La Niña continues for the third consecutive winter.

The National Weather Service (NWS) released its climate predictions for the February-April season. Although the Northern Hemispheres’ atmospheric conditions still reflect La Niña conditions, NWS predicts that La Niña will transition to ENSO-neutral (El Niño-Southern Oscillation) in early Spring.

If La Niña conditions persist, growers in the West/Northwest can expect cooler than average temperatures, and growers in the South/Northeast can expect warmer than average temperatures.

ProduceIQ Index: $1.14/pound, up +4.6 percent over prior week

Week #4, ending January 27th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Speaking of the weather, winter storm Leona made its way South over the weekend, plunging much of the U.S. into below-freezing temperatures. The frigid weather continues the pattern seen in the West throughout last week.

Although cold-related damage is minimal, the harvest of commodities like cauliflower and lettuce is experiencing delays.

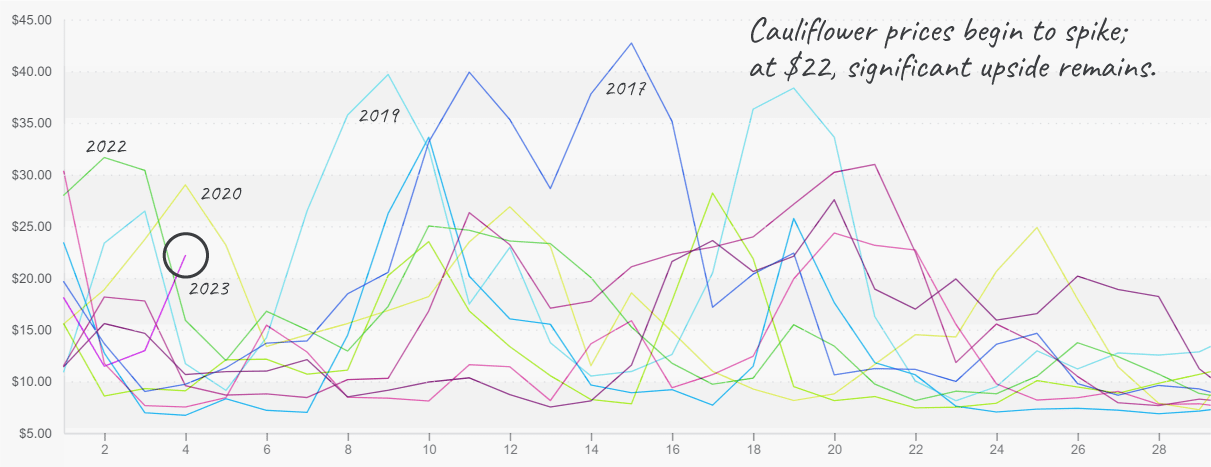

Cauliflower prices are up a steep +78 percent over the previous week. Prices spiked in response to a depleted supply. California is wrapping up, and growers in the Arizona desert could not harvest some of the new crop due to cooler weather.

With more cold weather and ice in the forecast for much of the West this week, cauliflower prices may rise and supply may worsen before they get better.

Cauliflower prices climb, yet the upside remains.

Lettuce markets are in a similar boat to cauliflower markets, but with a lot more metaphorical life jackets. While last week’s cold delayed harvest, prices are relatively steady thanks to ample supply. However, market conditions may change this week as growers grapple with more wintery weather and subsequent delayed harvesting.

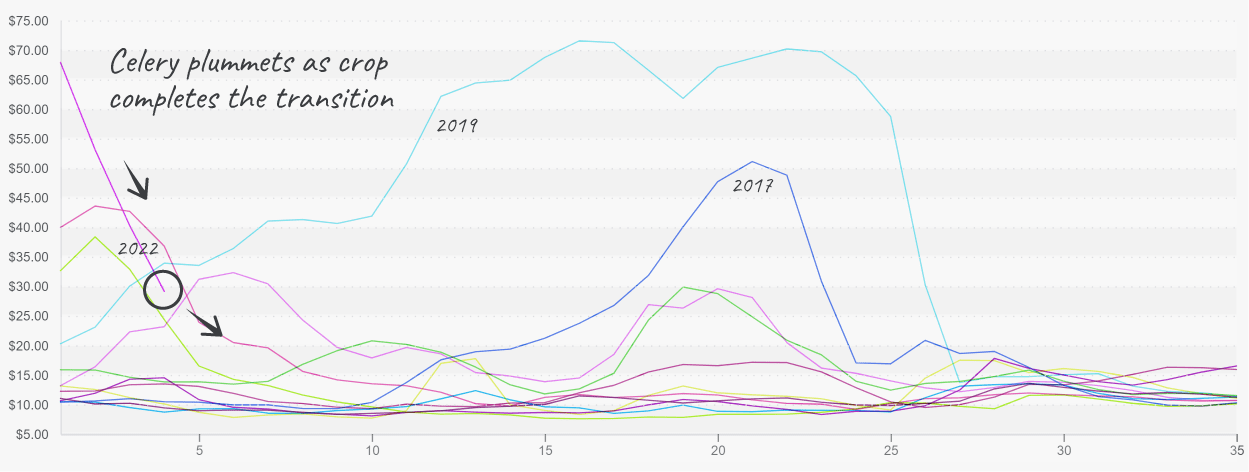

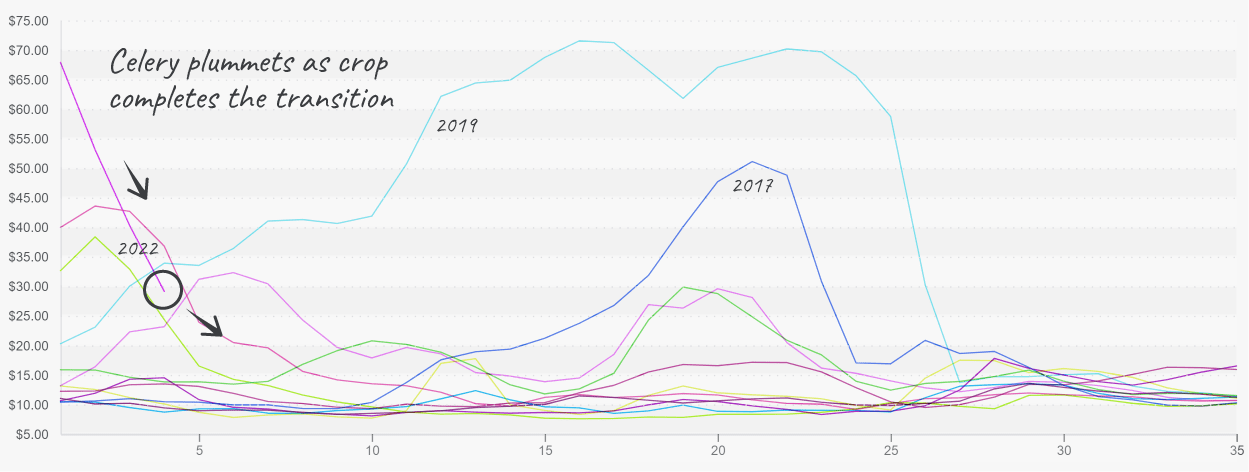

Celery markets are on the way down. Prices plummeted -29 percent over the previous week. The Santa Maria/Oxnard growing regions are finally exsiccating, and production in Arizona is picking up considerably. Expect prices to fall back to normal ranges for this time of year over the next few weeks.

Celery returns (quickly) to normalcy after record-high prices

Raspberry prices are nearing a ten-year high. Up +12 percent over the previous week, unseasonably cold weather and heavy rain in Central Mexico are limiting supply. In a vulnerable position due to consistently poor weather, raspberry markets are poised for volatility over the next couple of weeks.

Raspberry prices rising to $27 and poised for another winter of challenging supply.

It seems that avocado suppliers read last week’s highlights and are now endeavoring to force unwilling and sluggish prices upwards. Avocado import volumes don’t usually decline this significantly until week #7.

But despite a dramatic drop in the import volume of Mexican Hass avocados last week and increasing Super Bowl demand, avocado prices are still flat week over week.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.