After skipping two years, the IFPA’s big show in Orlando was well-attended and a striking success. Many produce professionals are staring at a stack of business cards right now, wondering how they can get someone else to do the proper follow-up.

Despite exceeding 20k steps per day, I did not make it to every booth.

Dry veg growers/shippers are only hungry for future customers as current supply is insufficient to cover commitments. In a surprising turn of events, a single English cucumber is more expensive than a clamshell of blueberries this week.

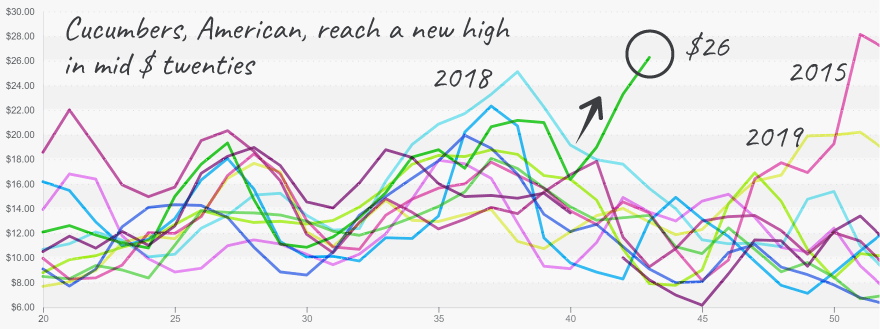

Cucumber prices are exploding due to a very light supply in the East and West. Average prices for American (slicing) cucumbers are up +12 percent this week to a shocking $26.

Earlier extreme weather in the Florida and Georgia is delaying production in the East. In the West, Nogales has started in a light way, although production won’t hit its stride until Mid-November.

Cucumber prices are on fire at a time when they are normally in decline due to product from Georgia and Florida

ProduceIQ Index: $1.08 /pound, Flat over prior week

Week #43, ending October 28th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Squash prices are gaining downward momentum as Eastern and Western supply increases. Historically, squash prices traverse a reasonably predictable course between week #40 and week #45. In weeks #40 and #41, prices diverged slightly from the well-trodden path; but it looks as though they (declining prices) are back on track thanks to increasing production in Mexico and the Southeast.

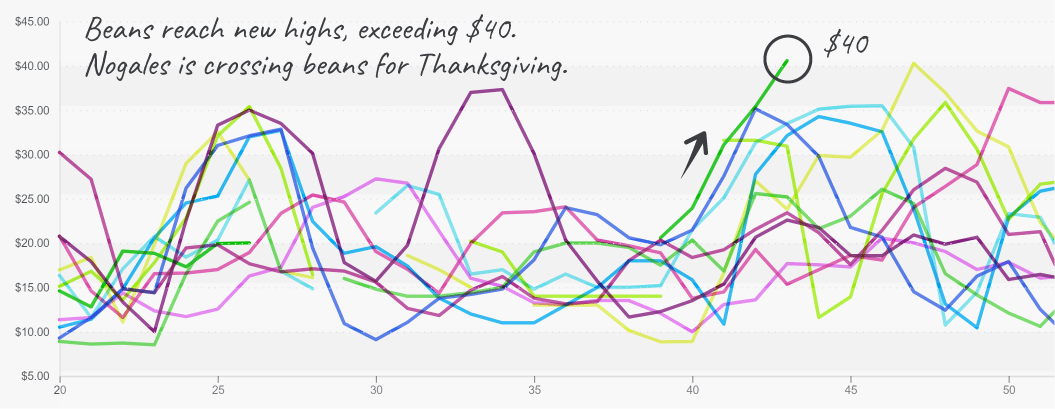

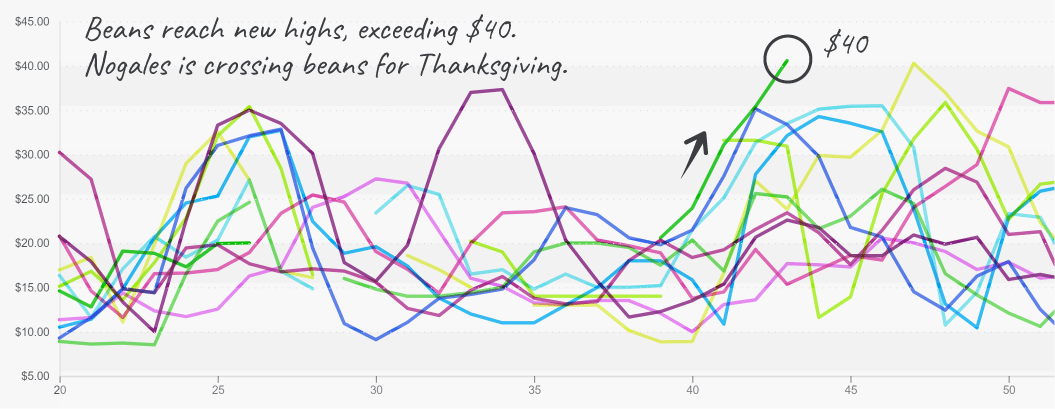

Skyrocketing green bean prices are doing little to dampen strong demand. In a typical year, Georgia and Florida pick up bean production around week #40. However, this year, Eastern production is delayed due to inclement weather. A slight gap in Western production is shaping up as growing regions transition from Baja into the Sinaloa region.

Additionally, Sinaloa growers battled heavy wind and rain from hurricane Roslyn last week, adding further pressure to a strained supply. As a result, prices should ease up slightly, then increase again as Thanksgiving demand intensifies.

Green beans through Nogales are being presold for the Thanksgiving pull.

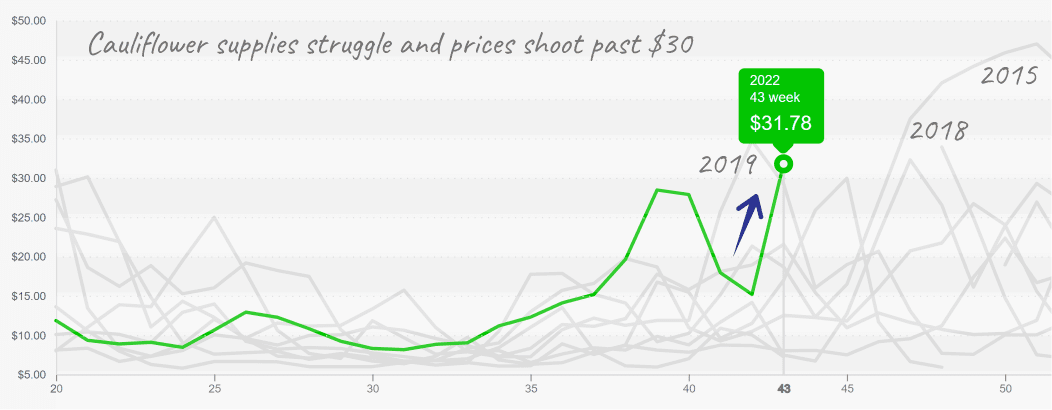

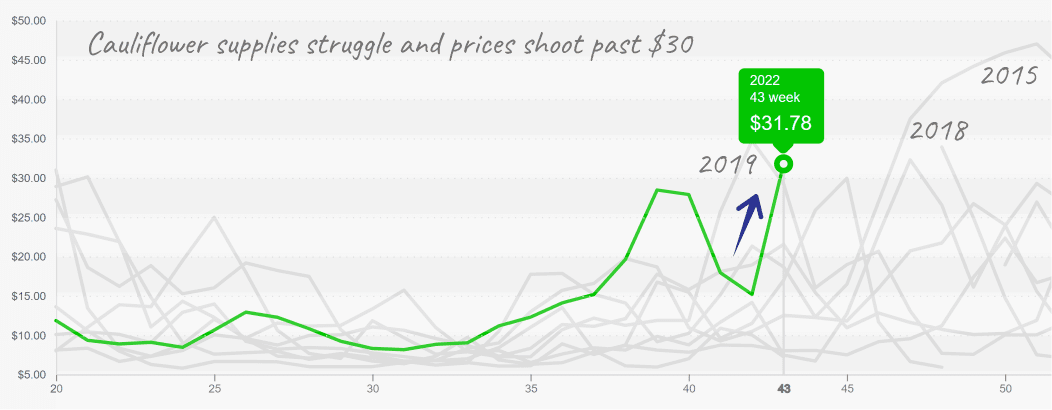

Poor weather, mainly rain and heat, is forcing cauliflower prices to shoot back up. Week 43’s reported volume out of Salinas/Watsonville is nearly half of week 42’s. As a result, prices quite effortlessly doubled to $32 this week from last week’s $17. Lettuce markets aren’t the only produce commodity looking forward to the desert season picking up production in a few weeks.

Cauliflower prices enter period of volatility and transitions.

Asparagus prices are tightening due to weak Mexican supply. Prices are up +7 percent over the previous week, a ten-year high. Poor weather is lowering yields in the West and will likely keep prices elevated for two more weeks as volume gradually recovers.

Tomatoes jumped onto our radar three weeks ago and have yet to make a grand exit. Round, grape-type, and plum-type are all at a ten-year high. Production in Quincy, FL, is nearly finished, and Central Florida growers are not ready to fill the gap due to damage from hurricane Ian. In the West, supply is similarly abysmal. As a result, expect prices to stay elevated for the near future.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.