We didn’t intend for last week’s headline to become a self-fulfilling prophecy. Let’s agree to blame El Nino, OK?

Jack Frost blasts wintery weather across the continent, plunging much of the U.S. into below-freezing temperatures, so out with the salads and in with the soups. Extreme cold can reduce fresh produce demand in northern cities as the public hunkers down in their homes.

Winter storms are making the transportation of fresh produce treacherous, with widespread reports of heavy ice and whiteout conditions. Over the weekend, the wind chill sunk below zero as far South as Dallas, TX. The silver lining, some NFL teams still made it through their Wild Card playoff game. Dolphins head coach Mike McDaniel looked a little cold, though.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.32/pound, down -3.65 percent over prior week

Week #2, ending January 12th

Overall produce prices are down -4 percent over the previous week. Decreasing stone fruit prices and a slight dip in blackberry, blueberry, and strawberry markets are helping the ProduceIQ index chill out a bit. Average prices are still at an all-time high for week #2 (more than 10 percent higher than any prior year).

This is the most widespread blast of arctic air the U.S. has seen since the infamous cold snap that socked Texans in February 2021. It’s like Mother Nature found a BOGO coupon for Freon and is making use of her ample supply. Fortunately, the effects, although forecasted to be extensive, shouldn’t be as devastating as that particularly catastrophic weather event for the general public.

For fresh produce, however, this week’s weather will undoubtedly have a chilling effect on struggling supply. Endangered commodities range from Arizona lettuce to strawberries and dry-veg commodities growing in Mexico and Florida. Expect slower growth rates, delayed transportation, and decreased shelf-life.

Check out how this next week’s weather unfolds using our weather tool at https://www.produceiq.com/weather.

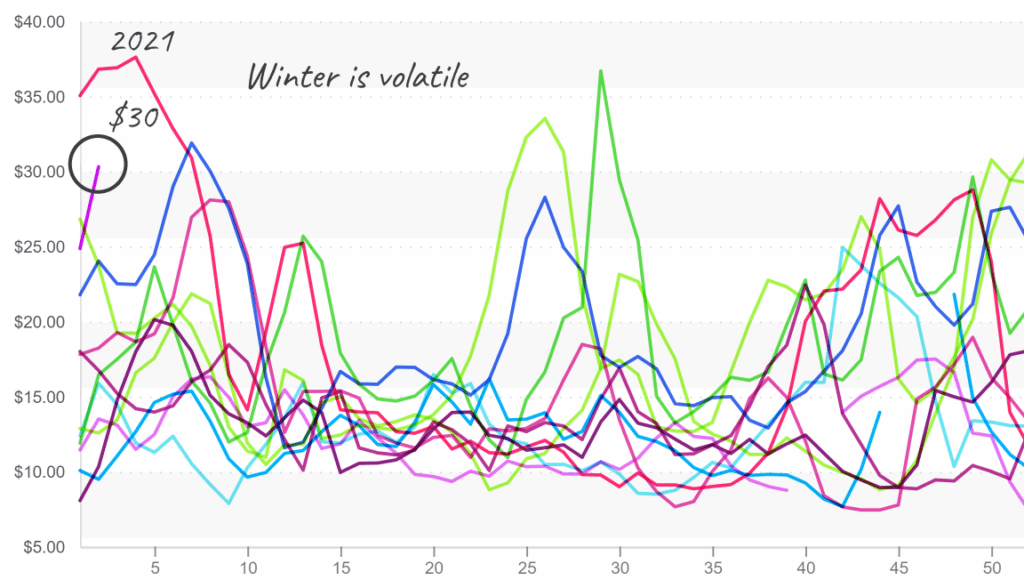

Sweet corn prices are up +20 percent over the previous week. Cold in Mexico and rain in Florida are strangling supply, forcing markets up to $30, the second highest in the last ten years. With more rain and cold in the forecast for the week, supply will likely not recover until late January.

Sweet corn prices jump to $30, proving another volatile winter.

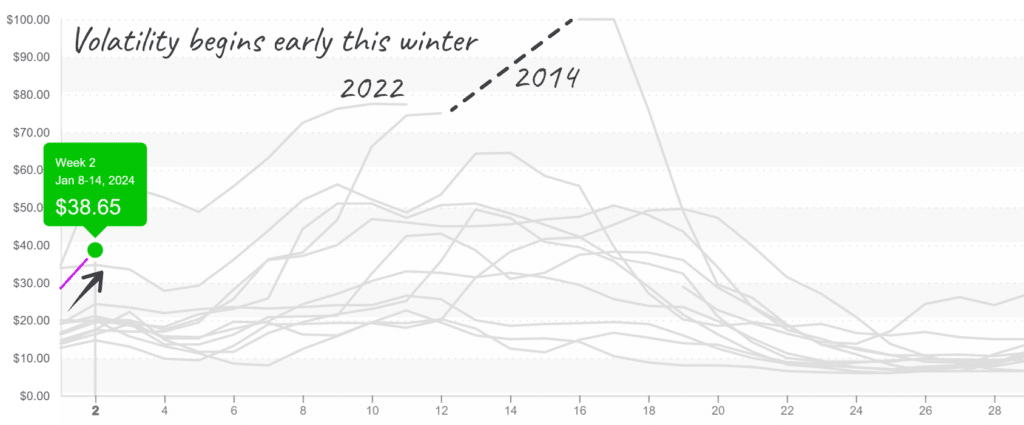

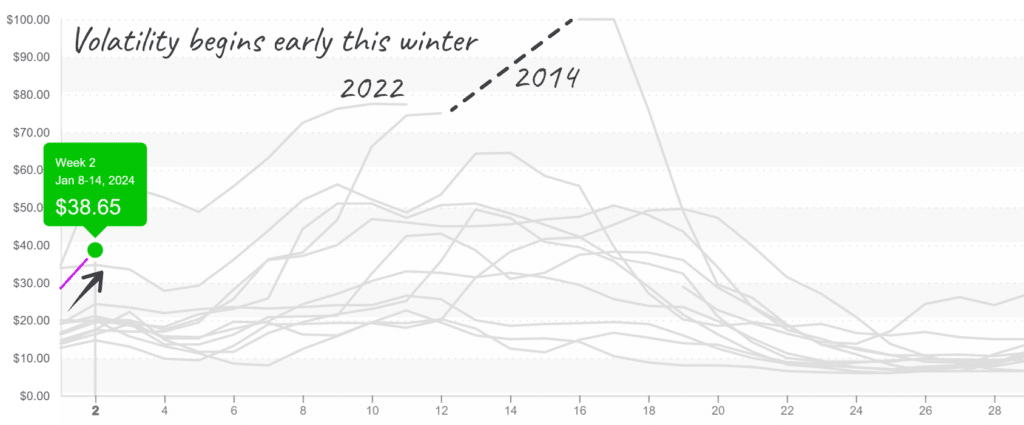

Declining Mexican lime volume is pushing prices higher earlier than usual. Rain in Veracruz, coupled with the seasonal decline in production, is tightening supply. Markets will likely increase over the next few weeks as the new crop ramps up production.

Lime prices (175ct) jump, appear poised to test earlier outliers.

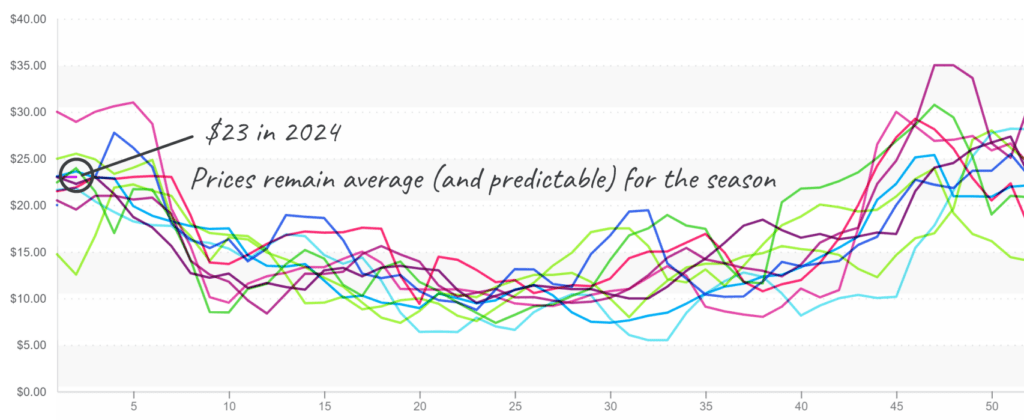

The Strawberry crop is tight on both coasts. Cold in California is keeping growers from filling the gap left by Florida and Mexico. Much to the dismay of suppliers and buyers, more rain and cold are unfortunately forecasted for next week.

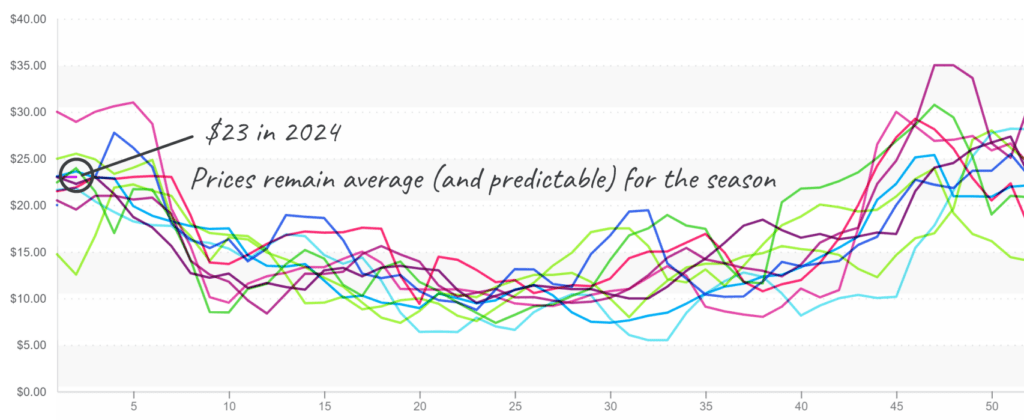

On the bright side, prices are down -6 percent over the previous week and should fall steadily, albeit slowly, as Spring production in Florida and California blooms.

Strawberry prices follow seasonal patterns, which, at $23, remains expensive during January.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.