The desert is ramping up production, and produce prices are here to tell the story. In line with historical trends for week #48, the ProduceIQ index is down -5 percent over the previous week.

ProduceIQ Index: $1.09/pound, down -5.2 percent over prior week

Week #48, ending December 1st

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Large decreases in the mixed berry category, as well as desert grown commodities such as cauliflower, broccoli, and iceberg lettuce, are helping to drag the index back toward more familiar price territory.

The Atlantic hurricane season is officially over. Despite heavy wind shear, there were 20 named storms this year in the Atlantic and 17 in the Eastern Pacific. A substantial number of the storms underwent rapid intensification, most infamously: Idalia, Otis, and Hilary. The effects of these major hurricanes, both positive and negative, are persisting well past their typical expiration date.

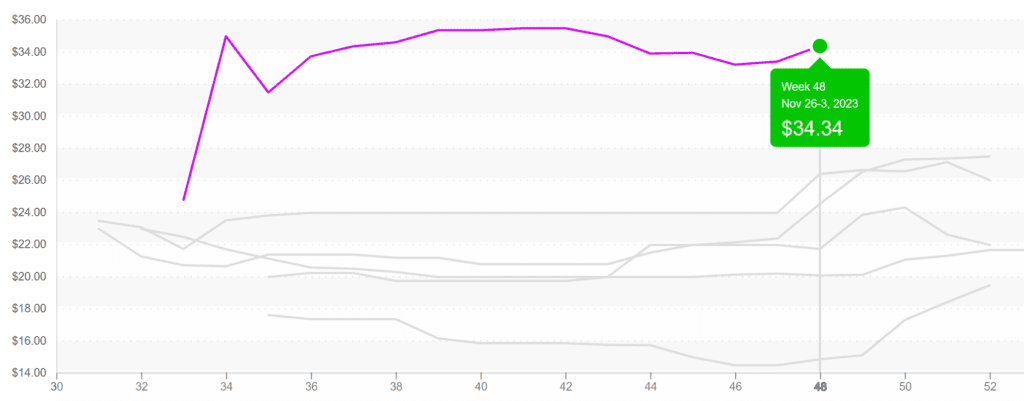

Table grapes continue a historic ten-year high streak for the 18th week! Hurricane season may be over, but the effects of this year’s frenetic season are still haunting grape markets. This year, growers in the Tulare and Kern counties lost a significant portion of their winter crop due to a fungus caused by rain from Hurricane Hilary.

As a result, grape markets have essentially skipped over a time of year typically marked by low, stable prices. As domestic production fades over the next three weeks, grape suppliers are optimistic that import season will provide some relief to what has been a very challenging season.

Table Grapes (red seedless) continue at $34, which is approx. $10 more than any prior year.

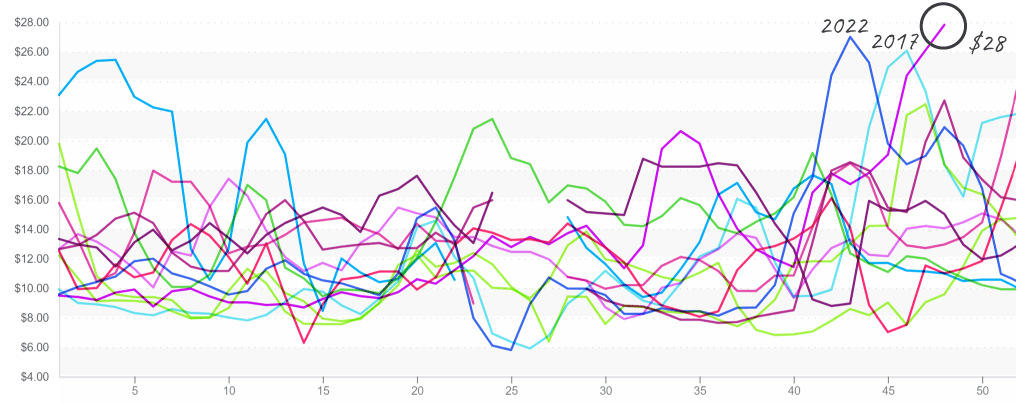

Grape-type tomatoes are having a moment. Prices are clinching a ten-year high by a significant margin. Usually considered a more economical alternative to cherry tomatoes, current prices are tarnishing their hard earned “affordable” reputation.

Volume from Mexico and Florida is significantly below the norm for week #48. Unfortunately, the future is not merry or bright for grape tomato buyers; supply is forecasted to struggle for the next 2-3 weeks.

Grape Tomato prices (12 x 1 pint) reach an all-time high, averaging $28 in the East.

Avocado prices have us doing a double-take. Quite uncharacteristically, we have no headline-grabbing story to explain current avocado prices. As far as we know, the crop is just a little lighter than expected. Resultingly, Hass avocado prices are at the second highest value for week #48 seen in the last ten years.

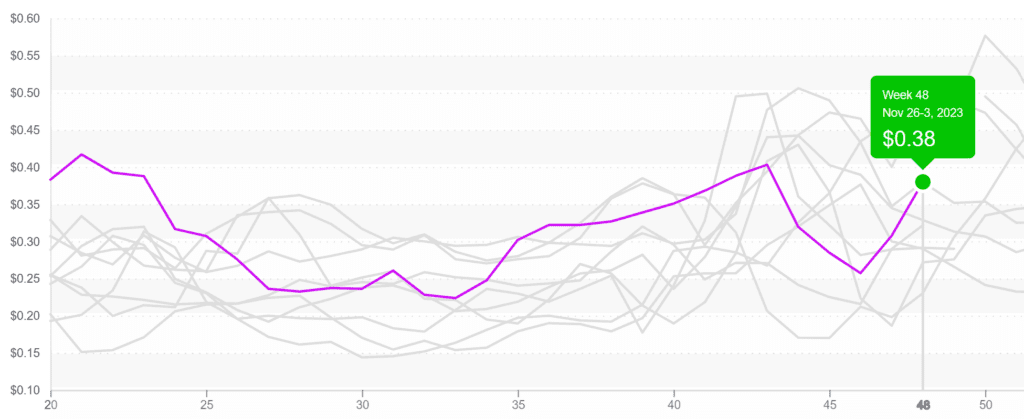

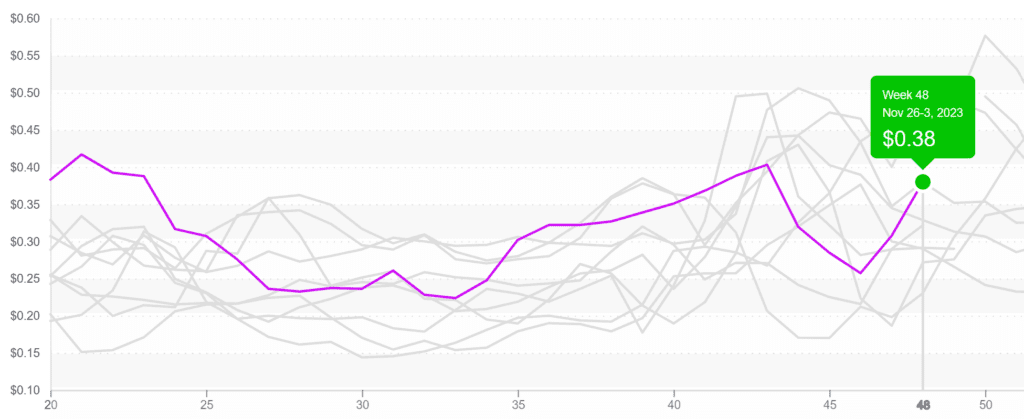

Domestic cantaloupe season is finished, and import volume is woefully below the norm for week #48. Cantaloupe prices are up +30 percent over the previous week. However, price increases can’t be attributed to the Salmonella outbreak. They are the result of two factors: a seasonal decline in cantaloupe production, and cooler weather in growing regions in Central America. Expect higher pricing for the next 2-3 weeks as growers in Central America ramp up production.

Cantaloupe prices ascend past $0.38/pound, which remains a ‘normal’ increase for this time of year

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is a digital toolset designed to improve the produce trading process for buyers and suppliers. We save you time, increase your profits, expand your network, and provide valuable information.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.