Pickup expected to gain market share and grow faster than Delivery and Ship-to-Home

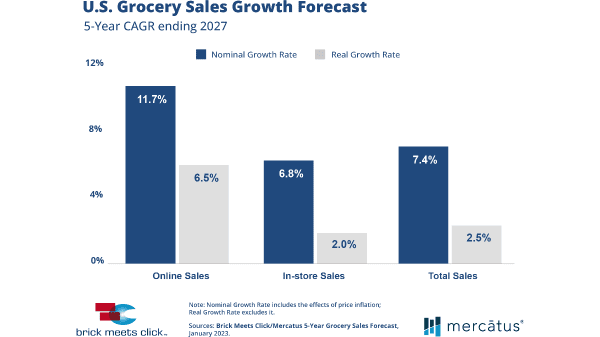

Barrington, Ill. – January 30, 2023 – U.S. online grocery sales are forecast to grow at a compound average growth rate (CAGR) of 11.7% over the next five years, increasing online’s share of overall grocery spending from 11.2% in 2022 to 13.6% in 2027, according to the 2023 Brick Meets Click/Mercatus 5-Year Grocery Sales Forecast.

Persistent price inflation, ongoing concerns about illnesses such as COVID, RSV, and the flu, and a maturing online segment are factors contributing to the outlook.

“This forecast reflects that the projected growth of online grocery sales is slowing after the significant gains of the last two-plus years,” said David Bishop, partner at Brick Meets Click. “Now more than ever, grocers need a grounded view of the future market while simultaneously strengthening the customer experience to protect their base business and improving the profitability of this higher cost-to-serve mode of shopping.”

Total grocery sales, i.e., combined online and in-store sales, excluding the impact of price inflation, are projected to grow at a 2.5% CAGR over the next 5 years, driven by an approximately 1.7% increase in household spending and 0.8% gain in the number of households. An aging population and declining household size are weighing down both measures.

Persistent grocery-related inflation is expected to continue at a 5-year CAGR of 4.8%, starting from 2022’s rate of 10.9% versus the prior year and tapering down to 2.8% by 2027. The impact of this ongoing price inflation is not evenly distributed. Inflation fuels nearly three-quarters of the projected gains for in-store sales but accounts for less than half of the gains expected for online sales.

Health concerns drive the demand for online grocery to some degree, and this is likely to continue. Concerns about contracting COVID-19 motivate around 10% of online grocery’s monthly active users (MAUs), according to the October 2022 Brick Meets Click/Mercatus Grocery Shopping Survey. The recent rise of other respiratory illnesses, such as RSV and the seasonal flu, is also motivating customers to shop online for groceries.

In terms of online grocery segments, Pickup sales are expected to grow at a 5-year nominal CAGR of 13.6% compared to 10.8% for Delivery and 8.0% for Ship-to-Home. Consequently, Pickup’s share of online grocery sales is forecast to expand from 45.4% in 2022 to 50.3% during 2027 at the expense of the other two segments.

Pickup is positioned to expand more than Delivery or Ship-to-Home due primarily to expected increases in market availability. This is because a small portion of U.S. households lacks convenient access to any Pickup service, and many U.S. grocery retailers are still in the process of rolling out Pickup services across their base of stores.

In contrast, Delivery is already saturated, with most customers having the choice of multiple home delivery options across a wide range of retail banners. Plus, use of Delivery is more sensitive than Pickup to financial and health concerns.

Spending per order and order frequency rates are both anticipated to increase but to varying degrees across the three online segments. Average order values (AOVs) over the next five years are projected to grow at a CAGR between 4.2% and 6.4% (inclusive of inflation) with Ship-to-Home coming in at the lower end, Delivery in the mid-range, and Pickup on the higher end.

At the same time, order frequency among active users is anticipated to increase from 1.9% to 3.3%, again with Ship-to-Home at the lower end, Delivery in the mid-range, and Pickup on the higher end.

“When it comes to achieving online channel profitability, my advice to grocery retailers is: Work smarter, not harder, and focus on the fundamentals,” said Sylvain Perrier, president and CEO, Mercatus. “Know who your customers are and the value you provide them. Use that insight to deliver a more personalized brand experience that is consistent and frictionless.

Take steps to improve margins using simple tactics like offering lower cost Pickup services, engaging with multiple third-party delivery providers, and leveraging first-party retail media to offset the cost to serve online customers.”

Check out the Brick Meets Click website for more insights from the forecast and information about the just released 2023 U.S. eGrocery Market Forecast report.

About the forecast

The 2023 Brick Meets Click/Mercatus 5-Year Grocery Sales Forecast resumes an annual initiative that was paused at the start of the pandemic. The 5-year forecast projects how grocery sales are expected to change across in-store and online’s three segments (Pickup, Delivery, and Ship-to-Home) in a proprietary model that leverages Brick Meets Click research and insights along with secondary sources from various government agencies.

The three online grocery segments are defined as follows:

• Delivery includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

• Pickup includes orders that are received by customers either inside or outside a store or at a designated location/locker.

• Ship-to-Home includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in consumer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company, Kowalski’s Markets, WinCo Foods, Smart & Final, Stater Bros. Markets, Southeastern Grocers’ Fresco y Más, Harveys Supermarket and Winn-Dixie grocery stores among others.

Media Inquiries

David Bishop, Partner, Brick Meets Click

847-722-2732, david.bishop@brickmeetsclick.com

www.brickmeetsclick.com