In response to a few fairly dramatic price increases, this week’s overall produce index is slowing its dramatic fall.

Week 33 notoriously has the lowest industry prices. However, compared to the last ten years, this week’s index price ($1.00) is tied with 2017 for the highest average price.

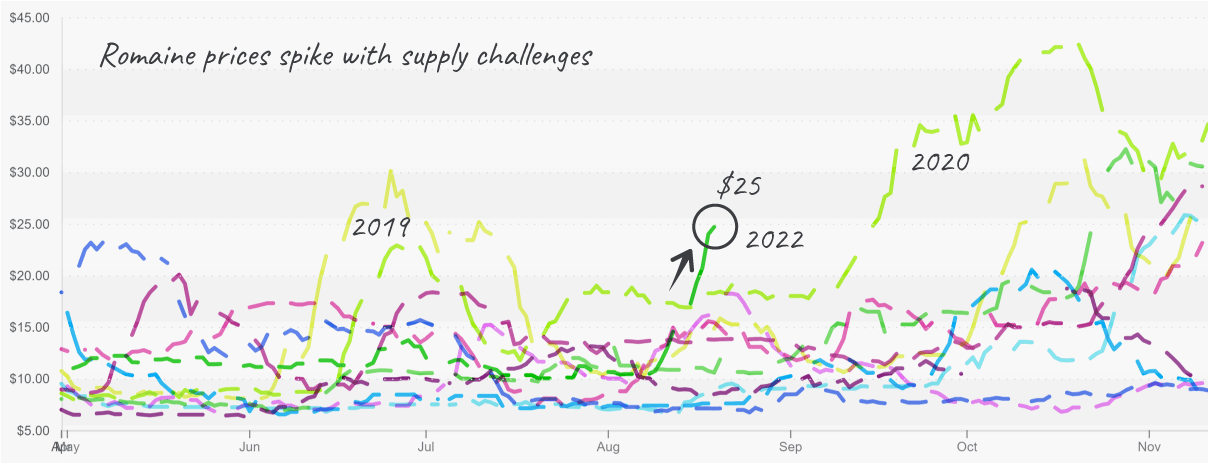

Wendy’s is pulling lettuce from their restaurants in Pennsylvania, Ohio, and Michigan after over 30 customers reported illness after eating sandwiches with romaine. The CDC is still working to confirm if the lettuce was the cause of this E coli outbreak.

However, the CDC has said there is no evidence that romaine lettuce sold at retail or other restaurants is linked and has not advised to stop eating at Wendy’s.

Food safety scares are never good for either the grower-shipper or the buyers. Over the past two weeks, romaine and iceberg prices have increased significantly due to various supply-side factors. Although, demand may soften if concerns about the outbreak spread.

Up +65 percent over the previous week, iceberg prices rise as growers are fighting INSV and Fusarium. INSV and Fusarium are diseases that negatively affect iceberg yields.

Romaine’s price increases are outpacing iceberg, up an astounding +77 percent over the previous week. E coli problems aside, romaine growers are dealing with serious quality issues. Mainly wind damage, cupping and the occasional seeder.

Lettuce supply will remain light for at least another two weeks as Santa Maria ramps up production.

Romaine prices were on a steep trajectory before E coli outbreak announced

ProduceIQ Index: $1.00 /pound, -2.0 percent over the prior week

Week #33, ending August 19th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

At $17, strawberry prices are at a ten-year high for this week 33. According to reports, heavy rain in Central Mexico destroyed hundreds of hectares of strawberry fields last week. Fusarium is also affecting yields in California. Strawberry supply is forecasted to remain tight well passed Labor Day.

Poor weather, mainly heat and rain, is elevating tomato prices. As a result, supply across all varieties is anticipated to be tight and prices volatile for the next 2-3 weeks.

At $27, lime prices barely scrape out a ten-year high. Quality issues are rendering a majority of the crop unusable, severely tightening supply. The new crop has started lightly but should get into full swing in the next 2-3 weeks.

Lime prices often peak near week 33 during the transition

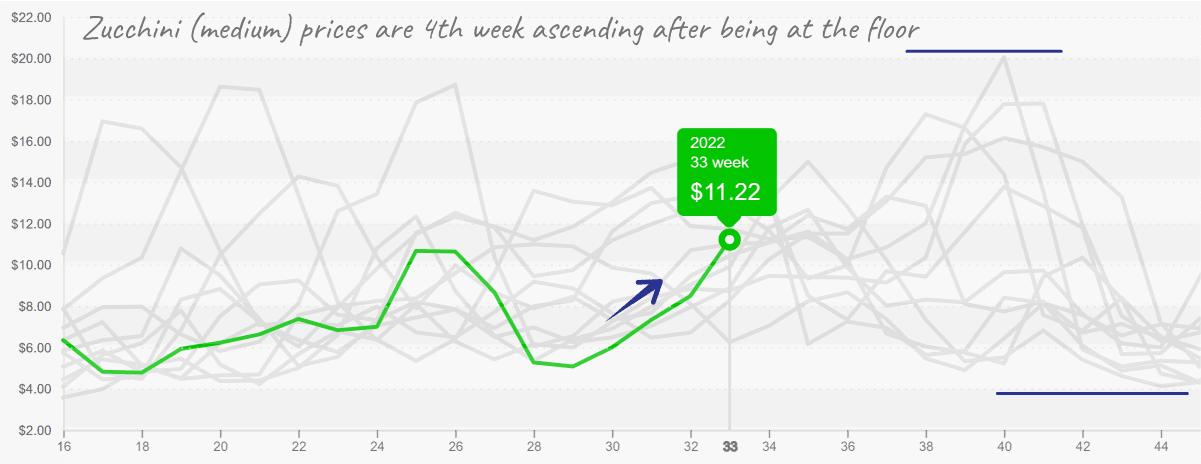

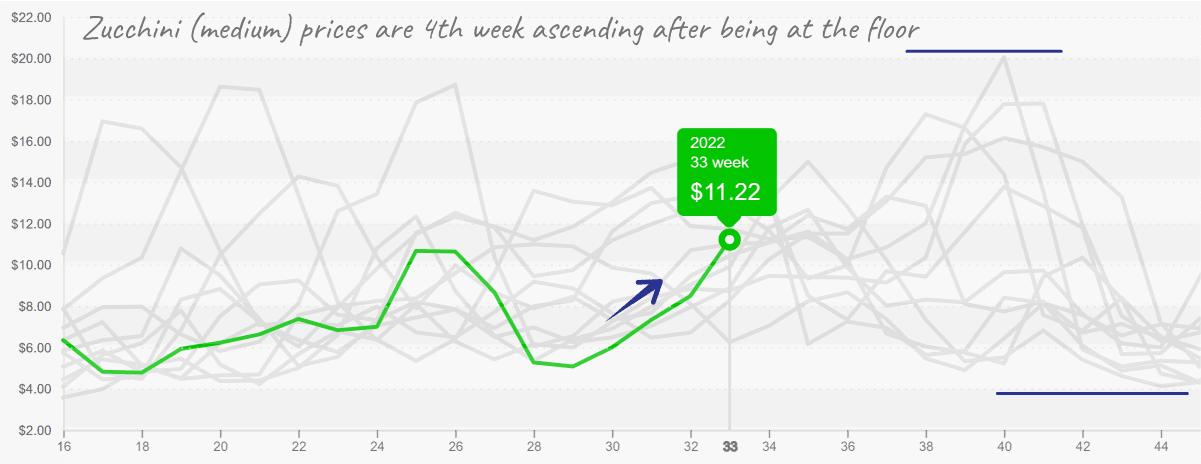

Squash markets are tightening up in response to a lull in supply on the East and West Coasts. Baja California, Mexico is done until mid-September, leaving California to handle the heaving lifting for the time being. On the East coast, quality issues and a gap in production are also tightening prices.

Zucchini squash scattered in the summer heat, waiting till Georgia fall season starts

Down another -11 percent this week (to $30 ish for 48-count), avocado prices are putting on quite a show. We thought prices had been scraping the bottom for the past couple of weeks, but it seems there is still room left to fall. Even though Peruvian volume typically declines at this point in the season, supply is solid and shows no signs of slowing down.

Please visit Stores to learn more about our qualified group of suppliers, or our online marketplace, here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.