Christmas came a bit early for Florida manatees this year. Florida Fish and Wildlife is continuing its program to save starving manatees with donated lettuce.

Even though prices are declining, lettuce markets are still in record-breaking territory. USDA reported iceberg to be sold for an average of $74 in week #50. Only the best for the beloved sea cows.

Overall prices are down an average of -10 percent over the previous week. This is due primarily to increasing supply. Much of the fall season has been marked by abnormally high prices, most notably for commodities such as lettuce and strawberries.

Now, increased availability from domestic growers, as well as Mexican production, is reducing supply-based pressure.

Increasing supply out of Mexico and Florida is an early Christmas gift for price-weary strawberry buyers. Although supply is slowly recovering, strawberry markets are holding tight to a downward trend. Expect markets to continue their dramatic descent throughout the new year.

ProduceIQ Index: $1.11 /pound, down -10.5 percent over prior week

Week #50, ending December 17th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

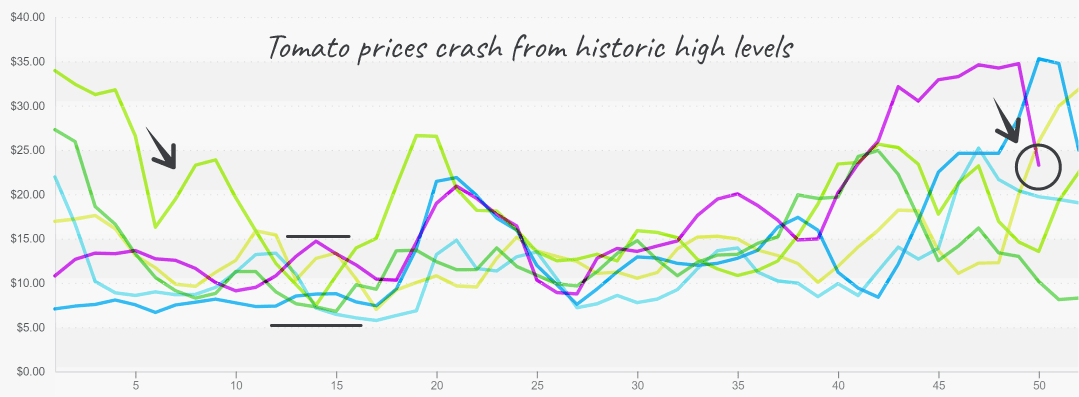

Tomato prices are especially benefiting from increased Eastern production. Tomato prices are down an average of -34 percent over the prior week. Grape-type tomato supply is still reportedly short. However, round and plum-type can meet demand. Barring any Acts of God for Florida growers, prices should continue to decline through January. Strengthening supply from Mexico and Florida will continue to drag tomato prices back to Earth.

Tomato prices will likely fall from now through winter as Mexico and Florida’s supply ramp up.

Lime production is in transition, and markets are responding. Prices are up +26 percent over the previous week. This time of year, prices typically increase as supply lessens due to a seasonal lull in Mexican production. Prices will likely climb higher through January and February as Mexican production hits its lowest point during the year.

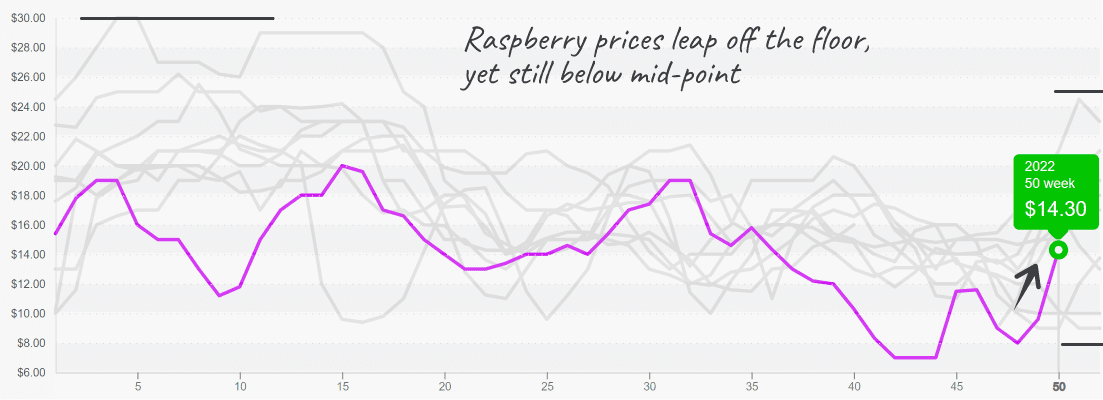

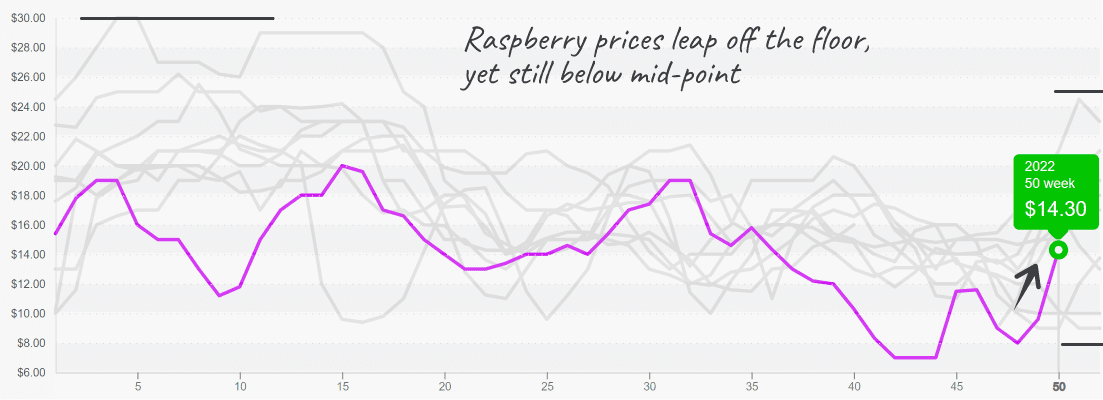

Another crop entering a seasonal transition, raspberries, are up +49 percent over the previous week. However, after weeks at record-low prices, markets are still far from the pricey territory expected this time of year.

Prices will climb and remain elevated until Spring. In the Spring, domestic growing regions will ramp up production again, providing much-needed supply to tight markets.

Raspberry prices are finally off the floor and have upside potential.

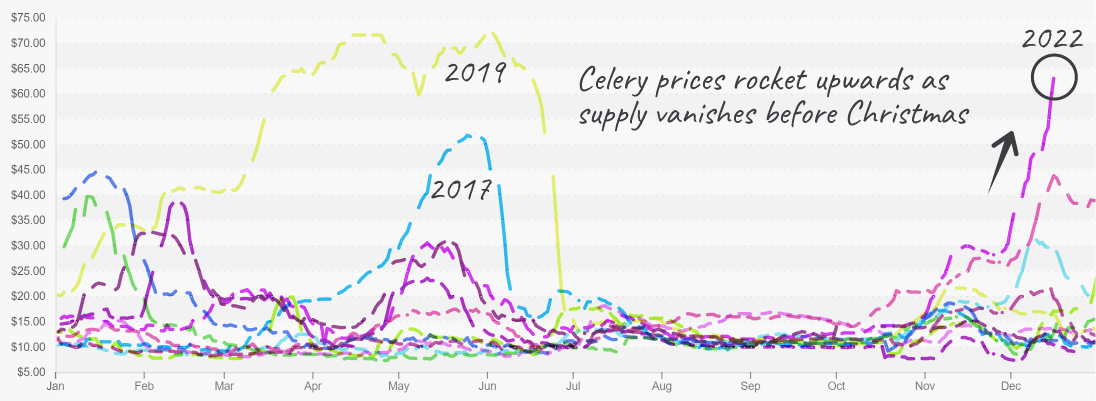

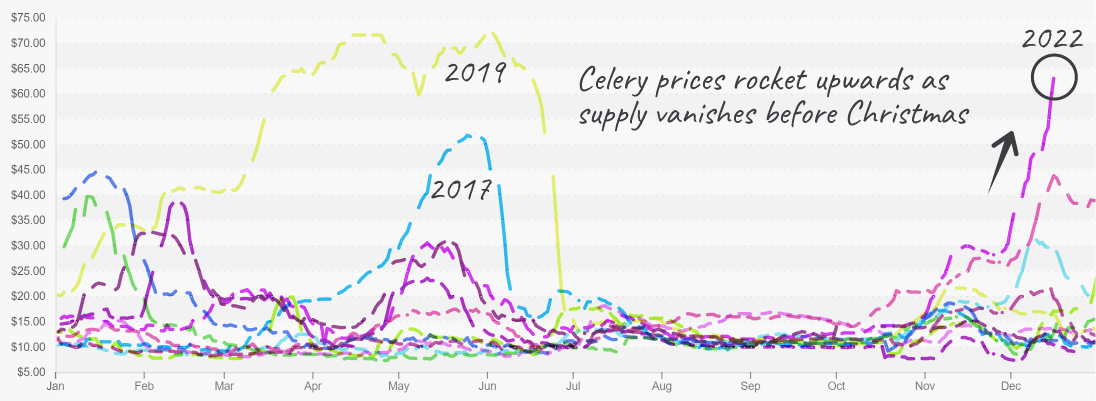

As noted in last week’s market update, celery prices are persisting in their uphill climb. Prices are into the scandalous $60s if you can find any. ProduceIQ: Markets soften post-Thanksgiving, yet remain at record highs – Produce Blue Book

Unfortunately for celery, it’s one of those ingredients not appreciated until sticker shock jolts buyers back into the reality of its irreplaceable utility. Bread and celery stuffing is a must-have over festive holiday celebrations. Celery markets are forecasted to remain elevated for another 2-3 weeks.

Celery prices take off as supply becomes extremely short during the holidays.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.