The World Cup kicked off yesterday, and for once, it feels like the whole globe is celebrating the Thanksgiving holiday with us.

That is the whole globe except the sad beer-less spectators in Qatar. I guess they will actually have to watch the matches this year.

Enough with the prelude. Let’s get stuffed on produce market news.

ProduceIQ Index: $1.20 /pound, up +2.56 percent over prior week

Week #46, ending November 18th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Overall produce prices are predictably up over the previous week. This year’s Thanksgiving meal is forecasted to be the most expensive on record. On the bright side, high prices might finally encourage U.S. consumers to take food waste seriously. It is considerably more gut-wrenching to toss the keto cauliflower rice stuffing that costs more to make than the turkey.

The rollercoaster that is holiday demand is reaching its peak. Demand and prices will fall fast beginning this week and continue their sharp descent next week.

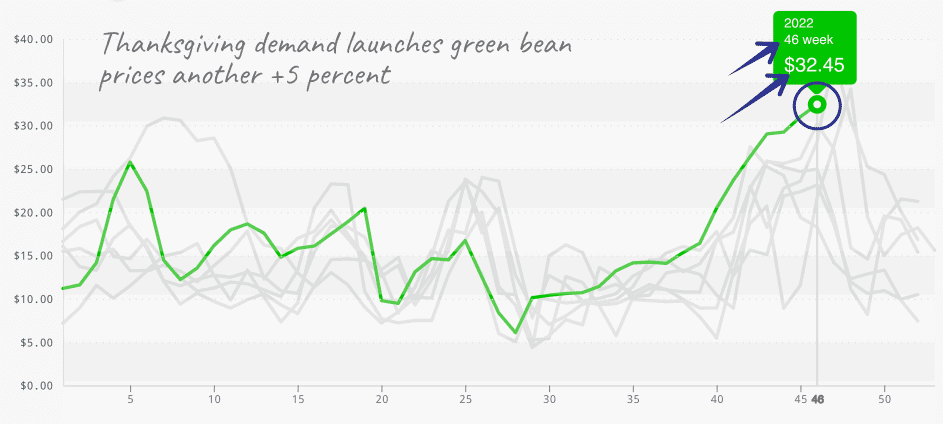

The green bean gods really chose the worst time of year to tighten supply. Annual green bean prices typically peak around Thanksgiving before beginning a steady decline. This week, prices are up another +5 percent on lean supply and strong demand. Damage from East Coast hurricanes and the annual transition from Georgia to Florida are mostly responsible; however, lighter than usual Mexican volume isn’t helping.

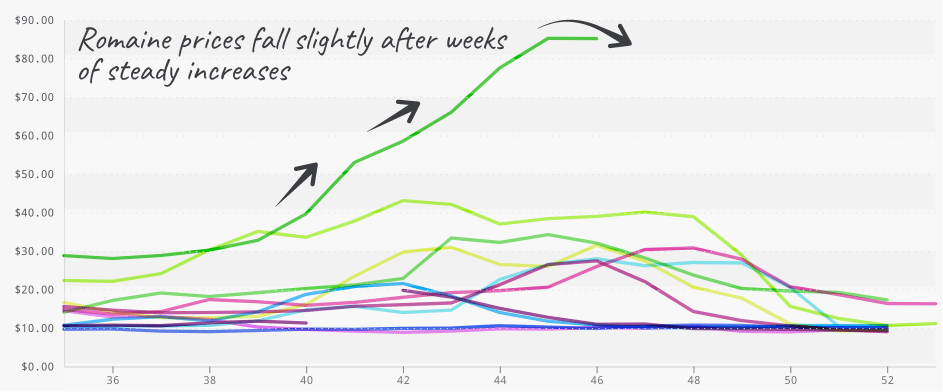

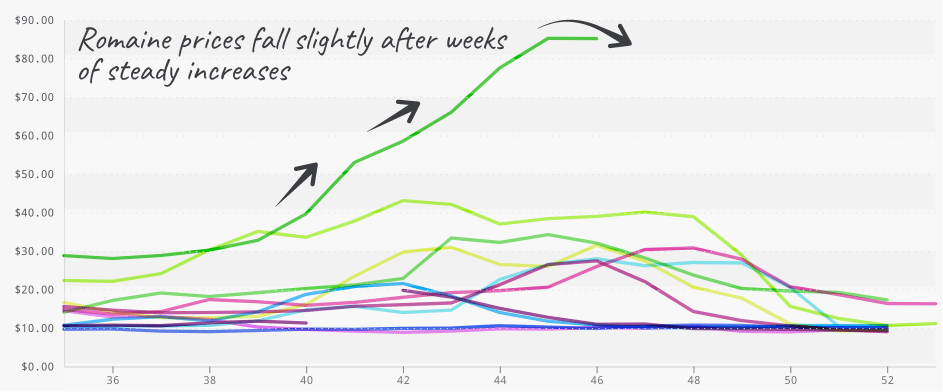

Romaine prices declined for the first time in nine weeks. Although prices are still scandalously high, relief may come sooner than initially anticipated. Thanks to an early transition to Yuma, AZ, from Salinas, CA, romaine, iceberg, broccoli, and cauliflower prices may all come down significantly over the next two weeks.

Yellow squash is trading cooler-than-usual weather in Georgia for Florida’s warmer but hurricane-steeped soil. As a result, Eastern supply is short. Central Mexico is still ramping up production in the West but should provide some relief to supply in early December.

Avocado prices are still hovering in historically low territory. This week, markets are down -6 percent over the previous week, around $23. Supply may drop slightly post-Thanksgiving due to decreased holiday labor in the U.S. and Mexico; otherwise, there is not much hope for stagnant avocado prices.

Happy Thanksgiving!

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.