March inflation reports are inspiring cautious optimism.

Grocery prices fell by 0.3 percent for the first time since September 2020, welcome news for price-weary consumers. However, experts are concerned that the small advance isn’t enough positive momentum to significantly alter the Fed’s anti-inflationary tactics.

Interestingly, our own ProduceIQ Index also fell by -1 percent. Year over year, the index is down to $1.22 from 2022’s record-breaking $1.23.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.22/pound, up +1. 7 percent over prior week

Week #15, ending April 14th

In weather news, a freak thunderstorm discharged a kiddy pool’s worth of water on Fort Lauderdale. A reported 25 inches soaked the city last week when an ordinary thunderstorm hooked up with a warm and wet gulf stream, a 24-hour record for the city. Sans hurricane, this impressive amount of water flooded cars and even shut down the airport unexpectedly.

Fortunately for fresh produce, there isn’t much agriculture left in Broward County, though the 1-in-1000 storm is a troubling reminder that no one is ever safe from the whims of mother nature.

Overdue Western produce is intensifying Spring produce markets. At this point, this phenom event needs an official name. May we suggest “The great salad bowl shortage of 2023.”

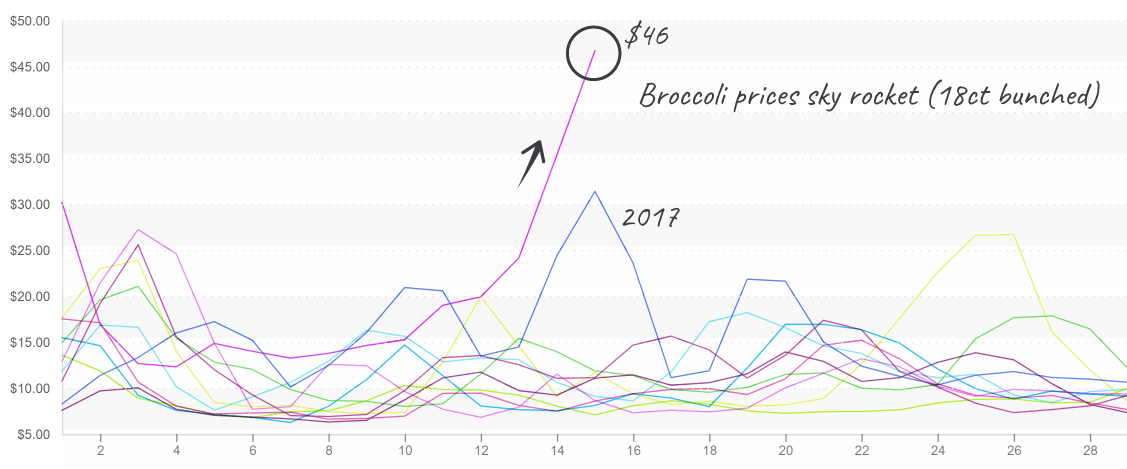

Broccoli and cauliflower markets are in an extreme demand-exceeds-supply situation. Prices are rapidly increasing. Broccoli is up +27 percent over the previous week to $40, and cauliflower is up +39 percent. Both commodities are at a ten-year high by a significant margin.

Growers in Salinas are significantly behind schedule due to historic flooding throughout the growing region. Those looking to cover shorts can look to Mexico and Santa Maria for coverage. Unfortunately for buyers, this is the situation in which they hope the adage “the cure for high prices is high prices” proves to be true sooner than later.

Broccoli prices continue their ascent to new levels.

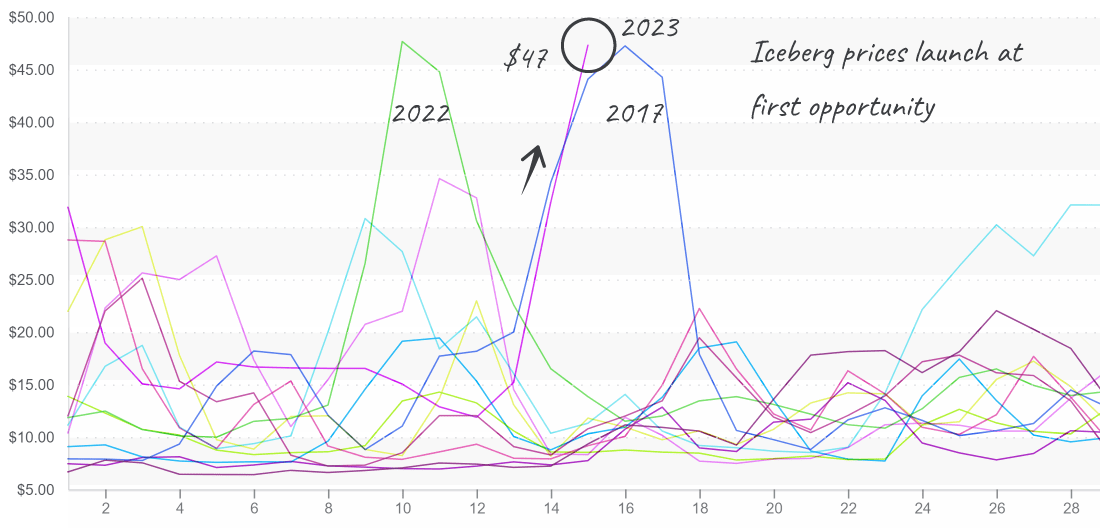

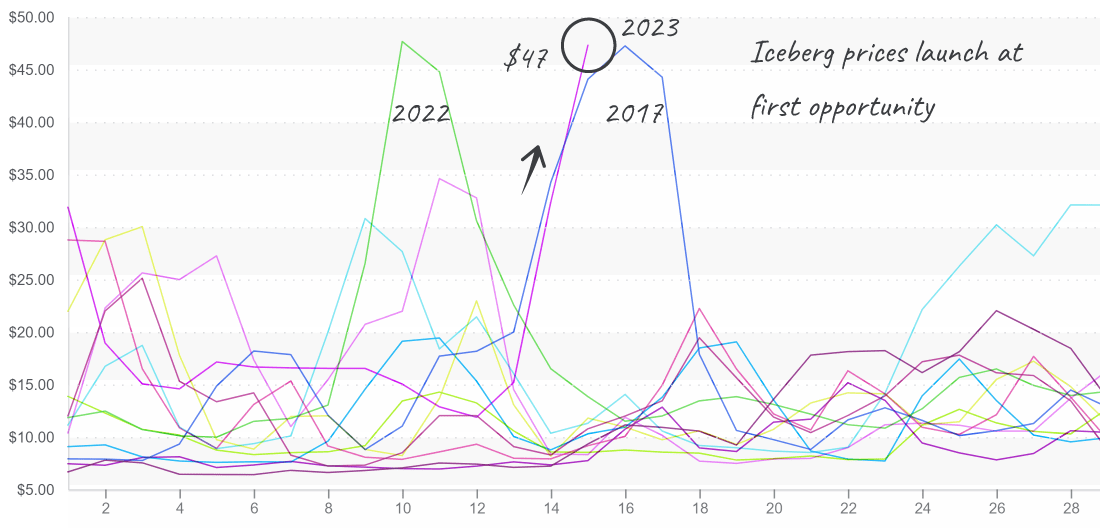

Lettuce and leaf markets are running as hot as their brassica cousins. The late winter rainstorms that steeped California growers throughout February and March is a gift that growers may wish came in a different package.

Average lettuce and leaf prices are up +48 percent over the previous week. Markets are forecasted to climb higher as delayed growers chase down the Spring produce train, which in some ways, feels like it is already pulling away from the station.

Iceberg, romaine, and leaf markets will remain volatile for 3-4 weeks.

Iceberg prices rise rapidly as shippers recall the $90 markets reached last November.

Grape production in Mexico and California is two weeks behind schedule. In South America, Chile and Peru are moving past peak production. As a result, red and green supply is weakening, and prices are up +16 percent over the previous week.

With lower supply from Chile and Peru, prices will likely escalate over the next few weeks. However, grape markets should stabilize in June when Mexico picks up production.

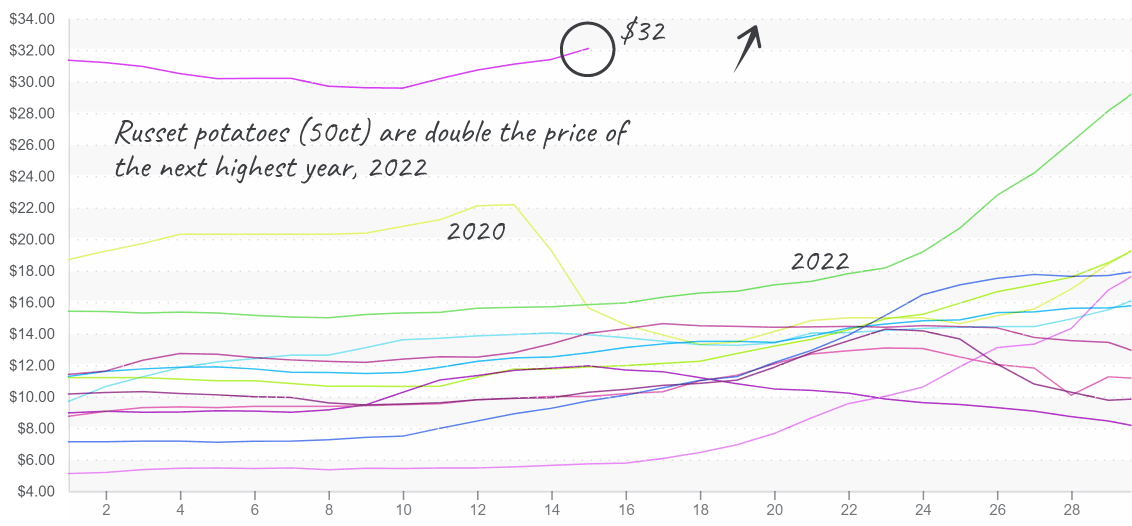

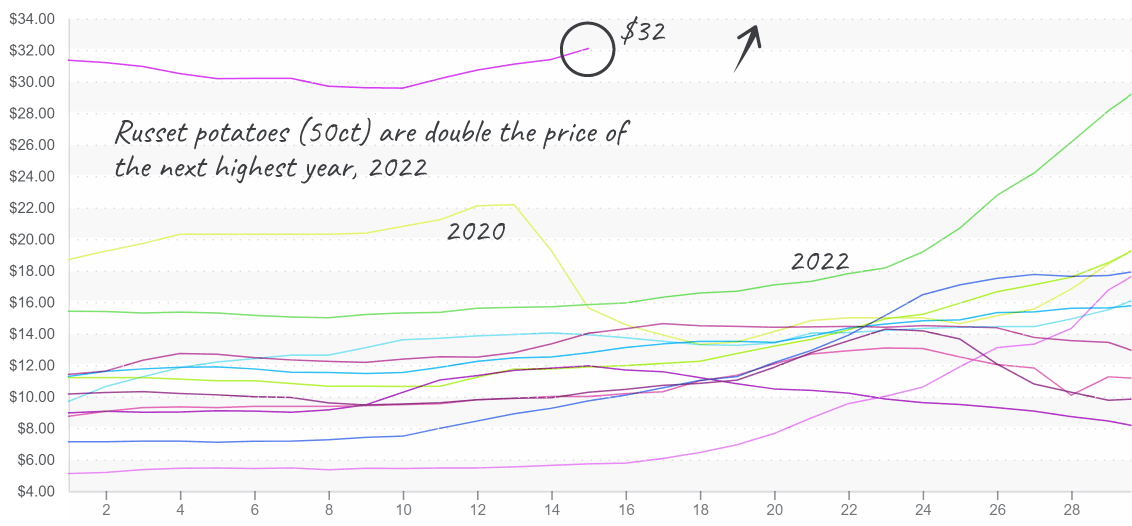

In more high-price news, a russet potato shortage destabilizes notoriously reliable potato markets. Prices are up +2 percent over the previous week. Late wintery weather is delaying the new crop planting, and suppliers are working on stretching the storage crop until the new crop begins, fingers-crossed, in a couple of weeks.

Russet potatoes continue at extreme price levels that began in June 2022

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.