Cost considerations creating headwinds for Grocery and fueling tailwinds for Mass

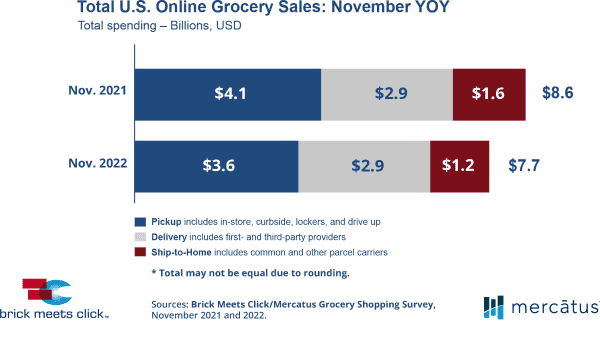

Barrington, Ill. – December 13, 2022 – The U.S. online grocery market finished November with $7.7 billion in total sales, down 10% compared to a year ago, but only 2% lower than the $7.8 billion reported for the two prior months, according to the monthly Brick Meets Click/Mercatus Grocery Shopping Survey fielded November 29-30, 2022.

The year-over-year decline in total sales was driven by fewer households buying groceries online, combined with lower order frequency and constrained spending per order among monthly active users (MAUs). Delivery was the only method to maintain sales versus a year ago, and the downward pressures were more present in Grocery formats than in Mass.

The total number of households that ordered groceries online using any of the three receiving methods, Delivery, Pickup, or Ship-to-Home, contracted 7% in November versus last year.

The decline was driven by a dramatic drop in the 60-and-older age group and a significant slide among the core customer segment of 30–44-year-olds. Compared to the prior year, the Grocery MAU base contracted 5% while the Mass base expanded by 6% as cost considerations grow in importance and customers seek to avoid unnecessary spending.

Cost was cited as the top factor in the choice of where to shop online by 42% of Delivery and/or Pickup MAUs in November, up from 37% in August 2020 when this question was first fielded.

The share of Mass MAUs who cited cost as the most important selection criteria has remained around 45% during that time, while the share of Grocery customers who cited cost as their top reason increased from 25% in August 2020 to 38% in November 2022.

This increased focus on cost may be influencing where and how Grocery’s customers receive online orders and motivating some of them to shift trips to Mass – especially those who already shop online with both formats.

In November, the cross-shopping rate between Grocery and Mass, which measures the share of Grocery MAUs who also shopped online for groceries with Mass during the same period, grew 6 percentage points versus a year ago to 30%.

“When it comes to shopping online – especially for Delivery or Pickup – cost considerations include more than the price paid for a basket of products,” said David Bishop, partner at Brick Meets Click. “Many customers also evaluate the total cost associated with using the service, which can include special charges, standard fees, and tips. And, when comparing the total of these costs to the customer, there’s a sizable gap in favor of Mass versus Grocery.”

In addition to November’s smaller base of active households, overall order frequency rates, defined as the number of orders received by MAUs during the period, declined just under 4% versus the prior year.

This aggregate decline was the result of contracting demand in the Ship-to-Home segment offset by Pickup being flat and Delivery growing in the low single digits. Order frequency by format also showed divergent year-over-year trends; Grocery MAUs reported a pullback of 11% in orders completed during November while Mass MAUs rang up 8% more orders versus last year.

On an aggregate basis, spending per order across Delivery, Pickup, and Ship-to-Home remained unchanged versus the prior year. Delivery was the only segment that posted a gain in the average order value (AOV), climbing 4% compared to November 2021.

In contrast, Pickup and Ship-to-Home both finished 5% lower than last year. Adding to the list of headwinds challenging Grocery formats, Grocery’s AOV slipped slightly, by approximately 140 basis points, while Mass was essentially flat year over year.

While the composite repeat intent level climbed 4 percentage points to 62% in November versus last year, Mass continued to outperform Grocery. For November, this key metric, which measures the likelihood that an online grocery customer will use the same service again within the next 30 days, came in at 65% for Mass compared to 59% for Grocery.

So, beyond increased cost pressures and declining AOVs, Grocery’s headwinds are also due to challenges related to providing the experience that customers now expect with online grocery shopping.

For November, total grocery spending softened, declining 5% versus last year. Since online sales decreased at twice that rate, online’s share of total grocery sales contracted over three points to finish at 10.1% in November. Excluding the Ship-to-Home segment (since it is not offered by most conventional supermarkets), Pickup and Delivery’s combined contribution was 8.5% for the month.

“Given that many shoppers are becoming more cost conscious, grocers should consider offering a tiered fee structure based on when a customer wants to receive their order and reduce some of the additional costs customers face when shopping online,” stated Sylvain Perrier, president and CEO at Mercatus. “We know that if offered the choice between shorter cycle times and lower fees, a significant share of online customers will select a time later that day or even the next day to save at least a couple of dollars.”

Check out the Brick Meets Click eGrocery Dashboard for November 2022 or visit the eMarket/eShopper page for additional insights and information about the full report

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on November 29-30, 2022, with 1,749 adults, 18 years and older, who participated in the household’s grocery shopping.

The three receiving methods for online grocery orders are defined as follows:

• Delivery includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

• Pickup includes orders that are received by customers either inside or outside a store or at a designated location/locker.

• Ship-to-Home includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology for each of the surveys conducted in 2022 – Oct. 28-29 (n=1,732), Sept. 29-30 (n=1,752), Aug. 29-30 (n=1,743), July 29-30 (n=1,690), June 29-30 (n=1,743), May 28-29 (n=1,802), Apr. 28-29 (n=1,746), Mar. 28-29 (n=1,681), Feb. 26-27 (n=1,790), and Jan. 29-30 (n=1,793); in 2021 – Dec. 29-30 (n = 1,836), Nov. 29-30 (n=1,785), Oct. 29-30 (n=1,751), Sept. 28-29 (n=1,728), Aug. 29-30 (n=1,806), July 29-30 (n=1,892), June 27-28 (n=1,789), May 28-30 (n=1,872), Apr. 26-28 (n=1,941), Mar. 26-28 (n=1,811), Feb. 26-28 (n= 1,812), and Jan. 28-31 (n=1,776); in 2020 – Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), Jun. 24-25 (n=1,781), May 20-22 (n=1,724), Apr. 22-24 (n= 1,651), and Mar. 23-25 (n=1,601); and in 2019 – Aug. 22-24 (n = 2,485).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in consumer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company, Kowalski’s Markets, WinCo Foods, Smart & Final, Stater Bros. Markets, Southeastern Grocers’ Fresco y Más, Harveys Supermarket and Winn-Dixie grocery stores among others.

Media Inquiries

David Bishop, Partner, Brick Meets Click

847-722-2732, david.bishop@brickmeetsclick.com

www.brickmeetsclick.com