OPEC announced the controversial decision to cut oil production by 2 million barrels per day. Surprise, the countries with the supply want to keep prices high. The White House is painting this as a disaster of epic proportions; however, some industry experts argue that global oil markets are forecasted to be in an over-supply situation through the end of the year. As a result, prices may not see the catastrophic increase that such a reduction could cause.

Global energy markets are on edge, and any move in the wrong (or right) direction will significantly affect fresh produce markets. In the short term, higher oil prices increase outbound freight costs, lowering FOB shipping point prices. Long-term, high oil prices increase growing costs, which reduce the availability of produce supply.

Speaking of forecasting the future, Hurricane Julia has its sights set on Central America. It hit Nicaragua over the weekend. Tropical storm warnings are in effect for Nicaragua, Honduras, and El Salvador’s Pacific coast. The storm is forecasted to bring heavy rain, 4-8 inches, throughout Central America. Fresh produce products, including, but not limited to, pineapples, bananas, berries, and peas, may be negatively affected.

ProduceIQ Index: $1.08 /pound, +4.9 percent over prior week

Week #40, ending October 7th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

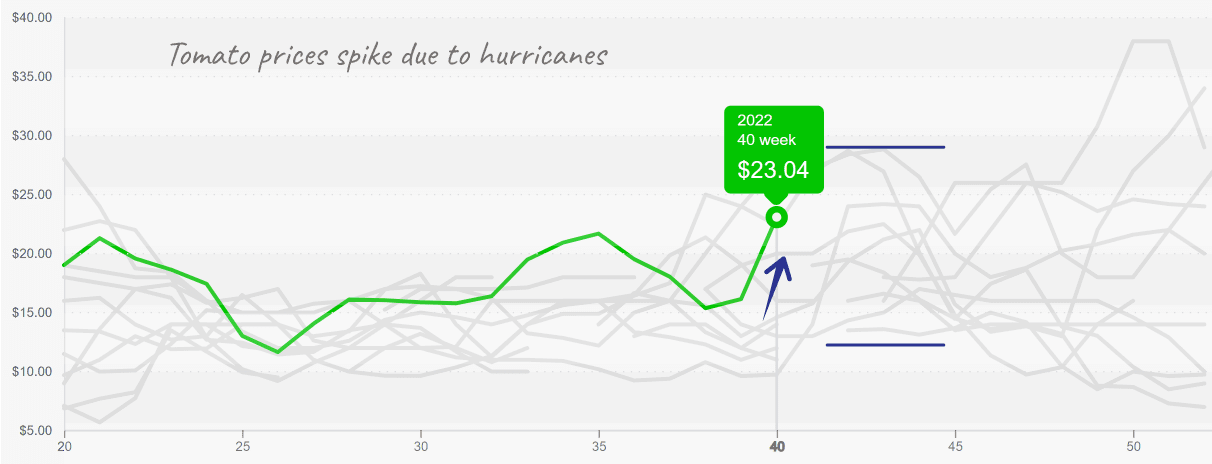

Tomatoes markets are besieged by severe weather. In the East, Tennessee and North Carolina are cooling down, and Florida’s season is just beginning in Quincy. Unfortunately, rain from Hurricane Ian drenched many of the tomato fields throughout central Florida, including tomato regions around Sarasota, though it takes a little more time to estimate total damage.

In Mexico, rain from Hurricane Kay is delaying tomato production in Baja California. Tropical Storm Orlene is off the West Coast of Mexico and will likely bring more heavy rain and damage to Mexican tomato fields early this week. All tomato varieties are extremely tight and will remain so through October.

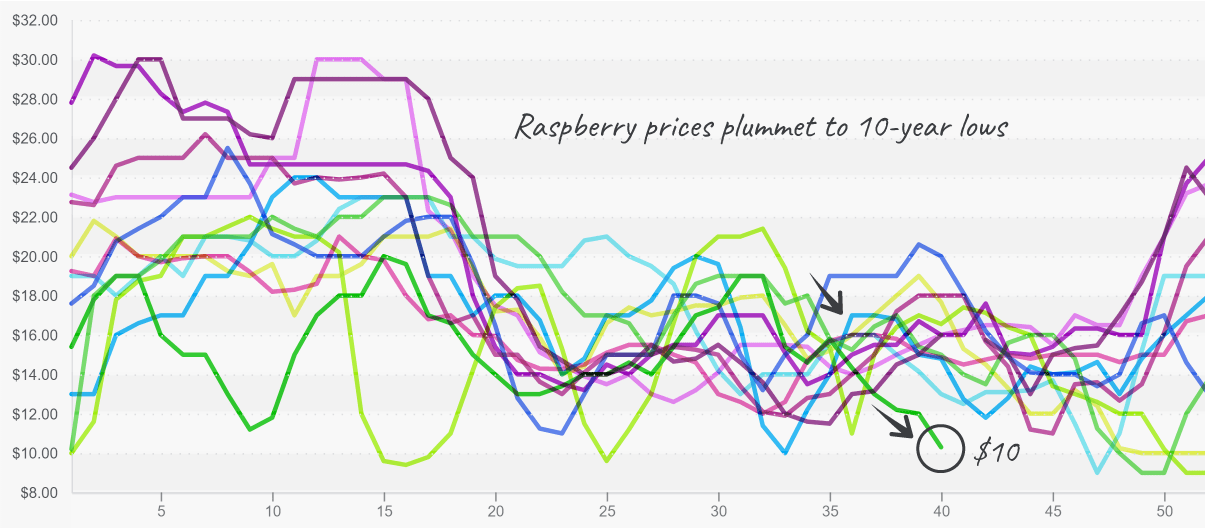

Tomato prices, mature green 5×6, accelerate during a time of transition and storms

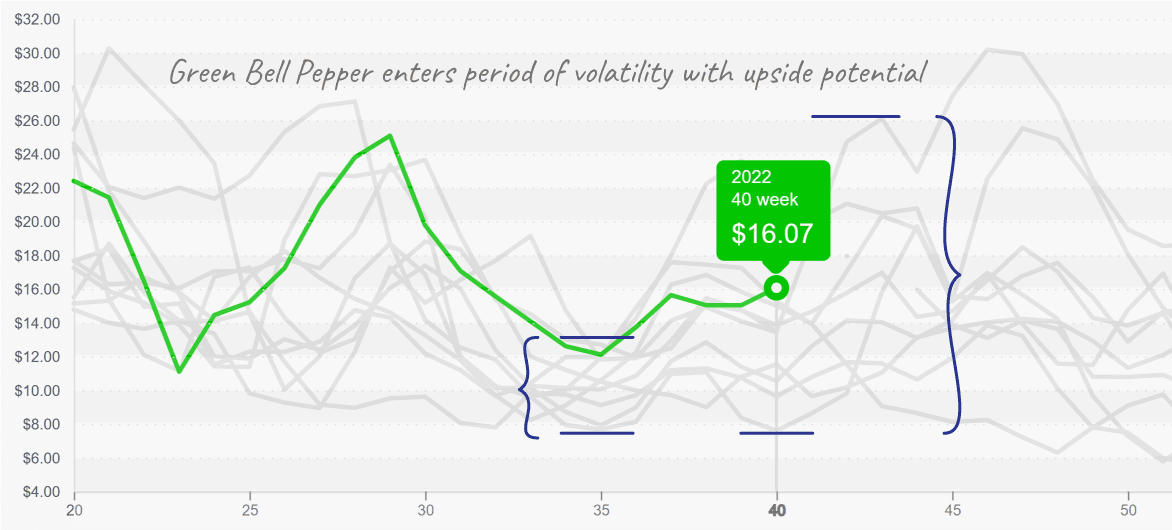

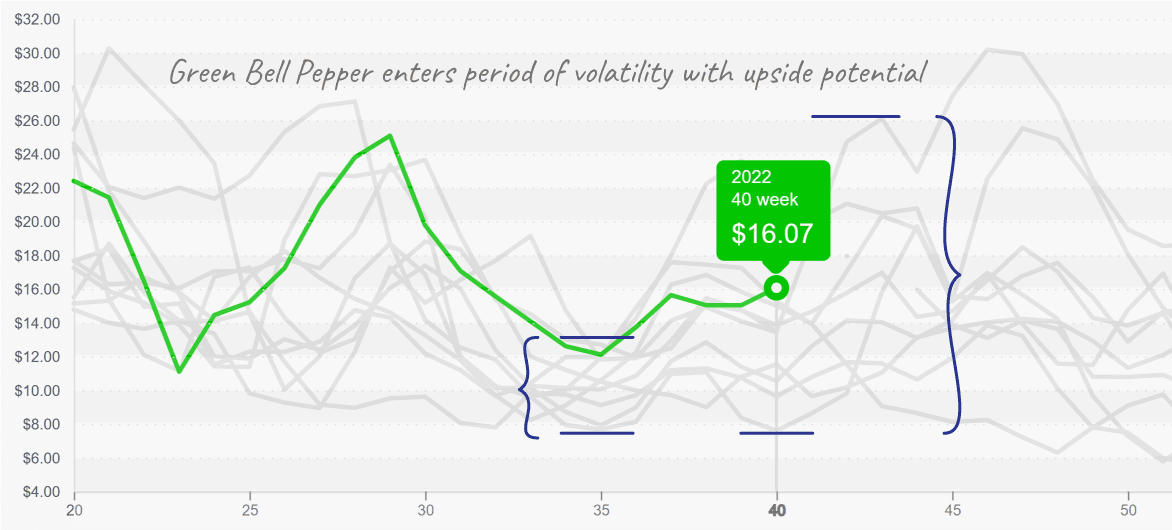

Pepper prices are up slightly over the previous week as cooler weather pushes domestic pepper production Southward and Florida growers assess damage from Hurricane Ian. Still, green bell supply is reportedly much more available than red and yellow supply. Colored bells will remain tight until Mexico’s export season picks up in December.

On the domestic side, Georgia is slowly ramping up production in the East. The weather had turned cooler after hurricane Ian passed through. While in the West, Northern California is nearly finished, and Coachella’s pepper season is only about a week away. As a result, prices may fluctuate over the next couple of weeks as domestic regions complete their annual fall transitions.

Green bell pepper (XL) crosses $16 with upside potential for Georgia growers

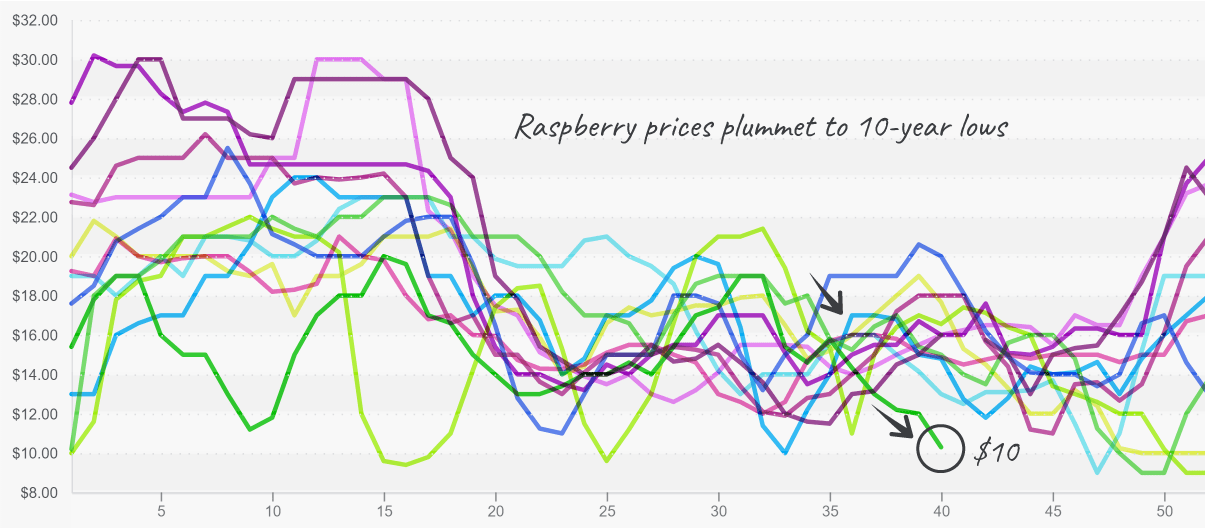

As predicted, mixed berry markets are veering in opposite directions this fall. Blueberry, raspberry and blackberry prices are declining thanks to increasing availability out of Mexico, California, Peru and Central America. On the other hand, Strawberry prices remain high after skyrocketing.

Over the past few years, Peru has turned into a prolific blueberry producer. This time of year, consumers now benefit from this massive uptick in supply as Peruvian growers come online and product floods the markets. Prices are only down -4 percent over the previous week but are expected to fall further.

Raspberry prices are hemorrhaging. Unseasonably good availability out of Mexico is sending prices to an incredible ten-year low. It’s the third time this year that we’ve seen low raspberry prices. So, take advantage of the surplus to promote raspberries.

Blackberry market’s supply is lagging slightly behind raspberry and blueberry markets. Still, it is forecasted to take a similar turn as we move into mid-October and more supply begins to pour out of Central California and Mexico.

Restaurant owners, now might be a great time to substitute that strawberry shortcake with a raspberry tart. Strawberry prices are holding near $19, a ten-year high.

On the bright side, relief for strawberries could come earlier than expected. California production is ramping up and may provide some reprieve in the form of increased supply as soon as next week. However, prices will likely remain somewhat elevated throughout the end of year.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.