a critical role in shaping crop prospects for the latter half of 2024.

Though overall industry prices range from stable to slightly declining, the ProduceIQ Index remains +12 percent higher for week #4 than in any prior year. Industry prices typically decline over the next six weeks and then begin to ascend in later March as volume from Mexico tapers off.

ProduceIQ Index: $1.31/pound, down 0.8 percent over prior week

Week #4, ending January 26th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Although El Niño is on the decline, the weather pattern and its effects persist. More water is on the way for Western states. Last week, bouts of heavy rain flooded lettuce fields and delayed harvesting. By mid-week, the atmospheric river is forecasted to push storms into growing regions ranging from Central California to Arizona.

Lettuce markets are only up slightly over the previous week despite harvesting delays. Supply may get some relief early this week as the fields dry out before potentially getting a good soaking again towards the end of the week.

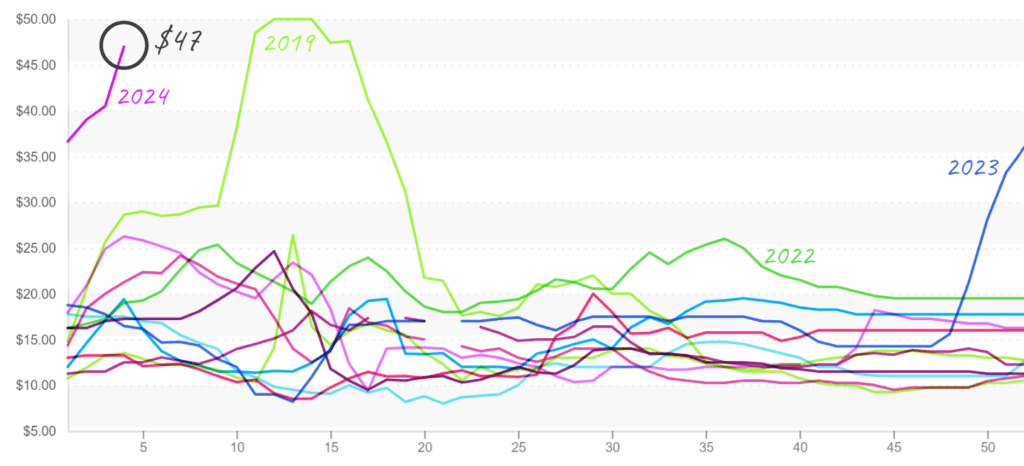

If I were an onion buyer, I’d be crying too. Unprecedented demand and rapidly declining domestic supply, particularly for white onions, have us wondering if onion prices are defining a new normal. Up another +10 percent over the previous week, onion prices are at a ten-year high and tempting to surpass all historical years.

Going forward, crossings from Mexico should begin in early February, and prices will work their way back toward normal, whatever that is…

White onions and 50lb sacks spike north of $45, nearly reaching the record-setting prices of 2019.

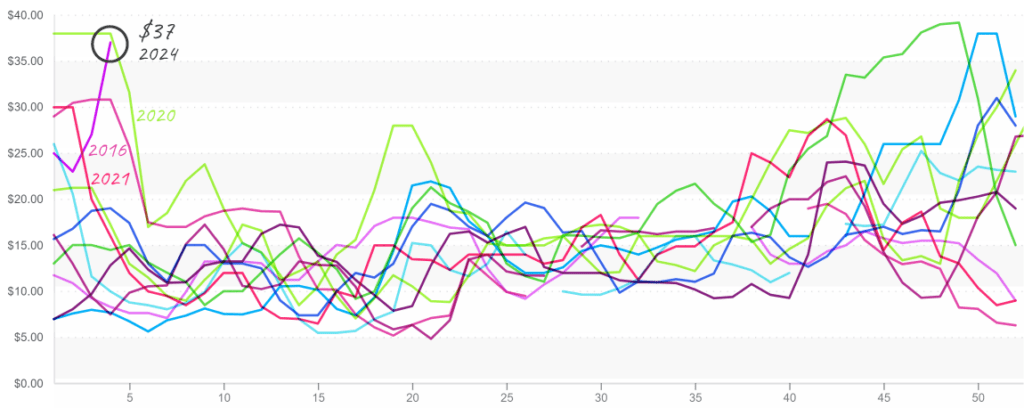

Round tomato markets escalate due to lean supply on both coasts. Week #4 yields from Mexico are down approximately 30 percent due to weather-related challenges. At an average of $35, tomato prices may set a record over the next few weeks that holds for years to come. Hopefully, the weather and supply will improve as growers in Florida and Mexico ramp up production.

Round tomatoes, 25lb 5×6, spike to $37 during a time when prices normally fall.

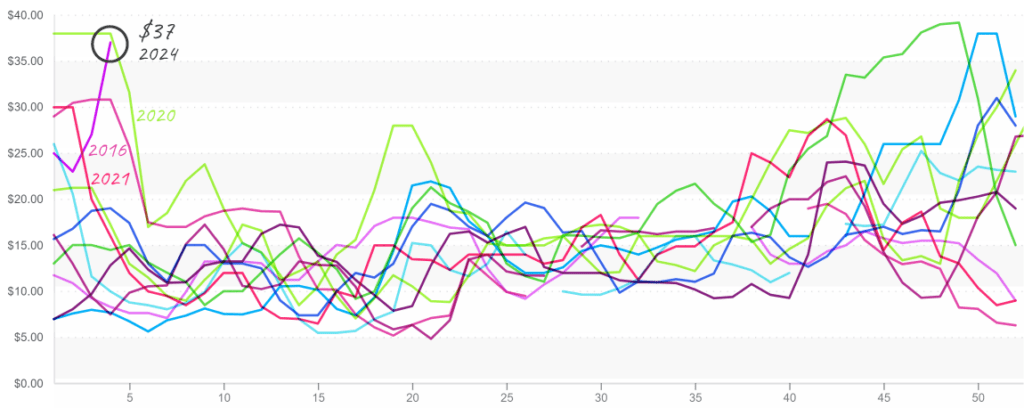

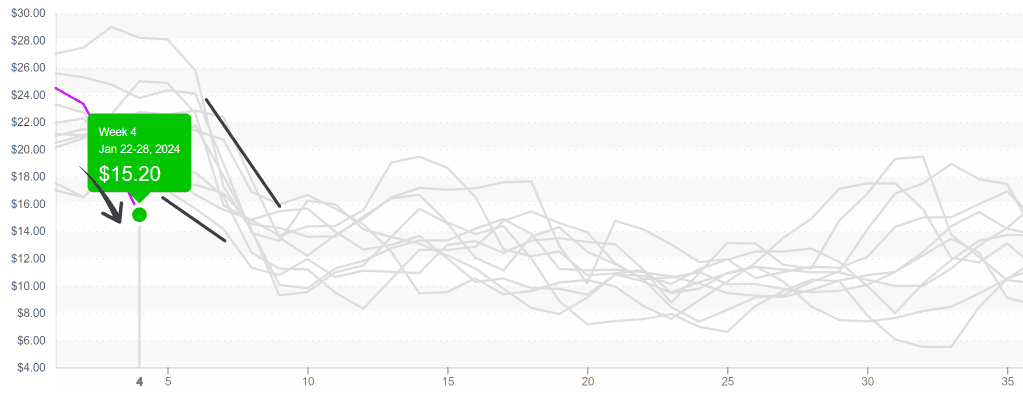

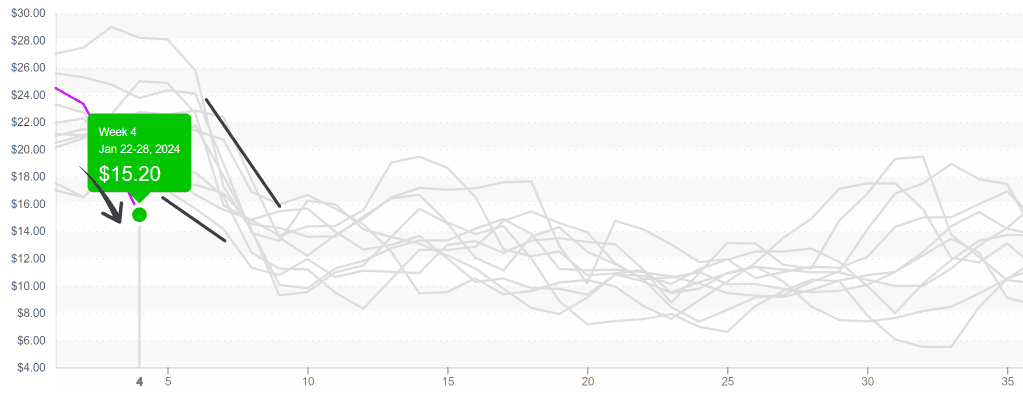

The floor fell out from under strawberry markets. After weeks of tight supply and elevated prices, markets plummeted by -42 percent. More favorable growing conditions and increasing supply from growers in Mexico, Florida, and California are taking prices from a near ten-year high to a ten-year low for week #4.

Strawberry prices reach new lows for week #4; prices typically decline further over the next six weeks.

Please visit our website to discover how our online tools can save time and expand your reach. [hyperlink:

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.