PRESS RELEASE – May 5, 2023 – Rabobank recently published its World Avocado Trade Map, charting global avocado production, consumption, and trade. In the next few years, avocado trade will continue to grow, but the market will be more competitive, forcing operators to be not only more efficient, but also increasingly sustainable.

World Avocado Map 2023: Global Growth Far From Over

Avocado production is expanding globally, offering year-round supply to consumers

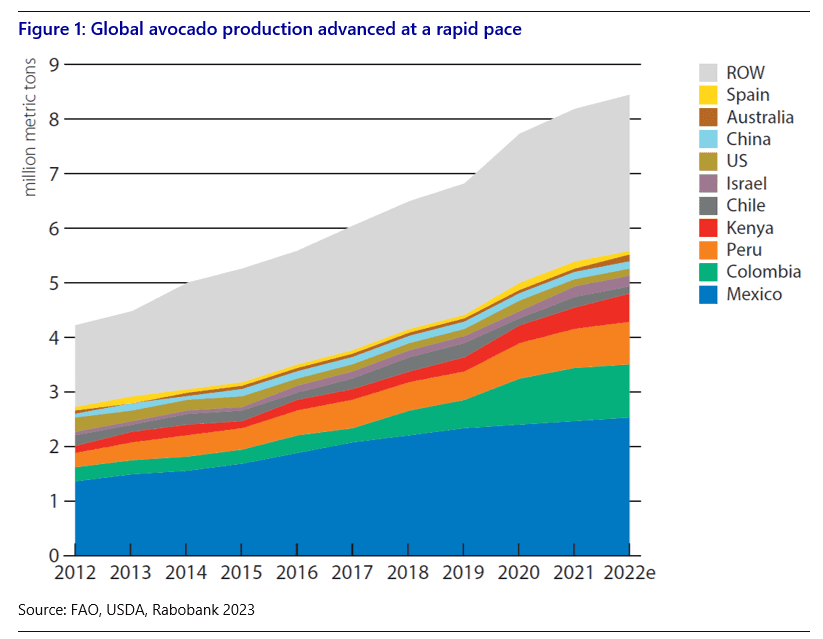

Global avocado production expanded by about 7% during the past decade.

“Attractive prices and returns during that period were relevant drivers to expanding production in key regions,” explains Cindy van Rijswick, Global Strategist – Fresh Produce, Farm Inputs at Rabobank.

In Mexico, which currently accounts for 30% of global avocado output, production grew by about 6% during the past decade. In Colombia, Peru, and Kenya, production increased roughly 15%,12%, and 11% during the same period, accounting for 12%, 9%, and 6% of current global production, respectively. On the other hand, the US, which still among the world’s largest avocado-producing countries in 2012, dropped a few places in the ranking and is no longer a top 10 producer.

Increased avocado production in countries with complementary harvesting seasons has allowed year-round availability in key markets, including the US, the EU, and some markets in Asia. While production in Mexico extends year-round, it reaches a seasonal low in June and July, when production peaks in the US (California) and Peru, providing steady supply to the US market.

Mexico remains the leading exporting country; the US is the largest importing market

“With exports increasing at an average annual growth rate of around 8% over the past decade, Mexico reaffirmed its place as the largest avocado-exporting country in the world, surpassing 1 million metric tons in 2022,” according to Van Rijswick.

The primary destination is, by far, the US market, where product versatility and promotional campaigns have helped to create demand for avocados in retail and foodservice channels. Globally, the US remains the largest destination market, with imports increasing by about 8% from 2012 to 2022.

Exports from Peru, Spain, and Kenya expanded by about 22%, 6%, and 15%, respectively, between 2012 and 2022. These countries mainly supply the European market. From 2012 to 2022, imports increased in the Netherlands (up 14%), Spain (20%), France (8%), Germany (16%), and the UK (12%). Among the top 10 avocado-importing countries, imports to Chile grew the most.

The global avocado market is worth about USD 18 billion

The estimated global commercial market value of fresh avocados was around USD 18 billion in 2022. “We believe there is room for significant growth in several markets around the world, as per capita consumption is highly variable,” says Van Rijswick.

In terms of per capita avocado availability (which is used as an indicator of consumption), Mexico leads, with a global record of about 9kg of fresh avocados per person per year, followed by Chile with almost 8kg. Australia and the US complete the list of countries with over 4kg per capita.

Sustainability concerns remain on the agenda for avocado producers, with water usage being the main issue discussed. Partly because of this, avocado growers have invested in advanced irrigation systems to improve water efficiency.