The financial expression, “past performance is no guarantee of future results,” holds true for fresh produce markets.

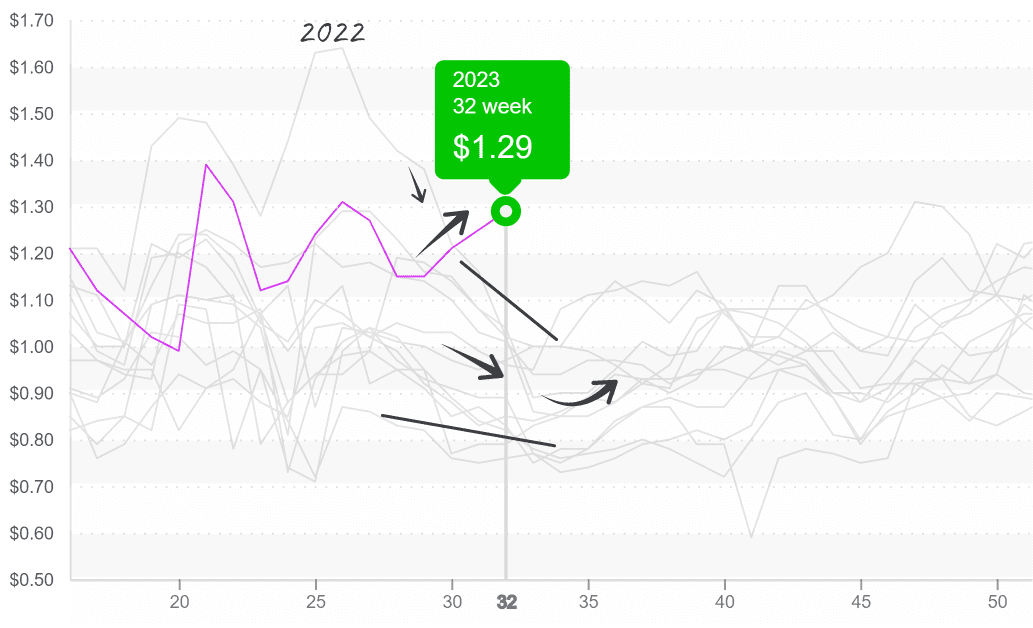

The ProduceIQ Index for the industry is up for the 3rd week in a row, an event that has never happened during this time of year. $1.29 is a record high during a season known for falling prices.

ProduceIQ Index price, $1.29, breaks the historical trends to continue rising during August.

ProduceIQ Index: $1.29/pound, up +3.2 percent over prior week

Week #32, ending August 11th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Our thoughts and prayers go to the people affected by the Maui wildfires. Last week, high winds caused wildfires to tear through Lahaina, killing over 90 people and destroying residents’ homes, farms, and livelihoods.

The wildfire fire will affect the agriculture economy at the local level. Although Maui is a renowned producer of pineapples, most of the farms are in the center of the island, away from the coastal areas most hard hit by the devastating wildfires. Smaller farms and the foodservice industry are among those devastated by this natural disaster.

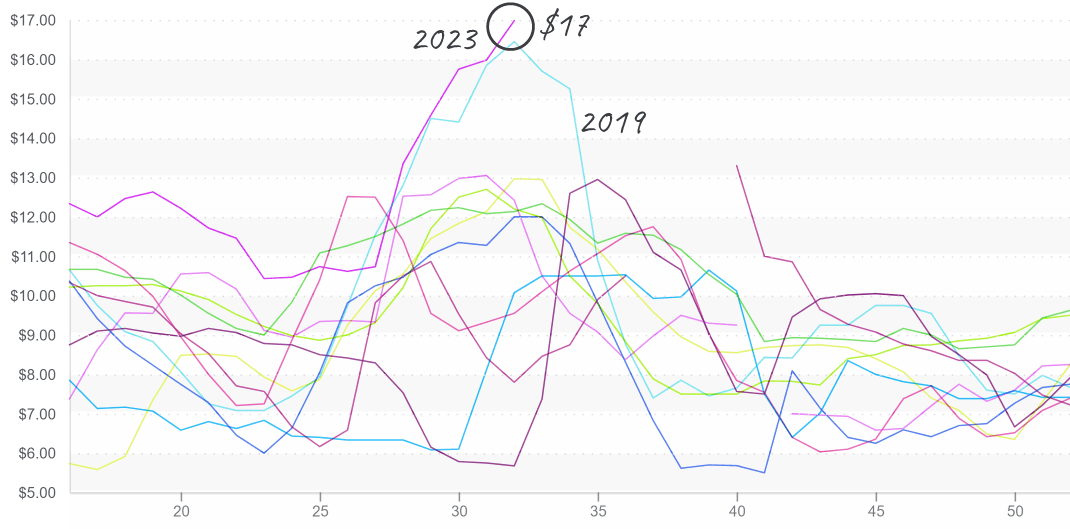

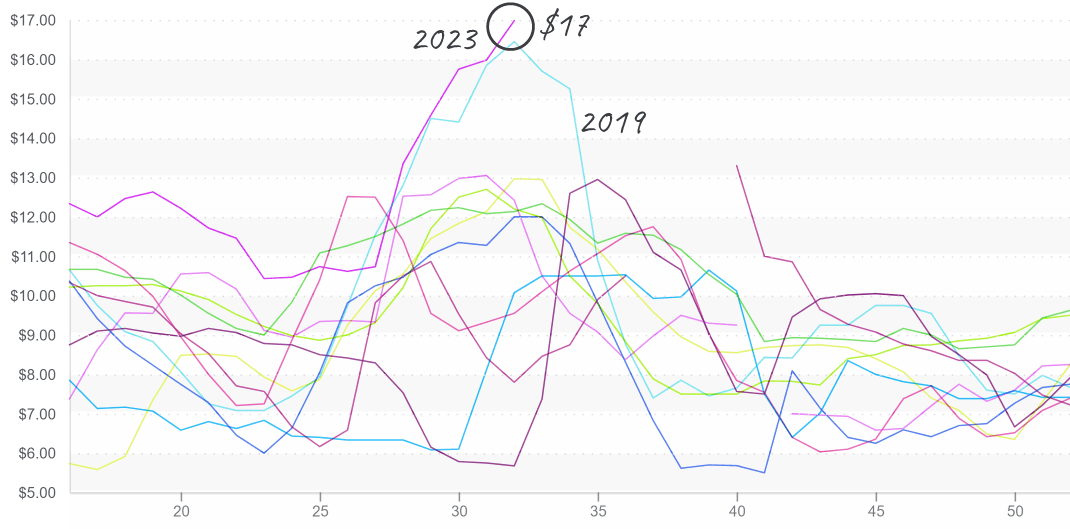

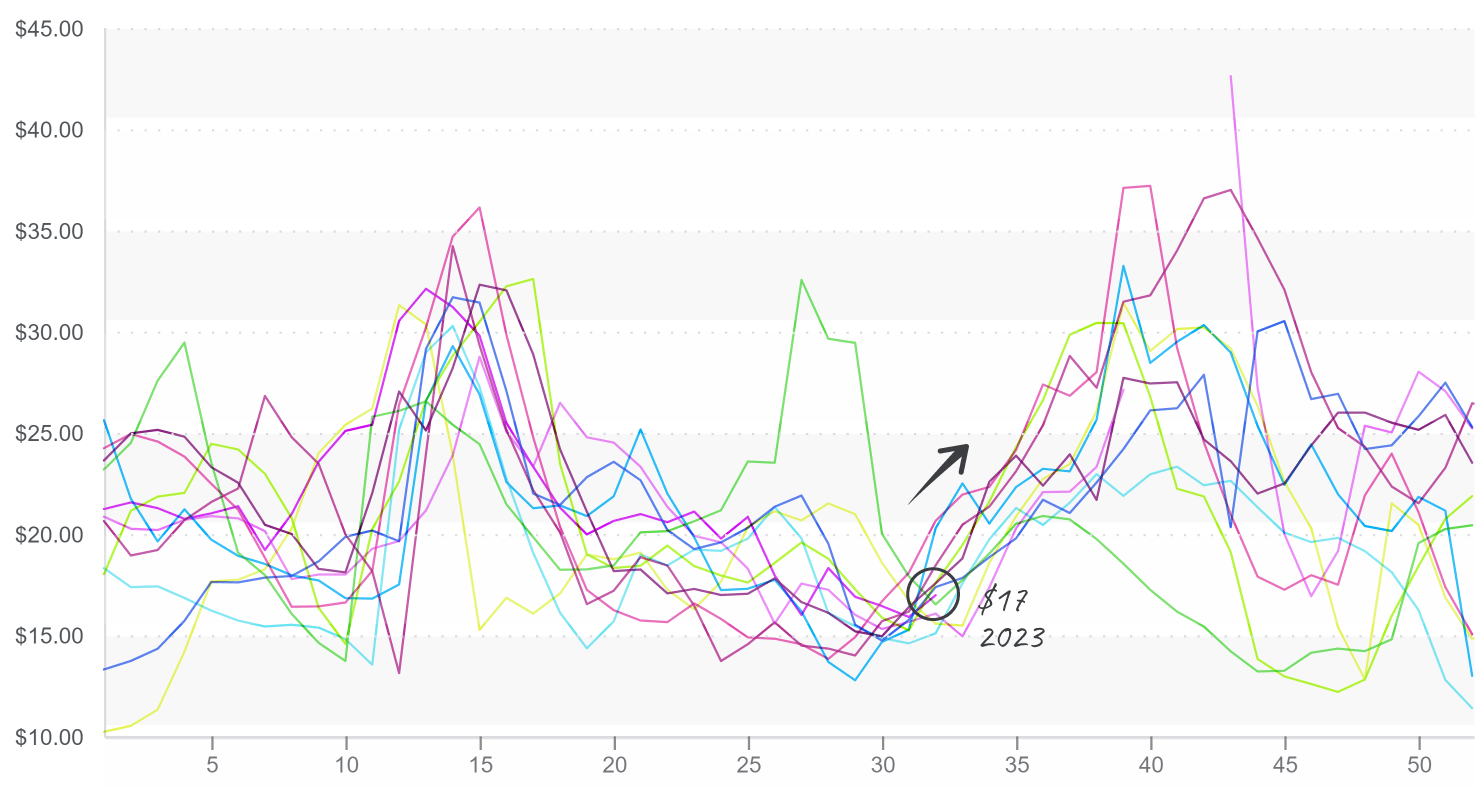

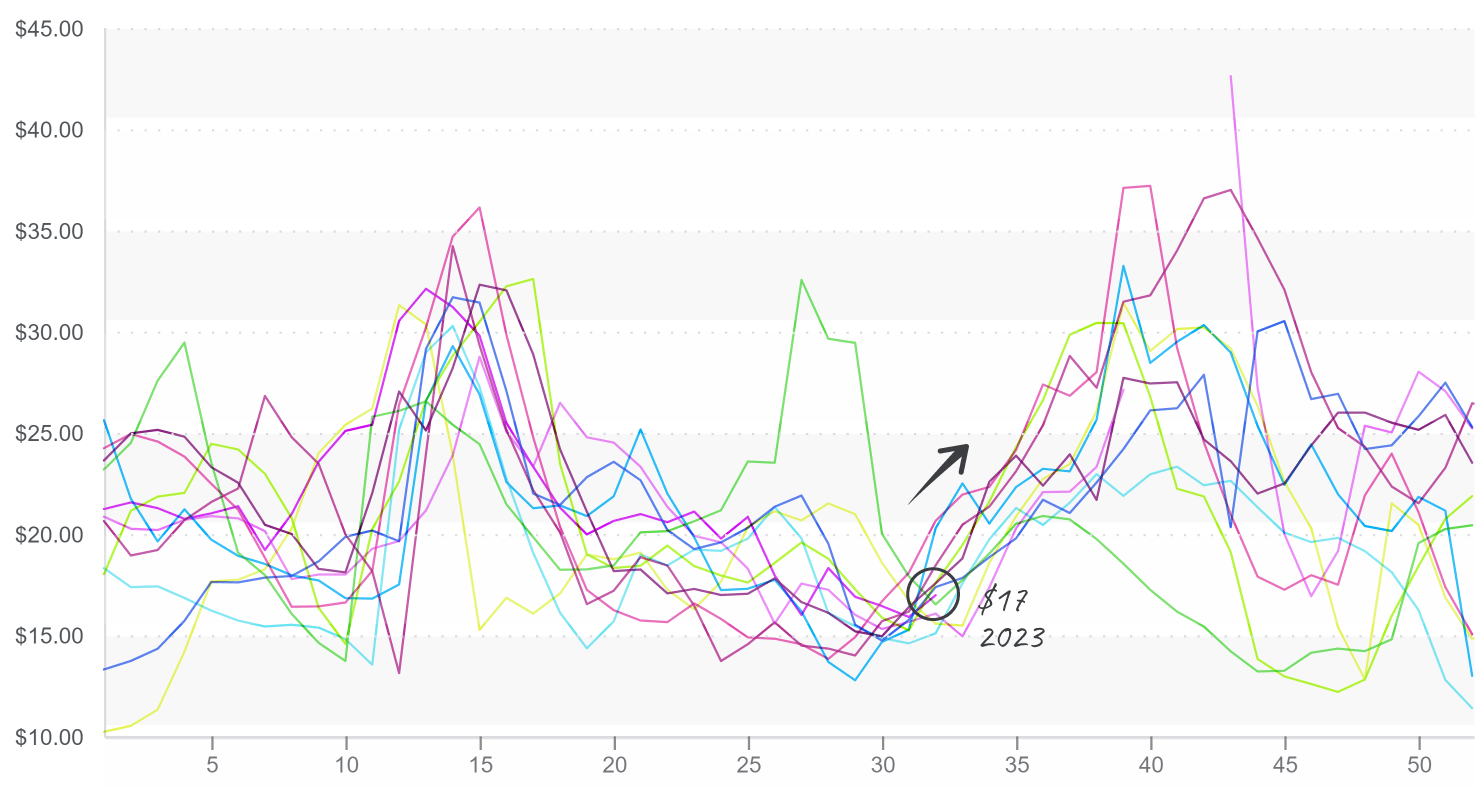

At $16, pineapple prices are falling just short of 2019’s ten-year high. Unseasonably dry or wet weather in tropical growing regions is causing a severe supply shortage, and volume is not forecasted to improve until September.

Pineapple prices

Fingers crossed, but potato markets may get the bumper crop they desperately need to return to pre-2022 prices. Potatoes markets are dropping thanks to increasing production out of Idaho. Prices are already down -6 percent over the previous week, and growers are still looking for ways to get rid of old inventory before the new crop floods the market.

Another commodity that’s on a hot streak, table grapes. After a few weeks of lower supply, Kern, CA, is here to rescue buyers and consumers from skyrocketing prices. Markets are still well above average for week #32. However, volume is forecasted to continue into the fall and will drag down prices.

The West Coast’s red and yellow pepper supply is short, forcing USDA prices into record-breaking territory. Though only $14 on the East Coast, the average red pepper price hits $20 on the West Coast, the third-highest value in the last ten years. High heat in Mexico, a seasonal transition on the West Coast, and low supply in the East are all straining markets and forcing prices up.

Red and yellow pepper supply is forecasted to remain short for at least two more weeks as growers on the West Coast navigate the transition.

Blueberry supply is going through it. Although domestic supply is strong, imports are about half of what they were last year during week #32. El Nino weather patterns are affecting South American produce production significantly, with blueberry growers forecasting up to 20 percent less volume this year than in 2022.

Blueberry prices are about average for week #32, but this buying opportunity could be short-lived if import volumes don’t improve soon.

Blueberry prices have a distinct pattern; they are currently at the low point before a steady price increase.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.