Although the rest of the world is so over 2023, we have a few more observations from the peanut gallery to digest.

El Niño is undoubtedly the phrase that summarizes the greater trends in produce markets for 2023. From hurricanes in California to record warm winter temperatures in South America, the climatic pattern has and will continue to define produce markets.

But, before we jump into the news, let’s review some of 2023’s most notable headlines.

In week #10, an atmospheric river sparked floods in California that kept strawberry markets at a record high through the summer holiday.

In week #33, a tropical storm struck Southern California for the first time in 84 years. The rain from Hurricane Hilary left table grape markets devastated.

But it wasn’t all-natural disaster and obliterated supply…

In week #23, cherry prices hit a ten-year low thanks to a robust domestic crop. Summer brought one of the best stone fruit seasons we’ve seen in a few years in terms of quality and volume.

More recently, in week #46, produce markets were able to give price-weary consumers a much-needed break from inflation thanks to ample supply and a decrease in input costs such as fertilizer and oil year over year.

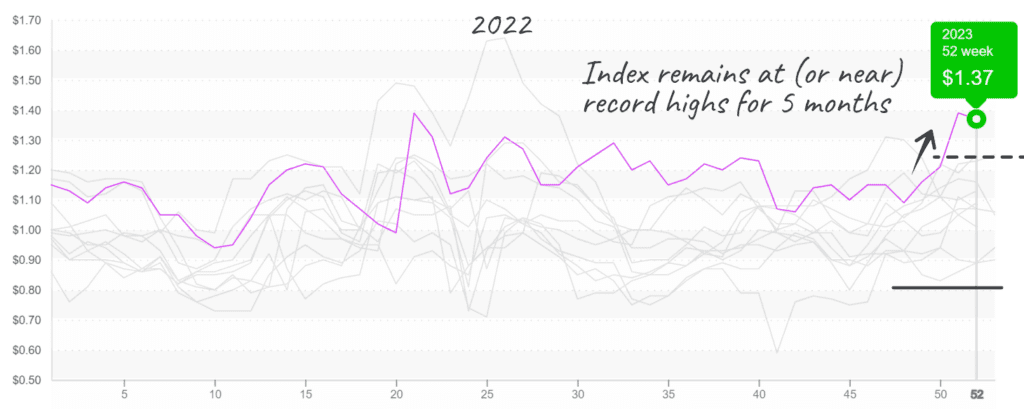

ProduceIQ Index: $1.37/pound, down -1.4 percent over prior week

Week #52, ending December 29th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

In the last week of 2023, overall produce markets faltered only slightly. Week #52 index prices are the highest seen, as a still-slumbering winter supply in Mexico and Florida drives towering prices. Just like we find it hard to pull ourselves out of dreamland when mornings are gray and cold, produce supply is struggling to shake off a rain and chill-induced hibernation.

ProduceIQ Index finishes the year in typical record-breaking fashion

We hope everyone had their fill of asparagus over the holidays because none are left. Asparagus supply is insufficient to report price changes over the previous week. High heat in Peru and rain in Mexico has severely limited supply, and volume won’t improve until mid-January.

Strawberry prices are only up slightly over the previous week; however, supply is still very lean. Holiday-prompted labor shortages in Mexico and heavy rain in Florida keep supply limited. Expect markets to slumber for a few more weeks as growers ramp production.

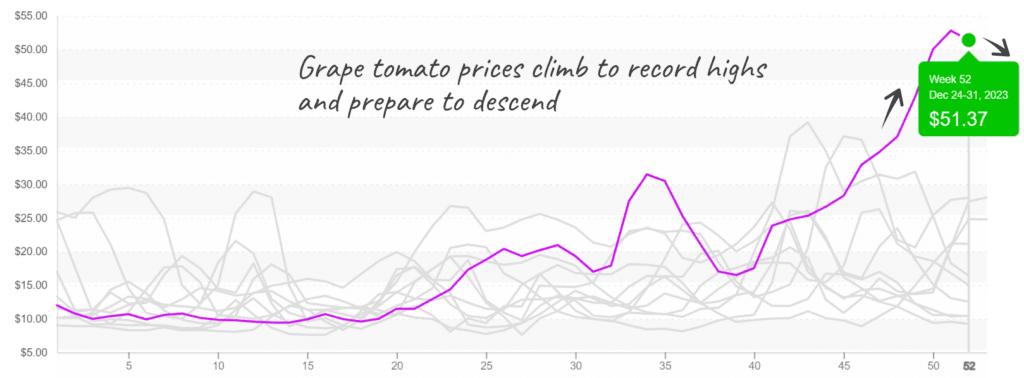

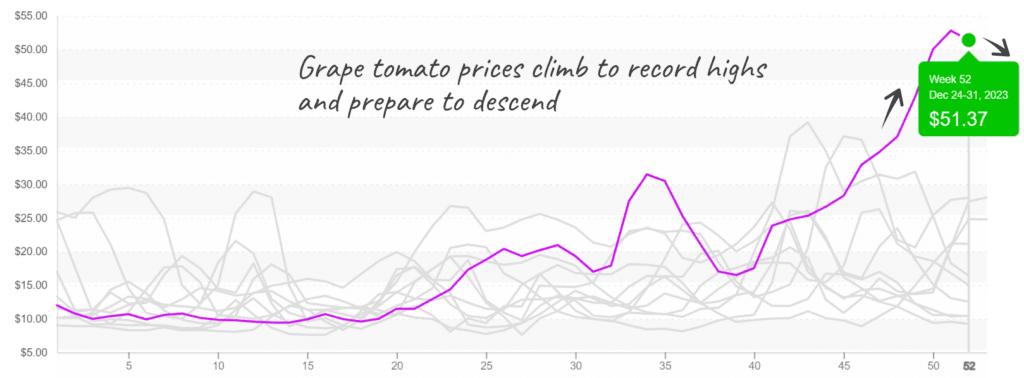

Tomato markets are at a turning point. Light demand combined with burgeoning volume from Mexico hints at imminent relief for overextended suppliers. Barring an AOG, prices should decline steadily over the next few weeks.

Grape tomatoes plateaued at prices over $50

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, increase your profits, expand your network, and provide valuable information.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.