While maybe not as sensational as the news that Taylor Swift caused a small earthquake in Seattle, gas prices are at an eight-month high. Keep calm. At $3.71, the average fuel price is still more than $1 below the astronomical highs we saw last July.

However, cuts by OPEC countries, elevated demand, and heat waves halting key refineries in Texas and Louisiana are putting U.S. oil markets in a precarious position just as we near peak Atlantic hurricane season.

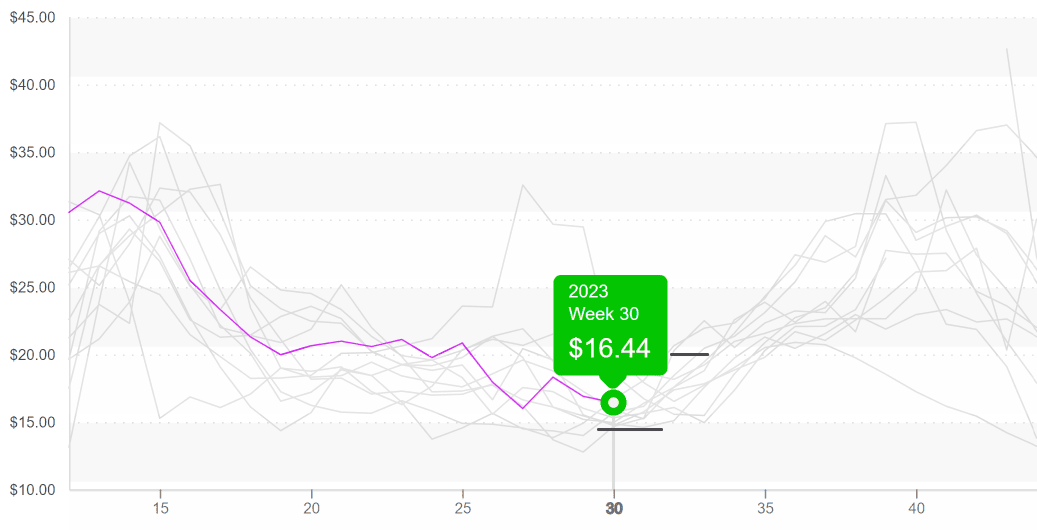

Up 5+ percent over the previous week, average produce prices are countering typical week #30 trends. This is the only time prices have risen during this week in the last ten years. Usually, produce prices follow a downward trend until reaching a low point in week #35. Significant increases in heavily weighted commodities are driving up average prices at a time typically marked by promotional opportunities.

ProduceIQ Index: $1.21/pound, up +5.2 percent over prior week

Week #30, ending July 28th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Mexican avocado growers have officially broken it off with the old crop and are now ‘all about the Loca.’ As a result, supply has significantly dropped week over week, and prices are up +7 percent to $48.

High prices aren’t forecasted to last long. Although avocado imports from Peru and Mexico are below the historical average for week #30, volume from Mexico is predicted to improve rapidly over the next few weeks. Increased supply should provide relief to overextended markets.

At $63, 48ct Hass avocado prices are at the higher end of the range during a volatile time of year.

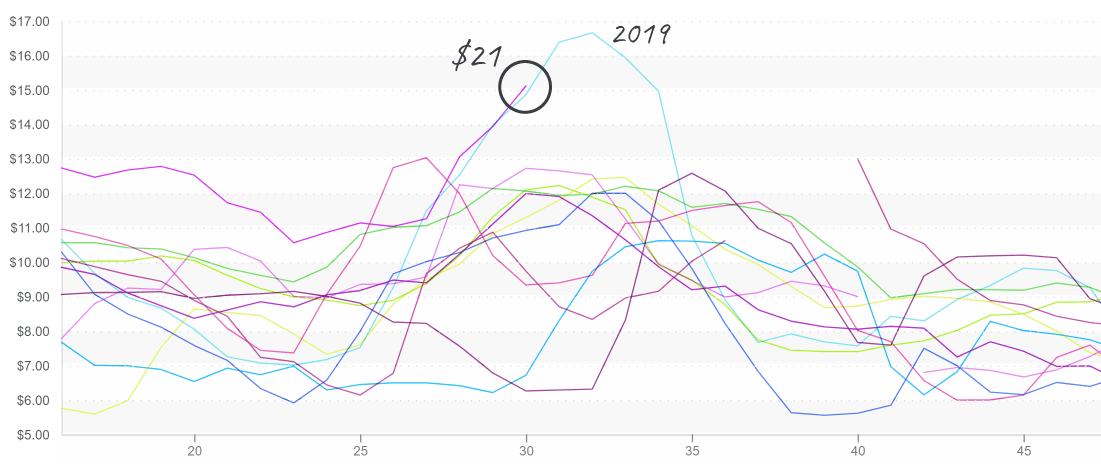

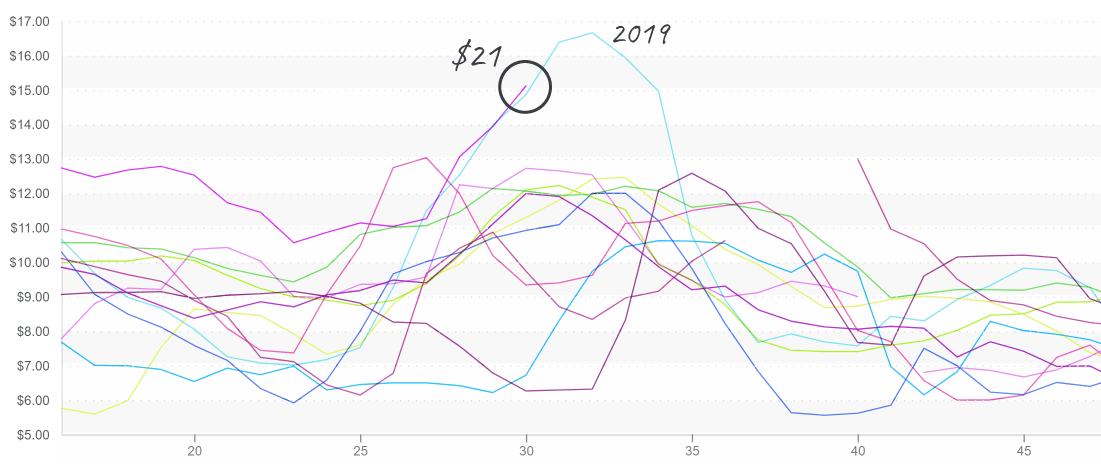

Drought in pineapple growing regions is preventing the fruit from sizing up. As a result, prices are nearing a ten-year high. The last time markets were anywhere near $15 was in 2019. Prices will likely reach a seasonal peak sometime in the next few weeks and slowly descend as supply improves.

Pineapple prices, $15, are spiking towards the highs reached in 2019.

The ProduceIQ Grapes and Berries category is on the move. Average prices are up +16 percent over the previous week.

Strawberries are tapering off quicker than anticipated. A seasonal decline of yields in the Salinas/Watsonville area, and an outbreak of fusarium wilt, are holding yields below average for week #30.

At $17, strawberry prices are very close to a ten-year high. A bit of the strong summer supply growers experienced just a few weeks ago is still working through the supply chain, so things don’t feel too terrible yet for consumers.

But, because Santa Maria growers won’t be ready until mid-August, prices will likely escalate in a harrowing way over the next few weeks as a formidable gap in supply demands to be filled.

Like strawberries, raspberries’ prospects for improved supply are grim for at least the next two weeks. Prices are at a ten-year high, and Mexican production is profoundly lower than the norm for this week.

Not all members of the grapes and berries category are stricken by supply woes. Blackberry and blueberry prices are up over the previous week. However, values are below the historical average, and supply is reportedly solid and may increase even more over the next few weeks.

So, while strawberries and raspberries may not fit your retail promotional plans, blackberries and blueberries could undoubtedly handle the job.

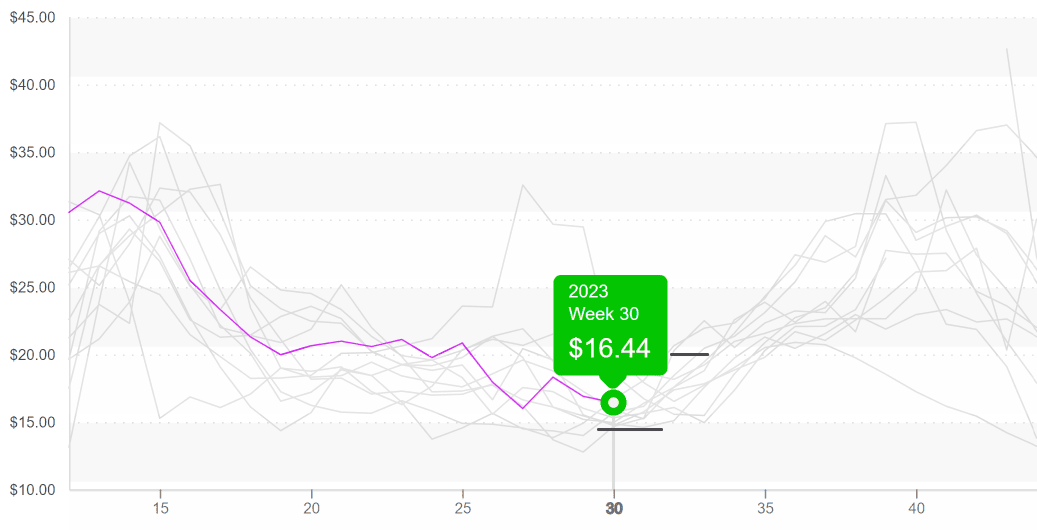

Blueberry prices, $16, are at the annual low point and are ripe for promotion.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.