The California sky is finally clear, but the damage reports are just rolling in. Strawberry growers in California are reporting close to $200 million in damages due to the volleys of wind, rain, and floods experienced over the past few weeks.

ProduceIQ Index: $1.09/pound, down -3.5 percent over prior week

Week #3, ending January 20th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Despite temporary setbacks, growers are generally optimistic about the effects all that water will have on spring crops. And fortunately for produce markets, most California growers are in-between seasons.

On the other hand, California farmworkers are feeling some of the worst immediate effects. Workers are grappling with reduced working hours and challenging conditions while dealing with devastating damage to their homes and property.

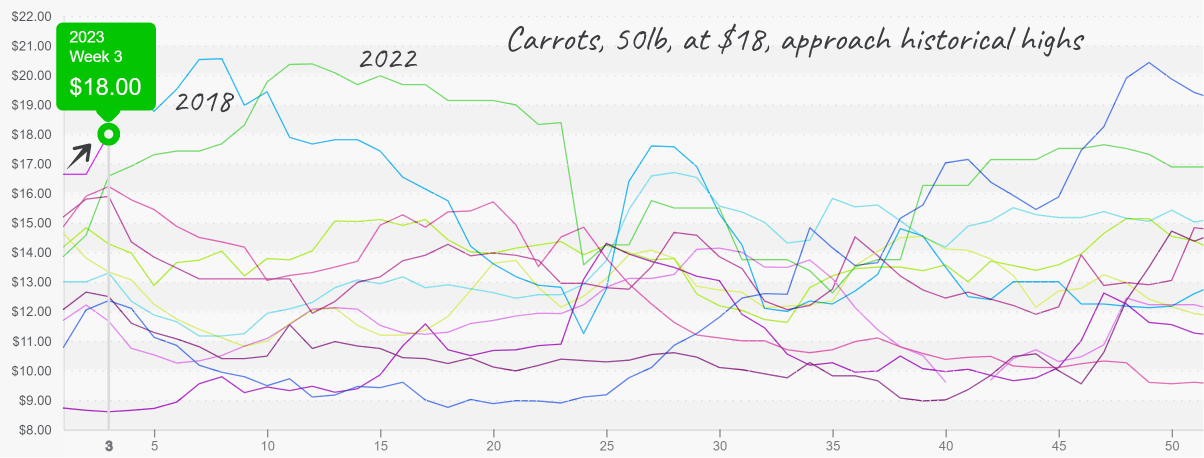

Grown year-round in California, carrots are one of the few commodities in season that are seeing significant supply changes due to flooding. As a result, average week #3 prices are up +5 percent over the previous week. At $18, carrot prices are at a ten-year high.

Carrot markets will likely remain tight until South Georgia begins production in a couple of weeks.

Carrot prices enter a volatile time of year at near-historic prices.

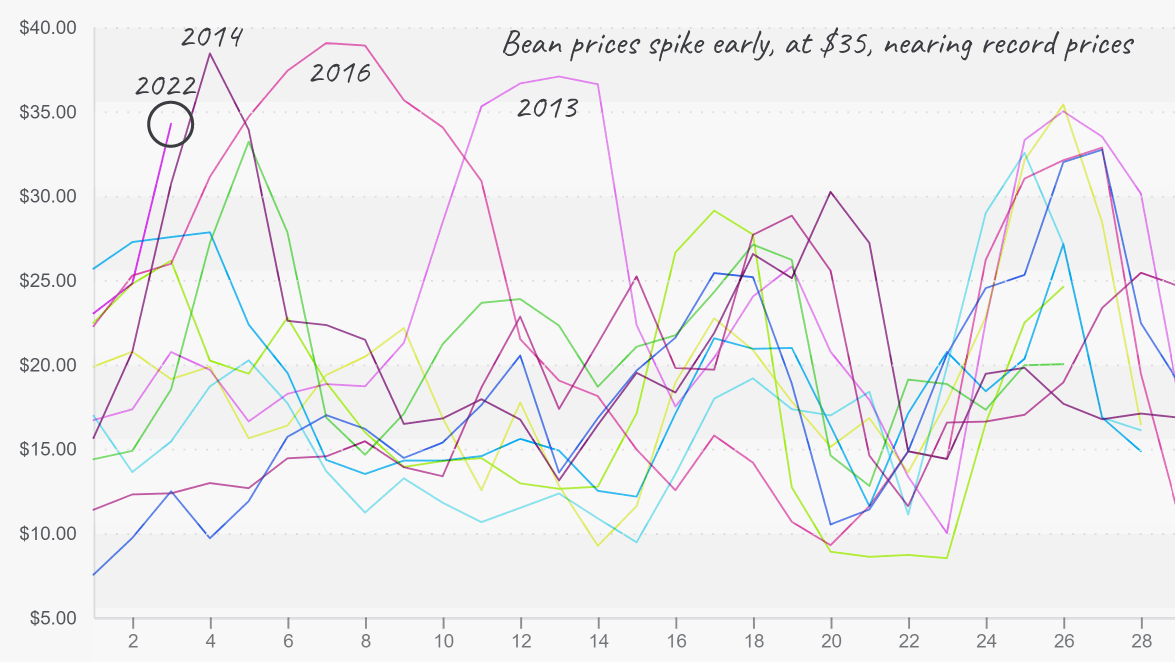

Cooler than usual weather in Sinaloa, Mexico, is tightening the supply of commodities like asparagus, beans, sweet corn, and raspberries.

Green bean prices (of all types) are at a ten-year high. Eastern and Western supply is minimal due to unseasonably cool weather. Prices will likely trend higher until supply from Mexico and Florida has time to recover.

Bean prices spike with cold weather and less acreage.

Up +16 percent over the previous week, asparagus prices are the third commodity at a ten-year high this week. In the East, Peruvian imports are waning due to a heat wave. In the West, cold weather in Mexico is delaying the start of Sinaloa’s season. However, western supply is forecasted to improve in the next two weeks as Mexico ramps up production.

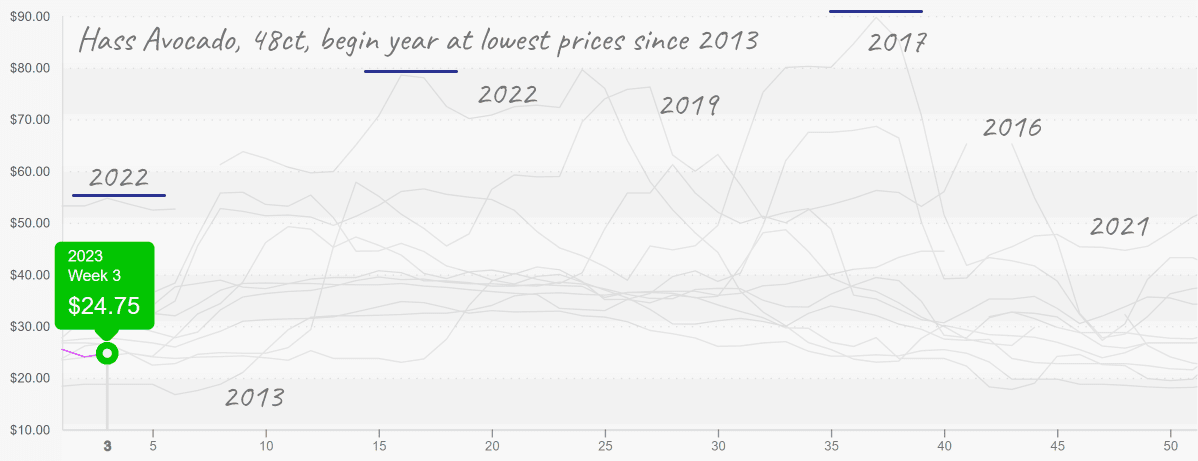

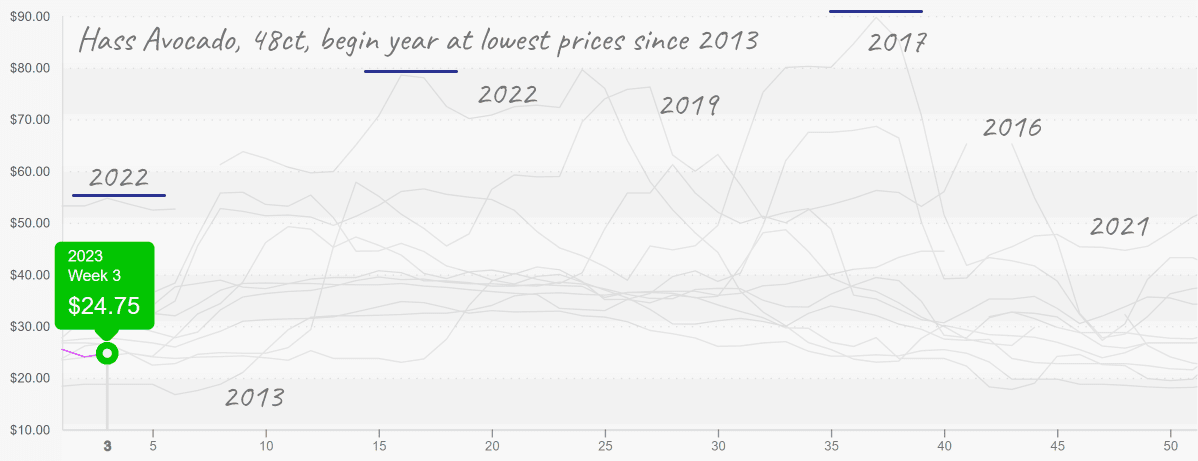

This year’s Super Bowl may have the lowest Hass Avocado prices on record. Although, Super Bowl demand for avocados is beginning to affect long-stagnant prices. There is lighter availability on smaller count avocados, but excellent availability of larger count avocados is forecasted to make your guacamole game unforgettable.

A note: Valentine’s Day and Super Bowl demand will overlap for the second year in a row. Although the duo poses some unique challenges, it also poses opportunities for unforgettable promotions. Strawberry-Avocado salsa, anyone?

Avocado Hass (48-count) prices are a bargain this year.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.